Using cryptocurrency to bypass government sanctions isn’t a clever hack-it’s a high-stakes gamble with prison time, massive fines, and global blacklisting as the possible outcomes. Since Russia’s invasion of Ukraine in 2022, Western nations have poured billions into tracking crypto transactions tied to sanctioned entities. The result? A regulatory net so tight that even the most technically savvy users are getting caught. This isn’t science fiction. It’s happening right now, in real courtrooms and regulatory hearings.

Why Crypto Isn’t Anonymous-And Why That Matters

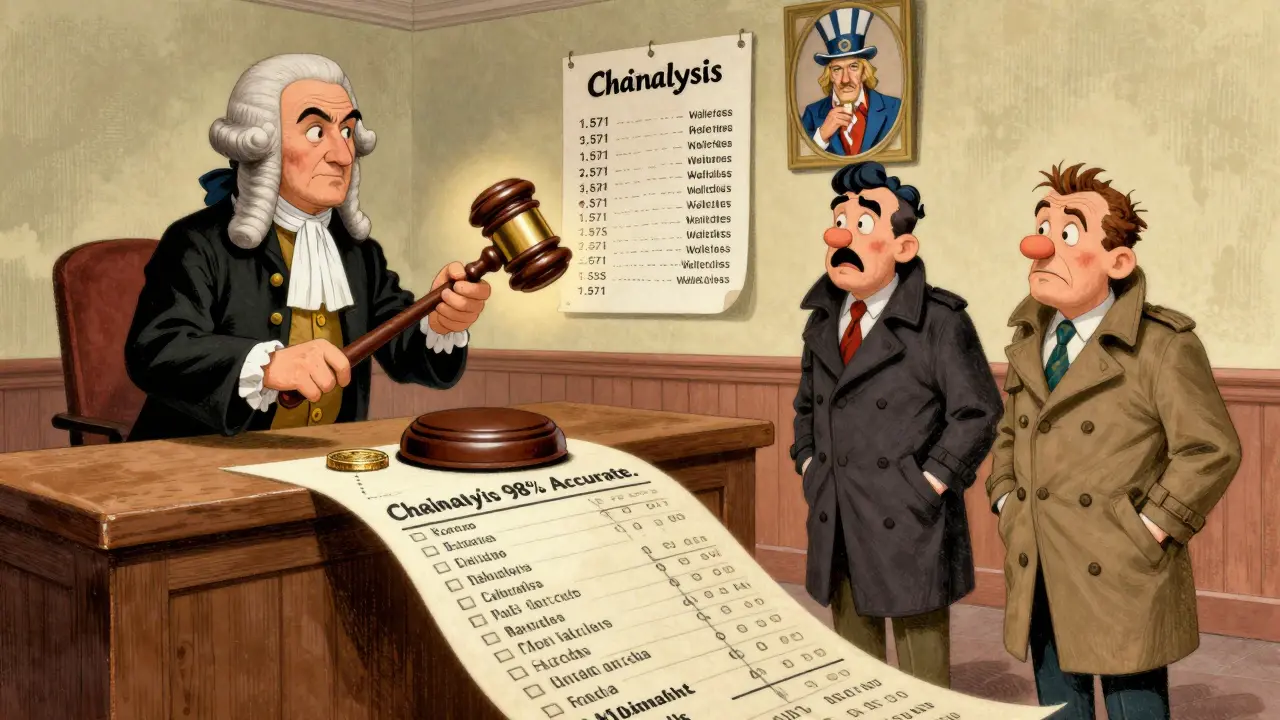

Many people think Bitcoin and Ethereum are anonymous. They’re not. Every transaction is permanently recorded on a public ledger. If you send crypto from a wallet linked to your real identity, regulators can trace every step. Even if you use a new wallet, blockchain analytics firms like Chainalysis and Elliptic can link it to your past activity through patterns, timing, and transaction amounts. As of 2023, these tools can trace 98% of Bitcoin and Ethereum transactions. That number was only 87% in 2021. The gap is closing fast.Privacy coins like Monero (XMR) are the exception, with only 65% traceability. But they’re not the solution most sanctions evaders use. Why? Because major exchanges-like Coinbase and Binance-don’t list them. If you want to convert Monero into fiat currency, you’re stuck using unregulated platforms, which are easy targets for law enforcement. And once you move money through those platforms, you’re leaving a trail that’s harder to erase than cash buried in the ground.

What Happens When You Get Caught

In November 2023, the U.S. Department of Justice charged two Russian nationals with trying to evade $1.3 billion in sanctions using cryptocurrency. That was the first criminal prosecution in U.S. history specifically for crypto-based sanctions evasion. They didn’t just lose money-they faced federal charges that could lead to decades in prison.It’s not just about jail. The U.S. Treasury’s Office of Foreign Assets Control (OFAC) can freeze your assets without a court order. If you hold crypto in a wallet flagged as linked to a sanctioned entity, that wallet is blocked. No withdrawals. No transfers. No exceptions. As of December 2023, OFAC’s list included 1,571 crypto wallet addresses tied to sanctioned individuals and organizations. If your wallet matches one of those, your funds are gone-no appeal, no notice.

Even if you think you’re clever, exchanges are required by law to report suspicious activity. Coinbase froze 25,000 Russian accounts totaling $225 million within 48 hours of the Ukraine invasion. Binance required proof of address for Russian users holding over €10,000. These weren’t voluntary moves-they were legal mandates. Ignoring them means losing your account, your funds, and your access to the entire crypto ecosystem.

The Legal Framework: It’s Global, Not Just U.S.

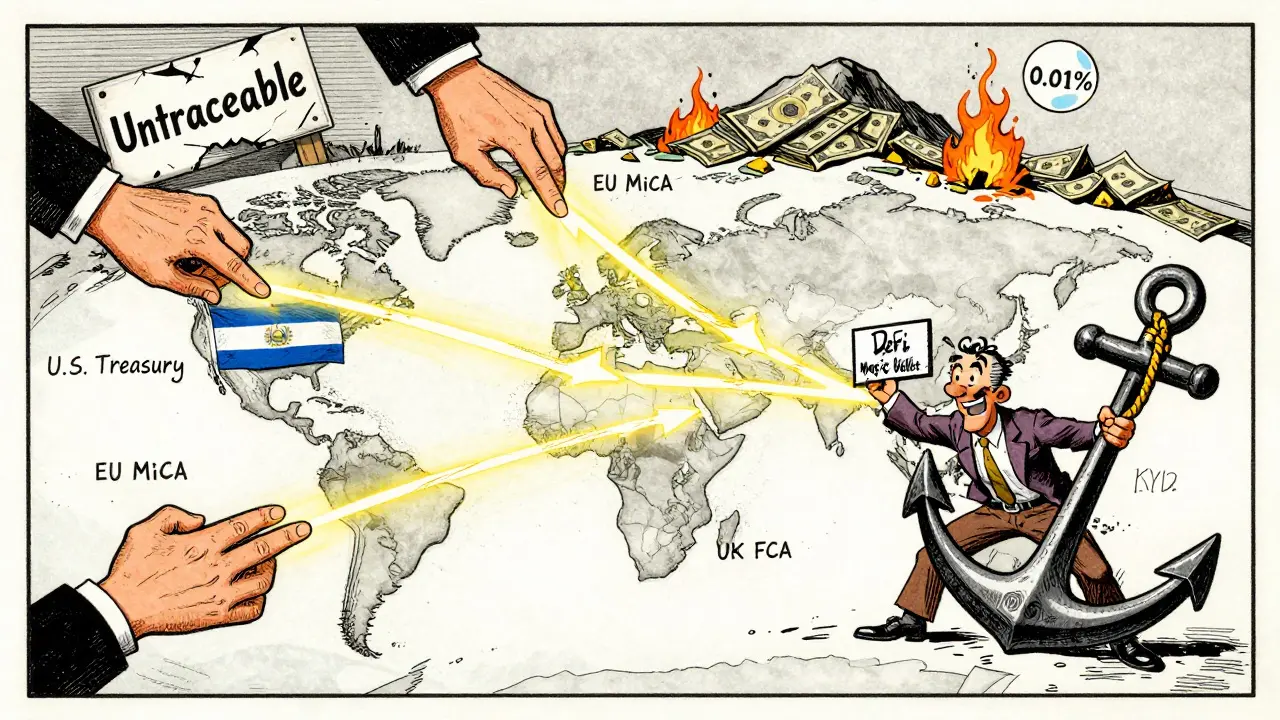

The U.S. isn’t acting alone. The European Union’s Markets in Crypto-Assets Regulation (MiCA), which took effect in June 2024, requires all crypto service providers to screen transactions against sanctions lists. This includes exchanges, wallet providers, and even decentralized finance (DeFi) platforms that operate in EU markets. Failure to comply means losing the right to operate in one of the world’s largest economies.The UK’s Financial Conduct Authority (FCA) and the Bank of England issued a joint statement in March 2022: “All UK financial services firms, including the cryptoasset sector, are expected to play their part in ensuring that sanctions are complied with.” That means if you’re a UK resident using crypto to move money for a sanctioned entity, you’re breaking the law-even if the transaction happens on a foreign exchange.

Even countries with looser rules aren’t safe havens. El Salvador and the Cayman Islands may have fewer restrictions, but if you send crypto from there to a U.S. bank or exchange, U.S. regulators can still pursue you. Jurisdiction doesn’t end at borders-it follows the money.

How Regulators Find You

Regulators don’t guess. They use tools built into the blockchain itself. Here’s how they spot evasion:- IP address tracking: If you connect to a crypto exchange from a Russian IP address while your account shows a U.S. address, that’s a red flag.

- Wallet clustering: Analytics firms link multiple wallets to one person by analyzing transaction patterns, timing, and amounts.

- Transaction history: Even if you use a mixer or tumbler, most tools leave traces. Chainalysis reported 99.2% detection rates for transactions involving Russian entities in 2023.

- Exchange cooperation: Major exchanges share data with regulators under legal pressure. In 2023, 87% of the top 50 exchanges implemented enhanced sanctions screening.

One of the biggest mistakes people make? Thinking that using a non-KYC exchange is safer. But the U.S. Government Accountability Office found that 37% of Russian-linked crypto transactions in early 2022 had no identifying information. That didn’t help the users-it made them stand out. Regulators now flag anonymous transactions as high-risk by default.

The Real Cost: More Than Just Money

The financial penalties are severe. Nexo Inc. paid $22.5 million in 2023 to settle charges of offering unregistered securities. Coinbase faced coordinated enforcement actions from nine U.S. states. These aren’t small fines-they’re corporate-level punishments designed to send a message.But the real cost is reputation. Once you’re flagged by OFAC or the EU, you’re blacklisted from the global financial system. Banks won’t open accounts for you. Payment processors will reject your business. Even legitimate crypto projects won’t work with you. You become untouchable.

And it’s not just individuals. Companies that fail to comply face criminal liability. Executives can be personally prosecuted. In 2023, the U.S. Department of Justice’s Cryptocurrency Enforcement Framework made it clear: “Virtual currencies undermine traditional financial markets and harm the interests of the United States and its allies.” That’s not rhetoric-it’s policy.

What About Decentralized Finance (DeFi)?

Some think DeFi protocols are immune to sanctions because they’re decentralized. That’s a dangerous myth. While smart contracts can’t be shut down, the people who interact with them can be. If you use a DeFi app to swap tokens for a sanctioned entity, regulators can trace your wallet. They can freeze your assets on centralized bridges. They can subpoena your identity from KYC-enabled wallets you used before.Proposed legislation like the Digital Asset Sanctions Compliance Act (introduced in September 2023) aims to extend sanctions rules to DeFi protocols. If passed, developers who build tools used for evasion could face criminal charges. The goal isn’t to ban DeFi-it’s to force it into the same regulatory box as banks.

Why the Numbers Don’t Lie

Despite all the hype, crypto plays a tiny role in sanctions evasion. According to the Center for Strategic and International Studies (CSIS), cryptocurrency accounted for only 0.01% of the $148 billion in Russian sanctions evasion attempts as of September 2023. The real methods? Commodity trading (42%), third-country intermediaries (38%), and physical cash smuggling (15%).Crypto isn’t the weapon of choice-it’s the weakest link. It’s fast, but traceable. It’s global, but regulated. It’s decentralized, but monitored. The more you try to use it to hide, the more you expose yourself.

What Should You Do?

If you’re not trying to evade sanctions, nothing changes. Crypto works fine under the rules. But if you’re considering bypassing restrictions, ask yourself this: Is the risk worth it?Regulators have spent billions building tools to catch you. Exchanges are legally required to report you. The blockchain doesn’t forget. And the penalties aren’t just financial-they’re personal, professional, and permanent.

There’s no secret backdoor. No untraceable path. No magic wallet. The system is designed to catch you. And it’s getting better every day.

Comments (13)

Bruce Morrison

Bitcoin’s public ledger isn’t a loophole-it’s a digital fingerprint. Every transaction you make leaves a trail, and regulators aren’t guessing anymore. They’ve got the tools, the data, and the legal backing to follow it straight to your door.

There’s no magic trick. No anonymous wallet that won’t get flagged. If you’re thinking of using crypto to bypass sanctions, you’re not being clever-you’re just making it easier for them to find you.

Andrew Prince

It is, in fact, a profound misapprehension to believe that blockchain technology offers any semblance of anonymity whatsoever; the very architecture of distributed ledger systems is predicated upon transparency, not obscurity. The notion that one can evade sovereign financial controls through cryptographic means is not merely naive-it is an egregious intellectual failure, particularly in light of the fact that Chainalysis, Elliptic, and other proprietary analytics platforms have achieved near-perfect transactional attribution rates since 2023. Moreover, the presumption that privacy coins like Monero constitute a viable alternative is demonstrably false, given that the overwhelming majority of regulated exchanges refuse to list them, thereby forcing users into unregulated, high-risk, and easily surveilled channels. The U.S. Department of Justice’s prosecution of Russian nationals for crypto-based sanctions evasion is not an anomaly-it is the logical culmination of a global regulatory convergence that has rendered decentralized finance an oxymoron in the context of sanctioned activity.

Jordan Fowles

It’s funny how people think the system is out to get them when it’s really just built to not let them get away with it.

Blockchain doesn’t care who you are. It just records. And now, the people who built the tools to track it? They’re not hackers-they’re accountants with subpoenas.

Most folks don’t realize the real cost isn’t the fine or the jail time. It’s becoming invisible. Once you’re on OFAC’s list, no bank, no exchange, no business will touch you. Not because they’re evil-because they’re scared. And that’s the quietest punishment of all.

Steve Williams

While the article presents a compelling legal perspective, it is imperative to acknowledge that the global financial architecture remains deeply asymmetric. The same regulatory mechanisms deployed against sanctioned entities are rarely applied with equal rigor to institutions in Western jurisdictions that facilitate opaque capital flows through shell companies and offshore trusts.

That said, the technical reality of blockchain traceability cannot be denied. For individuals in developing economies who rely on crypto for remittances or economic survival, the line between evasion and necessity is not always clear. The system may be technically sound, but its moral authority requires deeper scrutiny.

nayan keshari

Bro this whole thing is just corporate fearmongering. Crypto is supposed to be free money. If the government wants to control everything then why not just ban cash too? They already track your credit cards, your phone, your Netflix history. What’s one more ledger?

And yeah maybe you get caught. So what? Half the people on this planet are already blacklisted by someone. You think the system cares about you? It doesn’t. It just wants you to pay taxes and shut up.

Johnny Delirious

Let me be absolutely clear: this is not a debate. It is a warning. The era of financial anonymity is over. The tools are here. The laws are in place. The prosecutions are real.

If you’re still clinging to the fantasy that crypto is a loophole, you’re not just risking your money-you’re risking your freedom. And that’s not hyperbole. That’s the docket.

Don’t be the next headline. Do the right thing. Stay compliant. Stay free.

Kenneth Mclaren

They’re lying. All of it. Chainalysis? Owned by the CIA. Binance? A front for the NSA. The ‘public ledger’? A honeypot. They want you to think you’re being watched so you don’t even try to move money. But here’s the truth: they don’t track 98% of transactions-they track 98% of the people who *believe* they’re being tracked.

And the real targets? The ones who never touch crypto. The ones who use Swiss banks and art auctions. But you? You’re the distraction. They need you to panic so they can keep the system locked down for the rest of us.

They’re not catching criminals. They’re catching the gullible.

Prateek Chitransh

Let’s be honest-most people trying to use crypto to evade sanctions aren’t spies or oligarchs. They’re just regular folks in countries with broken banking systems, trying to send money home or pay for medicine. The system treats them like criminals because it’s easier than fixing the real problem.

Yes, the tech is traceable. Yes, the laws are strict. But if you’re going to criminalize survival, you better be ready to explain why your bank account is safe while theirs isn’t.

It’s not about blockchain. It’s about who gets to be human in this system.

christopher charles

Okay, so here’s the thing-I get it. The system’s rigged. But if you’re thinking of using crypto to dodge sanctions, you’re not a hacker-you’re a walking target.

Exchanges don’t mess around. They freeze accounts in minutes. Wallets get flagged. Your whole digital life gets dragged into court. And don’t even think about using a mixer-they all leave breadcrumbs.

And honestly? Even if you *do* pull it off, who wants to live like that? Always looking over your shoulder? No thanks. I’d rather just pay my taxes and sleep at night.

Just sayin’.

dayna prest

Oh sweet mother of all things decentralized, this is the most boringly accurate thing I’ve read all week. You know what’s more illegal than crypto sanctions evasion? Paying $20 for a coffee with a credit card that’s been flagged by a 12-year-old algorithm in a server farm in Ohio.

At least with crypto, you can see the trail. With your Visa? You’re just a data point in a Kafkaesque nightmare.

So yeah, maybe the system’s catching people. But it’s also catching *everyone*. And we’re all just pretending it’s only them.

Abhisekh Chakraborty

Why are you all acting like this is some new thing? I’ve been using crypto since 2017. I’ve seen this movie. The banks panic. The government panics. Then they make a law. Then they arrest someone. Then everyone forgets.

Meanwhile, I’m still buying my weed with Dogecoin and nobody’s come knocking.

It’s all theater. You’re scared because you’ve never done anything real.

Wake up.

Gavin Hill

The blockchain doesn’t lie but people do. They say it’s traceable. Fine. But traceable to what? A wallet. Not a person. Not a name. Not a location. The real power isn’t in the tech-it’s in the stories they tell about it.

They call it evasion. I call it survival.

They call it crime. I call it capitalism with a broken heart.

Don’t mistake the map for the territory.

SUMIT RAI

Bro the whole point of crypto is to be free from this crap 😤💸

They want to control everything? Cool. Then I’ll just use something they can’t touch. 🤷♂️

And if they come for me? Let them try. I got 10 wallets. One of them will survive. 🚀

Free money > your rules. 🇮🇳