Tokenization

When working with tokenization, the process of turning real‑world assets into blockchain‑based tokens. Also known as digital asset representation, it lets you trade, split, and program assets on chain. If you’ve ever heard the term crypto token, a digital unit that lives on a blockchain and can represent value, voting power, or access rights, you already understand one piece of the puzzle. Tokenization encompasses asset digitization, requires a secure blockchain, and enables fractional ownership, which means you can own a slice of a high‑value item without buying the whole thing.

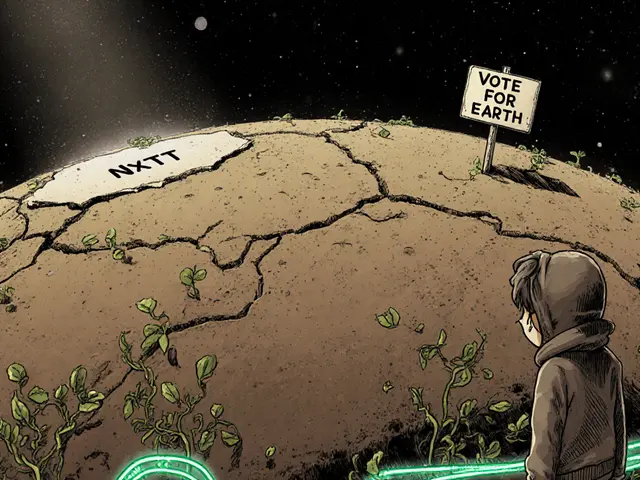

Why tokenization matters for DeFi and airdrops

In the world of DeFi, decentralized finance platforms that let you lend, borrow, and trade without traditional intermediaries, tokenized assets are the backbone. They turn real estate, art, or even future revenue streams into tradable tokens, opening up new liquidity pools and yield strategies. Meanwhile, airdrop, the distribution of free tokens to a community to bootstrap network effects often leverages tokenization to give participants a stake in a newly minted asset class, turning a simple giveaway into a real economic incentive.

Below you’ll find a mix of reviews, how‑to guides, and deep dives that cover everything from cross‑chain swaps to specific token airdrops. Whether you’re hunting for the next high‑yield DeFi token, curious about how a property can become a tradable NFT, or need step‑by‑step instructions for claiming a free token, the collection is organized to give you actionable insight without the fluff.

Ready to see how tokenization shapes the latest crypto trends? Scroll down for the full set of articles that break down the tech, the markets, and the real‑world use cases you can start using today.

Learn what Security Token Offerings (STOs) are, how they differ from ICOs and IPOs, the regulatory steps to launch one, and key risks and future trends in tokenized finance.

Continue reading