Mercatox Review: Is This Crypto Exchange Safe and Worth Using?

When you hear Mercatox, a cryptocurrency exchange that claims to offer low fees and a wide range of altcoins. Also known as Mercatox.io, it's a platform that pops up in search results for users looking to trade lesser-known tokens without strict KYC. But here’s the catch: Mercatox isn’t regulated by any major financial authority. That means no investor protection, no insurance for funds, and no official track record of handling disputes. If something goes wrong—like a withdrawal delay or a hacked account—you’re on your own.

Many users come to Mercatox because it lists coins no other exchange will touch. You’ll find tokens like GSTS, BAMP, and SCIX here—projects that have vanished from Binance, KuCoin, or Coinbase. But that’s not a feature; it’s a red flag. Exchanges that list dead or scammy tokens often do so because they don’t care about quality—they care about volume. And volume doesn’t mean safety. In fact, Mercatox has been flagged multiple times by crypto watchdogs for lack of transparency. No clear team info, no public audits, no security certifications. Compare that to exchanges like Binance or Kraken, which publish regular proof-of-reserves and third-party audits. Mercatox doesn’t even try.

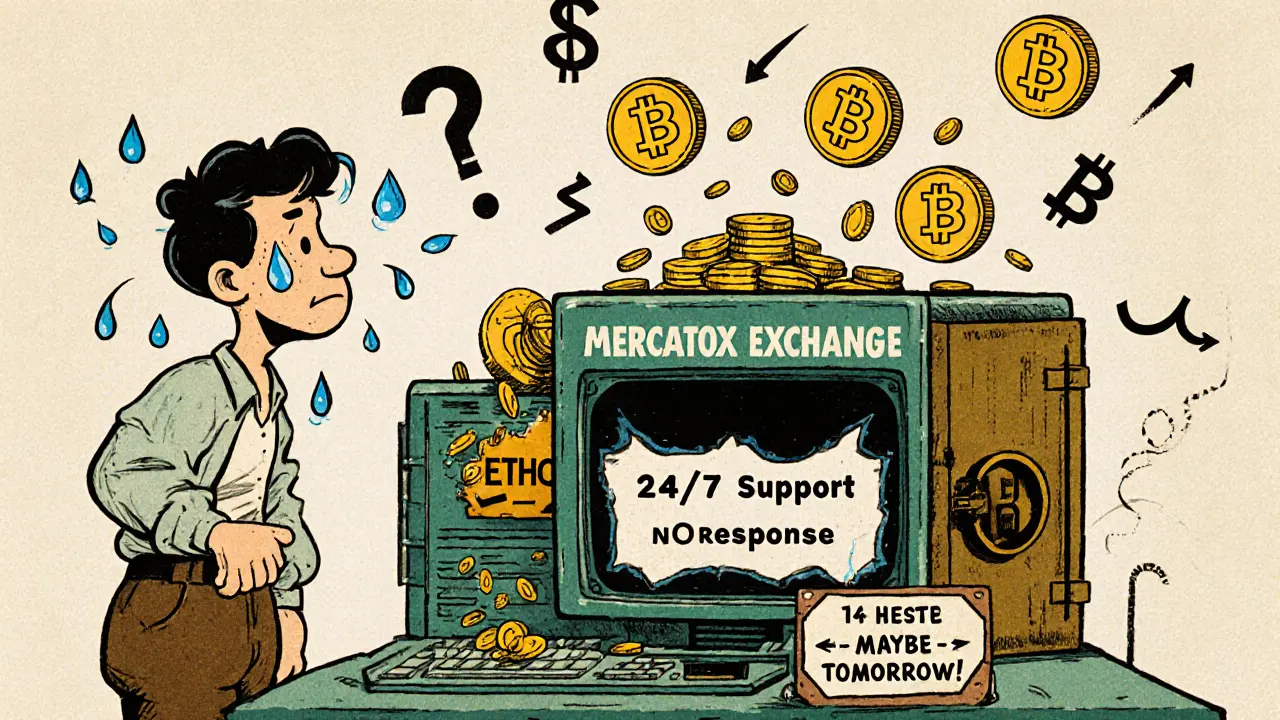

What about the fees? They look low on paper, but hidden costs creep in. Withdrawal delays can take days, and customer support is nearly impossible to reach. One user reported waiting 11 days for a small USDT withdrawal—only to get a generic reply that said, "Check your wallet address." That’s not support; that’s dismissal. And if you’re trading on Mercatox because you think it’s your only option for a specific token, ask yourself: is that token even worth the risk? Most of the coins listed here have zero liquidity, no development, and no future. You’re not investing—you’re gambling with money you can’t afford to lose.

Security is another huge concern. Mercatox doesn’t offer two-factor authentication by default, and there’s no public record of any cold storage practices. That’s not just careless—it’s dangerous. Think about it: if you’re holding crypto, your seed phrase is your last line of defense. But if the exchange you’re using gets hacked, and they don’t use cold wallets, your coins are sitting in hot wallets with no protection. That’s how people lose everything. And with no official response to past breaches or complaints, there’s no reason to believe Mercatox has improved.

So why do people still use it? Mostly because they don’t know better. New traders see a long list of coins and think, "More options = better." But in crypto, more options often means more traps. The real winners aren’t the ones trading the most coins—they’re the ones avoiding the risky ones. If you’re looking for a reliable place to trade, there are dozens of better alternatives. If you’re just curious about Mercatox, read the posts below. You’ll find real user experiences, scam warnings, and breakdowns of the exact tokens that got people trapped on this platform. Don’t guess. Learn first.

Mercatox is a decade-old crypto exchange with low fees and decent features, but serious withdrawal delays and poor customer support make it risky. Here's what real users are saying in 2025.

Continue reading