Venezuela Currency Converter

Convert Bolívar to USDT

See how your money actually works in Venezuela's economy

What this could buy:

When your paycheck buys less than a loaf of bread by the time you get home, money stops being money. In Venezuela, that’s not a metaphor-it’s daily reality. The bolívar has lost over 70% of its value since early 2025. Prices change multiple times a day. Supermarkets print new price tags every morning. People carry stacks of cash just to buy milk. And yet, somehow, life goes on. Not because the government fixed anything. But because millions of Venezuelans turned to something else: crypto.

Crypto Isn’t an Investment-It’s a Lifeline

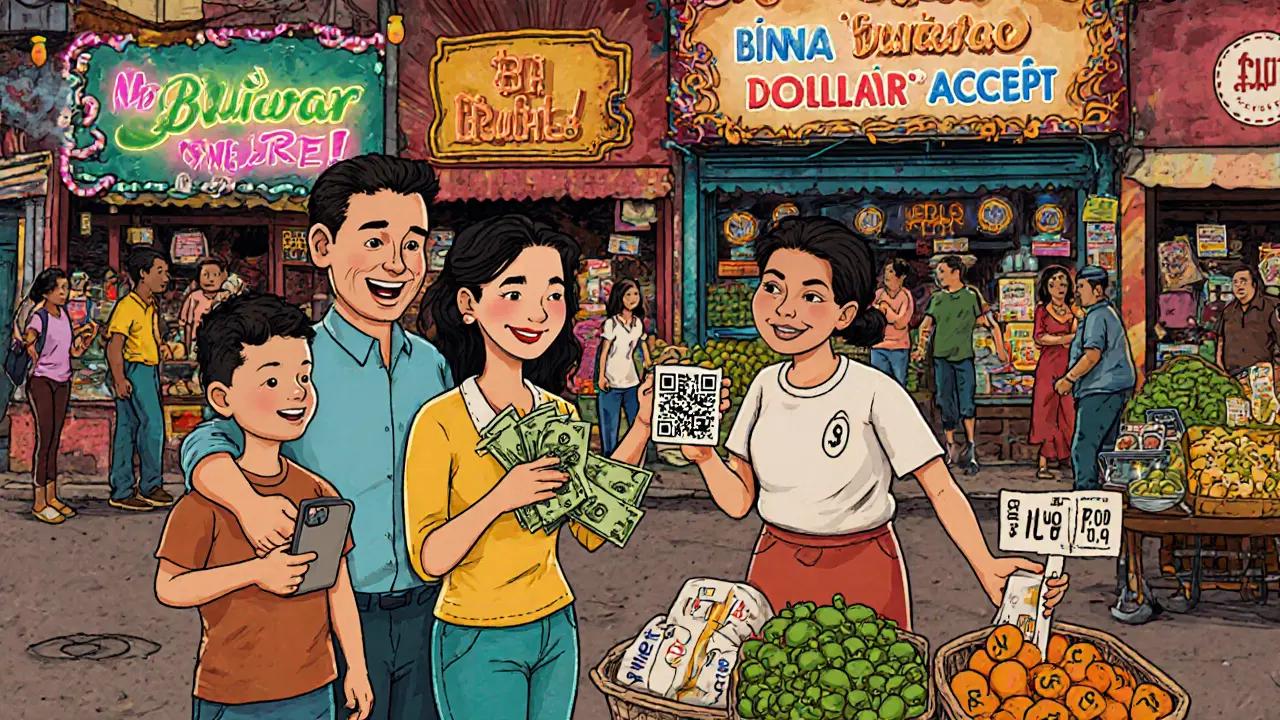

Forget buying Bitcoin to get rich. In Venezuela, crypto isn’t about speculation. It’s about survival. People use it to pay rent, buy groceries, send money to family, and even pay for medical care. The most common coin isn’t Bitcoin. It’s USDT-Tether. Why? Because it’s pegged to the U.S. dollar. One USDT = one dollar. No inflation. No surprise devaluation. It holds its value from the moment you buy it to the moment you spend it. You’ll hear Venezuelans call it "Binance Dollars." That’s not slang-it’s fact. Most people buy USDT through Binance, the world’s biggest crypto exchange. Even though it’s based overseas, it’s the most trusted platform in Caracas. Street vendors, taxi drivers, and university cafeterias now list prices in USDT. Receipts show totals in "Binance dollars" because the bolívar is too unstable to use.How Do You Even Start?

You don’t need a bank account. You don’t need paperwork. You just need a smartphone and a Wi-Fi connection. Most Venezuelans use mobile apps-Binance, LocalBitcoins, or Paxful-to buy crypto with cash. They meet strangers in parks or cafes to exchange bolívares for USDT. It’s risky, but safer than trusting the bank. Some use prepaid cards or gift cards as middlemen. Others trade through WhatsApp groups or Telegram channels where neighbors coordinate trades. The learning curve is short. Most people figure out how to send and receive crypto in two to three weeks. You don’t need to understand blockchain. You just need to know how to scan a QR code and enter a password. Security is still a problem-people lose keys, fall for scams, or get robbed. But the risk of holding bolívares is worse.Who’s Using It? Everyone

It’s not just tech-savvy youth. Grandparents use it. Street vendors use it. Doctors use it. Even public schools in Caracas accept crypto payments for school supplies. A 2025 report showed $119 million in crypto transactions in Venezuela just for July. That’s not a drop in the ocean-it’s a flood. Remittances from Venezuelans abroad have exploded. In 2023, about 9% of the $5.4 billion sent home came through crypto. Why? Because traditional wire services like Western Union charge too much, take too long, or block transfers entirely. Crypto skips the middlemen. A cousin in Miami sends $100 in USDT. It arrives in minutes. The recipient cashes out at a local exchange point. No forms. No delays. No fees that eat half the money.

The Black Market Is Now a Blockchain

Venezuela has three exchange rates running at once:- The official rate set by the Central Bank (useless)

- The "dólar negro" black market rate (unreliable)

- The USDT peer-to-peer rate (what people actually use)

What Keeps People From Quitting?

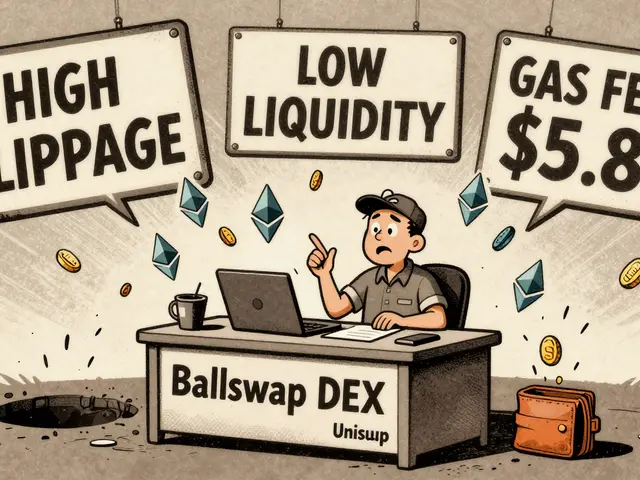

Power outages. Bad internet. Phones that die. These aren’t inconveniences-they’re daily battles. A user might wait 45 minutes for a transaction to confirm because the network is slow. They charge their phone at a neighbor’s house because their own power keeps cutting out. They carry spare batteries. They memorize wallet addresses because they can’t risk losing a link. But they keep going. Why? Because the alternative is worse. If you get paid in bolívares on Monday, by Friday your salary buys half as much. With crypto, your money doesn’t shrink. You know exactly what you have. You can plan. You can save. You can feed your family.

It’s Not Perfect-But It’s the Only Option

There are risks. The government occasionally shuts down crypto exchanges or cracks down on mining. U.S. sanctions make it harder to move money in and out. Stablecoins like USDT are controlled by a company in the U.S.-what if they freeze accounts? What if they stop supporting Venezuela? No one knows. But right now, there’s no backup. Banks are unreliable. The state won’t fix the economy. The world ignores the crisis. Crypto isn’t a cure. It’s a bandage. But it’s the only one that works.The Future? It’s Already Here

This isn’t a trend. It’s a transformation. Venezuela is the first country where crypto became the default currency-not because of policy, but because of collapse. Other nations watch. Brazil is adopting crypto through banks and stock exchanges. Venezuela is doing it in alleyways, on sidewalks, through WhatsApp. Even if the government changes tomorrow, it won’t matter. The trust in the bolívar is gone. People won’t go back. They’ve seen what happens when you rely on a currency that evaporates. They’ve seen what happens when you hold something that doesn’t. Crypto in Venezuela isn’t about technology. It’s about dignity. It’s about being able to buy food without watching your money disappear. It’s about sending money to your mother without losing half to fees. It’s about having control over your own life when the system has failed you. And that’s why, despite everything, Venezuelans keep using it. Not because they love crypto. But because they have no other choice.Why do Venezuelans use USDT instead of Bitcoin?

USDT is used because it’s pegged to the U.S. dollar and stays stable. Bitcoin’s price swings too much for daily spending-imagine paying for groceries with a coin that could drop 10% in an hour. USDT gives people a reliable value to price goods, pay rent, or save for the week. Bitcoin is used for larger transfers or savings, but USDT runs the day-to-day economy.

Can you buy crypto without a bank account in Venezuela?

Yes. Most Venezuelans buy crypto with cash. They meet sellers in public places-cafes, parks, bus stops-and trade bolívares for USDT. Apps like Binance and LocalBitcoins let you find nearby traders. Some use gift cards or prepaid cards as intermediaries. No bank, no ID, no paperwork needed.

Is crypto legal in Venezuela?

It’s not officially banned, but it’s not officially legal either. The government tolerates crypto use because it keeps the economy running, but it also cracks down on mining and exchanges when it wants to control the flow of dollars. The policy is inconsistent-tolerated in practice, unpredictable in law.

Why did the government’s Petro crypto fail?

The Petro was forced on people by the government, lacked transparency, and wasn’t backed by real value. People didn’t trust it. It was slow, hard to use, and couldn’t be easily exchanged for goods. Meanwhile, USDT was fast, trusted, and widely accepted. The state tried to control crypto. The people chose decentralized, open alternatives.

Do Venezuelans still use bolívares at all?

Sometimes, but only for small, informal transactions or when crypto isn’t available. Most prices are listed in bolívares for show-merchants actually expect payment in USDT. Even the government’s own receipts often show bolívar amounts with a note: "Equivalent to X USDT." The bolívar is a ghost currency now.

How do people protect their crypto from theft or scams?

Most users keep small amounts in mobile wallets for daily spending and store larger sums offline on paper wallets or hardware devices. They avoid sharing private keys. Many learn from community groups or YouTube videos in Spanish. Still, scams are common-people lose money to fake sellers or phishing links. Trust is built through repeated, verified transactions with known contacts.

Comments (16)

Kathleen Bauer

omg this is so real 😭 i had a friend in Caracas last year and she showed me how she pays for her kid’s meds in USDT… i cried. no one talks about this enough.

Carol Rice

THIS IS THE FUTURE!! 🚀 People aren’t waiting for permission-they’re building a new economy with their phones and grit! The bolívar is a ghost, and crypto? It’s the heartbeat of survival. No banks. No bureaucracy. Just trust, QR codes, and sheer willpower. We need to stop calling it ‘crypto’-it’s justice with a wallet.

Nidhi Gaur

my cousin in Mumbai says he’s thinking of trying this-like, what if we just skip the bank system entirely? imagine if we could trade rupees for usdt on whatsapp too. why do we even have banks anymore?

Henry Lu

lol you people act like this is some revolutionary innovation. it’s just black market dollar trading with a blockchain veneer. same thing, just more tech bro buzzwords. also usdt is centralized so it’s literally worse than the bolivar if binance decides to flip a switch

Aayansh Singh

What a pathetic narrative. You’re romanticizing chaos. Crypto isn’t a solution-it’s an adaptation to systemic failure. The real failure is the Venezuelan state, not the dollar. And let’s be honest: USDT is just a proxy for American financial hegemony. You’re not building autonomy-you’re outsourcing your economic sovereignty to a Delaware-based corporation. This isn’t liberation. It’s digital colonialism dressed in crypto bro hype.

Usnish Guha

Everyone is ignoring the real issue here. The fact that people have to use crypto to survive means the entire monetary system is broken. This isn’t innovation. This is desperation. And the fact that you’re celebrating it as some kind of grassroots triumph is morally bankrupt. People should not have to trade cash in parks for digital dollars just to feed their children. This is a humanitarian crisis, not a crypto success story.

Laura Lauwereins

So… the government built a crypto that no one trusts… and the people built their own? Interesting. Reminds me of when my grandma started baking bread because the grocery store ran out of flour. She didn’t call it ‘artisanal resilience’-she just made bread. Maybe we should stop naming movements and just let people live.

garrett goggin

USDT is controlled by Tether, which is secretly owned by the CIA and the Fed. They’re using Venezuela as a testbed to phase out cash globally. The power outages? Deliberate. The internet throttling? To force people into centralized wallets. You think this is freedom? It’s the final stage of the Great Reset. They want you to depend on their digital currency so they can freeze your account if you protest. Wake up.

Jess Zafarris

Wait-so people are using WhatsApp to trade crypto because the government won’t let them use banks… but the government also tolerates it? That’s not inconsistent-that’s just how authoritarian regimes work. They don’t ban things they can’t control. They just watch. And wait. And collect data. This isn’t rebellion. It’s surveillance with a QR code.

Jerrad Kyle

Let me tell you something: this isn’t just about money. It’s about dignity. Imagine being paid in a currency that loses half its value before lunch. Now imagine being able to buy milk for the same amount of crypto tomorrow, next week, next month. That’s not tech. That’s peace of mind. And yes, it’s messy. It’s dangerous. But it’s human. We need to stop talking like this is a startup pitch and start treating it like what it is: a quiet revolution in the alleyways.

Ella Davies

My sister works in a hospital in Medellín. They get medicine shipments paid in USDT from Venezuela. She says the doctors there have become unofficial crypto advisors. They teach patients how to use wallets. One grandmother learned to send money to her granddaughter in Caracas using a photo of a QR code. No phone, no Wi-Fi-just a friend who took it to a cafe. That’s the real tech.

rahul saha

It’s fascinating how the collapse of fiat reveals the true nature of value-something that exists not in state decree but in collective belief. The bolívar was a fiction; USDT is a shared hallucination. But here’s the paradox: the more people believe in it, the more real it becomes. Nietzsche would weep. Or laugh. Probably both.

Usama Ahmad

my uncle in Delhi does this too-he trades cash for usdt at a tea stall. no app, just a guy with a phone and a smile. he says it’s cheaper than hawala. simple. smart. why do we make it so complicated?

Peter Rossiter

people are using crypto because they have no choice. that’s it. no need to turn it into a TED talk. it’s survival. not innovation. stop romanticizing poverty

Marcia Birgen

✨ this is the most beautiful thing I’ve read all year. ✨ People didn’t wait for permission. They didn’t ask for a hero. They just… did it. With phones. With trust. With love. This isn’t crypto. This is humanity refusing to give up. We should all be so brave.

Gaurang Kulkarni

USDT is centralized so it’s not real crypto and the fact that Venezuelans use it shows they don’t understand blockchain and the whole thing is just a temporary workaround that will collapse when the US cracks down on Tether and the entire system will implode because no one has actually thought about the long term implications of relying on a corporate stablecoin backed by nothing but promises and offshore shell companies and also the power outages mean transactions fail constantly so it’s not even reliable and why are we celebrating this as progress when it’s just a symptom of a failed state