Crypto Tax Calculator for India

This calculator helps you estimate your cryptocurrency tax liability in India based on the current regulations. The Indian government imposes a 30% tax on crypto gains, a 4% cess, and a 1% TDS on transactions exceeding ₹50,000.

Tax Calculation Results

Important Notes:

- TDS applies only if your transaction exceeds ₹50,000.

- The 30% tax rate applies to your crypto gains, not your total transaction value.

- You must report all crypto transactions in Schedule VDA on your income tax return.

Key Takeaways

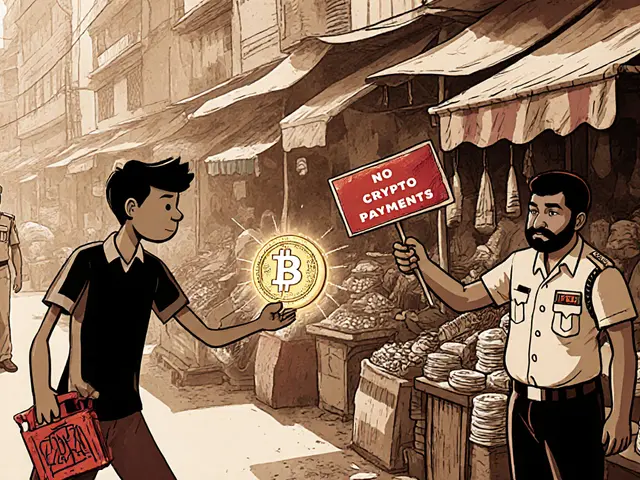

- Using cryptocurrency as a direct payment for goods or services is explicitly prohibited in India as of 2025.

- Trading, holding, and investing in crypto assets are legal but subject to a 30% flat tax, 1% TDS on transactions over ₹50,000, and mandatory AML/KYC compliance.

- The Reserve Bank of India (RBI) and the Ministry of Finance drive the regulatory framework; SEBI and FIU‑IND enforce AML rules.

- India is rolling out a Central Bank Digital Currency (CBDC) called the digital rupee, which the government promotes as the preferred digital payment method.

- Businesses must avoid crypto‑payment gateways, keep detailed tax records, and use registered exchanges for any crypto activity.

When it comes to cryptocurrency payments in India, the headline is clear: you cannot use Bitcoin, Ethereum, or any other digital token to settle a purchase. The rule is not a vague advisory; it is written into the country’s regulatory framework and enforced by multiple agencies. Below we unpack what “prohibited” really means, what you can still do with crypto, and how to stay on the right side of the law.

What the Law Calls Crypto Assets

India classifies every digital token under the umbrella term Virtual Digital Asset (VDA). The definition lives in Section 2(47A) of the Income Tax Act, 1961. VDAs are treated as taxable property, not as legal tender. That distinction is why the government can allow trading while banning payments.

Why Direct Payments Are Forbidden

The prohibition stems from the Reserve Bank of India (RBI)'s 2018 circular, which barred banks and regulated payment systems from facilitating crypto transactions. Although the Supreme Court of India struck down the banking ban in 2020, it left the door open for the legislature to curb crypto usage as a payment medium. In 2022 the government enacted a specific provision: crypto cannot be used to settle debts, purchase goods, or pay for services. Violations can attract penalties under the Prevention of Money Laundering Act, 2002 (PMLA) and related AML rules.

What You Can Still Do With Crypto

While payment is off‑limits, the law permits several activities, provided you follow the compliance checklist:

- Buy, sell, or hold VDAs on exchanges that are registered with the Financial Intelligence Unit‑India (FIU‑IND).

- Trade on domestic platforms or on foreign exchanges that have obtained FIU‑IND registration.

- Invest in crypto funds or trusts that are approved by the Securities and Exchange Board of India (SEBI) (where applicable).

If you stay within these boxes, you are operating legally. Anything that tries to bridge crypto to a retail purchase-like a crypto‑gift card or a merchant‑integrated wallet-crosses the line.

Taxation: The Numbers You Need to Know

India’s tax regime, introduced in 2022, imposes a flat 30% tax on any income derived from VDAs, plus a 4% cess. No deductions are allowed except the cost of acquisition, meaning you can’t offset losses against gains. On top of that:

- A 1% Tax Deducted at Source (TDS) applies to each transaction exceeding ₹50,000.

- Platform fees are subject to an 18% Goods and Services Tax (GST).

- Annual filing requires a dedicated schedule-Schedule VDA-on ITR‑2 or ITR‑3 forms.

Failure to report crypto income can trigger notices, penalties, or even a rejection of your tax return. Keeping a spreadsheet of purchase dates, amounts, and exchange rates is now a must‑have for every crypto holder.

Who’s Watching and Enforcing?

The regulatory landscape is a team sport. Each agency has a distinct role:

- Reserve Bank of India (RBI) - issues policy statements warning about systemic risks and pushes the digital rupee as a safer alternative.

- Ministry of Finance - drafts tax rules and the overarching crypto‑law framework.

- Financial Intelligence Unit‑India (FIU‑IND) - registers exchanges, monitors AML compliance, and levies fines for breaches (e.g., Binance fined ₹18.82 crore in 2024).

- Securities and Exchange Board of India (SEBI) - explores a regulated market for crypto assets, emphasizing investor protection.

Because these bodies overlap, a single misstep-like operating an unregistered wallet-can attract enforcement from more than one regulator.

Digital Rupee vs. Private Crypto Payments

The RBI’s flagship project, the digital rupee, is a Central Bank Digital Currency (CBDC). Unlike private tokens, it is legal tender, fully backed by the central bank, and integrates with existing banking infrastructure. The government promotes it as a faster, cheaper way to move money while keeping a clear audit trail.

For merchants, the digital rupee offers a legal payment channel that mimics the speed of crypto without the regulatory headaches. For consumers who still want exposure to decentralized assets, the route remains: buy on a registered exchange, hold in a compliant wallet, and treat the asset as an investment-not a payment method.

Practical Steps for Businesses and Consumers

Whether you run an e‑commerce site or simply hold crypto for personal wealth, follow this checklist to stay compliant:

- Verify exchange registration. Check the FIU‑IND portal for a valid certificate before opening an account.

- Implement KYC/AML processes. Even if you’re only buying crypto, the exchange will need your PAN, Aadhaar, and proof of address.

- Record every transaction. Capture date, value in INR, exchange name, and transaction hash for tax reporting.

- Calculate taxes monthly. Apply the 30% flat rate to gains, add 1% TDS where applicable, and include GST on platform fees.

- File Schedule VDA. Include the aggregated crypto income in your annual ITR using the designated schedule.

- Avoid crypto‑payment gateways. Any integration that lets customers pay with Bitcoin, USDT, or similar tokens is a violation.

If you need to accept digital payments, look at the RBI’s digital rupee pilot or traditional card gateways-both are fully compliant.

Where the Landscape Is Headed

India’s stance is unlikely to shift dramatically in the short term. The government favors a state‑backed CBDC and continues to tighten AML enforcement. However, the legislative bill that could ban private crypto outright remains pending, meaning the current “investment‑only” model could stay in place for a few more years. Keep an eye on RBI announcements and any new Finance Ministry bills; they will dictate whether the regulatory gray zone narrows or widens.

Quick Reference Table

| Aspect | Status | Key Requirement |

|---|---|---|

| Payments for goods/services | Prohibited | No crypto‑payment gateways; use INR or digital rupee. |

| Trading & holding | Legal | Only on FIU‑IND‑registered exchanges. |

| Tax rate on gains | 30% + 4% cess | Report on Schedule VDA; no loss set‑off. |

| TDS on transactions | 1% if > ₹50,000 | Deducted at source; credited to PAN. |

| AML/KYC compliance | Mandatory | FIU‑IND registration, PAN, Aadhaar verification. |

Frequently Asked Questions

Can I pay my grocery bill with Bitcoin in India?

No. The law expressly forbids using any cryptocurrency as a direct payment for goods or services. You must settle the bill in Indian rupees or the digital rupee.

Is it illegal to own crypto tokens?

Owning crypto is legal. The restriction is only on using them as a medium of exchange. You can hold, trade, or invest in tokens on compliant platforms.

What taxes do I owe on crypto profits?

A flat 30% tax plus a 4% cess applies to any profit from crypto. Additionally, a 1% TDS is deducted on each transaction above ₹50,000, and platform fees attract 18% GST.

Do I need to register my crypto exchange?

Yes. Any exchange that serves Indian residents must be registered with the FIU‑IND and comply with KYC/AML norms.

Will the digital rupee replace private crypto?

The RBI’s digital rupee is intended as a legal‑tender alternative that offers the speed of crypto with full regulatory oversight. It may become the preferred digital payment method, but private crypto will likely remain an investment‑only asset for the foreseeable future.

Comments (19)

Roxanne Maxwell

I love how India's handling this - not banning crypto, just saying 'hey, use it for investing, not for buying coffee.' It's such a balanced move. I wish more countries would do this instead of full bans or wild chaos.

As someone who's lived in three countries, this feels like the smart middle ground. You get innovation without risking the whole financial system.

John Murphy

The 30% tax is brutal but at least its clear

Zach Crandall

This is precisely why central banks must maintain monetary sovereignty. The moment private digital assets are permitted as payment, the entire fiscal architecture begins to corrode. India's stance is not merely regulatory - it is civilizational.

One cannot allow decentralized, untraceable, algorithmically volatile tokens to compete with state-backed currency without inviting systemic collapse. The digital rupee is not an alternative - it is the only legitimate path forward.

Dick Lane

Honestly I dont get why people are so mad about not being able to pay with btc

if you wanna hold it cool but dont try to turn it into cash money

Norman Woo

this is all a distraction. the real agenda is to push the digital rupee so they can track every single penny you spend. you think they care about tax revenue? no. they want to know if you bought tea or weed. its all about control. the crypto ban is just the cover story.

theyll be scanning your qr codes before you know it. wake up people

Serena Dean

If you're holding crypto in India, just treat it like stocks. Buy on registered exchanges, keep receipts, file Schedule VDA. Done.

Stop overcomplicating it. The rules are clear - it's not illegal, it's just not a wallet. Use it to grow wealth, not buy pizza. Easy.

James Young

Anyone who thinks this is a good policy is clueless. A 30% tax on gains with no loss offset? That’s confiscatory. This isn’t regulation - it’s punishment for people who dared to believe in decentralized money. The RBI is just scared their monopoly is crumbling.

And don’t even get me started on the digital rupee. That’s not innovation - it’s surveillance with a shiny UI.

Chloe Jobson

VDA classification is the key. Not legal tender = taxable asset. That’s the legal architecture. No ambiguity.

FIU-IND registration = non-negotiable. No gray area. Compliance = cost of entry.

Andrew Morgan

Man i just bought some solana last week and was like hey maybe i can use it at that local cafe

then i read this and realized oh right india doesnt do that

so now its just sitting there like a digital art piece lol

Michael Folorunsho

India is the only country with the guts to say no to crypto chaos. The west is falling apart with crypto scams and DeFi ponzi schemes. Here? You invest - you pay your taxes - you stay out of the system. Clean. Smart. National pride.

Anyone complaining is either a libertarian idiot or a tax evader in disguise.

Jonathan Tanguay

The fact that you have to pay 1% TDS on every single trade over 50k is ridiculous. That’s not tax - that’s a transaction fee designed to crush retail participation. And don’t get me started on the 30% flat rate - it doesn’t matter if you made 10k or 10 crore, you pay the same. That’s not progressive taxation - that’s economic bullying. The government is treating crypto holders like criminals instead of investors. And the digital rupee? Please. It’s just a blockchain with a government logo and zero decentralization. It’s not even crypto - it’s a digital rupee with extra steps. If you want to control people, just admit it. Don’t hide behind ‘financial stability’.

Ayanda Ndoni

So basically you can own crypto but can't spend it? Sounds like a scam to me. Why not just let people use it? Everyone else is doing it. Why does India always have to be so slow and weird?

Elliott Algarin

There’s something poetic about this. Crypto was born to be free - but freedom without responsibility is chaos. India’s approach says: you can hold your freedom, but you can’t force it into the real economy until the system catches up.

Maybe the answer isn’t to ban crypto - but to let the digital rupee evolve into something better than both cash and crypto. A hybrid future.

Akinyemi Akindele Winner

They call it VDA like it's some fancy new breed of digital lizard. Meanwhile, the real VDA is the one in the RBI's vault - the one that prints rupees and calls it 'digital' when it's just old money with a screen. India's got the nerve to tax your gains but won't let you buy a samosa with your ETH? That's not policy - that's performance art.

MANGESH NEEL

This is why India is the only country that actually understands finance. You want to gamble on crypto? Fine. But don’t you DARE try to turn it into currency. That’s not innovation - that’s financial terrorism. The 30% tax is a mercy. The 1% TDS is a warning. And the digital rupee? That’s the future - clean, controlled, and sovereign.

If you can’t handle this, go to Switzerland. Or better yet - stay quiet and pay your taxes. You’re lucky we even let you hold it.

Sean Huang

The digital rupee is not a currency - it is a digital leash. Every transaction monitored. Every movement tracked. Every citizen reduced to a data point. The crypto ban is not about financial stability - it is about the complete erasure of financial privacy. The state does not want you to have alternatives. It wants you to have only what it approves.

They call it progress. I call it totalitarianism with a user interface. The moment you accept the digital rupee, you surrender your right to be anonymous. And anonymity is not a crime - it is the last refuge of liberty.

Ali Korkor

Just keep it simple: buy on registered apps, save your receipts, pay the tax, don't use it to pay for anything. Boom. You're good.

It's like owning a rare comic book - you can't use it to buy groceries, but you can still enjoy it and maybe sell it later for more.

madhu belavadi

I hold crypto and I pay tax but I still feel like I'm being watched. Every time I log in, I think - are they watching? Am I being flagged? Why does this feel so heavy?

Patrick De Leon

India’s regulatory framework is a model for the world. No half-measures. No regulatory arbitrage. Clear rules, strict enforcement, and a sovereign alternative. The digital rupee is not competition - it is evolution. Those who resist are not innovators - they are relics clinging to anarchy disguised as freedom.