Swapr Fee Estimator

Calculate estimated fees for your cross-chain swap on Swapr. Input your source chain, destination chain, and amount to see projected costs.

When you hear the name Swapr is a privacy‑focused crypto swap platform that launched in early 2025. It promises a four‑step process - pick the pair, set your address, send to the deposit address, and receive funds - and it does it without asking for any KYC documents. In a market where regulators are tightening rules and users are craving anonymity, Swapr lands right in the middle of two big trends: cross‑chain swapping and no‑KYC services.

What Swapr Actually Does

Swapr positions itself as a cross‑chain swap service, not a traditional order‑book exchange. Instead of matching buyers and sellers, it acts as an intermediary that moves assets from one blockchain to another on your behalf. The workflow looks like this:

- Select the source and destination tokens (e.g., ETH → BNB).

- Enter the wallet address where you want the final token sent.

- Send the source token to the unique deposit address shown on the screen.

- Watch the platform automatically bridge the chain and credit the destination address.

Because the user never hands over private keys, the service is non‑custodial - you stay in control of your funds the whole time.

Key Features & How They Compare

| Feature | Swapr | Uniswap | Symbiosis | Kraken |

|---|---|---|---|---|

| KYC Requirement | No KYC | No KYC (but wallet‑connect only) | No KYC | Mandatory KYC |

| Cross‑Chain Support | Yes (multiple chains, specifics not disclosed) | Single‑chain (Ethereum, Base, Arbitrum, Optimism) | Yes (10+ chains) | Limited (major fiat pairs, some crypto) |

| Fee Structure | Undisclosed (likely low‑to‑medium) | Variable gas + 0.3% protocol fee | Low fees, transparent breakdown | 0.02%‑0.26% depending on volume |

| Custodial Model | Non‑custodial | Non‑custodial | Non‑custodial | Custodial |

| Security Audits | Not publicly disclosed | Multiple audits (e.g., ConsenSys Diligence) | Audited by PeckShield & others | Regular internal & external audits |

The table shows why Swapr might appeal to users who want a quick, anonymous bridge between chains without the hassle of filling out forms. If you need deep liquidity, a proven audit record, or fiat on‑ramps, a more established exchange like Kraken could be a better fit.

Who Should Consider Using Swapr?

- Privacy‑conscious traders who dislike sharing personal data.

- People who already hold crypto in a non‑custodial wallet and need to move assets across chains quickly.

- Users who prefer a simple UI over complex DeFi routing tools.

Conversely, if you are a beginner looking for extensive educational material, or you need fiat‑to‑crypto capabilities, you might lean toward platforms like Coinbase or Kraken that offer guided onboarding.

Security Considerations

Any service that handles cross‑chain transfers inherits the risk of smart‑contract bugs. While Swapr’s public documentation does not list a specific audit firm, competitors in the same niche (e.g., Symbiosis) have been vetted by reputable auditors such as PeckShield. Until Swapr releases a formal audit report, users should:

- Start with a small amount to test the flow.

- Verify the deposit address on‑chain before sending.

- Keep an eye on community forums for any reported exploits.

Regulatory pressure is also mounting. Europe’s MiCA framework, enforced in 2024, forces many platforms to adopt KYC/AML procedures. Swapr’s no‑KYC stance could attract scrutiny, potentially leading to service interruptions in jurisdictions with strict compliance rules.

Performance & Volume Landscape

Q22025 saw cross‑chain swap volumes surpass $800million globally, according to CoinGape. While Swapr’s individual contribution isn’t disclosed, the sheer market size suggests enough demand to sustain a niche player. By contrast, legacy DEXs like PancakeSwap reported over 37million trades in a 30‑day window, handling a TVL of roughly $3.3billion. Swapr’s focus on simplicity means it likely targets a fraction of that traffic, but with higher per‑transaction value for users who need rapid chain hopping.

Pros & Cons - Quick Reference

- Pros:

- No KYC, instant onboarding.

- Cross‑chain swaps in a single step.

- Non‑custodial - you keep your private keys.

- Cons:

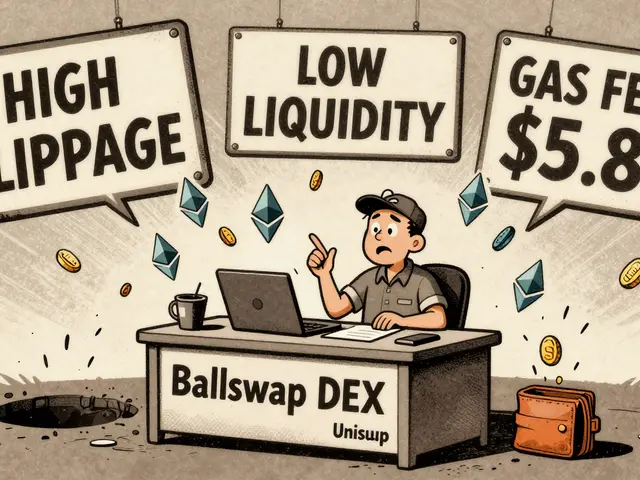

- Fee structure not transparent.

- No publicly verified security audit.

- Limited to crypto‑to‑crypto; no fiat on‑ramps.

- Potential regulatory headwinds.

Future Outlook

Cross‑chain technology is evolving fast. Projects like Symbiosis predict faster, cheaper bridges in the next 12‑18 months. If Swapr can integrate those advances and publish a solid audit, it could move from a niche privacy tool to a mainstream bridge. However, compliance trends might force the platform to adopt optional KYC layers, which could dilute its core appeal.

Bottom Line

If you already know how to manage a non‑custodial wallet and you value anonymity above everything else, Swapr offers a clean, four‑step pathway to move assets across chains. It isn’t a replacement for full‑featured DEXs or centralized exchanges that provide deep liquidity, fiat on‑ramps, and rigorous security audits. Think of Swapr as a fast lane for cross‑chain swaps, not a one‑stop shop for all trading needs.

Frequently Asked Questions

Is Swapr really a no‑KYC platform?

Yes. Swapr does not ask for identity documents during the onboarding process. Users simply connect a wallet and start swapping.

Which blockchains does Swapr support?

The exact list isn’t publicly disclosed, but the platform markets itself as a multi‑chain solution, similar to other cross‑chain bridges that cover Ethereum, Binance Smart Chain, Avalanche, and Polygon.

How are fees calculated on Swapr?

Swapr does not publish a detailed fee table. Users should expect a combination of gas costs on the source chain and a platform fee that is likely competitive with other no‑KYC bridges.

Is my money safe on Swapr?

Since the service is non‑custodial, your private keys stay in your wallet. The main risk is a potential smart‑contract vulnerability. Until an audit is public, treat the platform as experimental and start with small amounts.

Can I use Swapr from the EU without issues?

EU regulators are tightening rules on anonymous services. While Swapr currently operates without KYC, future legal changes could affect accessibility in certain European countries.

Comments (16)

Jordan Collins

Swapr positions itself as a no‑KYC, cross‑chain solution, which immediately raises questions about regulatory compliance. The platform’s fee estimator is cleanly integrated, but the lack of transparency in the fee structure is concerning. Users should be aware that hidden costs can emerge when bridging between chains with different gas dynamics. While the UI is intuitive, the security note about starting with small amounts is sound advice. Overall, Swapr could serve casual traders, yet power users will likely demand audited contracts before committing larger sums.

Andrew Mc Adam

The moment I opened Swapr I felt like I was stepping onto a wild west frontier of crypto swaps. Its promises of “no‑KYC” are thrilling but also kinda scary, especially when the fee breakdown is hidden in the shadows. The design looks sleek, yet the codebase is still a mystery-definately needs a third‑party audit. I love the cross‑chain magic, but without clear numbers you’re basically gambling with your wallet. So, enjoy the ride but keep a close eye on that invisible fee monster.

Michael Bagryantsev

Swapr’s cross‑chain feature is straightforward enough for a newcomer. However, the fee estimator could benefit from displaying real‑time gas prices on each chain.

DeAnna Greenhaw

Upon thorough examination of the Swapr exchange interface, one discerns a concerted effort to streamline cross‑chain transactions whilst eschewing identity verification protocols. The fee estimator, though aesthetically pleasing, unfortunately omits a granular breakdown of intermediary costs, thereby engendering a degree of opacity detrimental to fiduciary prudence. Moreover, the platform’s reliance on unverified smart contracts raises legitimate concerns regarding systemic vulnerabilities. In the milieu of contemporary decentralized finance, transparency is not a luxury but an exigency. Consequently, prospective participants are behooved to conduct diligent audits prior to the allocation of substantive capital. In sum, Swapr offers a compelling proposition, albeit one that demands circumspect engagement.

Luke L

The fee model looks like a cash grab.

Cynthia Chiang

Swapr tries to make swapping easy, but the hidden fees can bite you when you least expect it. I think their UI is friendly, yet the lack of audit reports makes me nervous. If you’re new, start with a tiny amount and watch how the fees change across chains. Their no‑KYC stance is cool, but it also means less oversight for user protection. Overall, it’s a decent tool if you’re willing to take a little risk.

Hari Chamlagai

From a technical perspective, Swapr’s cross‑chain router leverages existing bridge contracts that have historically suffered from replay attacks. The fee estimator does not account for the underlying gas surcharge that each bridge imposes, leading to under‑estimates. Users should also consider the liquidity depth on the destination chain, as slippage can dramatically inflate the effective cost. Until a comprehensive security audit is released, I would refrain from moving more than a negligible amount.

Ben Johnson

Oh great, another “no‑KYC” swap platform that pretends fees are a mystery. The UI is shiny, but the fine print is as clear as mud. If you enjoy guessing games with your crypto, Swapr might be your playground.

Jason Clark

Swapr advertises frictionless swaps, yet the fee estimator feels like a roulette wheel. The numbers presented are vague, and without audit logs you’re left to trust a black box. It’s a neat concept, but execution falls short of industry standards. Proceed with caution and verify the bridge contracts yourself.

Jim Greene

Swapr’s interface is super user‑friendly 😊. The cross‑chain feature is handy for quick moves, and the no‑KYC policy is a plus for privacy lovers. Just remember to test with a small amount first, then you’ll be good to go! 🚀

Della Amalya

While Luke’s blunt assessment hits the nail on the head, it’s worth noting that fee structures can evolve as platforms mature. Keeping an eye on future updates may reveal a more transparent model.

Teagan Beck

Andrew’s enthusiasm is contagious, but a bit more caution wouldn’t hurt. A quick look at the contract’s source code could save a lot of headaches.

Kim Evans

Jason makes a good point about the lack of clear fee breakdown. For anyone wanting to dig deeper, the contract on Etherscan shows the exact gas cost calculations. 👀

Steve Cabe

Swapr’s current fee estimator omits the variable gas fees inherent to each blockchain, which can skew the projected cost. Additionally, the platform does not disclose the source of its price oracle, raising potential price manipulation concerns. Users should therefore cross‑reference the displayed fees with independent gas trackers. Until these transparency issues are addressed, caution is advisable.

shirley morales

Steve’s warnings are noted but overly cautious. The platform’s design is sophisticated enough for discerning users.

Mandy Hawks

In the grand tapestry of decentralized finance, every new protocol is both a promise and a dilemma. Swapr’s ambition to eliminate KYC reflects a broader yearning for autonomy in the digital age. Yet autonomy, when untethered from accountability, can drift toward unchecked risk. The fee estimator’s opacity is a microcosm of this tension, where convenience masks hidden costs. Users, like travelers, must map their journey before setting foot on unfamiliar terrain. Without a transparent ledger, one relies on faith rather than facts, and faith is a fragile foundation. Moreover, the absence of a publicly audited contract invites speculation about potential vulnerabilities that could affect the entire ecosystem. Philosophically speaking, the platform challenges the balance between trustless systems and the need for societal safeguards. Each cross‑chain transaction becomes a small act of rebellion against conventional oversight, but rebellion without strategy can be self‑defeating. The community’s role, therefore, is not merely to adopt but to interrogate, to demand clarity, and to foster collective security. While Swapr may serve a niche of privacy‑conscious traders, those who value long‑term sustainability should press for better disclosure. The iterative nature of crypto tools suggests that today’s shortcomings are tomorrow’s learning opportunities. In that light, Swapr could evolve, integrating transparent fee structures and third‑party audits, thereby harmonizing freedom with responsibility. Until such evolution manifests, prudence remains the most prudent companion. Ultimately, the decision rests with each individual, guided by both curiosity and caution.