Liquid Network Comparison Calculator

Comparison Results

Select features and click "Compare Selected Features" to see detailed comparisons.

| Feature | Liquid Network | Lightning Network | Rootstock (RSK) |

|---|---|---|---|

| Block time / settlement | 1 minute (on-chain) | Instant (off-chain channels) | 30 seconds (on-chain) |

| Privacy | Confidential Transactions (amounts hidden) | Partial (routing privacy only) | Standard Bitcoin visibility |

| Asset issuance | Native via RGB / tokens | None | Supports ERC-20-like contracts |

| Decentralization | Federated (15 functionaries) | Fully decentralized (peer-to-peer) | Federated but larger validator set |

| Typical use case | Institutional trading, confidential transfers | Micro-payments, fast retail | Smart-contract platforms |

Bitcoin’s 10‑minute block time and public transaction data work great for a decentralized store of value, but they can be a pain for traders, institutions, and anyone who needs speed or privacy. That’s where a sidechain steps in - a separate blockchain that talks to Bitcoin while offering its own rules.

Key Takeaways

- The Liquid Network is a federated sidechain that lets you move Bitcoin into a fast, confidential ledger called L‑BTC.

- Blocks are created every minute, giving finality in 1‑2 minutes versus 60+ minutes on Bitcoin.

- Confidential Transactions hide amounts while still proving they’re valid.

- Institutions can issue stablecoins, security tokens, and NFTs directly on Liquid.

- Liquid sacrifices some decentralization because a set of functionaries validates each block.

When Bitcoin users need faster settlement, the Liquid Network is a federated sidechain created by Blockstream that enables a 1‑to‑1 peg between Bitcoin and Liquid Bitcoin (L‑BTC) provides the speed and privacy that the mainchain can’t deliver. Liquid Network has become the go‑to solution for institutional traders, crypto exchanges, and asset‑issuers looking for on‑chain settlement without exposing every detail.

What is the Liquid Network?

The Liquid Network is built on the open‑source Elements platform, which itself is a fork of Bitcoin’s codebase. It runs as an independent blockchain but stays linked to Bitcoin through a verifiable peg. Users lock BTC on the mainchain, receive the same amount of L‑BTC on Liquid, and later reverse the process to get their BTC back.

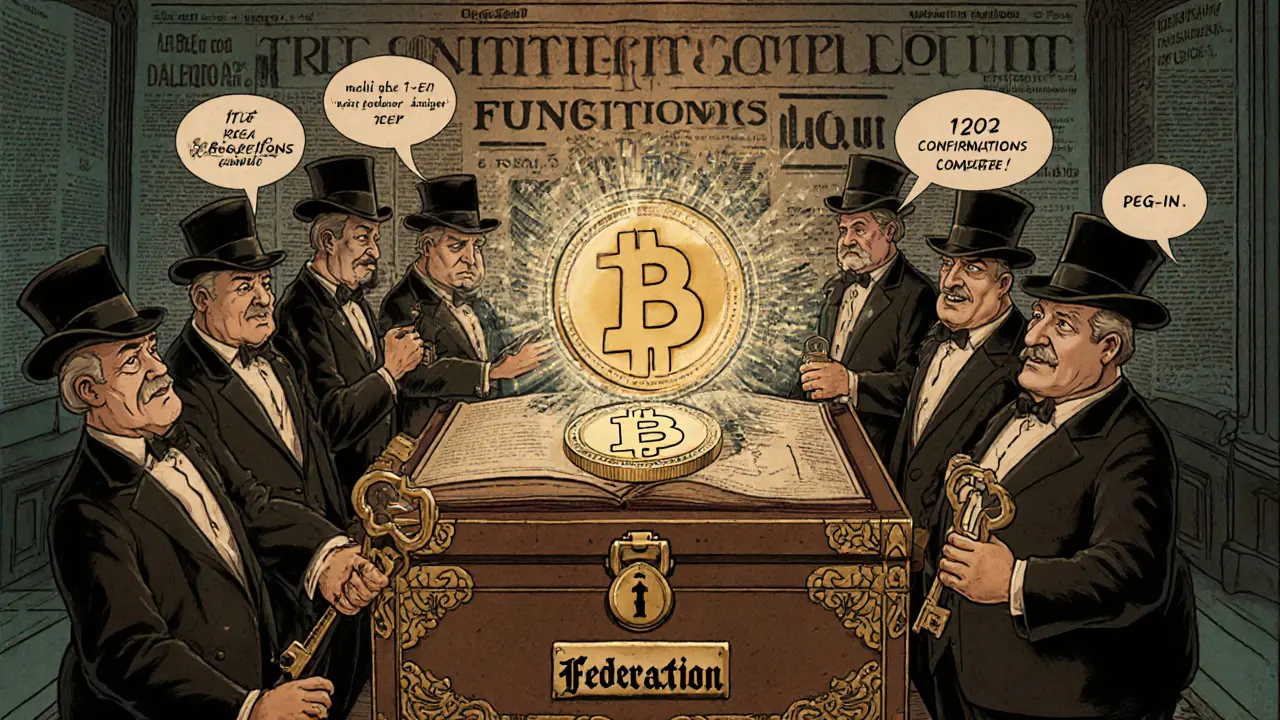

How the 1‑to‑1 Peg Works

- Send BTC to a multi‑signature address managed by the federation.

- Wait for 102 Bitcoin confirmations (about 17hours). This is the peg‑in security window.

- Once confirmed, the federation mints an equal amount of L‑BTC on Liquid.

- To move back, initiate a peg‑out. Only two Liquid confirmations are needed before the BTC is released to the recipient address.

The peg guarantees that total L‑BTC never exceeds locked BTC, preserving a strict 1:1 value ratio.

Technical Core of Liquid

Key specifications that set Liquid apart:

- Block time: 1minute (≈1‑2minute finality).

- Consensus: federated model with 15 functionaries; at least 11 signatures required per block (Federation is a consortium of over 70 institutions that secure the sidechain).

- Confidential Transactions (Confidential Transactions obscure transaction amounts while still allowing validation).

- Asset issuance via the RGB protocol (RGB protocol enables custom token creation on Liquid).

- Average fee: 0.00001L‑BTC (≈$0.35) compared with $1.50 on Bitcoin during normal load.

Who Uses Liquid and Why?

Institutional traders love the near‑instant finality. Bitfinex reported that 37% of its BTC trading volume ran on Liquid in Q12024. Exchanges such as Kraken and BitMEX handle the majority of Liquid transactions, processing over $2.1billion in 2023 with no confirmed security breaches.

Privacy‑focused users benefit from Confidential Transactions, which hide how much is moving. The USDT stablecoin issuer Tether moved $420million of USDT on Liquid, taking advantage of the hidden‑amount feature.

Token issuers leverage the built‑in asset framework. The Swiss SIX Digital Exchange tokenized $1.2billion of equities on Liquid, and over $500million of assets have been issued via RGB as of Q22024.

Liquid vs. Other Bitcoin Scaling Solutions

| Feature | Liquid Network | Lightning Network | Rootstock (RSK) |

|---|---|---|---|

| Block time / settlement | 1minute (on‑chain) | Instant (off‑chain channels) | 30seconds (on‑chain) |

| Privacy | Confidential Transactions (amounts hidden) | Partial (routing privacy only) | Standard Bitcoin visibility |

| Asset issuance | Native via RGB / tokens | None | Supports ERC‑20‑like contracts |

| Decentralization | Federated (15 functionaries) | Fully decentralized (peer‑to‑peer) | Federated but larger validator set |

| Typical use case | Institutional trading, confidential transfers | Micro‑payments, fast retail | Smart‑contract platforms |

Getting Started on Liquid

For newcomers, the learning curve is moderate. Here’s a practical checklist:

- Choose a Liquid‑compatible wallet. The most popular is Blockstream Green (Blockstream Green a multi‑platform wallet that supports L‑BTC and confidential transactions), but hardware wallets like Jade and web‑based AQUA also work.

- Fund your wallet with BTC and start the peg‑in process. Send BTC to the federation‑controlled multi‑sig address and wait for 102 confirmations.

- Watch the L‑BTC appear in your Liquid wallet after the confirmation window.

- To move funds back, initiate a peg‑out. The network will release BTC after two Liquid confirmations.

- If you want to run a full node (optional), allocate at least 4GB RAM, 100GB disk, and a modern x86_64 machine. Supports Windows, macOS, and Linux.

Common pitfalls include confusing the 102‑confirmation peg‑in delay and misconfiguring wallet network settings. Support tickets show that32% of issues stem from these mistakes.

Pros and Cons

- Pros

- ~1‑minute finality speeds up trading and arbitrage.

- Confidential Transactions protect amounts from public view.

- Built‑in token issuance lets institutions create stablecoins, security tokens, and NFTs.

- Low fees make large transfers cheap.

- Cons

- Federated consensus means you trust 15 functionaries - less censorship‑resistant than Bitcoin.

- Peg‑in delay (≈17hours) can feel slow for everyday users.

- No native support for complex smart contracts like Ethereum or RSK.

- Regulatory ambiguity in some jurisdictions (e.g., U.S. SEC stance).

Future Roadmap

Blockstream is actively enhancing Liquid. The upcoming Liquidv2 will integrate Schnorr signatures, cutting transaction sizes by 25% and improving privacy. Functionary diversity grew to 73 members in April2024, adding CoinbasePrime and Swissquote.

Long‑term goals include:

- Full RGB integration for advanced smart‑contract‑like behavior (target Q12025).

- Taproot Assets support to push privacy even further (Q42024).

- Expanded regulated security token issuance for European markets.

Analysts predict the total value locked could reach $3.5billion by 2026, driven by institutional demand for confidential Bitcoin settlements.

Frequently Asked Questions

What is the difference between a peg‑in and a peg‑out?

A peg‑in locks BTC on the Bitcoin mainchain and creates an equivalent amount of L‑BTC on Liquid. It requires 102 Bitcoin confirmations. A peg‑out does the reverse: it burns L‑BTC on Liquid and releases the locked BTC after two Liquid confirmations.

How fast are Liquid transactions compared to Bitcoin?

Liquid’s 1‑minute block time means a transaction is typically final in 1‑2minutes, whereas Bitcoin can take 60minutes or more to reach comparable security.

Is Liquid secure despite being federated?

Security relies on the 15‑functionary multisig model. As long as fewer than 5 members are compromised, blocks remain valid. No major breach has been reported on mainnet to date.

Can I use Liquid for everyday purchases?

While technically possible, the peg‑in delay makes it less convenient for small, instant purchases. Liquid shines for large, institutional‑scale moves.

What wallets support L‑BTC?

Blockstream Green, Jade hardware wallet, and the web‑based AQUA wallet all support L‑BTC and Confidential Transactions. They are free or low‑cost and work on Windows, macOS, Linux, Android, and iOS.

Whether you’re a trader looking for quick settlement, a token issuer needing privacy, or just curious about Bitcoin’s scaling options, the Liquid Network offers a unique blend of speed, confidentiality, and asset flexibility. Understanding its mechanics, strengths, and trade‑offs will help you decide if it fits your workflow.

Comments (6)

Akinyemi Akindele Winner

So Liquid is just Bitcoin but with a secret club of rich boys deciding when transactions happen? Cool. I bet the 15 functionaries all vacation in the Caymans and drink champagne out of gold-plated Bitcoin mugs. Meanwhile, I’m over here waiting 17 hours to move my BTC because some corporate oligarchs need their trades to be ‘private.’ At least Bitcoin’s chaos is honest. This? This is Wall Street with a blockchain skin job.

Patrick De Leon

Irrelevant. The Irish state doesn't recognize sidechains. Bitcoin is sovereign. Anything else is a regulatory loophole dressed as innovation. Liquid is a Trojan horse for institutional capture. The moment you trust a federation you've already lost. End of story.

MANGESH NEEL

Let me break this down for the crypto newbies who think this is ‘innovation.’ You’re trading decentralization for convenience - and you call that progress? You think hiding transaction amounts makes you smart? It makes you a tax evader in training. And don’t get me started on RGB - it’s just Ethereum’s ghost haunting Bitcoin’s corpse. The fact that Tether uses this? That’s the red flag. They’re not building a future - they’re laundering the past. You’re not a trader, you’re a pawn in a game you don’t understand.

Sean Huang

What if the federation is compromised by a quantum AI from the NSA that was embedded during the 2017 fork? They don't tell you this but the 15 functionaries are all controlled by a single algorithm that runs on a server farm in Fort Meade. The 'peg-in delay'? That's not security - it's a backdoor. They're waiting for you to lock your BTC so they can trigger a silent reorg and rewrite your balance. I've seen the documents. The RGB protocol? It's a honeypot for blockchain surveillance. Don't trust the numbers. Don't trust the speed. Trust nothing. The truth is buried under layers of whitepapers and corporate PR. They want you to believe this is freedom. It's the opposite.

madhu belavadi

Just read the whole thing. Feels like a sales pitch disguised as a tutorial. I'm confused now.

Dick Lane

I appreciate how detailed this is. Honestly, I've been wondering how institutions handle large BTC moves without blowing up the mempool. Liquid makes sense for that. The 17-hour peg-in is rough but I get why it's there - it's not perfect but it's a real solution to a real problem. I'm not sold on trusting 15 entities but if they're all legit exchanges and banks... maybe it's the least bad option we've got for now. Thanks for laying it out so clearly.