Bolivia Crypto Compliance Penalty Estimator

Calculate Your Potential Penalty

Input transaction details to estimate regulatory consequences in Bolivia.

Important Note: Penalties are case-specific and determined by authorities based on severity, intent, and repeat offenses.

Compliance Guidelines

✅ Stay Compliant

- Use licensed banks or approved payment channels

- Only use stablecoins like USDT/USDC

- Report business profits at 25% tax rate

- Keep transaction records for 5 years

- Never send crypto directly to wallets without bank routing

Estimated Penalty Range

Regulatory Actions:

⚠️ Critical Risk: This is an estimation based on Bolivia's regulatory framework. Actual penalties may vary significantly.

When Bolivia banned cryptocurrency in 2014, trading Bitcoin or Ethereum could land you in serious legal trouble. But that changed in June 2024. Today, crypto isn’t illegal in Bolivia - but it’s not free either. If you’re trading crypto there, you need to know exactly where the line is. Cross it, and you’re not just risking your money - you’re risking a regulatory investigation, fines, or worse.

What’s Legal Now in Bolivia?

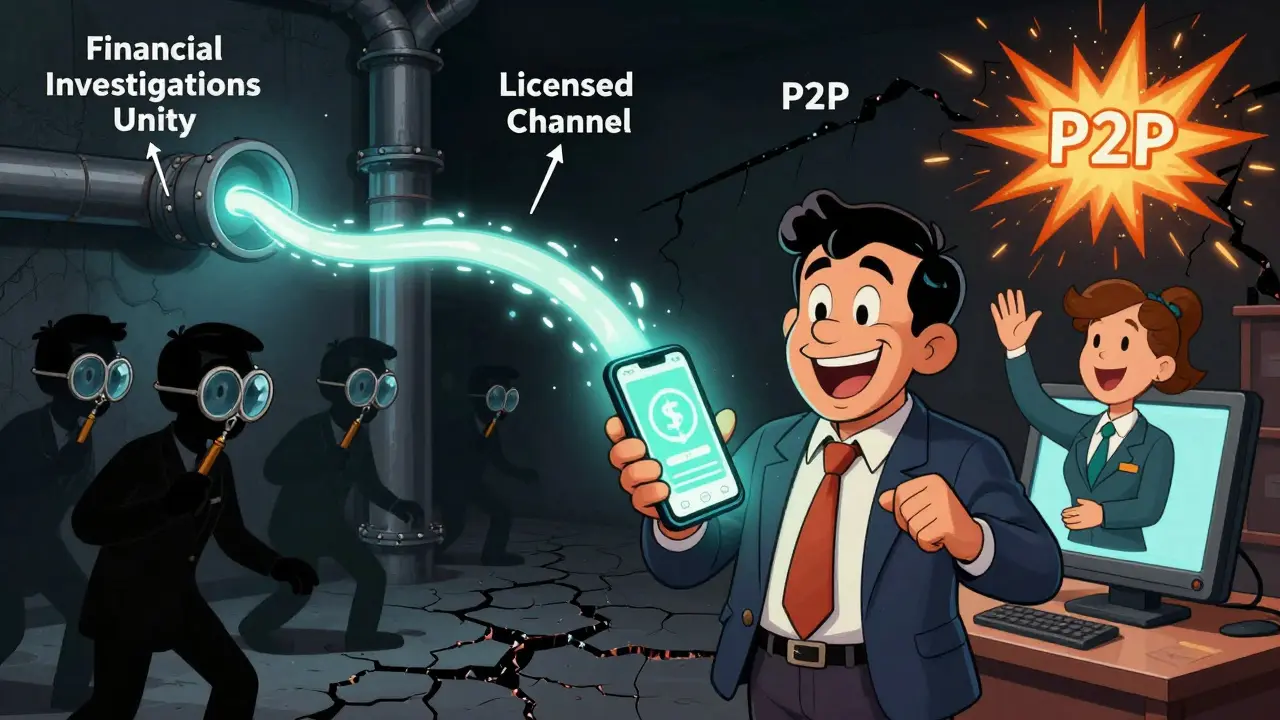

The big shift came with Central Bank of Bolivia Resolution N°082/2024. For the first time since 2014, crypto transactions became legal - but only under strict conditions. You can own Bitcoin, Ethereum, and especially stablecoins like USDT and USDC. You can even use them to pay employees or settle invoices. But here’s the catch: all transactions must go through licensed banks or approved electronic payment channels. No peer-to-peer trades. No direct transfers between wallets. No using crypto to pay at local shops unless the business is registered with the Central Bank and uses an authorized platform. If you’re sending USDT from your Binance wallet to a friend’s wallet in La Paz without going through a bank? That’s a violation. The government doesn’t treat crypto as money. The boliviano is still the only legal tender. Crypto is treated like an Electronic Payment Instrument (EPI) - a tool, not a currency. That means you can’t demand payment in Bitcoin. But you can accept USDT if your bank allows it.Who’s Watching You?

Bolivia didn’t just lift the ban - it built a surveillance system. Three agencies now monitor crypto activity:- Central Bank of Bolivia (BCB): The main regulator. They set the rules and track transaction volumes.

- Financial System Supervisory Authority (ASFI): Oversees financial institutions to make sure they’re following the rules.

- Financial Investigations Unit: Looks for money laundering, sanctions violations, and fraud.

What Happens If You Break the Rules?

There’s no public list of fines. You won’t find a table saying “$500 for unlicensed trading.” That’s because penalties aren’t fixed. They’re decided case by case, based on severity, intent, and whether the person is a repeat offender. Here’s what you risk if you bypass the system:- Transaction blocking: Your bank can freeze any crypto transfer that doesn’t go through an authorized channel.

- Account suspension: If you’re a business using crypto without registration, your bank account could be shut down.

- Regulatory fines: ASFI can impose financial penalties. While exact amounts aren’t published, similar cases in Latin America suggest fines can reach tens of thousands of dollars for businesses.

- Criminal investigation: If regulators suspect money laundering, tax evasion, or fraud, the Financial Investigations Unit can refer your case to prosecutors.

Taxes: No Capital Gains, But Business Profits Are Taxed

Here’s one of the most surprising parts: Bolivia doesn’t tax personal crypto gains. If you bought Bitcoin at $30,000 and sold it at $60,000, you keep the profit. No capital gains tax. No reporting required. That’s rare in Latin America. But if you’re running a business - mining, staking, running a crypto exchange, or trading as a professional - you pay 25% corporate income tax on profits. That’s the same rate as for any other business. You have to register with the tax authority, keep records, and file returns. This creates a clear split: casual traders are mostly left alone. Commercial operators are tightly regulated. If you’re making $10,000 a month trading crypto as a side hustle, you’re probably safe. If you’re running a crypto arbitrage business with automated bots? You need to register as a company and pay taxes - or risk penalties.Who’s Doing It Right?

Banco Bisa, one of Bolivia’s biggest banks, launched a stablecoin custody service in October 2024. They now hold USDT for customers, allowing them to send and receive it through their banking app. It’s not a crypto exchange - it’s a regulated financial service. This is the model the government wants: crypto moving through the banking system, not around it. The Central Bank reports that over 75% of users are men between 20 and 40. Most use Binance or similar platforms to buy stablecoins, then transfer them to their bank accounts. The trend is clear: people want crypto for its speed and lower fees - but they’re doing it within the new legal boundaries.

What About Mining or Staking?

Mining Bitcoin or staking Ethereum isn’t banned. But if you’re doing it as a business - meaning you’re earning income from it - you’re subject to the 25% corporate tax. You also need to prove your equipment and electricity costs are legitimate. If you’re mining from your home and earning $500 a month, you’re unlikely to be audited. But if you’re running a farm of 50 ASICs, you’re definitely on the radar. The government doesn’t care if you mine. They care if you profit and don’t report it.International Cooperation and Future Risks

Bolivia isn’t going it alone. In late 2024, they signed a Memorandum of Understanding with El Salvador’s National Commission for Digital Assets. That means they’re sharing tech, training, and enforcement strategies. El Salvador has experience with Bitcoin as legal tender. Bolivia is learning how to regulate without banning. This signals two things: first, Bolivia’s rules aren’t temporary. Second, enforcement is getting smarter. Expect more automated monitoring, better data sharing with other countries, and tighter controls on cross-border transfers.Bottom Line: Stay Inside the Lines

Bolivia’s crypto rules are simple if you remember one thing: use the bank. If your transaction flows through a licensed financial institution, you’re protected. If you try to go around it, you’re playing with fire. You can trade. You can hold. You can even profit. But you can’t hide. The system is watching. And the penalties aren’t about owning crypto - they’re about avoiding the rules. If you’re in Bolivia and want to use crypto, here’s your checklist:- Only use stablecoins like USDT or USDC.

- Buy and sell through licensed banks or approved platforms.

- Never send crypto directly to another person’s wallet unless it’s routed through a bank.

- If you’re making money from crypto as a business, register and pay 25% tax.

- Keep records of all transactions - even if you’re not taxed.

Comments (15)

Stanley Machuki

So Bolivia finally gets it - crypto isn’t the enemy, just unregulated chaos. Love that they’re forcing it through banks instead of letting it run wild. Smart move.

Tiffany M

OMG I can’t believe they don’t tax personal gains?? That’s like… the ONLY country in Latin America doing this?? I’m packing my bags. 🤯🇺🇸

Nicholas Ethan

The regulatory architecture is structurally sound but operationally fragile. The absence of standardized penalty matrices introduces systemic uncertainty. This is not policy - it’s discretionary enforcement disguised as law.

Rakesh Bhamu

Interesting how they treat crypto as an EPI instead of currency. It’s a smart workaround - lets people use it without giving it legal tender status. Keeps the boliviano intact while letting innovation breathe. Good balance.

Jessica Petry

So you're telling me I can buy USDT on Binance, hold it, and not pay taxes? That’s basically a loophole for the rich. What’s next? Tax-free gold bars in your basement? This isn’t innovation - it’s regulatory surrender.

Kathryn Flanagan

Hey everyone - if you’re thinking about using crypto in Bolivia, just remember: use the bank. Seriously. It’s not that hard. Buy your USDT through Banco Bisa’s app, keep your receipts, and you’re golden. No need to overcomplicate it. People make it sound like a heist when it’s really just… banking with extra steps.

Lynne Kuper

630% increase in crypto volume?? That’s wild. And 86% stablecoins? Of course. Nobody wants to gamble on BTC when they’re trying to pay their rent. Smart users. Dumb regulators who still think crypto = chaos.

Kathy Wood

Wait… so you can mine 50 ASICs but if you don’t register, you’re a criminal? But if you just hold USDT? Totally fine?? This isn’t regulation - it’s a trap for the greedy. Who even thinks this is fair??

Lloyd Cooke

There is a metaphysical tension here: the state seeks to domesticate the decentralized, to cage the wild ether with institutional chains. Yet the people - the quiet, pragmatic traders of La Paz - have already chosen their sovereignty. They do not rebel. They simply route. And in that routing, they outmaneuver the bureaucracy. Is this not the quietest revolution?

Jessica Eacker

For real - if you’re trading as a side hustle, don’t stress. The system isn’t looking for you. But if you’re running bots and making bank? Register. File. Pay the 25%. It’s not scary. It’s just… paperwork. You got this.

Andy Walton

bro i just bought 50k in usdt on binance and sent it to my cousin in cochabamba 😭😭😭 we didnt use a bank… is we gonna jail?? 😭😭😭

Rakesh Bhamu

@Andy Walton - yeah you’re gonna get your transaction frozen and flagged. Banks are scanning every single transfer now. They don’t care if it’s your cousin. If it’s not routed through a licensed channel, it’s a red flag. Don’t risk it. Just use the bank app - it’s literally one extra tap.

Candace Murangi

Love that Bolivia’s letting people use crypto without turning it into a police state. Most countries either ban it or go full surveillance. This? This is middle ground. Real people doing real things. No drama. Just stablecoins and bank apps.

Albert Chau

Anyone else notice how the entire system is designed to favor the wealthy? Only people with bank accounts and access to licensed platforms can participate. The poor? Still stuck with cash. This isn’t financial inclusion. It’s exclusion with a blockchain veneer.

Madison Surface

Just wanted to say - if you’re new to this, don’t panic. The rules aren’t that complicated. Buy through a bank. Don’t send direct wallet-to-wallet. Keep records. If you’re just holding or trading casually? You’re fine. If you’re doing it for business? Register. It’s not scary. You’ve got this. I believe in you 💪