WPAY Staking Calculator

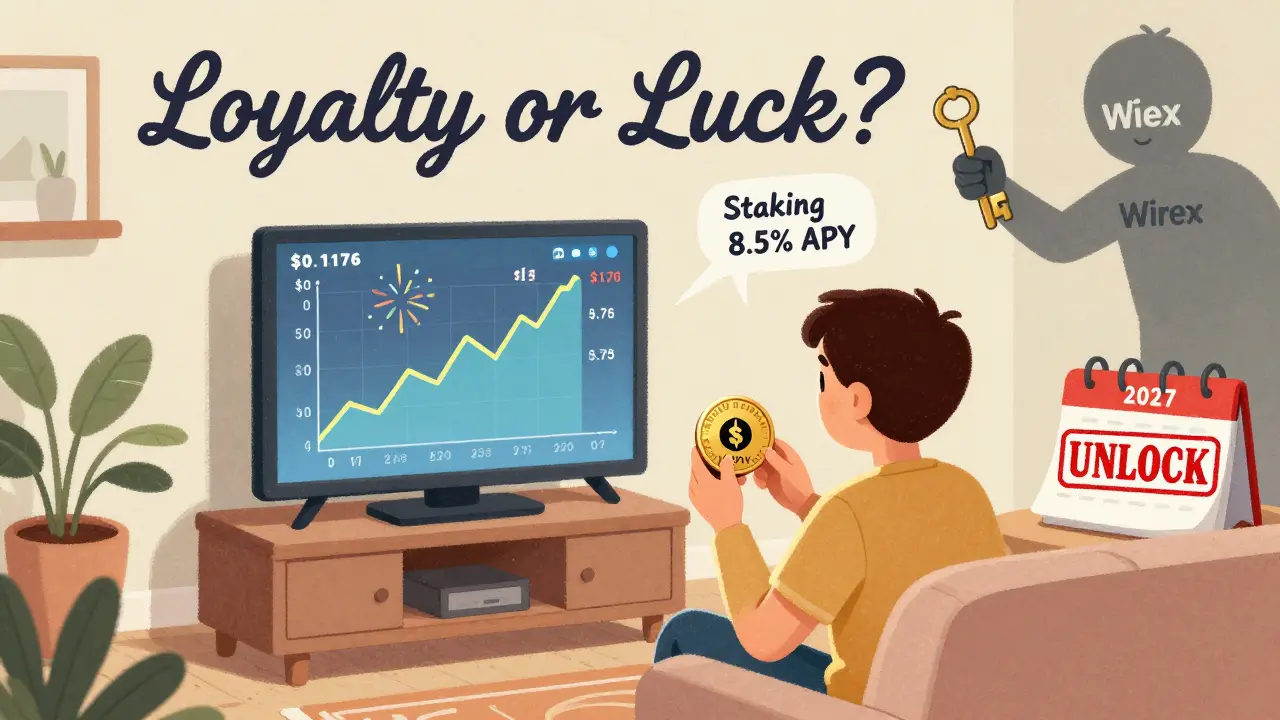

Calculate potential earnings from staking WPAY tokens. Current staking APY is 8.5% (as announced for Q2 2025). Note: This is an estimate based on Wirex's roadmap. Actual returns may vary based on token price fluctuations and ecosystem adoption.

Staking Calculator

Important Considerations

WPAY staking is not yet available. This calculator is based on Wirex's announced roadmap for Q2 2025 with an 8.5% APY.

WPAY's value is highly volatile and tied to Wirex's platform adoption. High Risk - Consider the risks mentioned in the article: locked token supply, limited real-world utility, and Wirex's regulatory challenges.

Staking requires locking your tokens. If WPAY price drops or the token unlocks (2026-2027), your rewards could lose value.

WPAY, or Wirex Pay, is a cryptocurrency token launched in September 2024 by the payment platform Wirex. Unlike Bitcoin or Ethereum, WPAY doesn’t exist as a standalone blockchain. Instead, it runs on the Polygon network as an ERC20 token. Its entire purpose is to serve one thing: making Wirex’s existing payment system work better for its users.

What WPAY Actually Does

WPAY isn’t meant to be a store of value or a speculative asset you buy and hold. It’s a utility token - think of it like a loyalty card you can use inside Wirex’s app. If you’re already using Wirex to spend crypto on a debit card, send money abroad, or swap coins, WPAY gives you perks for doing so.

Right now, WPAY lets you get discounts on transaction fees when you use your Wirex card. In the next few months, Wirex plans to roll out more uses: paying for cross-border transfers with WPAY, and eventually staking it to earn interest. That’s the whole idea - keep users inside the Wirex ecosystem by giving them a reason to hold and use WPAY instead of just using regular crypto or fiat.

How Many WPAY Tokens Exist?

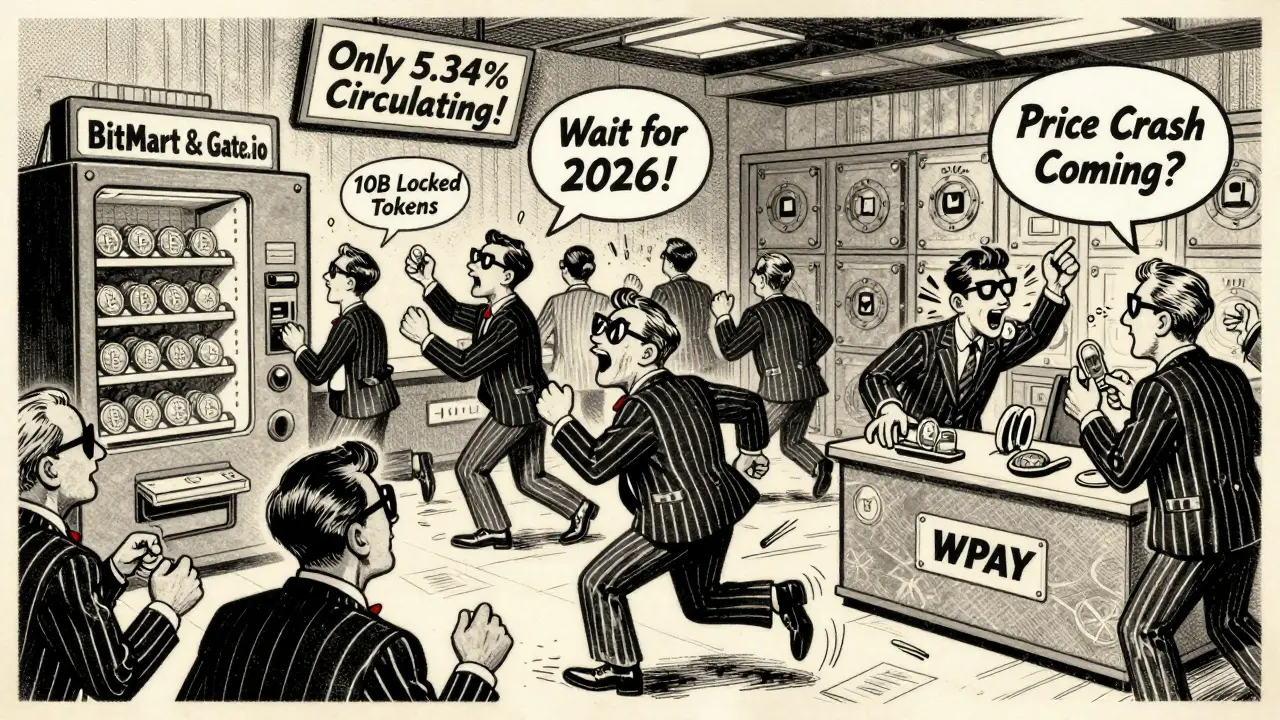

There are 10 billion WPAY tokens total. That sounds like a lot - and it is. But here’s the catch: only 534 million are circulating right now. That’s just 5.34% of the total supply. The rest? Locked up. Some are held by Wirex for future development. Others are reserved for team members, investors, and node operators who helped launch the token.

This creates a big risk. If all those locked tokens suddenly get released - say, in 2026 or 2027 - there could be a flood of WPAY hitting the market. If demand doesn’t keep up, the price could crash. Experts warn this is WPAY’s biggest vulnerability. One analyst put it simply: “WPAY’s price isn’t driven by users. It’s driven by unlock dates.”

Where Can You Buy WPAY?

You won’t find WPAY on Coinbase or Binance - not yet. As of December 2025, it’s only available on four exchanges: BitMart, Gate.io, SushiSwap, and QuickSwap. Most trading happens on BitMart and Gate.io, where the WPAY/USDT pair makes up nearly all volume.

But here’s the problem: liquidity is thin. On SushiSwap and QuickSwap, there’s barely any trading depth. That means if you try to buy or sell more than a few hundred WPAY tokens, your price will move a lot. You’ll pay more than you expect - or get less when you sell.

Most people get WPAY through Bitget’s “Learn2Earn” programs. You watch a short video, answer a few questions, and get 50 to 200 WPAY tokens for free. It’s not a bad way to start, but don’t expect to use them yet. Wirex hasn’t fully integrated WPAY into its app, so many users just hold them as a gamble.

What’s WPAY Worth Right Now?

As of December 2025, WPAY trades around $0.176. That’s up from its initial public sale price of $0.05 in August 2024. People who bought early made over 250% profit. But that doesn’t mean it’s a good investment now.

Its market cap is just $5.7 million. Compare that to XRP ($28 billion) or even Stellar ($3.2 billion). WPAY is tiny. Its fully diluted valuation - meaning if all 10 billion tokens were in circulation - is over $1 billion. That’s what investors are betting on: that Wirex will grow fast enough to make all those locked tokens valuable.

Price predictions vary wildly. Some models say WPAY could hit $1.76 by 2041. Others warn it could drop below $0.01 in 2027 before recovering. That kind of volatility isn’t normal for a utility token. It suggests people aren’t using WPAY - they’re just trading it.

Can You Use WPAY Outside Wirex?

No. Not really.

There are no major merchants accepting WPAY. You can’t use it to pay for groceries, rent, or Netflix. Even within Wirex’s ecosystem, the features are limited. The app doesn’t let you pay bills with WPAY. You can’t send it to friends outside Wirex as a payment. It’s not even listed as a spending option in most crypto wallets unless you manually add the contract address: 0x7ABE9Edf5C544A04dA83e9110CF46DBC4759170c.

That’s a red flag. A real payment token needs adoption beyond its own platform. Bitcoin works because you can buy coffee with it. Ethereum works because developers build on it. WPAY only works if Wirex makes it essential - and so far, it’s not.

Wallet Compatibility and How to Store WPAY

You can store WPAY in any wallet that supports the Polygon network. That includes MetaMask and Trust Wallet. But you have to add it manually. Open your wallet, click “Add Token,” paste the contract address, and set decimals to 18. If you skip this step, you won’t see your WPAY balance.

Don’t store WPAY on exchanges long-term. If Wirex ever changes the token contract or if an exchange gets hacked, you could lose access. Always move it to a wallet you control.

Who’s Behind WPAY?

Wirex is a UK-based fintech company founded in 2015. It’s not a startup - it’s been around for a decade and has over 7 million users. It lets people buy crypto with credit cards, spend it via a debit card, and earn interest on holdings. WPAY is its attempt to lock those users in.

But Wirex has its own problems. Users complain about slow customer support - responses often take 72 hours. Some regulators have cracked down on its operations in Europe. If Wirex struggles, WPAY struggles. That’s the core risk: WPAY is 100% tied to one company’s success.

Is WPAY a Good Investment?

It depends on what you’re looking for.

If you want to use crypto for payments, WPAY isn’t the answer. XRP, Stellar, or even USDT are better for that. If you’re chasing quick gains, WPAY might look tempting - it’s had big jumps since launch. But those jumps are fueled by promotions and speculation, not real usage.

Here’s the hard truth: WPAY only makes sense if you’re already a Wirex user. If you use Wirex daily, then holding WPAY could save you money on fees. But if you’re not using Wirex at all, there’s no reason to buy WPAY. It’s not a currency. It’s not a store of value. It’s a loyalty token with a lot of risk.

Analysts give WPAY a medium-high risk score. The token is concentrated in a few wallets. The supply is mostly locked. The utility is limited. And the company behind it is under regulatory pressure.

What’s Next for WPAY?

Wirex has a roadmap. By Q1 2025, WPAY will be used to pay for cross-border transfers. By Q2 2025, they plan to launch staking with an 8.5% APY. That could change things - if they deliver.

They also claim WPAY will list on Binance and Coinbase in 2025. But neither exchange has confirmed it. That’s a common tactic: announce big listings to pump interest, then quietly delay.

Right now, WPAY’s future hangs on one question: Will Wirex turn its 7 million users into WPAY users? If yes, the token could grow. If no, it’ll fade into obscurity like dozens of other utility tokens that promised more than they delivered.

For now, treat WPAY like a lottery ticket - not an investment. Buy it only if you’re already using Wirex. Don’t expect it to make you rich. And never invest more than you’re willing to lose.

Is WPAY a real cryptocurrency?

Yes, WPAY is a real cryptocurrency - but not in the way Bitcoin or Ethereum is. It’s a utility token built on the Polygon blockchain as an ERC20 token. It has a smart contract, a fixed supply, and is traded on exchanges. But its value comes entirely from its use inside Wirex’s platform, not from being a decentralized currency.

Can I mine WPAY?

No, you cannot mine WPAY. It’s not mined or staked for new tokens. All 10 billion WPAY tokens were created at launch. New tokens are not generated over time. The only way to get WPAY is to buy it on an exchange, earn it through promotions, or receive it as a reward.

Why is WPAY’s price so volatile?

WPAY’s price moves mostly because of speculation and promotional activity, not real usage. With only 5.34% of tokens circulating, even small trades can swing the price. Promotions on Bitget and other platforms create artificial demand. When those end, the price often drops. Also, rumors about listings on bigger exchanges like Binance cause spikes - even if they’re unconfirmed.

Where can I check WPAY’s real-time price?

You can check WPAY’s price on CoinGecko, CoinMarketCap, or directly on BitMart and Gate.io. Be careful - some sites show the fully diluted valuation (FDV) as the market cap, which is misleading. The real market cap is $5.7 million, not over $1 billion. Always check the circulating supply to get the correct price.

Should I stake WPAY when it launches?

Only if you’re already using Wirex and plan to keep using it long-term. The promised 8.5% APY sounds good, but staking means locking your tokens. If Wirex fails to deliver on its roadmap, your staked WPAY could lose value. Also, if the token unlocks in large amounts later, the price could drop, making your staking rewards worthless. Weigh the risk carefully.

Is WPAY regulated?

WPAY is designed as a utility token to avoid being classified as a security. But regulators, especially the SEC, are cracking down on tokens that lack real-world use. If Wirex doesn’t prove WPAY has actual utility beyond speculation, it could face legal challenges. Wirex itself has already been under scrutiny in several European countries. WPAY’s regulatory status is uncertain and could change.

Can I send WPAY to friends?

Technically yes - if they have a wallet that supports Polygon and the WPAY contract. But there’s no reason to. WPAY has no value outside Wirex’s ecosystem. Sending it to a friend doesn’t help them unless they also use Wirex. Most users treat it like a speculative asset, not a payment tool.

What’s the difference between WPAY and Wirex’s other tokens?

Wirex doesn’t have other native tokens. WPAY is their first and only utility token. Before WPAY, Wirex users earned rewards in Bitcoin, Ethereum, or stablecoins. WPAY replaces those rewards with its own token to keep value inside the ecosystem. It’s a shift from using external crypto to using a platform-specific token.

How do I add WPAY to my MetaMask wallet?

Open MetaMask, click “Add Token,” then “Custom Token.” Paste the contract address: 0x7ABE9Edf5C544A04dA83e9110CF46DBC4759170c. Make sure your network is set to Polygon PoS. The token symbol will auto-fill as WPAY, and decimals should be 18. Click “Next” and “Add Tokens.” You’ll now see your WPAY balance.

Is WPAY a scam?

No, WPAY is not a scam. It’s a legitimate token backed by a real company with millions of users. The smart contract is verified on Etherscan. The team is public. But legitimacy doesn’t mean it’s a good investment. WPAY has high risk due to low utility, locked supply, and dependence on one company’s execution. Treat it as speculative, not safe.

Comments (19)

Kurt Chambers

This whole WPAY thing is just another corporate cash grab wrapped in blockchain glitter. America built the internet, not some UK fintech startup playing dress-up with ERC20 tokens. If you're buying this, you're funding a company that can't even answer customer support in under 72 hours. Wake up.

Kelly Burn

Okay but like… 🤔 WPAY is basically the crypto version of a loyalty card 🎫✨. If you're already using Wirex daily, it's a no-brainer to stack it for fee discounts. But if you're just HODLing for moonshots? Honey, that's not investing-that's gambling with extra steps. #UtilityNotSpeculation

Vidhi Kotak

I’ve been using Wirex for 2 years and WPAY is the only reason I haven’t switched to another platform. The fee discounts on international transfers saved me over $200 last year. Yes, the supply is concentrated, and yes, it’s risky-but if you’re already in the ecosystem, it’s the most practical token I’ve used. Just don’t expect it to be your retirement fund.

Steven Ellis

The structural risk here isn't just the locked supply-it's the complete absence of interoperability. A true payment token must be accepted beyond its walled garden. WPAY has neither merchant adoption nor wallet integration outside manual contract entry. It's a token in search of a purpose, and right now, that purpose is speculative arbitrage. The 8.5% APY is a siren song for those who don't read the fine print.

Kathy Wood

This isn’t crypto. This is a pyramid scheme with a website.

Rakesh Bhamu

I appreciate the breakdown, but I think people are missing the bigger picture. Wirex has 7 million users. Even if only 10% start using WPAY regularly, that’s 700k active holders. That’s a real user base. The real question isn’t whether WPAY is a good investment-it’s whether Wirex can execute on their roadmap. And honestly? They’ve delivered before.

Madison Surface

I just got 150 WPAY from a Learn2Earn thing and I have NO IDEA what to do with them. I tried sending them to my MetaMask, forgot to add the contract, and thought I lost them for 3 days. I’m so confused. Is this what crypto is supposed to feel like? Like you’re playing a game with invisible rules?

Tiffany M

LMAO. They’re literally trying to turn a debit card app into a crypto empire. And you people are buying it? WPAY is a corporate loyalty token with a blockchain tattoo. It’s not decentralized. It’s not useful. It’s not even *fun*. It’s a spreadsheet with a smart contract. And the fact that people are treating it like Bitcoin? That’s the real scam.

Eunice Chook

Market cap $5.7M? FDV $1B? Classic. This is the same playbook as every failed utility token since 2017. Lock 95% of supply. Pump with promotions. Wait for retail FOMO. Then dump when unlocks hit. The 8.5% APY? That’s not yield-it’s a trap. Don’t be the last one holding the bag when the unlock date hits.

Lois Glavin

If you're already using Wirex, just hold a little WPAY. It saves you on fees. If you're not using Wirex? Don't touch it. It's not crypto. It's a coupon. And coupons don't make you rich.

Scot Sorenson

So let me get this straight-you’re excited about a token that only works inside an app that takes 3 days to respond to support tickets? And you think this is the future of payments? I’d rather use cash. At least cash doesn’t need a 12-step guide to add to MetaMask.

Ike McMahon

WPAY isn’t for everyone-but if you’re already on Wirex, it’s a no-brainer. Think of it like airline miles. You don’t buy miles to invest-you buy them because you fly. Same logic. Just don’t go all-in. Keep it small, use it, and enjoy the perks.

JoAnne Geigner

I’ve been thinking about this a lot… and I wonder if WPAY is actually a test case for how centralized platforms can tokenize user behavior without being a security. It’s not perfect-but it’s a step toward making crypto feel less like gambling and more like… participation? Maybe? I’m not sure. But I’m watching.

Alex Warren

Contract address: 0x7ABE9Edf5C544A04dA83e9110CF46DBC4759170c. Decimals: 18. Network: Polygon PoS. Verified on Etherscan. No red flags on the code. But utility? Still minimal. This is a corporate token masquerading as decentralized finance.

Claire Zapanta

You know who benefits most from WPAY? The people who sold early. The ones who bought at $0.05. The insiders. The VCs. The team. And now you’re all here, buying at $0.176, thinking you’re smart. But the real game? The real game is the 9.5 billion tokens sitting in wallets that will unlock in 2026. That’s not a token. That’s a time bomb.

Jeremy Eugene

The regulatory uncertainty surrounding WPAY is substantial. While classified as a utility token, its design and distribution model align closely with characteristics that regulators may classify as securities. Given Wirex’s existing scrutiny in European jurisdictions, WPAY’s legal standing remains precarious. Investors should proceed with extreme caution.

Hari Sarasan

WPAY is the future of fintech. The fact that you don’t understand it means you’re stuck in 2015. This is the new paradigm: platform-native tokens that incentivize loyalty. The 10 billion supply isn’t a flaw-it’s a strategic advantage. The market will catch up. You’re just too slow to see it. I’ve been stacking since day one. You’re still asking if it’s a scam. Pathetic.

Stanley Machuki

Just got my first WPAY from Bitget. Didn’t even know how to add it. Took me 20 mins. But now I’ve got 200 of them. Feels like free money. I’m not selling. I’m holding. If Wirex grows, I win. If they crash? Oh well. It’s just a few bucks.

Lloyd Cooke

The philosophical paradox of WPAY lies in its contradiction: it is simultaneously a tool of liberation-enabling frictionless crypto payments-and a mechanism of enclosure, tethering users to a centralized entity. Its value is not derived from decentralization, but from dependency. This is not the future of finance. This is its elegy.