When you use a weather app on your phone, it pulls real-time data from a weather service like AccuWeather. But what if that same app is running on a blockchain? How does a smart contract know the current temperature? That’s where API3 comes in. API3 isn’t just another crypto coin-it’s the infrastructure that lets blockchains talk directly to real-world data sources without middlemen.

What API3 Actually Does

Most blockchains can’t access live data on their own. They need something called an oracle-a bridge between the blockchain and the outside world. But traditional oracles, like Chainlink, rely on third-party operators who fetch data and feed it into smart contracts. That creates a weak point: if the oracle is hacked or goes offline, the whole system breaks.

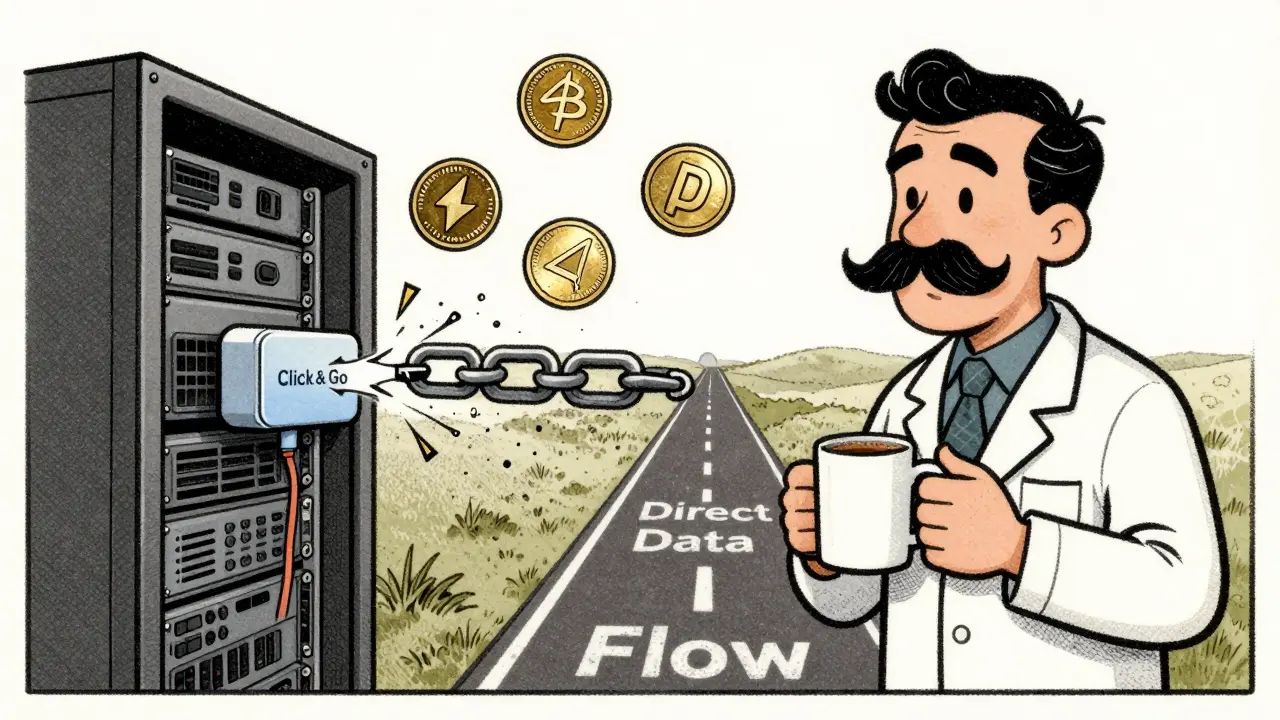

API3 fixes this by letting the data providers themselves run the oracles. AccuWeather doesn’t need to hire a blockchain engineer. They just install Airnode, API3’s serverless oracle node software, and start sending weather data directly to smart contracts. No middleman. No extra fees. No guesswork.

This is called the first-party oracle model. Instead of trusting someone else to deliver the data, you trust the original source. It’s like getting your stock price directly from Bloomberg instead of a random tweet.

How Airnode Makes It Work

Airnode is the engine behind API3. It’s designed so that API providers-companies like Amberdata, AccuWeather, or even your local bank-can run oracle nodes without knowing anything about blockchain.

Here’s how it works: When a dApp (a decentralized app) needs weather data, it sends a request. Airnode listens for that request, pulls the data from AccuWeather’s API, and sends it straight to the blockchain. The user who made the request pays the gas fee. The data provider doesn’t pay anything. They don’t even need to hold cryptocurrency.

This flips the script. In older oracle systems, the oracle operator had to buy crypto to pay for gas, then charge users enough to cover costs and make a profit. But gas prices swing wildly. One day it’s $0.50, the next day $5. That made pricing impossible. API3 removes that problem entirely. The requester pays. The provider earns. Simple.

The API3 Token: More Than Just a Coin

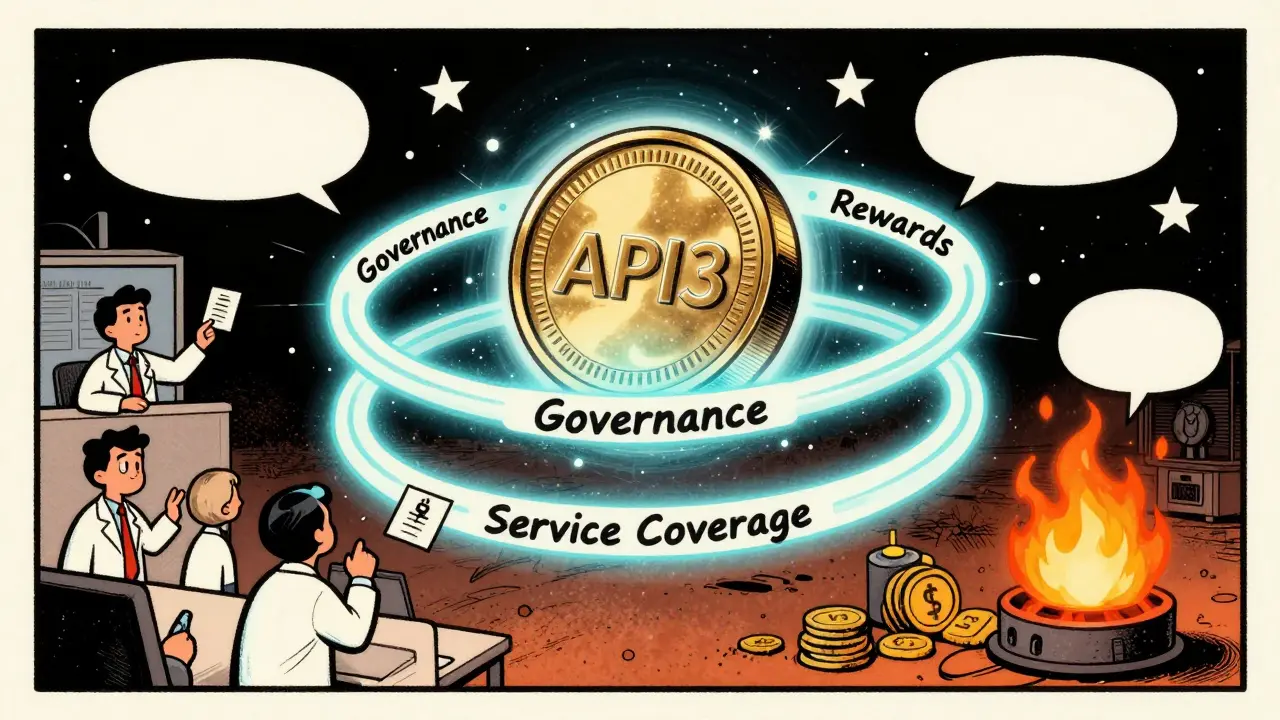

The API3 token isn’t just for trading. It’s the glue that holds the whole system together. There are three main uses:

- Governance-Holding and staking API3 tokens lets you vote on changes to the network. Want to add a new data provider? Change the fee structure? You get a say.

- Service Coverage-Stakers lock up API3 tokens to guarantee that dAPIs (decentralized APIs) stay online. If a data feed fails, stakers lose part of their stake. That’s how the system stays reliable.

- Rewards-Stakers earn new API3 tokens every week. It’s not a yield farm. It’s a system where the more you help secure the network, the more you get paid.

The API3 DAO (Decentralized Autonomous Organization) runs everything. No CEO. No corporate board. Just token holders voting on proposals. There are two voting tracks: one for anyone who can gather enough signatures, and another just for big holders (those with at least 0.1% of the total supply). This keeps small players involved while giving heavy stakeholders more influence.

How Revenue Flows

When a dApp uses a dAPI, it pays a subscription fee-usually in ETH, USDC, or another crypto. That fee gets converted into API3 tokens through a decentralized exchange. Then, here’s the twist: most of those tokens are burned.

Burning means they’re permanently removed from circulation. That reduces supply. Meanwhile, new API3 tokens are issued weekly as staking rewards. So you have two forces: inflation from rewards, and deflation from burning. The goal? Keep the token value stable over time by balancing supply and demand.

It’s not a pump-and-dump model. It’s a feedback loop: more dApps using dAPIs → more fees → more burning → higher scarcity → higher demand for staking → more security → more adoption.

Real Partnerships, Not Just Hype

API3 isn’t just theory. It’s live. Over 150 data providers have signed on. AccuWeather delivers real-time weather data to DeFi apps that insure crops against bad weather. Amberdata feeds crypto market data into trading bots. Financial institutions are testing API3 for real-time credit scores.

These aren’t tokenized memes. These are companies that already make money from APIs. They didn’t need to learn Solidity or deploy smart contracts. They just clicked a button and started earning from Web3.

Why API3 Is Different

Other oracles try to be everything to everyone. API3 focuses on one thing: connecting existing APIs to blockchains. No custom coding. No complex node setups. No reliance on anonymous validators.

It’s like building a highway instead of a maze. You don’t need to redesign every car. You just give them a clear road to follow. API3 gives data providers that road.

It also avoids the centralization trap. If Chainlink goes down, thousands of DeFi apps crash. If one API3 data provider fails, only their specific dAPI goes offline. The rest keep running. That’s resilience by design.

How to Get API3

You can buy API3 tokens on major exchanges like MEXC, Binance, and KuCoin. You can use credit cards, bank transfers, or even PayPal to buy it directly. Once you have it, you can hold it, trade it, or stake it in the API3 DAO to earn rewards and help secure the network.

Staking is open to anyone. You don’t need a minimum amount. Just lock your tokens into the DAO pool, and you’ll start earning weekly rewards. You’ll also get voting rights-so you can help decide whether to onboard new data providers, change fee structures, or fund development.

What’s Next for API3

API3 is still early. But its model is catching on. More traditional companies are waking up to the fact that Web3 isn’t just about NFTs and crypto speculation. It’s about real utility-like automated insurance payouts, dynamic loan rates based on live data, and real-time supply chain tracking.

As more dApps need reliable data, API3’s role as the go-to connector will grow. And because it’s built on real-world partnerships-not speculation-it has staying power.

Is API3 a good investment?

Whether API3 is a good investment depends on your view of Web3 infrastructure. If you believe that blockchains need reliable, real-world data feeds-and that the current oracle models are too fragile or expensive-then API3 offers a rare combination of utility and tokenomics. It’s not a meme coin. It’s a protocol with real revenue, real partners, and a deflationary token model. But like all crypto, it’s volatile. Don’t invest more than you can afford to lose.

Can I stake API3 without technical knowledge?

Yes. You can stake API3 through the official API3 DAO dashboard using a wallet like MetaMask. The interface guides you step by step. You don’t need to understand gas fees, smart contracts, or node operation. Just connect your wallet, approve the transaction, and start earning. The system handles the rest.

How is API3 different from Chainlink?

Chainlink uses third-party node operators who collect data from multiple sources and aggregate it. API3 lets the original data provider-like AccuWeather or Bloomberg-run the oracle themselves. Chainlink is a middleman; API3 removes the middleman. Chainlink’s fees are paid in LINK, which can be volatile. API3’s fees are paid in any crypto, converted to API3, and burned. Chainlink’s security relies on economic incentives for random validators. API3’s security comes from the data provider’s reputation and staked collateral.

Does API3 have a maximum supply?

Yes. The total supply of API3 is capped at 100 million tokens. About 38 million are in circulation as of early 2026. The rest are locked in team, investor, and ecosystem funds, and are being released gradually over time. The burning mechanism reduces circulating supply, making scarcity a core part of the token’s value.

What happens if a data provider goes offline?

If a dAPI goes offline, users who paid for service coverage get compensated from the staking pool. The data provider loses part of their staked API3 tokens as a penalty. This ensures providers have skin in the game. The DAO can also vote to remove underperforming providers and replace them with others.

Can I run an Airnode node myself?

Technically yes, but it’s not meant for regular users. Airnode is designed for API providers-companies that already have data feeds. Running one requires server access, API keys, and some technical setup. For most people, the best way to participate is by staking API3 tokens and voting in the DAO.

Is API3 only for Ethereum?

No. API3 is blockchain-agnostic. Its dAPIs work on Ethereum, Polygon, Arbitrum, Base, and other EVM-compatible chains. The protocol doesn’t care which chain you’re on-it just delivers the data. That makes it scalable and future-proof.

API3 isn’t trying to replace Bitcoin or Ethereum. It’s trying to fix a quiet but critical flaw in Web3: how blockchains access real data. And it’s doing it by empowering the companies that already have that data-instead of forcing them to become blockchain experts. That’s why it matters.

Comments (14)

SAKTHIVEL A

The fundamental flaw in API3’s architecture lies in its assumption that data providers possess inherent incentives to maintain oracle integrity. In reality, corporations like AccuWeather are bound by shareholder fiduciary duties-not blockchain ethos. Their primary obligation is profit maximization, not decentralization. When market conditions shift, or regulatory pressure mounts, these entities will prioritize compliance over consensus. The so-called 'first-party oracle' model is merely a rebranding of centralized trust, dressed in Web3 aesthetics. The system collapses the moment a provider’s legal counsel advises against participation.

Moreover, the tokenomics are mathematically unsound. Burning fees while simultaneously minting staking rewards creates a pseudo-deflationary illusion. Inflationary pressure from weekly emissions will inevitably outpace burn rates, especially as adoption plateaus. The equilibrium is a mathematical fantasy, not an economic reality. This is not innovation-it is financial engineering masquerading as protocol design.

Robbi Hess

API3 is a brilliant abstraction of a problem that doesn’t need solving. Blockchains don’t need real-world data-they need certainty. And certainty comes from consensus, not from AccuWeather’s API endpoints. The moment you tether a smart contract to a corporate data feed, you’ve surrendered decentralization at the altar of convenience. This isn’t progress-it’s regression wrapped in a whitepaper.

The DAO governance structure is a farce. Voting power is concentrated in the hands of whales who hold 0.1% of supply. That’s less than 100,000 tokens. In practice, it’s three hedge funds deciding the fate of a global infrastructure. The ‘decentralized’ label is a marketing tactic, not a technical achievement.

And don’t get me started on Airnode. It’s not ‘serverless’-it’s just another HTTP endpoint with a blockchain wrapper. The latency, the single points of failure, the lack of cryptographic verification-this isn’t innovation. It’s a Band-Aid on a hemorrhage.

The only real value here is in the token speculation. Anyone who believes this is about utility is fooling themselves. It’s a liquidity pump disguised as infrastructure. The real winners? The early investors who dumped their tokens before the first dApp went live.

Donna Patters

How utterly predictable. Another ‘revolutionary’ protocol that depends on corporations-entities that have spent decades fighting transparency, accountability, and open access-to be the guardians of decentralized truth. This isn’t Web3. It’s Web2.1-same power structures, new blockchain glitter.

AccuWeather? Really? The same company that charges $20,000/month for enterprise weather data? They’re now ‘running oracles’? What’s next? Goldman Sachs operating a node for stock prices? The irony is so thick you could cut it with a butter knife.

The burning mechanism? A sleight of hand. You burn fees to ‘create scarcity,’ but mint new tokens to reward stakers. That’s not a balanced economy-it’s a Ponzi with a whitepaper. And the claim that ‘providers don’t need crypto’? Utter nonsense. They’ll convert fees to stablecoins, then sell them on Coinbase. The API3 token is a middleman between two centralized exchanges.

This is not infrastructure. It’s a confidence trick dressed in technical jargon. The only thing decentralized here is the delusion of its users.

Claire Sannen

I appreciate the depth of this explanation. It’s rare to see a project that actually addresses a real technical bottleneck in blockchain adoption. The shift from third-party oracles to first-party data providers is a meaningful evolution.

What stands out is how API3 reduces friction for traditional businesses. Companies don’t need to become blockchain experts-they just need to expose their existing APIs. That’s huge. It means adoption can happen organically, without massive re-engineering.

The staking model also makes sense: if you’re securing a data feed, you’re incentivized to keep it running. The penalty system for downtime is elegant-it aligns incentives without requiring trust.

I’ve seen too many projects overpromise. API3 feels like one that’s underpromising and overdelivering. The partnerships with real data providers aren’t marketing fluff-they’re operational reality. That’s rare.

If you’re looking for infrastructure that’s actually being used-not just theorized-this is worth watching.

Michelle Cochran

Let’s be honest: this entire system is built on the delusion that corporations will voluntarily sacrifice control for decentralization. AccuWeather doesn’t care about your smart contract. They care about their quarterly earnings report. The moment a regulator says ‘stop feeding data to unlicensed financial protocols,’ they’ll pull the plug. No questions asked.

And let’s not pretend staking collateral is meaningful. How much API3 does a company like Amberdata have to lock up? 10,000 tokens? 100,000? That’s pocket change compared to the revenue they make from their API. The penalty is meaningless. It’s theater.

The burning mechanism? A distraction. You’re burning fees, but minting new tokens every week. That’s not deflation-it’s inflation with a side of smoke and mirrors.

This isn’t a protocol. It’s a marketing campaign with a GitHub repo. The real innovation here? Selling hope to crypto investors who refuse to learn from past failures.

John Doyle

Bro, I just staked my API3 and got 0.8 tokens back this week. That’s like 3% APY. Not bad for just holding. I didn’t even have to touch a command line. Just connected MetaMask, clicked ‘Stake,’ and boom. Done.

And honestly? The fact that AccuWeather is actually feeding real weather data into DeFi insurance apps? That’s wild. People are getting paid out automatically when their crops get destroyed. No paperwork. No claims adjuster. Just code.

I used to think blockchain was all memes and speculation. But this? This is actually useful. Like, ‘I can see this changing how insurance works’ useful.

Don’t overthink it. The tech is solid. The team’s not shady. The partnerships are real. Just hold, stake, and let it do its thing.

Christopher Wardle

The elegance of API3 lies not in its novelty, but in its restraint.

It does not attempt to solve every problem. It does not build a new consensus mechanism. It does not mint tokens to incentivize meaningless participation.

It identifies one clear bottleneck-the reliance on opaque, third-party oracles-and surgically removes it.

By empowering data providers to serve their own feeds, it transforms the oracle from a trust-minimized intermediary into an accountable participant.

The tokenomics are not perfect. But they are coherent. Burning fees to offset staking rewards creates a dynamic equilibrium. It is not a fixed supply. It is a living system.

This is not revolution. It is evolution. And evolution, when executed with precision, is more powerful than revolution.

Santosh kumar

I’ve been following API3 since its early days. The team didn’t raise millions in VC funding. They didn’t hire influencers. They just built something that works.

My friend runs a small agricultural startup in Kerala. They use API3’s weather data to trigger micro-insurance payouts when rainfall drops below thresholds. No bank. No paperwork. Just a smart contract and a phone.

That’s the real win. Not token price. Not DAO votes. Real people getting real help.

It’s quiet. It’s not flashy. But it’s changing lives. That’s worth more than any hype cycle.

Brittany Meadows

Okay, so let me get this straight: we’re trusting AccuWeather-yes, the same company that once said ‘10% chance of rain’ when it poured for 3 days straight-to be the ‘trustless’ oracle for DeFi insurance? 😂

And we’re burning tokens to ‘create scarcity’ while the team’s still minting new ones like they’re printing Monopoly money? 🤡

And the DAO? Hah! The ‘voting’ is just the top 0.1% of holders deciding everything. That’s not decentralized-that’s oligarchy with a blockchain logo.

Also, why is there a 100M cap? Who decided that? Some guy in a hoodie? Or did the SEC greenlight it? 🤔

API3 is just Chainlink 2.0 with better PR and a slightly less obvious rug pull. I’m out. 🚫💸

Jeremy Lim

Okay, but… why? Why does a blockchain need weather data? Why not just… use a regular app? This feels like over-engineering for the sake of over-engineering.

And if the data provider goes offline? What then? Do we all just… wait? No backup? No fallback? No redundancy?

Also, burning tokens? That’s just throwing money away. Why not just… give it to developers? Or… I dunno… buy a server?

I don’t get it. I don’t trust it. And I definitely don’t understand why anyone would stake this.

It’s like building a rocket to deliver a sandwich. The sandwich is fine. The rocket? Not so much.

monique mannino

This is actually one of the most thoughtful projects I’ve seen in crypto.

The fact that you can stake 1 API3 token and get voting rights? That’s huge. Most DAOs require thousands. Here, anyone can participate.

And the burning? It’s not magic-it’s math. More usage → more fees → more burns → higher scarcity → higher demand to stake → more security. It’s a loop that rewards participation, not speculation.

I’ve used API3-powered dAPIs for loan collateral checks. It’s fast. It’s accurate. It’s quiet. No drama. Just work.

It’s not glamorous. But it’s real. And in crypto? That’s rare.

Keturah Hudson

As someone from the U.S. who’s watched the slow creep of corporate capture in Web3, I’m cautiously hopeful about API3.

It’s not perfect. But it’s the first project I’ve seen that doesn’t treat data providers as enemies to be replaced-but as partners to be empowered.

AccuWeather doesn’t need to become a blockchain company. They just need to plug in. That’s respect.

And the fact that this is already live, with real users, real payouts, real insurance claims being triggered? That’s more than I can say for 90% of the projects I’ve seen.

It’s not a moonshot. It’s a slow, steady climb. And sometimes, that’s how real change happens.

Benjamin Andrew

API3 is a Trojan horse. It masquerades as decentralization, but its architecture is fundamentally centralized at the data source layer. The moment any of the 150+ providers is acquired, regulated, or pressured by state actors, the entire system becomes a single point of failure-albeit with 150 different single points.

Furthermore, the tokenomics are a regulatory time bomb. By converting fees into API3 and burning them, the protocol effectively creates a de facto security token. That triggers Howey Test scrutiny in the U.S. and similar frameworks globally. This is not a utility token. It’s a revenue-sharing instrument disguised as a governance token.

The DAO structure is a legal fiction. Voting rights cannot be meaningfully delegated without KYC, yet the protocol claims to be permissionless. This contradiction will be its undoing.

Do not invest. Do not stake. Do not participate. This is not innovation. It is regulatory risk dressed in open-source code.

John Doyle

Just saw someone say API3 is a Ponzi. Bro, I staked 50 tokens last month. Got 0.8 back. My wallet’s still there. My insurance claim got paid. The weather data worked. You’re not seeing the forest because you’re stuck on the trees.

Most of you are scared of what you don’t understand. That’s fine. But don’t call it a scam because you didn’t read the docs.