Tokenized Real Estate: How Blockchain Is Changing Property Ownership

When you think of tokenized real estate, a digital representation of physical property ownership issued on a blockchain. Also known as real estate tokens, it turns a building, land, or apartment into fractions you can buy, sell, or trade like crypto. This isn’t science fiction—it’s happening right now. Instead of needing $500,000 to buy a rental property, you can invest $50 in a share of one. The blockchain records who owns what, and smart contracts handle rent splits, sales, and even voting rights—no lawyers or banks needed.

Tokenized real estate connects directly to DeFi, a system of financial tools built on blockchain that removes traditional intermediaries. You can stake your property tokens to earn yield, borrow against them, or trade them on decentralized exchanges—just like you would with Bitcoin or Ethereum. It’s not just about ownership anymore; it’s about using property as a financial asset in a 24/7 global market. And because these tokens are built on open ledgers, anyone with an internet connection can participate, no matter where they live.

But it’s not all smooth sailing. Many projects fail because the underlying property isn’t legally structured for tokenization, or the platform behind the tokens lacks transparency. Some tokens are backed by real assets in the U.S. or Europe, where regulations are clearer. Others are tied to unverified land in countries with shaky property laws. That’s why you need to check who owns the title, where the property is, and if there’s real income—like rent—flowing back to token holders. This isn’t a meme coin. It’s real estate, just with a digital key.

Related concepts like blockchain property, the use of distributed ledgers to track ownership and transactions of physical assets and digital real estate, virtual land or assets in metaverse platforms that sometimes overlap with physical tokenization often get mixed up. But they’re different. Blockchain property is about real buildings. Digital real estate is about virtual worlds. One has taxes and tenants. The other has avatars and NFTs. Don’t confuse the two.

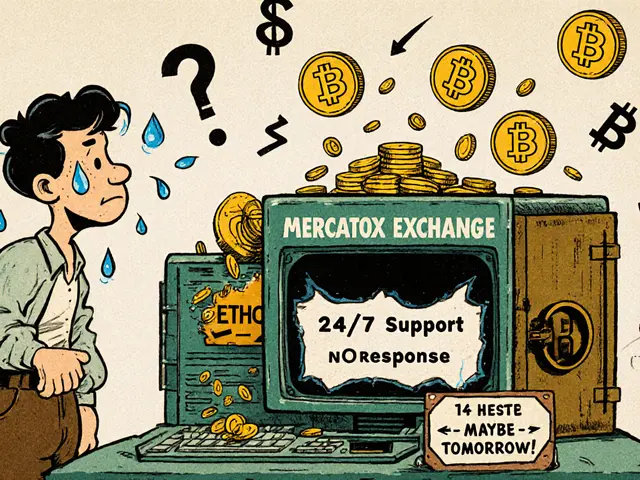

What you’ll find below are real reviews, warnings, and breakdowns of projects that tried to bring property onto the blockchain. Some worked. Most didn’t. You’ll see how scams disguise fake land tokens as legitimate investments, how some platforms lock your money without giving you actual rights, and why a few honest projects are slowly building trust. No hype. No fluff. Just what’s real, what’s risky, and what you should avoid.

Real estate security tokens turn property ownership into digital shares regulated as financial securities. They let investors buy fractional stakes in buildings with as little as $100, using blockchain for transparency and efficiency-without breaking securities laws.

Continue reading

Tokenized real estate lets you own fractions of properties using blockchain, with lower costs, higher liquidity, and global access. See how it works, why returns are rising, and who’s investing now.

Continue reading