Tornado Cash Sanctions Impact Checker

Sanctions Status Overview

This tool helps you understand the current status of Tornado Cash sanctions and what it means for different stakeholders.

Enter your role and click "Check Sanctions Impact" to see how Tornado Cash sanctions affect you.

Key Facts About Tornado Cash

- 1Launched in August 2019

- 2Processed over $7.6 billion in ETH

- 3Sanctioned by OFAC in August 2022

- 4Smart contracts delisted in March 2025

- 5Developers still sanctioned

When the U.S. Treasury slapped sanctions on a privacy‑boosting tool called Tornado Cash, the whole crypto world stopped to listen. If you’ve ever wondered what a crypto mixer actually does, why officials treated it like a money‑laundering ring, and what the recent court rulings mean for developers and users, you’re in the right place. This guide walks you through the tech, the legal fight, and the practical takeaways you need to navigate a changing landscape.

What Are Crypto Mixers?

Cryptocurrency mixer is a service that breaks the link between a sender’s address and a receiver’s address on a blockchain by pooling and redistributing funds through a series of transactions. The goal is simple: make it harder for anyone-be it law‑enforcement, analysts, or curious onlookers-to trace the flow of money. Most mixers operate on a non‑custodial model, meaning they never hold users’ assets; instead, they use smart contracts or off‑chain processes to shuffle coins.

Mixers have legitimate uses, such as protecting the privacy of donors in oppressive regimes or shielding everyday users from the transparent nature of public ledgers. However, the same anonymity that protects privacy also attracts illicit actors, which is why regulators keep a close eye on them.

How Tornado Cash Works

Tornado Cash is a non‑custodial Ethereum mixer launched in August2019 that uses smart contracts to let users deposit Ether and withdraw it to a new address, effectively erasing the on‑chain link. Users deposit a fixed amount (e.g., 0.1ETH, 1ETH, 10ETH) into a Tornado Cash contract, receive a secret note, and later submit that note to withdraw the same amount to a completely different address. Because the contract aggregates many deposits, the withdrawal appears unrelated to the original deposit.

According to Chainalysis, Tornado Cash processed over $7.6billion in Ether since its debut, with roughly 30% of that volume tied to illicit activity. The platform’s open‑source code means anyone can interact with the contracts directly, even if the official website is taken down.

Timeline of OFAC Sanctions

On August82022, the Office of Foreign Assets Control (OFAC) a division of the U.S. Department of the Treasury that administers and enforces economic and trade sanctions added Tornado Cash to the Specially Designated Nationals (SDN) list under Executive Order13694. The sanction cited the mixer’s role in laundering more than $7billion, including $455million stolen by North Korea’s Lazarus Group from the Axie Infinity hack, $96million from the Harmony Bridge heist, and $7.8million from the Nomad exploit.

OFAC’s order prohibited all U.S. persons from interacting with any of Tornado Cash’s Ethereum addresses, effectively blacklisting the smart contracts themselves-not just the developers. The immediate impact was a steep drop in transaction volume, although a stripped‑down version of the contracts remained accessible via scripts and dark‑web mirrors.

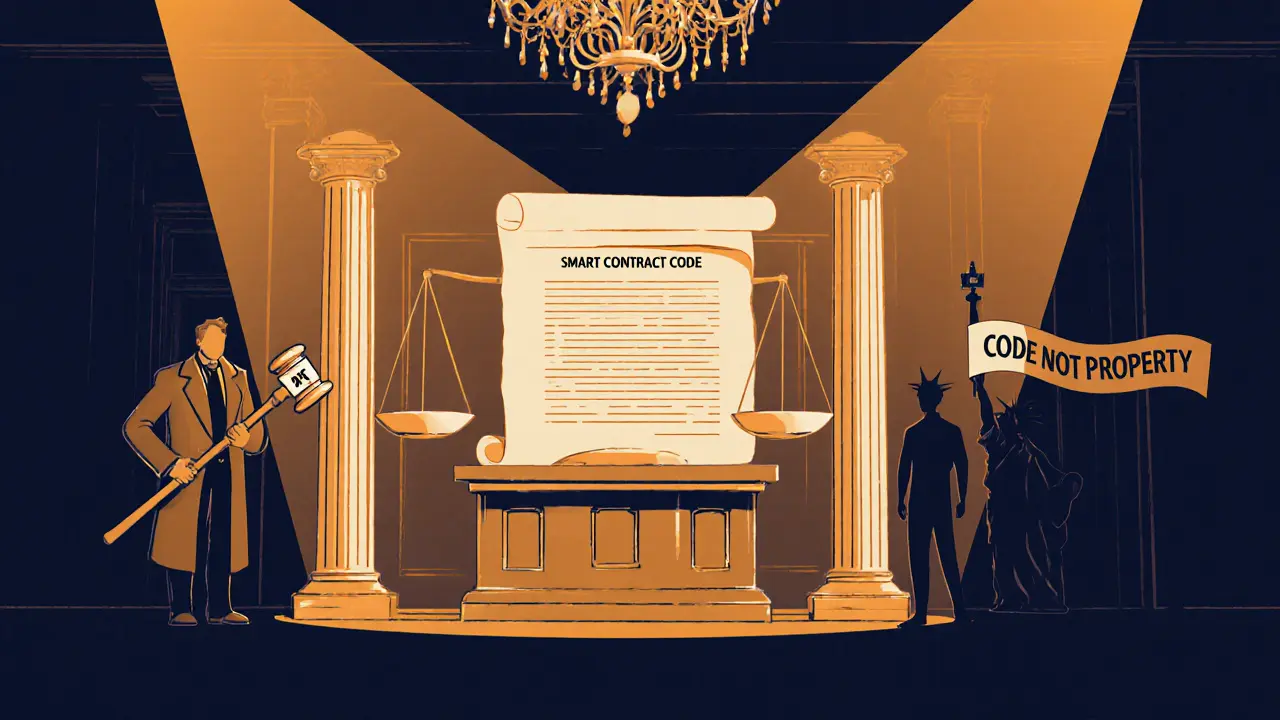

The Legal Battle: VanLoon v. Department of Treasury

In November2024, the Fifth Circuit Court of Appeals handed down a landmark ruling in VanLoon v. Department of Treasury a case challenging the OFAC sanction on the basis that the immutable smart contracts do not qualify as “property” under the International Emergency Economic Powers Act (IEEPA). The court concluded that OFAC had overstepped its authority because the smart contracts are code, not property, and therefore cannot be blocked as assets.

The decision sent the case back to the district court with instructions to grant a partial summary judgment for the plaintiff. While the ruling targeted the protocol‑level sanction, it left the sanctions against the individual developers untouched.

Sanctions Lifted-but Not Completely

On March212025, the Treasury announced it was removing the OFAC designation from Tornado Cash’s smart contracts. The delisting was limited to the code; the agency maintained sanctions against co‑founder Roman Semenov the identified developer of Tornado Cash who remains on the SDN list. This nuanced approach signaled a strategic shift: regulators can target individuals while acknowledging the technical challenges of sanctioning immutable blockchain code.

Despite the delisting, the Department of Justice proceeded with criminal charges against co‑founder Roman Storm accused of conspiracy to money‑launder, operate an unlicensed money‑transmitting business, and violate IEEPA. The case underscores that even if protocol‑level sanctions are rolled back, developers can still face personal liability.

Implications for Future Regulation

The Tornado Cash saga teaches several lessons for regulators, developers, and users alike:

- Code vs. Property: The Fifth Circuit’s ruling highlights a legal gray area-blockchain code may not fit traditional asset definitions, limiting the reach of financial sanctions.

- Targeting Individuals: Agencies can still pursue developers and operators, creating a dual‑track enforcement model.

- Compliance Complexity: Non‑custodial protocols challenge existing AML/KYC frameworks, demanding new technical solutions.

- Privacy Advocacy: The delisting was celebrated by privacy groups as a win for decentralized technology, reinforcing the debate between privacy rights and illicit finance prevention.

Analysts at Chainalysis note that the case “will influence how regulators draft future sanctions against decentralized finance protocols.” The industry is now watching for guidance on how to implement effective safeguards without stifling innovation.

Practical Checklist for Users and Developers

| Stakeholder | What to Do | Why It Matters |

|---|---|---|

| Casual Users | Verify that any address you interact with is not on the SDN list; use reputable blockchain explorers. | Avoid inadvertent violations that could trigger enforcement. |

| Developers | Implement on‑chain compliance filters (e.g., denylist checks) and consider adding optional KYC modules. | Demonstrate good‑faith effort to mitigate illicit use and reduce regulatory risk. |

| Law Firms | Advise clients on the distinction between protocol‑level and individual sanctions; monitor ongoing DOJ actions. | Provide accurate risk assessments and prevent costly legal exposure. |

| Exchanges | Update AML screening tools to flag transactions involving Tornado Cash contracts, even after delisting. | Maintain compliance with FinCEN and other global AML regimes. |

Frequently Asked Questions

Frequently Asked Questions

Is it legal for a U.S. person to use Tornado Cash now?

Yes, the Treasury removed the OFAC designation from the smart contracts, so interacting with the protocol is no longer prohibited. However, using any service linked to sanctioned individuals (e.g., the developers) could still pose legal risks.

What exactly did the Fifth Circuit rule?

The court held that OFAC cannot sanction immutable smart contracts because they are not "property" under IEEPA. The decision invalidated the protocol‑level sanction but did not affect sanctions against the developers.

How does a mixer differ from a centralized exchange?

A mixer never holds users’ funds; it simply shuffles them on‑chain via smart contracts. A centralized exchange custodies assets, runs KYC, and can freeze accounts, making it far more transparent to regulators.

Will future sanctions target other mixers?

Regulators are likely to focus on developers and operators rather than the code itself, following the Tornado Cash precedent. Expect more guidance around AML‑compatible designs for privacy tools.

Can I still earn crypto anonymously?

Yes, but you should use mixers that have built‑in compliance features or rely on privacy‑first wallets that incorporate stealth addresses. Always stay aware of the legal environment in your jurisdiction.

Comments (16)

ചഞ്ചൽ അനസൂയ

Hey folks, great read on the Tornado Cash saga. It really shines a light on how privacy tools walk a tightrope between freedom and regulation. Think of it like a yoga pose – you need balance, flexibility, and a solid core. The community can support developers while still championing user rights. Remember, every protocol is a living system; nurturing it helps keep the ecosystem healthy.

Stay curious and keep the conversation going.

Orlando Lucas

Reading through the timeline makes me appreciate the philosophical underpinnings of code as property. If we treat immutable smart contracts as pure logic, sanctioning them feels like trying to ban a language. Yet the human element – the developers – remains a tangible target. It’s a compelling case study of law trying to catch up with technology. One could argue that the Fifth Circuit’s decision nudges regulators toward more nuanced frameworks, perhaps focusing on intent rather than mere code.

Philip Smart

Sure, the whole sanction saga is a wild ride, but privacy matters.

Jacob Moore

Yo, the delisting of the contracts is a win for the devs, but don’t get too comfy. Exchanges should still flag interactions, and users need to double‑check addresses. Think of it as a safety net – you want the best of both worlds: anonymity and compliance.

Stay alert, stay safe.

Manas Patil

From an Indian perspective, the balance between financial sovereignty and global AML standards is crucial. Crypto mixers like Tornado Cash offer a layer of obfuscation that resonates with users seeking protection from surveillance. However, regulatory bodies worldwide are honing in on the “know‑your‑customer” paradigm.

By integrating on‑chain compliance filters, developers can foster trust without sacrificing core privacy principles.

Annie McCullough

Honestly the whole thing feels like a witch‑hunt 🤔 sanctions on code? that’s just overreach lol but i guess they’ll keep targeting the devs 🤷♀️

Lady Celeste

Regulators love to misuse the law. This only fuels more secrecy.

Ethan Chambers

One must question whether the sanctimonious moral high ground taken by OFAC truly reflects the nuanced reality of decentralized finance. To vilify an entire protocol is, frankly, a reductionist viewpoint that ignores the broader tapestry of cryptographic innovation. The Fifth Circuit’s decision merely scratches the surface of a profound legal conundrum.

gayle Smith

Okay, let’s get real – privacy tools are a double‑edged sword, but we can’t just throw them in the trash because some bad actors use them. The narrative needs more nuance, and the community should push for smarter, not stricter, oversight.

mark noopa

Whoa, the Tornado Cash saga is practically a textbook on modern crypto law, and here’s why every sentence matters. First, the OFAC designation on the smart contracts illuminated the unique challenge of applying traditional sanctions to immutable code, sparking debates about property rights in the digital realm. Second, the Fifth Circuit’s ruling that code isn’t "property" under IEEPA set a precedent that could reshape future enforcement strategies across the blockchain industry. Third, despite the delisting of the contracts, the continued targeting of developers like Roman Semenov underscores a dual‑track approach where individual actors remain vulnerable.

Fourth, the case illustrates how privacy‑enhancing technologies, while beneficial for legitimate users, can inadvertently aid illicit activities, compelling regulators to seek balanced solutions.

Fifth, the legal narrative reveals the importance of clear on‑chain compliance tools, such as deny‑lists and optional KYC modules, which developers can adopt to mitigate risk.

Sixth, the community’s reaction, from privacy advocates cheering the delisting to enforcement agencies tightening AML screenings, showcases the polarizing nature of the debate.

Seventh, the timeline from 2019 inception to the 2025 delisting provides a longitudinal view of how policy evolves alongside technology.

Eighth, the case demonstrates how judicial decisions can influence Treasury actions, as seen when the Fifth Circuit sent the matter back to the district court for further consideration.

Ninth, the ongoing DOJ criminal charges against co‑founder Roman Storm remind us that individual liability persists regardless of protocol‑level outcomes.

Tenth, the broader implications for DeFi regulation suggest that future sanctions may focus more on developers and operators rather than the code itself.

Eleventh, analysts from Chainalysis predict that this precedent will inform how regulators draft sanctions for other privacy tools, potentially leading to more nuanced guidance.

Twelfth, from a technical standpoint, the non‑custodial nature of mixers adds complexity to AML frameworks, pushing for innovative on‑chain analytics.

Thirteenth, the case fuels philosophical debates about the nature of code, property, and personal freedom in the age of decentralized finance.

Fourteenth, the community should use this moment to bolster privacy‑preserving solutions that incorporate compliance without sacrificing core values.

Finally, all stakeholders-from users to developers to policymakers-must engage in constructive dialogue to navigate the delicate balance between privacy and security.

🔍💡🚀

Rama Julianto

Listen up, the whole thing is a massive mess and you gotta stay sharp. If you keep using mixers without checking the latest sanction lists you’re basically signing up for a legal nightmare. Do your own research, keep tabs on OFAC updates, and don’t be a fool. The blockchain world is ruthless – only the informed survive.

Helen Fitzgerald

Hey team, love how this post breaks down the complexities! Just a reminder: if you’re building on‑chain tools, adding optional KYC layers can keep you on the right side of regulators while still giving users privacy options. Let’s keep sharing knowledge and supporting each other.

Jon Asher

Great summary, guys. It’s clear that the line between privacy and compliance is getting blurrier, but with open dialogue we can find a middle ground that works for everyone.

Nathan Van Myall

Adding onto the brief note earlier, it’s worth highlighting that the smart contracts themselves remain public code, meaning anyone can audit the changes post‑delisting. This transparency can serve as a protective measure for users who worry about hidden backdoors.

debby martha

yeah but i still think the whole developer sanction thing is overkill lol

Ted Lucas

🚀 Absolutely! The long‑form analysis nails the key points and reminds us that compliance isn’t a roadblock-it’s a roadmap. Keep the deep dives coming, and let’s keep the community informed and resilient! 👍