When you type "UBIX Exchange" into a search box, you probably expect a new crypto trading platform. In reality, there is no UBIX exchange at all - the name belongs to the UBIX Network a blockchain project that issues the UBX token. This article clears up the confusion, walks through the network’s tech, looks at market data, and tells you whether UBIX is worth a closer look.

What Exactly Is UBIX Network?

The UBIX Network was launched in June 2021 by a team led by CEO Alexander Petrov. It runs on a Proof‑of‑Stake consensus mechanism that lets token holders validate transactions and earn rewards. Its native token, UBX functions as a medium of exchange within the network and as a staking asset, and it exists in three formats: unwrapped UBX, wrapped UBX (WUBX) on Ethereum, and versions on Waves and TRON.

Technical Architecture and Performance

UBIX’s blockchain is built for cheap, high‑speed microtransactions. Official benchmarks claim an average throughput of about 1,200 TPS transactions per second under normal load with finality around 2.5 seconds. During peak periods, performance can dip 30‑40 %, which is still faster than many legacy chains.

The network’s fee model is deflationary: a tiny portion of every fee is burned, while roughly 10 % is funneled into a development fund. Fees average only $0.00012 per transaction, making UBX attractive for sub‑dollar transfers that would be prohibitively expensive on Ethereum (which averaged $1.27 per txn in 2023).

Cross‑chain capability is a core promise. UBIX can move assets between Ethereum, Waves, and TRON via cross‑chain bridges smart contracts that lock tokens on one chain and mint equivalents on another. However, bridge usage is modest because of the token’s low liquidity.

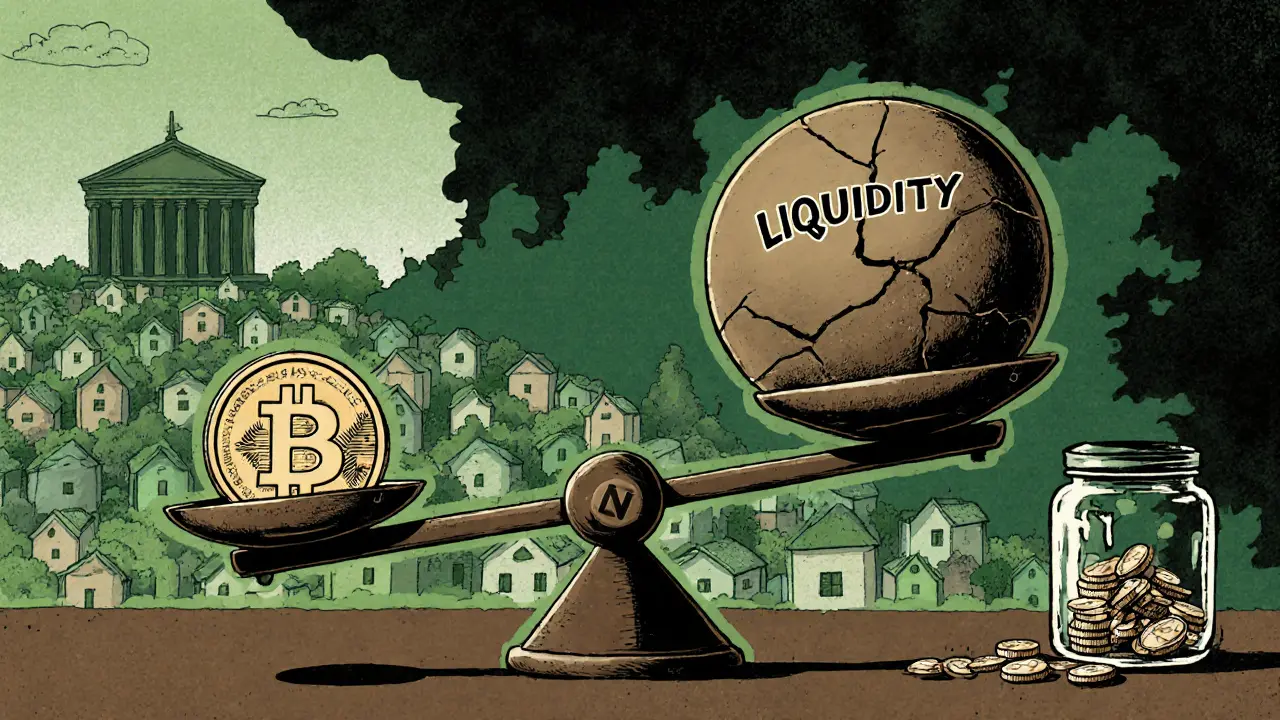

Market Presence, Liquidity, and Exchange Listings

Despite its technical features, UBIX suffers from a severe market‑visibility problem. As of October 2023, the token’s market cap hovered around $3.2 million, ranking it beyond the top 2,800 cryptocurrencies on CoinGecko a major crypto data aggregator. Daily trading volume averages under $5,000 across all venues, according to CoinMarketCap the industry’s leading market‑data provider. This tiny volume translates into massive slippage on decentralized exchanges (DEXs) - users regularly report 15 %‑plus price impact when trying to move more than a few hundred dollars worth of UBX.

The token is not listed on any major centralized exchange. Gate.io, a mid‑size exchange that occasionally adds micro‑caps, explicitly stated in an October 2023 notice that UBX “has not yet been listed for trading or related services”. The only practical routes to acquire UBX are peer‑to‑peer swaps or DEXs on Ethereum (via WUBX) and on the Waves network.

Use Cases - Where UBX Might Shine

UBX’s ultra‑low fees make it a candidate for certain niche scenarios:

- Micropayments for content creators who want to move fractions of a cent without incurring prohibitive costs.

- Machine‑to‑machine (M2M) transactions in IoT ecosystems that require high transaction volume but tiny value per transfer.

- Testing environments for developers experimenting with cross‑chain integrations without spending much on gas.

In practice, these use cases remain largely theoretical because the token’s scarcity on exchanges makes it difficult to obtain the amount needed for real‑world deployments.

Pros, Cons, and Risk Factors

| Aspect | Strength | Weakness |

|---|---|---|

| Transaction Speed | ~1,200 TPS, 2.5 s finality | Performance drops 30‑40 % under heavy load |

| Fees | $0.00012 per txn (deflationary) | Low fees attractive only if token is liquid |

| Cross‑Chain | Supports Ethereum, Waves, TRON | Bridges are under‑utilized, no mainstream DEX integration |

| Market Cap | $3.2 M (micro‑cap) | Rank #2,847 - tiny community, $4.9 K daily volume |

| Community | 1,200+ members across Telegram, Discord, Twitter | Very low activity (≈17 msgs/day), poor support response |

Overall, the technology checks many boxes for a low‑cost micro‑transaction platform, but the lack of exchange listings, liquidity, and a robust ecosystem heavily outweighs those benefits for most investors.

How to Acquire UBX - Step‑by‑Step Guide

- Set up a compatible wallet (e.g., MetaMask for WUBX, or a Waves‑compatible wallet for native UBX).

- Obtain a small amount of ETH (for gas) if you’ll use the Ethereum bridge.

- Visit a decentralized exchange that lists WUBX - Uniswap, SushiSwap, or PancakeSwap often have a “unverified token” option.

- Enter the contract address for WUBX (found on the official UBIX GitHub repo) and swap a tiny amount of ETH for WUBX.

- If you need native UBX, use the cross‑chain bridge - deposit WUBX, wait for the bridge to mint UBX on the target chain, then withdraw to your wallet.

- For larger amounts, coordinate a peer‑to‑peer trade on Reddit’s r/CryptoCurrency or Discord communities; always use escrow services to avoid scams.

Remember, because daily volume is under $5,000, even a $500 purchase can move the market significantly and generate high slippage. Expect to pay more than the quoted price on DEX aggregators.

Verdict - Should You Pay Attention to UBIX?

If you’re an investor looking for a high‑risk, high‑reward micro‑cap, UBIX offers a speculative play with a technically sound foundation. The token’s deflationary fee model and cross‑chain ambition are intriguing, but the odds are stacked against long‑term survival. Industry data from CoinDesk shows that micro‑caps with daily volume below $10,000 face a 78 % chance of becoming illiquid within 18 months. UBIX is already in that danger zone.

For developers who need a sandbox for cheap, fast transactions, UBIX can be a useful testnet. For anyone hoping to trade, store value, or build a commercial product, the lack of major exchange listings and minimal community support make it a poor choice right now.

Frequently Asked Questions

Is UBIX a crypto exchange?

No. UBIX refers to a blockchain project (UBIX Network) that issues the UBX token. It does not operate a centralized exchange.

Where can I buy UBX?

UBX is mainly available on decentralized exchanges as wrapped WUBX on Ethereum, or via peer‑to‑peer trades. It is not listed on major centralized exchanges like Binance or Coinbase.

What are the transaction fees on UBIX?

Fees average $0.00012 per transaction, with a tiny portion burned and 10 % redirected to the development fund.

Is UBX a good long‑term investment?

Given its micro‑cap status, negligible liquidity, and lack of exchange listings, UBX is high‑risk. Only allocate money you can afford to lose.

How does UBIX’s cross‑chain bridge work?

Users lock WUBX on Ethereum, the bridge contract records the lock, then mints an equivalent amount of native UBX on the target chain (Waves or TRON). The process reverses when withdrawing.

Comments (18)

Jessica Pence

Here's a quick rundown of how you can actually get your hands on UBX without blowing up your gas fees. First, grab a MetaMask wallet, make sure you have a sliver of ETH for the bridge. Then head to Uniswap, paste the WUBX contract address from the official repo (watch out for fake contracts – they’re everywhere). Swap whatever tiny amount you can afford, then use the UBIX bridge to mint native UBX on Waves or TRON.

Remember, because the daily volume is under $5k, even a $200 trade can shift the price a lot, so keep your orders smal and watch the slippage.

johnny garcia

From a theoretical standpoint, the UBIX Network presents an intriguing case study in micro‑payment scalability. Its sub‑cent transaction cost is commendable, yet the dearth of liquidity renders practical deployment virtually infeasible at present. Should the project secure listings on reputable CEXs, the token's utility could experience a substantive uplift. Until such milestones are achieved, I would advise only speculative allocation of capital. 📈💡

Ryan Comers

Everyone's yakking about how UBX is a dead‑end micro‑cap, but that’s exactly why it’s a diamond in the rough! While the masses chase the glitter of big‑cap hype, the real gains lie in these overlooked gems. If you can stomach the volatility, you’ll be laughing when the market finally wakes up to the ultra‑low fee tech. Don’t let the “no major exchange” narrative scare you – it’s a blessing in disguise.

Prerna Sahrawat

It is incumbent upon the discerning observer to appreciate the nuanced tapestry that constitutes the UBIX Network, a project which, despite its modest market capitalization, endeavors to resolve a confluence of systemic inefficiencies endemic to the broader blockchain ecosystem. The architecture, predicated upon a Proof‑of‑Stake consensus, endows token holders with a participatory role in transaction validation, thereby fostering a decentralized ethos that is both egalitarian and scalable. Moreover, the deflationary fee structure, wherein a fractional portion of each transaction is irrevocably excised from circulation, ostensibly engenders a subtle scarcity mechanism that could, over an extended horizon, augment token value. Nevertheless, such theoretical virtues are inexorably tethered to the pragmatic exigencies of liquidity, market visibility, and user adoption. The empirical data, as chronicled by CoinGecko and CoinMarketCap, delineates a stark portrait of an asset languishing beyond the 2,800‑th rank, with quotidian trading volumes scarcely breaching the $5,000 threshold. This paucity of volume engenders pronounced slippage, a phenomenon that is antithetical to the very low‑fee premise that the network espouses. In practice, a modest purchase of merely a few hundred dollars can precipitate a price distortion exceeding fifteen percent, thereby dissuading prospective entrants. The cross‑chain bridge, while architecturally elegant, suffers from a dearth of utilization, a symptom of the overarching liquidity conundrum. Consequently, the promise of seamless asset migration across Ethereum, Waves, and TRON remains, at present, an aspirational rather than operational reality. From a developer’s perspective, however, the environment offers a fertile sandbox wherein one may experiment with high‑throughput, low‑cost transactions without incurring prohibitive gas expenditures. Yet, this niche utility is circumscribed by the obstacles inherent in token acquisition, which is predominantly confined to decentralized exchanges of questionable depth or peer‑to‑peer arrangements. The community, albeit modest in size, exhibits a commendable degree of technical acumen, but is hampered by limited engagement metrics, as evidenced by quotidian message frequencies. In summation, while the UBIX Network crystallizes several laudable technical feats, the macro‑economic variables that dictate token viability-namely exchange listings, robust liquidity, and sustained community growth-remain conspicuously underdeveloped. Prospective investors are thus counseled to calibrate expectations, allocating capital commensurate with the specter of illiquidity that looms over micro‑caps of this ilk.

Erik Shear

UBX fees are practically zero.

Tom Glynn

Exactly, Erik! Those micro‑fees open doors for developers tinkering with IoT payments or content creator tips. Just remember to keep an eye on slippage when you scale up. 🚀

Johanna Hegewald

If you’re new to UBX, start with a tiny amount on Uniswap, then use the bridge to move it to Waves. It’s the safest way to test the process without risking a lot.

Benjamin Debrick

Indeed; the UBIX Network, whilst ostensibly engineered to ameliorate micro‑transactionic frictions, is inexorably hamstrung by an egregious deficit in market profundity, thereby engendering a paradox wherein the technological prowess is obfuscated by a paucity of liquid capital; consequently, one must interrogate the viability of sustained engagement, lest the project capitulate under the weight of its own ambitions.

Anna Kammerer

Wow, Benjamin, you’ve really nailed it. So basically UBIX is a fancy demo that no one can actually use because nobody wants to trade it. Got it.

Mike GLENN

The allure of sub‑cent transaction costs is undeniably seductive, especially for developers seeking a sandbox environment free from the prohibitive gas fees that plague Ethereum. Yet, the reality of acquiring UBX remains a labyrinthine endeavor, fraught with liquidity cliffs and price impact that can erode any theoretical gains. While the cross‑chain bridges promise interoperability, their utilisation is scant, reflecting a chicken‑and‑egg dilemma: low usage begets low liquidity, which in turn deters usage. For hobbyist miners or small‑scale content creators, the token could theoretically serve as a tip‑jar, but the practical barrier of obtaining even a modest balance often outweighs the convenience. Investors must therefore weigh the speculative upside against the palpable risk of being stuck with an illiquid asset. In essence, UBIX epitomises the classic micro‑cap conundrum: impressive tech juxtaposed with a fragile market ecosystem.

BRIAN NDUNG'U

While the challenges you outline are substantive, it is imperative to recognise that nascent ecosystems often endure initial turbulence before achieving equilibrium. By incrementally fostering community participation and pursuing strategic listings, UBIX may yet transcend its current limitations and fulfil its envisioned role as a low‑cost transaction conduit.

Donnie Bolena

Hey folks! Even if UBX looks rough now, the crypto world loves a good underdog story. With the right hype and a few big‑exchange listings, we could see the price explode! Keep an eye out for community events; they often spark sudden interest.

Elizabeth Chatwood

i think ubx could be cool if they get more ppl to trade it its like hidden gem waiting to be found

Tom Grimes

Elizabeth, I hear you, but let me elaborate on the intricacies that you seem to gloss over. The notion that a mere increase in trader count will magically resolve the liquidity quagmire ignores the structural deficiencies inherent in the token’s distribution model, the tenuous bridge infrastructure, and the overarching market sentiment that currently marginalises micro‑caps of this nature. In other words, your optimism, while well‑intentioned, lacks the gravitas of a nuanced market analysis, and I would advise tempering such exuberance with a sober assessment of the prevailing macro‑economic variables.

Paul Barnes

They don’t want you to know that the founders hold most of the supply; when they finally dump, the price will nosedive.

John Lee

Let’s brainstorm ways to boost UBX visibility. Maybe we could organise a community AMA with the devs, create tutorial videos, and share them across Reddit and Twitter. The more real‑world use cases we showcase, the better the chances of attracting exchange listings.

Jireh Edemeka

Ah yes, because the world’s most pressing financial issue is whether a micro‑cap token with sub‑cent fees can survive without a major exchange. Truly, we stand on the brink of a revolutionary breakthrough.

del allen

😂😂 you nailed it, Jireh. If only the big players cared about micro‑fees, we’d have UBX on every portfolio!