NFT Royalty Enforcement Strategy Calculator

Configure your settings and click "Analyze My Strategy" to see recommendations.

- EIP-2981 is the standard for royalty implementation

- Blocklists require ongoing maintenance

- Allowlists ensure compliance but limit flexibility

- Cross-chain transfers may lose royalty data

- Royalty-embedded blockchains offer zero-trust enforcement

When a creator mints a digital collectible, the goal is to keep earning a slice every time it flips hands. NFT royalties are a set of rules baked into the token’s smart contract that tell the blockchain how much of each secondary‑sale price should be sent back to the creator. The magic happens on‑chain: once the royalty percentage is stored in the contract, every compliant marketplace or wallet can execute the payment automatically, without a middleman.

Key Takeaways

- EIP‑2981 is the de‑facto royalty standard for ERC‑721 and ERC‑1155 NFTs.

- Blocklists prevent non‑compliant contracts from transferring an NFT; allowlists restrict trading to approved platforms.

- Cross‑chain moves often strip royalty data unless a bridge or royalty‑aware chain is used.

- Emerging blockchains (Enjin, RARI‑Foundation testnet) embed royalty enforcement at the protocol layer.

- Creators must balance strict enforcement with composability - the more you lock down transfers, the less flexible the NFT becomes.

What On‑Chain NFT Royalties Actually Are

On‑chain royalties are just a piece of code that runs every time an NFT changes owner. The code reads two values from the contract: the royalty % (or a fixed amount) and the beneficiary address(es). Then it splits the sale price and sends the share directly to those addresses. Because the logic lives in the smart contract, it can’t be altered by a rogue marketplace - the blockchain itself guarantees the payout.

Why EIP‑2981 Became the Standard

EIP‑2981 is a simple interface that any ERC‑721 or ERC‑1155 contract can implement to expose royalty information. The interface defines a single function, royaltyInfo(uint256 tokenId, uint256 salePrice), that returns the address that should receive the royalty and the exact amount owed. Because the function is part of the ERC‑721/1155 spec, any marketplace that reads the interface can automatically deduct the royalty before completing the transfer.

Key attributes of EIP‑2981:

- Percentage‑based or fixed‑amount royalties.

- Multiple beneficiaries via custom logic (many contracts split the payout internally).

- Read‑only - the royalty data can’t be changed after mint unless the contract explicitly allows it.

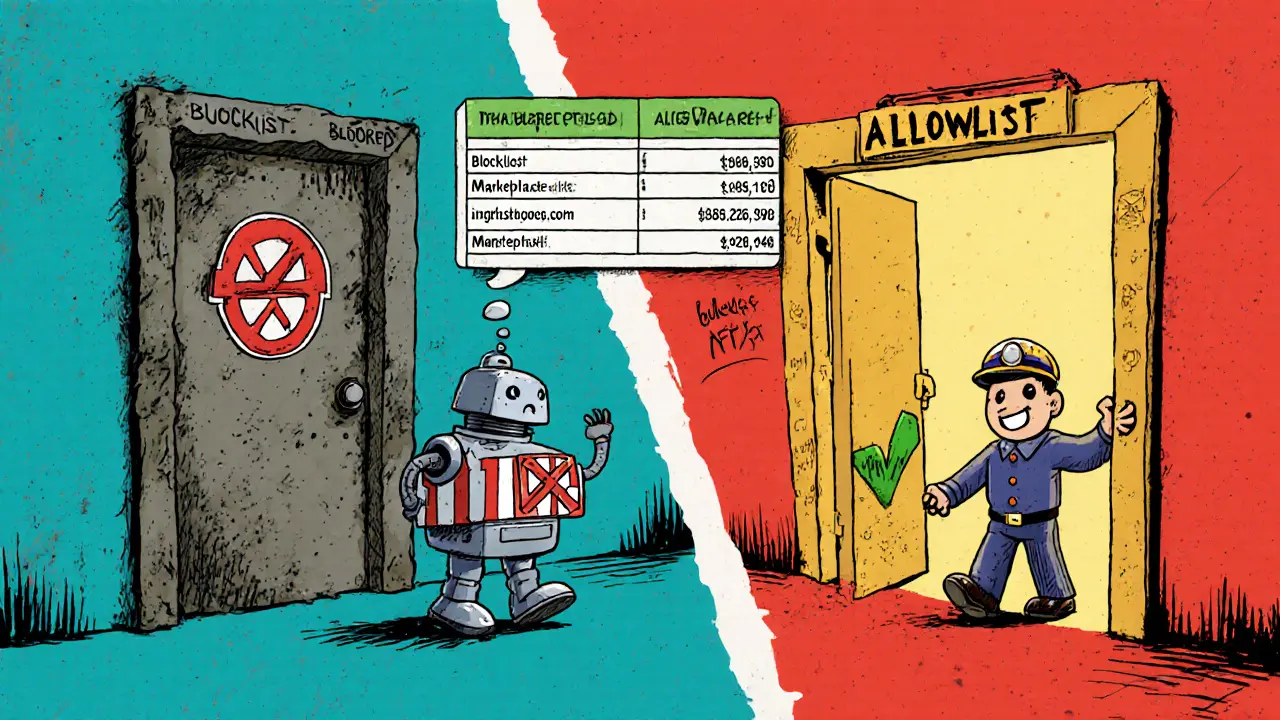

How Blocklists and Allowlists Enforce Royalties

Even with EIP‑2981, a marketplace could simply ignore the function and let the sale go through. To stop that, developers add transfer‑gate checks inside the NFT contract.

Blocklist Approach

A blocklist works like a firewall. The NFT contract stores a list of addresses (usually other contracts) that are not allowed to call transferFrom or safeTransferFrom. If a buyer tries to trade on a non‑compliant platform, the transaction reverts.

Pros:

- Creators keep flexibility - they can add new bad actors to the list as they appear.

- Doesn’t require prior approval of every marketplace.

Cons:

- New rogue marketplaces appear all the time; keeping the list up‑to‑date is a full‑time job.

- Blocklists can be bypassed by proxy contracts or by using a “trade‑off‑chain” settlement.

Allowlist Approach

An allowlist is the opposite: the contract only accepts transfers from a whitelist of known, royalty‑honoring platforms. Anything else fails.

Pros:

- Guarantees that any successful trade respects royalties.

- Reduces monitoring overhead - you only add trusted platforms.

Cons:

- Limits composability; users cannot sell on emerging marketplaces without a contract upgrade.

- May deter collectors who prefer open‑source, permissionless trading.

Blocklist vs. Allowlists - At a Glance

| Aspect | Blocklist | Allowlists |

|---|---|---|

| Flexibility | High - add bad actors as they emerge | Low - only pre‑approved platforms work |

| Maintenance | Continuous monitoring required | One‑time vetting, occasional updates |

| Composability | Preserved - works with most dApps | Reduced - restricts trade routes |

| Bypass Risk | Medium - proxy contracts can slip through | Low - only vetted contracts accepted |

Cross‑Chain Royalty Challenges

Moving an NFT from Ethereum to another chain (e.g., Polygon, Solana) usually involves a bridge that locks the original token and mints a wrapped version on the destination chain. If the bridge doesn’t understand EIP‑2981, the wrapped token loses its royalty metadata, meaning the new chain can’t enforce the original creator’s cut.

Solutions are emerging:

- Royalty‑aware bridges that copy the

royaltyInfopayload to the wrapped token. - Standardized royalty fields in cross‑chain token specs (e.g., ERC‑721A on Polygon).

- Native royalty support on newer blockchains, eliminating the need for wrappers.

Until interoperability matures, creators risk losing income when their art jumps across ecosystems.

Royalty‑Embedded Blockchains: A New Direction

Some projects have taken the enforcement problem to the protocol layer. Instead of relying on smart contracts to enforce royalties, they bake the rule into the blockchain itself.

Enjin launched a mainnet in June2023 that includes a native royalty field for every NFT mint. Similarly, the RARI Foundation released a testnet in early2023 and a full‑scale EVM‑compatible mainnet on 24January2024 where the node validates royalty payouts on every transfer.

Benefits of this approach:

- Zero‑trust enforcement - the chain itself rejects a transfer that skips the royalty.

- Universal applicability - any dApp built on the chain automatically respects royalties.

- Reduced monitoring - creators no longer need to manage blocklists or allowlists.

Drawbacks include lower composability with existing Ethereum‑based tooling and the need for users to adopt a new ecosystem.

Real‑World Market Dynamics

Marketplace behavior shows a split. OpenSea announced in 2023 that it would block royalty‑optional platforms like Blur, effectively forcing all sales on its UI to honor on‑chain royalties. Blur, on the other hand, lets sellers set royalty percentages to zero, attracting traders who want to maximize short‑term profit.

Nansen data from July2023 recorded a two‑year low in royalty collections on Ethereum, suggesting creators lost tens of millions of dollars during the optional‑royalty experiment. The trend highlights that enforcement mechanisms matter as much as the technical standard.

Practical Checklist for Creators

- Implement EIP‑2981 in the NFT contract and set an appropriate royalty % (commonly 5‑10%).

- Decide on a transfer‑gate strategy: blocklist if you value openness, allowlist if you need certainty.

- Monitor major marketplaces regularly - tools like Royalty Watch can flag new contracts that bypass royalties.

- If you plan cross‑chain sales, choose bridges that support royalty metadata or mint directly on a royalty‑aware chain.

- Consider launching on a royalty‑embedded blockchain for maximum security, especially for high‑value series.

Future Outlook

Industry consensus points toward two complementary paths: improved cross‑chain standards (e.g., a future EIP‑xxxx that adds royalty fields to token bridges) and the rise of royalty‑native blockchains. Regulatory clarity could also push platforms to honor creator fees, as some jurisdictions begin treating royalty agreements as enforceable contracts.

For creators, the safest bet today is a mixed approach: use EIP‑2981, adopt an allowlist for core marketplaces, and keep an eye on emerging royalty‑embedded chains. The ecosystem is still evolving, but the tools to protect your income are becoming more robust.

Frequently Asked Questions

Can I enforce royalties on a marketplace that doesn’t support EIP‑2981?

Not directly. You can either add a blocklist entry for that marketplace’s contract address or move your NFT to a royalty‑embedded blockchain where the rule is enforced at the protocol level.

What’s the difference between a blocklist and an allowlist?

A blocklist denies specific contracts from transferring the NFT, while an allowlist only permits transfers from pre‑approved contracts. Blocklists are more flexible but require constant updates; allowlists are stricter but limit where the NFT can be sold.

Do royalty‑embedded blockchains work with existing Ethereum wallets?

Most popular wallets (MetaMask, Trust Wallet) can connect to any EVM‑compatible chain, so you can manage royalty‑native NFTs just like standard ERC‑721 tokens. The key difference is that the chain itself validates royalty payouts.

How can I protect my royalties when moving NFTs across chains?

Use bridges that explicitly copy the royaltyInfo data, or mint the NFT directly on a chain that supports the same royalty standard. Some projects also issue a “wrapped” token that carries the royalty metadata on the destination chain.

Is it legal to enforce royalties via smart contracts?

Legal enforceability varies by jurisdiction. In many regions, a smart contract can be treated as a binding agreement, but some places don’t yet recognize it. Creators should consult local IP counsel if they rely on royalties for significant revenue.

Comments (15)

Roxanne Maxwell

Love how this breaks down the real trade-offs without hype. I’ve seen so many creators get burned by assuming royalties just work. The blocklist vs allowlist comparison? Gold. I’m switching my next drop to an allowlist-better peace of mind than chasing shady marketplaces.

Also, shoutout to Enjin. Their native royalty layer is the future. No more guessing if a sale went through. Just mint and walk away.

Jonathan Tanguay

Okay so let me get this straight-you’re telling me we’re supposed to trust some dumb EIP that’s been around since 2020 but still isn’t universally adopted? LOL. OpenSea says they enforce it but Blur still lets people set royalties to 0 and nobody does anything. This whole thing is a house of cards built on optimism and wishful thinking. And don’t even get me started on cross-chain bridges-those are just glorified phishing tools with a whitepaper. You think a wrapped token on Polygon is gonna carry your royalty data? Nah. It’s just a ghost. And the ‘royalty-aware chains’? More like ‘royalty-wannabe chains’ trying to piggyback on Ethereum’s name. I’ve seen this movie before. It ends with the dev wallet drained and the community screaming into the void. EIP-2981? More like EIP-2981-Please-Stop-Lying-To-Us.

Ayanda Ndoni

Man I just want to sell my art and get paid. Why does it have to be this complicated? I spent 3 weeks on one NFT and now I gotta learn smart contracts and blocklists and bridges? I’m tired. Can’t we just have one platform that does it right? Why do we keep reinventing the wheel? Also I tried to use OpenSea last week and my royalty didn’t show up. Felt like someone stole my lunch money. 😞

Elliott Algarin

There’s something poetic about the tension here-creators trying to protect their labor against a system designed for liquidity and speed. The more we lock things down, the less alive the art becomes. NFTs were supposed to be about ownership, not control. Maybe the real question isn’t how to enforce royalties, but whether we should be trying to enforce them at all. What if the value isn’t in the cut, but in the community that grows around the work? I don’t have an answer. Just wondering.

John Murphy

Blocklist is easier to start with but you gotta keep updating it. I’ve been using Royalty Watch and it’s saved me three times already. Found a new marketplace that wasn’t even on the radar. Also EIP-2981 is solid but not enough. You need the transfer gate too. My last collection had 10% royalties and I lost maybe $8k in the first month because someone used a proxy. Now I use allowlist on main marketplaces and blocklist everywhere else. Works fine. Just annoying to manage.

Zach Crandall

One must pause and reflect upon the fundamental philosophical underpinnings of intellectual property in decentralized ecosystems. The notion that a smart contract can enforce a moral obligation-however well-intentioned-is an anthropomorphic projection onto code. Royalties, as a social construct, were never meant to be codified in immutable ledgers. To do so is to confuse legal precedent with computational logic. One might argue that the true spirit of the NFT movement lies in liberation from such constraints. Yet, paradoxically, the very mechanism designed to empower creators becomes the instrument of their entrapment within an ever-narrowing set of compliant protocols. This is not progress. This is enclosure.

Akinyemi Akindele Winner

Y’all acting like royalties are some sacred cow when in reality it’s just a glorified tip jar with a blockchain tattoo. You think your pixelated ape is art? Nah. It’s a digital baseball card with a side of ego. And you wanna get paid every time someone flips it? Bro, you’re not a musician-you’re a speculator with a fancy wallet. If you really cared about your ‘art’, you’d give it away and build a community. Instead you’re out here playing landlord on a blockchain. The whole system’s rigged. Let the free market do its thing. No royalties. No drama. Just vibes.

Patrick De Leon

Let me be blunt. The whole EIP-2981 thing is a joke. American devs think they can legislate morality through code. Meanwhile in Europe we’re building actual legal frameworks for digital rights. You think a smart contract holds up in a Dublin court? No. It’s just lines of text on a server. The only thing that matters is whether the buyer agrees to pay. Not some automated payment that gets ignored by 90% of platforms. This is not innovation. It’s delusion dressed up as tech.

MANGESH NEEL

HOW DARE YOU suggest that creators should compromise on royalties? This is not a negotiation. This is theft. Every time a marketplace ignores a royalty, they are stealing from the soul of the artist. You think I don’t know what it’s like to spend 6 months on a piece and then see it flipped for 50x with zero return? I’ve cried over my laptop. I’ve lost sleep. And now you want me to ‘balance’ it with ‘composability’? COMPOSABILITY? That’s just a fancy word for letting thieves win. I will not be silenced. I will not be ignored. I will enforce my royalties with fire and code and I will not apologize. This is justice. And if you disagree, you’re part of the problem.

Sean Huang

Have you ever stopped to think that maybe the entire NFT royalty system is a controlled demolition? The big players want you to believe in EIP-2981 and allowlists because it keeps you locked into Ethereum. Meanwhile, they’re quietly building off-chain royalty tracking systems that bypass all this. They don’t need on-chain enforcement. They just need you to think you do. And guess what? The bridges that ‘copy’ royalty data? They’re all backdoored. The Enjin chain? Owned by a shell corp in the Caymans. The ‘royalty-aware’ protocols? All funded by the same VC that owns OpenSea. You’re not protecting your art. You’re feeding the machine. Wake up. The blockchain isn’t free. It’s a cage with a pretty lock.

Ali Korkor

Hey new creators reading this-you got this. Start with EIP-2981, set 7.5%, and use an allowlist for the big 3 marketplaces. Don’t overthink it. You don’t need to fight every battle. Just make sure your first 100 sales are protected. Then grow from there. The tools are better than they were a year ago. And if you get stuck, DM me. I’ll help you set it up for free. You’re not alone in this.

madhu belavadi

My NFTs got stolen last week. Not the art. The royalties. Someone minted a copy on a new chain and sold it. I didn’t even know until I saw the transaction. I cried. Again. Why does this always happen to me?

Dick Lane

Blocklist works fine until someone deploys a proxy contract that looks like a legitimate marketplace. Happened to me. Took me 3 weeks to find it. Now I use a hybrid-allowlist for the top 5, blocklist for known bad actors, and I monitor on-chain transfers with a script. It’s a pain but it works. Also EIP-2981 is good but not perfect. Some wallets don’t read it right. Just something to keep in mind.

Norman Woo

Wait so if I mint on Enjin and then move it to Ethereum via bridge... does the royalty still work? Or is it like... a ghost royalty? I tried this once and my wallet said 'no royalties found' and I was like... did I just get haunted by code? 😅

Serena Dean

Just launched my first collection using the allowlist method + EIP-2981. First sale went through on OpenSea and the royalty hit my wallet in 4 minutes. I screamed. My cat ran out of the room. This is why we do this. You can do it too. Start small. Stay consistent. And don’t let the trolls make you doubt your worth. Your art matters. Your cut matters. Keep going.