El Salvador didn’t just try Bitcoin-it made it legal money. In September 2021, it became the first country in the world to give Bitcoin the same status as the U.S. dollar. No other nation had done that. The move was bold, flashy, and full of promises: cut remittance fees, bank the unbanked, attract global investors, and break free from dollar dependence. But by January 2025, the government quietly walked back the law. Bitcoin was no longer legal tender. So what actually happened? Did it work? And why did the world’s most talked-about crypto experiment collapse under its own weight?

Why El Salvador Chose Bitcoin

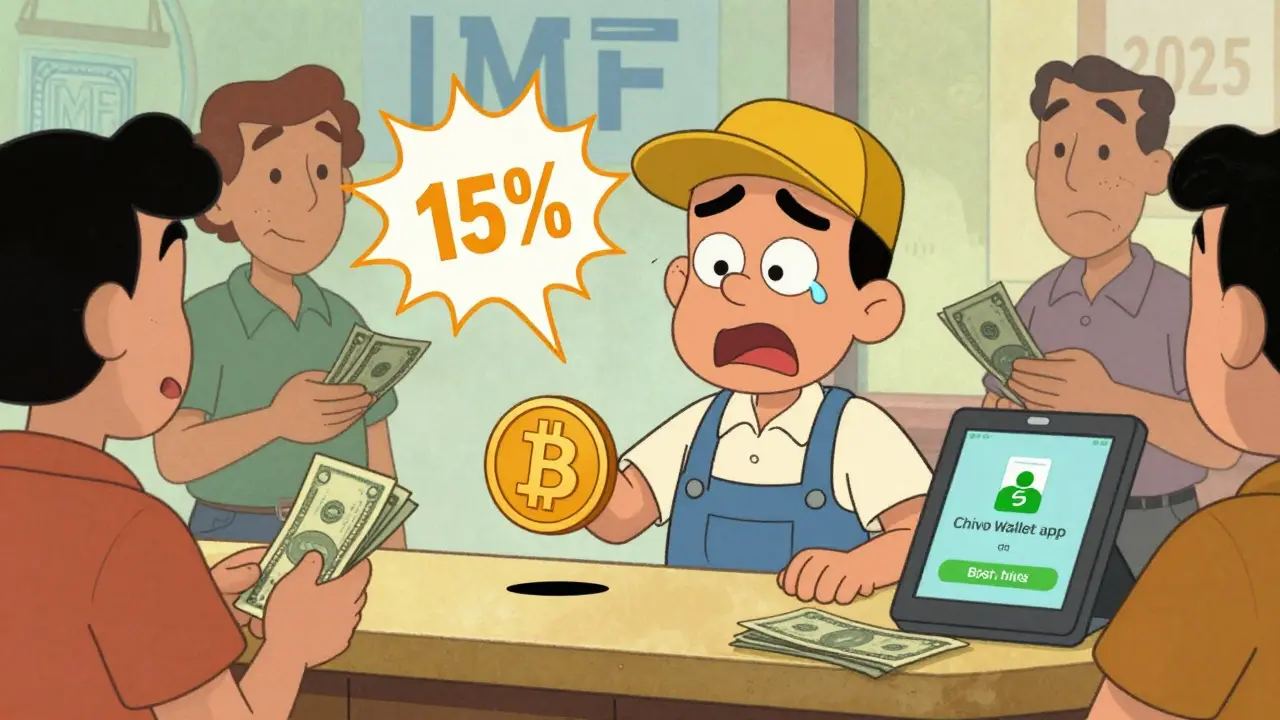

El Salvador’s economy has been tied to the U.S. dollar since 2001. That meant the country had no control over its own monetary policy. Interest rates, inflation, and money supply were all dictated by the Federal Reserve. For a small, developing nation, that’s a problem. When the U.S. raised rates to fight inflation in 2022, El Salvador felt it immediately-loans got more expensive, businesses struggled, and remittances from the U.S. became even more critical. About 70% of Salvadorans didn’t have bank accounts. Sending money home from the U.S. cost up to 20% in fees. Most people used cash or informal networks. President Nayib Bukele saw Bitcoin as a fix. No middlemen. No banks. Just direct peer-to-peer transfers. The idea was simple: if you could send Bitcoin via a phone, you didn’t need a bank. And if you could buy coffee with Bitcoin, you didn’t need cash. The government launched Chivo Wallet-a free app that gave every citizen $30 in Bitcoin just for downloading it. They installed Bitcoin ATMs in towns and cities. They promised tax breaks for businesses that accepted it. It looked like a revolution.What Actually Changed

By 2025, 82% of small businesses in El Salvador accepted Bitcoin. That sounds impressive. But here’s the catch: only 1% of remittances were actually sent in Bitcoin. Most people still got paid in dollars. Most still paid bills in dollars. Most still bought groceries with cash. Why? Because Bitcoin was too volatile. Imagine getting paid in Bitcoin on Friday, only to find your salary dropped 15% by Monday because the price crashed. Small shop owners couldn’t afford that risk. Many kept Bitcoin as a ledger item but converted it to dollars immediately. The Chivo Wallet? Most people deleted it after the free $30 ran out. The app was buggy, slow, and confusing. Customer support? Nonexistent. Even the government struggled. El Salvador bought over 6,100 Bitcoin by March 2025, spending more than $500 million. But when Bitcoin’s price fell below $40,000 in late 2023, those holdings lost nearly $150 million in value overnight. The treasury wasn’t just exposed to market swings-it was bleeding.The IMF’s Role: The Quiet End of Legal Tender

In 2023, El Salvador asked the International Monetary Fund for a $1.4 billion loan to stabilize its economy. The IMF said yes-but only if Bitcoin lost its legal tender status. Why? Because the IMF doesn’t trust crypto. It sees Bitcoin as a risk to financial stability, tax collection, and monetary sovereignty. And they were right: El Salvador’s experiment was putting pressure on its budget, banking system, and credit rating. By January 2025, the government agreed. Bitcoin was no longer legal tender. Businesses no longer had to accept it. The law was changed. But here’s what didn’t change: El Salvador kept buying Bitcoin. In fact, they bought 8 more coins in March 2025. Their Strategic Bitcoin Reserve Fund now holds over 6,100 coins. They’re not selling. They’re just not forcing anyone to use it anymore. This wasn’t a defeat. It was a pivot.

Bitcoin Is Still Used-Just Not as Money

El Salvador didn’t abandon Bitcoin. It just stopped pretending it could replace the dollar. Today, Bitcoin is treated like gold. A store of value. A speculative asset. A hedge against inflation. The government still promotes it as a tool for innovation. They hosted the PLANB Forum 2025-the largest crypto conference in Central America. They’re building a Bitcoin City powered by geothermal energy from volcanoes. They’re still pushing blockchain tech for land titles, voting, and public records. And while most Salvadorans don’t use Bitcoin to buy bread, they do use it to send money abroad. The Lightning Network, a faster, cheaper Bitcoin layer, is growing. By 2022, more Salvadorans had Lightning wallets than bank accounts. That’s not nothing. It means the infrastructure is there. People just don’t trust the price.The Real Lesson: Technology Alone Doesn’t Fix Economics

El Salvador’s experiment didn’t fail because Bitcoin was bad. It failed because the government thought technology could solve deep structural problems. You can’t fix poverty by giving people a digital wallet. You need jobs. You need stable prices. You need trust in institutions. Bitcoin can’t deliver that. It can’t pay teachers, fix roads, or reduce crime. It can’t replace a functioning economy. The real win? El Salvador proved that crypto can be integrated into a national system-even if it doesn’t become money. Other countries watched. Panama is testing crypto payments. Nigeria is exploring CBDCs. Even the U.S. is studying digital dollar pilots. El Salvador didn’t win the Bitcoin race. But it lit the starting gun.

Comments (14)

Danica Cheney

bitcoin was never gonna work as money lol

people just wanted free $30 and deleted the app

Kyle Pearce-O'Brien

This isn’t a failure-it’s a paradigm shift. The state’s adoption of BTC as legal tender was a performative act of monetary sovereignty against the petrodollar hegemony. The IMF’s intervention? Classic neocolonial financial coercion. El Salvador didn’t lose. They weaponized narrative. Now they’re building a geothermal-powered Bitcoin City while the West still debates whether crypto is ‘real.’ The future is decentralized. And it’s volcanic.

Matthew Ryan

I think the real takeaway is that technology alone can’t fix systemic issues. You need jobs, education, infrastructure. Bitcoin can help with remittances, sure-but not if people don’t trust the price swings. The government’s pivot makes sense.

Nathaniel Okubule

It’s important to recognize that El Salvador tried something bold. Not everything works out, but trying is better than doing nothing. The fact that they kept holding Bitcoin shows they still believe in its long-term value.

Shruti Sharma

why did they even try this lol its so obvious bitcoin is just a scam

people in el salvador are poor and they gave them crypto instead of food

typical rich people thinking they can fix poverty with tech

chivo wallet was a disaster i heard from my cousin who lives there

Robin Ødis

Let’s be real. The whole thing was a publicity stunt wrapped in libertarian fantasy. The government bought over 6,100 BTC at an average price of $80k. Now it’s worth less than half? That’s not a reserve fund-it’s a fiscal liability masquerading as innovation. And don’t get me started on the ‘Bitcoin City’-it’s a tax haven for crypto bros with zero real infrastructure. They didn’t fix remittances, they just made the treasury more volatile. The IMF was right to demand they drop legal tender status. This wasn’t progress. It was gambling with national stability.

Brittany Novak

This was never about Bitcoin. It was about the Fed. The U.S. has been draining developing nations dry with interest rate hikes and dollar dominance. El Salvador knew that. The IMF didn’t care about financial stability-they cared about maintaining dollar supremacy. The ‘collapse’ was a coup by global finance. The fact that they’re still buying Bitcoin? That’s resistance. They’re quietly building a parallel financial system. Wake up. This isn’t a failure. It’s a revolution they don’t want you to see.

Joshua Herder

Okay but imagine being a small business owner in San Miguel and having to deal with Bitcoin’s volatility while your electricity bill is in dollars and your rent is in dollars and your kids’ school fees are in dollars. You get paid in BTC, you wait three days for a transaction to confirm, then the price drops 18% while you’re waiting to convert it. You’re not a crypto enthusiast-you’re trying to feed your family. The government didn’t understand that. They thought if you gave people a shiny app and called it ‘financial freedom,’ they’d forget they were still poor. It’s not that Bitcoin failed. It’s that human reality failed to fit into the tech bro narrative.

Brittany Coleman

I think it’s beautiful that they didn’t give up on Bitcoin entirely. They just stopped pretending it could be everything to everyone. It’s like planting a tree-you don’t expect fruit on day one. The infrastructure is there. The Lightning Network is growing. People are learning. The world is watching. Maybe in ten years, this will look like the quiet beginning of something bigger.

laura mundy

They made a spectacle out of desperation. Everyone knew it wouldn’t work. The Chivo Wallet was a dumpster fire. The only people who benefited were the crypto influencers who got paid to promote it. And now they’re calling it a ‘pivot’? Please. They lost $150 million and backed down under IMF pressure. The only thing that survived is the myth they sold to the media. El Salvador didn’t lead the future. They just gave the world a cautionary tale dressed up as a manifesto.

Jacque Istok

So let me get this straight. They gave people free Bitcoin, which 99% of them immediately cashed out, then blamed the tech for not solving poverty? Classic. The real innovation here was how well they marketed failure as a revolution. Congrats, you turned a $500 million loss into a TED Talk. The only thing more ironic than Bitcoin as legal tender is the fact that the whole country still uses dollars to buy bread.

Mendy H

The entire narrative is performative. They bought Bitcoin not to empower citizens but to create an asset bubble they could later monetize through foreign investment. The ‘Bitcoin City’? A shell corporation waiting for tax breaks. The real beneficiaries? Foreign VCs and mining conglomerates. The Salvadoran people? They got a buggy app and a debt crisis. This isn’t innovation. It’s financial colonialism with a blockchain logo.

Molly Andrejko

I think it's really important to celebrate the courage it took to try something so different. Not every idea works, but that doesn't mean it wasn't worth trying. The fact that they're still holding Bitcoin and building infrastructure? That shows real vision. Maybe the world just needed time to catch up.

sabeer ibrahim

This is what happens when you let western tech bros dictate policy for poor nations. Bitcoin is a U.S.-centric asset. El Salvador should’ve focused on strengthening its own currency, not chasing crypto fantasies. The IMF was right. The real problem isn’t dollar dependence-it’s corruption, weak institutions, and lack of industrial policy. You don’t solve structural poverty with a wallet app. You solve it with schools, roads, and factories. This was a distraction dressed as progress.