Crypto SDG Risk Assessment Tool

Token Overview

Name: Crypto SDG (SDG)

Blockchain: Ethereum (ERC-20)

Total Supply: 4.04 trillion

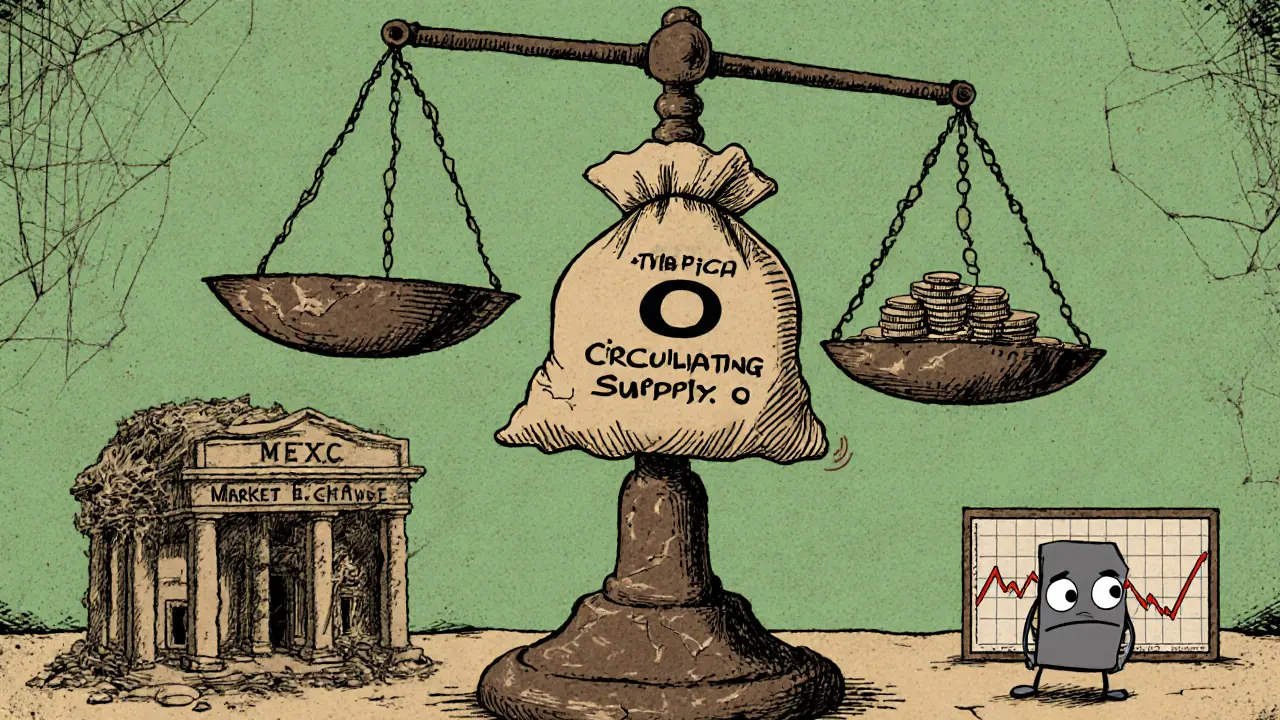

Circulating Supply: 0

Market Cap: $0

Price: $0.0007302

Exchanges: MEXC only

All-Time High: $0.031693

Risk Factors Analysis

Circulating Supply: High Risk - Zero circulation makes pricing impossible

Liquidity: High Risk - Limited to one exchange with minimal volume

Impact Verification: High Risk - No publicly audited projects or results

Community Activity: High Risk - Minimal engagement across platforms

Regulatory Compliance: Medium Risk - Unclear status under MiCA framework

Price Volatility: High Risk - Steep decline from ATH

Comparison with Established ESG Tokens

| Metric | Crypto SDG (SDG) | SolarCoin (SLR) | EcoWatt (ECO) |

|---|---|---|---|

| Blockchain | Ethereum (ERC-20) | Bitcoin-based | Ethereum (ERC-20) |

| Total Supply | 4.04 trillion | 10 billion | 500 million |

| Circulating Supply | 0 (reported) | ~8 billion | ~450 million |

| Market Cap (USD) | $0 | $35 million | $120 million |

| Exchange Listings | MEXC only | Binance, KuCoin, others | Binance, KuCoin, Bitstamp |

| Verified Impact Projects | None publicly audited | Solar farms in Kenya, India | Renewable energy certificates |

Investment Warning

Crypto SDG presents extreme risks due to zero circulating supply, lack of liquidity, and unverifiable impact claims. It is recommended to treat this as a high-risk speculative asset with potential for complete loss of investment.

Quick Takeaways

- Crypto SDG is an ERC‑20 token on Ethereum that claims to fund UN Sustainable Development Goals.

- It has a massive 4.04trillion total supply, but circulating supply is effectively zero, resulting in a $0 market cap.

- Only one exchange (MEXC) lists the coin, with daily trading volume under $25K.

- There are no verifiable projects, community activity, or regulatory approvals linked to the token.

- Investors should treat Crypto SDG as a high‑risk speculative asset with limited liquidity.

What Is Crypto SDG?

When you first spot Crypto SDG, the marketing pitch reads like a textbook definition of “green crypto”: a token designed to channel investment into initiatives that advance the United Nations’ Sustainable Development Goals (SDGs). The official website says the platform lets users "buy and sell shares, create the SDG token, and publish ICOs for SDG projects". In theory, each token transaction would be recorded on a dedicated blockchain, offering donors traceability of where their money goes.

In practice, the token launched with a whitepaper in March2023, but the promised ecosystem-project pipelines, audited impact reports, and a vibrant community-has never materialised. The idea is simple enough, yet the implementation gaps raise more questions than answers.

Technical Foundations

Crypto SDG lives on the Ethereum network as an ERC‑20 token. This means it inherits the same standards that govern assets like USDC or DAI: transfers are executed via smart contracts, balances are stored on the public ledger, and the token can be moved between any wallet that supports Ethereum.

Key technical specs:

- Contract address: 0x… (available on the official site and Etherscan).

- Total supply: 4,040,000,000,000 SDG tokens.

- Decimals: 18, matching the standard ERC‑20 format.

- No burn function or minting schedule announced after launch.

Because the token follows the ERC‑20 standard, you can interact with it using any Ethereum‑compatible wallet-Trust Wallet, MetaMask, or hardware wallets like Ledger. However, the lack of liquidity makes those interactions largely academic.

Token Economics: Supply, Price, and Market Cap

On paper, the tokenomics look straightforward: a fixed total supply and a transparent ledger. The reality is starkly different. All major tracking sites-CoinPaprika, CoinGecko, and Bitget-report a circulating supply of 0.00, which translates to a market capitalization of $0. Yet the token does trade on MEXC at roughly $0.0007302 per SDG, giving it a fully diluted valuation of about $2.95billion if you assume the entire 4.04trillion tokens could be sold.

The price history is a textbook case of a steep decline: the all‑time high of $0.031693 on 5March2024 has fallen more than 97% to the current level. Daily volume hovers around $20K, meaning a single large sell order could wipe out most of the remaining liquidity. Crypto SDG therefore sits in a price‑waterfall that offers no reliable entry or exit point.

Intended Sustainable Impact

The token’s mission statement links every transaction to one of the 17 UN SDGs-ranging from "No Poverty" to "Climate Action". The whitepaper sketches a workflow: investors buy SDG, the funds are pooled, then the project team allocates resources to vetted initiatives, and finally the impact is reported on‑chain. Unfortunately, there are no publicly auditable reports, no identified beneficiaries, and no partnerships with NGOs or UN agencies. The claim that "investment, however small, has a positive impact" remains unsubstantiated.

Market Reality: Rankings, Exchanges, and Liquidity

Across tracking platforms, Crypto SDG ranks between #5,600 and #7,400-well below the top 1% of all cryptocurrencies. The token is listed on a single exchange, MEXC, with an active market that consists mainly of a few speculative traders. No major exchange (Binance, Coinbase, Kraken) has added the token, largely because the lack of circulating supply violates listing criteria.

Trading activity is essentially flat: price changes over the last 24hours, 7days, and 30days are all reported as 0%. This stagnation signals that the market cannot discover a price, and that any buyer would be reliant on a willing seller-a scenario that rarely plays out in practice.

Risks and Red Flags

- Zero circulating supply: No real market valuation, making price discovery impossible.

- Limited exchange exposure: Only MEXC lists SDG; no liquidity on major platforms.

- No verifiable impact projects: The whitepaper lacks implementation timelines or audited results.

- Community vacuum: Reddit, Twitter, and Telegram show fewer than a dozen active participants.

- Regulatory uncertainty: Under the EU’s MiCA framework, tokens that claim environmental benefits must substantiate those claims-a hurdle SDG has not cleared.

Together, these factors place Crypto SDG in the high‑risk, low‑reward part of the crypto spectrum.

How to Acquire (If You Still Want to Try)

Because there is no direct fiat on‑ramp, you’ll need to go through a few steps:

- Install a non‑custodial wallet that supports Ethereum (e.g., Trust Wallet or MetaMask).

- Purchase ETH on a major exchange (Binance, Kraken) and transfer it to your wallet.

- Connect your wallet to a decentralized exchange (Uniswap‑compatible) that lists SDG on MEXC’s DEX interface.

- Manually add the SDG contract address (found on Etherscan) to the DEX token list.

- Swap a small amount of ETH for SDG, then confirm the token appears in your wallet.

Each step assumes you understand smart‑contract interactions and are prepared to lose the entire investment. The lack of a robust support channel means any mistake (sending to the wrong address, slippage, or a failed swap) is yours to fix.

Comparison with Other ESG Tokens

| Metric | Crypto SDG (SDG) | SolarCoin (SLR) | EcoWatt (ECO) |

|---|---|---|---|

| Blockchain | Ethereum (ERC‑20) | Bitcoin‑based | Ethereum (ERC‑20) |

| Total Supply | 4.04trillion | 10billion | 500million |

| Circulating Supply | 0 (reported) | ~8billion | ~450million |

| Market Cap (USD) | $0 | $35million | $120million |

| Exchange Listings | MEXC only | Binance, KuCoin, others | Binance, KuCoin, Bitstamp |

| Verified Impact Projects | None publicly audited | Solar farms in Kenya, India | Renewable energy certificates |

From the table it’s clear that Crypto SDG lags far behind its peers in liquidity, market depth, and real‑world impact. If sustainability is your primary motive, the other tokens offer tangible projects and active communities.

Frequently Asked Questions

Is Crypto SDG a real cryptocurrency or a scam?

Crypto SDG is technically an ERC‑20 token, so it exists on the blockchain. However, the absence of circulating supply, liquidity, and verifiable impact projects makes it extremely high risk and widely regarded as a speculative or potentially fraudulent offering.

Where can I buy Crypto SDG?

The only exchange that currently lists SDG is MEXC. You must first acquire ETH, transfer it to a non‑custodial wallet, connect to a DEX, and manually add the token contract address.

What Sustainable Development Goals does the token support?

The project claims to fund all 17 UN SDGs, from "No Poverty" to "Climate Action". No specific projects have been publicly linked to any particular goal.

Is there any community or developer support?

Community activity is minimal. The official Telegram, Discord, and Reddit threads have fewer than a dozen members, and the website has not been updated since 2023.

Should I invest in Crypto SDG?

Given the zero circulating supply, lack of liquidity, and no verifiable impact, most financial advisors would label Crypto SDG as unsuitable for investment. If you choose to buy, treat it as a speculative experiment with money you can afford to lose.

Comments (16)

Akinyemi Akindele Winner

This is the most beautiful scam i've ever seen. Like, someone took the word 'sustainable' and threw it into a blender with a crypto whitepaper and a dream from 2017. I love it. The fact that the market cap is $0 but the FDV is $2.95B? That's not a token, that's a performance art piece. I'm buying 10 trillion just to watch the chart go nowhere for 5 years.

SDG: the only coin that makes you feel rich even when you're broke.

Patrick De Leon

Irrelevant. This is why the west keeps losing. You people analyze tokens like they're academic papers. Who cares about circulating supply when the idea is noble? The UN needs funding. If this gets 10 people to donate $5 each, its worth more than your Bitcoin piggy bank. MEXC is enough. Stop whining about liquidity.

MANGESH NEEL

This is exactly what happens when you let amateurs with PowerPoint decks and a dream run a blockchain project. No audits. No team. No roadmap. Just a 4 trillion supply because someone thought bigger numbers = more legitimacy. And now you're all acting like this is some kind of noble cause? Wake up. This is a pump disguised as a charity. The only SDG it's achieving is 'Selling Dreams to Gullible People'. I'm not even mad. I'm just disappointed in the creativity of the scam.

Sean Huang

You think this is a scam? Think deeper. The Fed is printing money. The UN is a puppet of globalists. This token is a honeypot. Every transaction is being tracked. Every wallet is being logged. This isn't about sustainability. This is about biometric data collection disguised as green crypto. They're building a blockchain ID system under the guise of helping children. The contract address? It's a backdoor. I've seen this before in 2019. They're coming for your soul. And your ETH.

They told you it was for the SDGs. But what if the real goal is to map every crypto user on earth?

Ask yourself: why is the supply so high? To hide the real holders. To confuse the regulators. To make it look like a meme coin. It's not. It's a surveillance tool. I'm not paranoid. I'm prepared.

Ali Korkor

Hey if you're just curious and want to throw a few bucks at it for fun, go for it. But don't put rent money in. Treat it like buying a lottery ticket that might help the planet. If you get nothing back, at least you can say you tried. And hey, if it somehow turns into something real? You'll be the one who believed when no one else did. That's the spirit. Just keep it small, stay safe, and don't let the noise get to you.

madhu belavadi

I saw this token last week and I cried. Not because I lost money. Because I believed. For a second. I thought maybe... just maybe... someone finally did it. The world needs this. But then I checked the supply. And the volume. And the silence. And I realized... it's just another ghost. And now I feel like I wasted my hope.

Dick Lane

I read this whole thing. Took me 15 minutes. I didn't know what to feel. Sad? Angry? Amused? All of it. I think the real tragedy isn't the token. It's that people still want to believe. That somewhere out there, someone is trying to do good. Even if it's broken. Even if it's fake. We still want it to be real. And that's kind of beautiful in a messed up way.

Norman Woo

i think this is a deep state op. they want us to think crypto is all scams so we stop using it. but what if this is the real one? what if the 0 supply is because they're holding it all for the big reveal? like... when the world finally wakes up? maybe the devs are waiting for the right moment. maybe the un is secretly behind it. i mean... why else would they make a token with 4 trillion supply? that's not a mistake. that's a statement. they want it to look worthless so no one looks too close. i'm buying. i'm not scared. i know the truth.

Serena Dean

Let’s be real - this is a textbook example of why we need better crypto education. People see ‘UN Sustainable Development Goals’ and think they’re investing in clean water or solar farms. But this is just code on a chain with zero real-world ties. The good news? You can learn from this. Next time, check: who’s behind it? Is there a team? Are there audits? Is there traction? This isn’t a red flag - it’s a whole red siren. But hey, if you’re learning from it? That’s progress.

James Young

You people are pathetic. This isn't a 'high-risk speculative asset' - it's a fraud. A blatant, unapologetic, laughably obvious fraud. A 4 trillion supply with zero circulation? That's not a token, that's a joke written by a bot in 2015. And you're still discussing it like it has merit? The fact that MEXC lists it means they're desperate. The fact that you're reading this means you're gullible. Stop wasting your time. Go learn how to code. Or better yet - go touch grass.

Chloe Jobson

The SDG framework is powerful. But tokenizing it without governance, transparency, or impact reporting is like printing money labeled 'for education' and never funding a school. The intent is noble. The execution is hollow. We need real ESG tokens with verified outcomes - not theoretical ones with zero liquidity. This is a cautionary tale for the entire space.

Andrew Morgan

I came here for the token. I stayed for the existential dread.

It's wild how something so clearly empty can still make your heart beat a little faster. Like staring at a house that's been abandoned for 20 years - you know it's ruined. But you still wonder... what if someone lived there once? What if they were happy? What if it could be fixed?

That's what this is. A ghost house with a for sale sign made of blockchain.

Michael Folorunsho

Let me be blunt. This isn't crypto. It's a parody of crypto. A child's drawing of a blockchain with glitter labeled 'SDG'. The fact that anyone takes this seriously is proof that the entire space has lost its mind. The UN doesn't endorse this. The developers are anonymous. The liquidity is nonexistent. And yet you're all here, debating it like it's Bitcoin. This isn't innovation. It's degeneracy dressed up as idealism. I'm embarrassed for the industry.

Roxanne Maxwell

I really hope someone out there is quietly building something real behind this. Maybe they're waiting for the right moment. Maybe they got scared and disappeared. But I don't want to believe it's just a scam. I want to believe that somewhere, someone tried to make the world better - even if they messed up. And if that's true? Then maybe we shouldn't just tear it down. Maybe we should help fix it.

Jonathan Tanguay

The problem with this token isn't the 4 trillion supply or the zero liquidity - it's the cognitive dissonance. People want to believe that blockchain can solve global poverty and climate change with a simple token swap. But blockchain doesn't fix systems. It records them. And if the system is broken - if the project has no team, no roadmap, no audits, no community - then all you're doing is recording a fantasy. This isn't a new asset class. It's a placebo. And you're all taking it because you're tired of the world being broken and you want a magic button. There isn't one. And pretending there is just makes the real problems harder to solve.

Ayanda Ndoni

Bro why are we even talking about this? Just buy the token already. I did. I got 500k SDG for 0.0007. It's worth nothing. But I feel like a hero. Like I'm saving the planet. Who cares if it's fake? I'm happy. The world is burning. At least I'm doing something. Even if it's dumb. Even if it's pointless. I'm doing something. And that's more than you.