Ever wondered if you could snag a slice of Base’s soon‑to‑be native token? The buzz around a Base token airdrop isn’t just hype - Coinbase’s own Layer 2, Base, has officially said it’s exploring a network token and a possible distribution in 2026. Below you’ll find everything you need to know to stay ahead of the curve, from the timeline and eligibility to the exact on‑chain actions that could earn you a share of the BRW (Base Reward) airdrop.

What is the Base native token?

Base native token is the upcoming utility token that will power the Base Layer 2 ecosystem, aligning incentives for developers, users, and the broader Coinbase community. While the token is still in the exploration phase, the announcement at BaseCamp 2025 confirmed that Base is moving from a product‑first approach to one that includes token‑based incentives.

Why the excitement?

Base already ranks as the second‑largest Ethereum L2 by transaction volume and total value locked (TVL). With more than $5 billion locked and over 300 million monthly transactions, the network’s scale suggests any future token could carry substantial utility and market value. The backing of Coinbase - the world’s largest publicly traded crypto exchange - adds credibility and a built‑in user base of over 100 million.

Official timeline (as of October 2025)

- Q4 2025: Community feedback collection and token design iterations.

- Q1 2026: Finalization of tokenomics, governance model, and distribution parameters.

- Q2 2026: Potential airdrop rollout to qualified participants.

The exact dates may shift, but the roadmap gives a clear window for anyone wanting to qualify.

How will the airdrop be allocated?

Base has hinted that the distribution will focus on “active ecosystem participants.” In practice, that usually means rewarding users who:

- Execute on‑chain transactions on Base.

- Provide liquidity to Base‑based DeFi protocols.

- Interact with native dApps (e.g., NFT marketplaces, gaming, or social platforms).

- Stake or bridge assets using Base’s integrated bridges.

- Contribute to open‑source projects or community governance.

Each activity will likely be assigned a weighting factor - the more diversified and sustained your involvement, the larger your potential slice.

Top qualification strategies

Below are the most efficient ways to boost your odds, based on patterns observed in previous L2 airdrops like Arbitrum’s.

- Swap & trade on Base‑native DEXs. Even small swaps generate on‑chain history that can be counted.

- Provide liquidity. Deposit assets into pools on platforms like BaseSwap or Base Finance. Longer‑term LP positions usually score higher.

- Bridge assets. Move tokens from Ethereum to Base (or vice‑versa) using the native bridge. Each bridge transaction adds a data point.

- Use NFTs. Mint, buy, or trade NFTs on Base‑hosted marketplaces; activity there is often rewarded.

- Participate in governance. Vote on early token‑design proposals or community polls - if Base implements a DAO, early voters tend to receive airdrop bonuses.

Tools to track your on‑chain activity

Keeping tabs on your qualification metrics can be tedious. These tools simplify the process:

- Base Explorer (official). Shows all transactions, bridges, and contract interactions tied to your address.

- DeBank. Aggregates DeFi activities across Base, including LP positions, yield farms, and loan history.

- Zapper. Visual dashboard for liquidity provisioning, NFT holdings, and token swaps.

- Nansen. Advanced analytics that can spot “airdrop‑ready” wallets based on activity patterns.

Common pitfalls to avoid

Even if you’re eager, there are a few traps that can nullify your eligibility:

- One‑off spamming. Random, high‑frequency transactions without real usage can be filtered out as noise.

- Using centralized bridges only. Base emphasizes on‑chain bridges; off‑chain swaps may not be counted.

- Short‑term LP farming. Providing liquidity for a day or two and pulling out quickly often yields minimal or zero reward.

- Neglecting address hygiene. Using multiple addresses without clear intent can appear as Sybil behavior.

Comparison: Base vs. Arbitrum airdrop

| Metric | Base (2026 - planned) | Arbitrum (2023) |

|---|---|---|

| Total TVL at announcement | $5 B | $3.2 B |

| Primary eligibility actions | Swap, liquidity, bridge, NFT, governance | Swap, bridge, staking |

| Estimated airdrop size | Undisclosed (potentially > $200 M market cap) | ~ $150 M |

| Backer | Coinbase (publicly listed) | Off‑chain investors, no exchange backing |

While exact numbers for Base remain speculative, the comparison highlights why many view the upcoming airdrop as a potentially bigger opportunity.

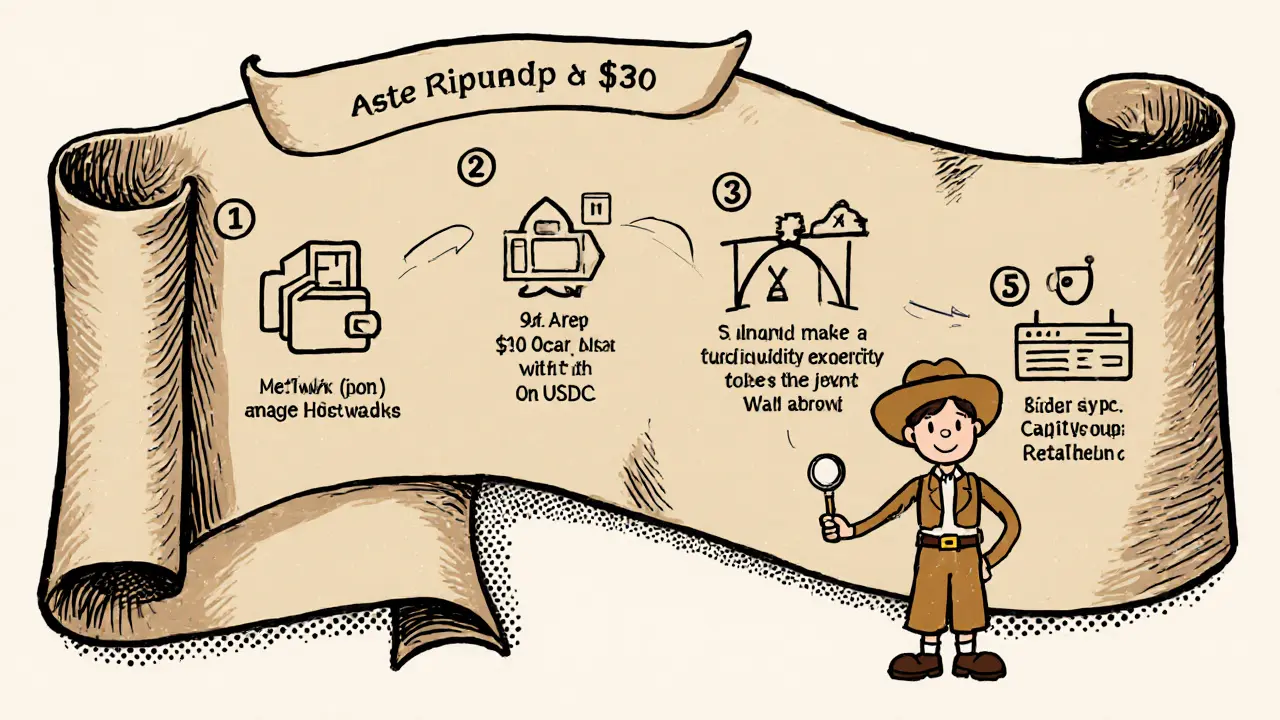

Next steps - get started today

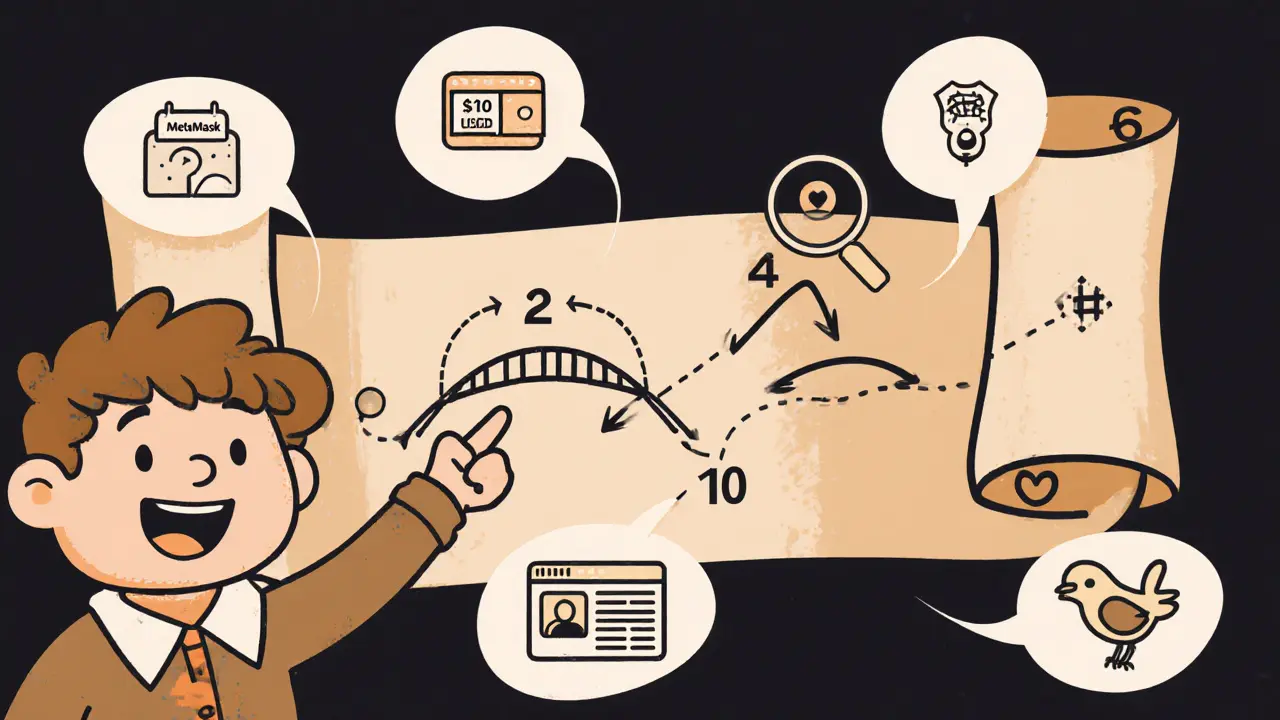

- Connect a wallet (e.g., MetaMask) to the Base network.

- Make a modest swap on a Base‑native DEX - even $10 worth of USDC counts as activity.

- Provide liquidity to a stable‑coin pool for at least one week.

- Bridge a token from Ethereum to Base and back once.

- Visit the official Base Explorer weekly to verify that your transactions are visible.

- Follow Base’s official channels (Twitter, Discord, BaseCamp blog) for updates on token design and eligibility criteria.

By ticking these boxes now, you’ll be well‑positioned when the airdrop window finally opens.

When is the Base token airdrop expected?

Base has outlined a Q2 2026 timeframe for a possible airdrop, but the exact date will be announced closer to the rollout after tokenomics are finalized.

Do I need to hold any specific token to qualify?

No. Qualification is based on on‑chain activity such as swaps, liquidity provision, bridging, NFT usage, and governance participation - not on holding a pre‑existing token.

Will my activity on other L2s (e.g., Arbitrum) count?

Only activity recorded on the Base network will be considered. Cross‑chain bridges that move assets onto Base do count, but actions solely on other L2s won’t.

How can I track my eligibility score?

Use the official Base Explorer or third‑party dashboards like DeBank and Zapper. They aggregate your swaps, LP positions, bridges, and NFT interactions in one view.

What are the biggest mistakes to avoid?

Don’t spam the network with one‑off transactions, avoid short‑term liquidity farming, and make sure you use on‑chain bridges. Also, keep your wallet address clean to prevent Sybil‑filtering.

Comments (18)

Aniket Sable

Yo fam, the Base airdrop looks like a sweet chance to get in early. If you start swapping a little on the native DEX, you’ll already have a trace on‑chain. Adding some liquidity to a stable‑coin pool for a week can boost your score without too much hassle. Bridging assets from Ethereum to Base once also counts as a legit move. Keep an eye on the Base Explorer, it’ll show you what’s being recorded. Stay consistent and you’ll be set when the reward drops.

Santosh harnaval

All of the eligibility actions are on‑chain, so a simple swap does the trick. Just track your activity with DeBank or Zapper.

Claymore girl Claymoreanime

One must appreciate that the tokenomics of a nascent network are not mere happenstance. The allocation framework appears meticulously crafted, privileging sustained engagement over fleeting speculation. Arbitrary one‑off transactions are dismissed as noise, a sentiment echoed by the architects of prior L2 distributions. Consequently, participants should orchestrate a diversified portfolio of swaps, liquidity provision, and governance votes. Only through such disciplined involvement will the meritocratic ethos of Base be honored.

Will Atkinson

Absolutely love the enthusiasm here! 🎉 Maintaining a steady flow of modest swaps can really set you apart; consistency is key. Diversify with LP positions-those long‑term stakes often reward you handsomely. And don’t forget to bridge assets; each bridge transaction is a golden data point. Keep checking the explorer; it’s your personal dashboard of progress!

Elizabeth Mitchell

The roadmap clearly outlines the Q2 2026 window for the airdrop. It’s wise to start small and build up activity over time. Watching the official channels will keep you informed of any shifts.

Chris Houser

To maximize your eligibility, think of each action as a signal to the protocol’s incentive engine. Swaps generate transaction volume, while liquidity provision illustrates capital commitment. Bridging demonstrates cross‑chain interoperability, a critical metric for Base. Engaging with NFTs showcases on‑chain asset interaction, another weighted factor. Consistently logging these activities in DeBank will give you a clear picture of your standing.

William Burns

Your observations lack substantive depth.

Ashley Cecil

The ethical implications of chasing airdrops cannot be overlooked. Participants should prioritize genuine network use over mere token hunting. Such integrity sustains the ecosystem’s long‑term health.

John E Owren

Remember, sustainable liquidity provision yields better outcomes than fleeting farms. Keep your assets in pools for at least a week to demonstrate commitment. This approach aligns with the network’s preference for long‑term participants. Patience truly pays off in these scenarios.

Joseph Eckelkamp

Oh, the sheer brilliance of assuming a token will magically appear just because you tossed a few trades into the ether!; Yet, the reality is far more nuanced, demanding consistent, diversified activity across the ecosystem. One‑off spikes are filtered out-as if the protocol has a built‑in sense of taste. Perhaps it’s time to treat your on‑chain actions like a disciplined portfolio, not a gambling spree. In the end, only a thoughtful strategy will earn you that coveted airdrop.

adam pop

Some say the airdrop is just a PR stunt to boost Base’s image. I suspect there’s a deeper agenda, perhaps data collection under the guise of incentives. Keep your transactions minimal until the true motives are revealed. Trust but verify every announcement.

Dimitri Breiner

Take action now-start swapping, add liquidity, and bridge assets. Document each step in a tracker to avoid missing points. Assertiveness shows the network you’re serious about participation.

angela sastre

Hey everyone! If you want a quick snapshot of your eligibility, fire up DeBank-its dashboard is super intuitive. You can see swaps, LP positions, and bridges all in one place. It’s also handy for watching the latest Base updates. Share your progress with the community; we learn more together!

Jennifer Rosada

The proliferation of speculative airdrop chasers threatens the virtue of genuine ecosystem development. It is imperative to critique such behavior with rigorous analysis. Maintaining a morally sound approach safeguards the network’s future.

Brody Dixon

Quietly building a consistent activity pattern often yields the best results. Focus on steady swaps and long‑term liquidity rather than flashy moves. Your understated presence can still be rewarded by the protocol.

Mike Kimberly

Embarking upon the journey to qualify for the anticipated Base token airdrop necessitates a methodical and comprehensive approach. First, one should acquire a reliable wallet-MetaMask or any compatible hardware wallet-and ensure it is correctly configured for the Base network, complete with the appropriate RPC endpoints. Upon successful connection, initiate a modest trade on a Base‑native decentralized exchange; even a trade of ten dollars in USDC serves as a verifiable on‑chain event. Following this, allocate a portion of your assets to a stable‑coin liquidity pool, preferably one with a proven track record of low impermanent loss, and retain the position for a minimum duration of seven days to manifest sustained commitment. Simultaneously, engage with the bridge infrastructure by transferring a token from Ethereum to Base and back, thereby demonstrating cross‑chain interoperability. Moreover, explore the burgeoning NFT marketplaces on Base by minting or acquiring a modest non‑fungible token, ensuring that the transaction is recorded on the ledger. Participation in any governance proposals, even through a simple vote, adds another dimension to your activity profile. It is advisable to regularly monitor your aggregated metrics via DeBank, Zapper, or the official Base Explorer, noting any discrepancies or omitted interactions. Document each action in a personal spreadsheet, categorizing them by type, timestamp, and associated contract address for future reference. Consistency remains paramount; sporadic bursts of activity are likely to be dismissed as noise by the token distribution algorithms. Additionally, maintain a clean address reputation by avoiding the creation of multiple wallets without clear purpose, as this may trigger Sybil detection mechanisms. Keep abreast of official communications from Base, as adjustments to eligibility criteria may be announced at any moment. Patience, discipline, and a diversified on‑chain footprint collectively enhance the probability of inclusion in the forthcoming airdrop. In summary, a balanced portfolio of swaps, liquidity provision, bridging, NFT interaction, and governance participation-meticulously recorded and consistently executed-constitutes the optimal strategy for prospective participants.

Patrick Rocillo

Yo, that strategy looks fire! 🚀 Keep those swaps rolling and the airdrop will be yours soon! 😎

Prabhleen Bhatti

Let’s break this down step by step; first, secure your wallet and connect it to the Base network-this is the foundation of any successful endeavor. Next, conduct a small swap on a DEX; even a modest trade signals genuine usage to the protocol. Then, allocate liquidity to a reputable pool and let it sit for at least one week-duration matters! Also, bridge an asset at least once; each bridge transaction adds a valuable data point to your profile. Don’t forget to explore the NFT space-minting or purchasing a token showcases diverse activity. Finally, regularly audit your progress on DeBank or the Base Explorer; staying informed will keep you ahead of any eligibility changes. Consistency, diversification, and patience are your best allies in this quest.