Subnet Token Trading: What It Is, Why It Matters, and What You Need to Know

When you trade a subnet token, a cryptocurrency token that operates on a dedicated blockchain segment separate from the main chain. Also known as layer-2 token, it enables faster, cheaper transactions by offloading activity from congested networks like Ethereum or Solana. Subnet token trading isn’t just another buzzword—it’s how many new DeFi projects survive. Without a dedicated subnet, tokens drown in high fees and slow confirmations. But here’s the catch: most subnet tokens have tiny trading volumes, weak liquidity, and zero real-world use. If you’re trading them, you’re betting on adoption that hasn’t happened yet.

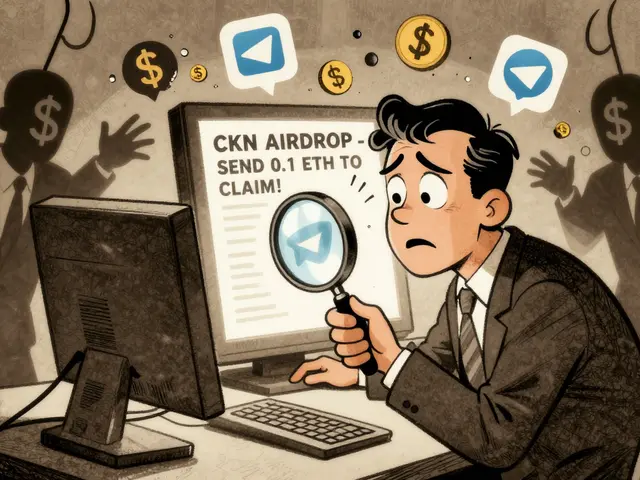

Subnet token trading relies on three things: a working subnet, a token with actual demand, and a decentralized exchange that supports it. Many projects skip the first two and just launch a token on a subnet that doesn’t exist. You’ll see names like BSC AMP, a token tied to a Binance Smart Chain subnet with no trading activity and nearly all tokens locked, or SCIX, a project claiming an airdrop but with no app, no volume, and no team. These aren’t failures—they’re red flags. Real subnet trading happens when users actually swap tokens, not just speculate on a whitepaper. Look for tokens with consistent volume on DEXs like Uniswap v3 on Blast or LeetSwap, even if those platforms themselves are risky.

Why does this matter now? Because every major blockchain is pushing subnets. Ethereum has rollups. Solana has sidechains. Avalanche has subnets. But most of these subnets don’t have active users. The ones that do—like those supporting real DeFi apps or gaming economies—have token trading that actually moves. The rest? They’re ghost towns with fake liquidity. If you’re trading subnet tokens, you’re not just buying a coin—you’re betting on whether the subnet will ever get users. And that’s a gamble most retail traders don’t understand.

What you’ll find below are real cases: tokens that vanished after airdrops, exchanges that collapsed, subnets that never launched, and a few that actually worked. No fluff. No hype. Just what happened, why it happened, and what you should avoid next time. If you’re trading subnet tokens, you need to know the difference between a working network and a ghost project. This collection shows you exactly how to tell.

Subnet Tokens isn't a crypto exchange - it's a misleading label for Bittensor's subnet tokens. Learn how to trade them safely, avoid scams, and understand the real staking mechanics behind this high-risk AI crypto ecosystem.

Continue reading