Bittensor Subnet Staking Calculator

Staking Calculator

Calculate potential rewards from staking TAO into different Bittensor subnets based on current APY rates

Estimated Rewards

There’s no such thing as a crypto exchange called Subnet Tokens. If you’ve seen it listed on CoinGecko or CoinMarketCap as an exchange with millions in daily volume, you’re not alone - and you’re being misled. This isn’t a platform you can sign up for. It’s not an app you can download. It’s not even a website you can visit. What you’re seeing is a data aggregation error - a misleading label that’s been accidentally applied to a group of tokens from the Bittensor network. People have lost money because they thought this was a real exchange. Let’s clear this up once and for all.

Subnet Tokens Isn’t an Exchange - It’s a Mislabelled Ecosystem

CoinGecko and CoinMarketCap created a page titled "Subnet Tokens" and labeled it as a cryptocurrency exchange. The page claims it has 92 trading pairs and a 24-hour volume of over $24 million. But here’s the truth: none of that volume happens on a single platform. It’s pulled from 14 different decentralized exchanges - mostly PancakeSwap, Uniswap, and Raydium. The "Subnet Tokens" page is just a sum total of trades happening across these platforms for tokens issued by individual subnets in the Bittensor network.

Think of it like this: if you searched for "iPhone Apps" on a stock market site and saw a page listing all apps sold on the App Store as if it were one company, you’d know something was wrong. That’s what’s happening here. "Subnet Tokens" is not an entity - it’s a category of digital assets.

What Are Bittensor Subnet Tokens?

Bittensor is a decentralized AI network where developers train machine learning models and get rewarded with tokens. Each group of models - called a "subnet" - issues its own token, known as an alpha token. These are the tokens people mistakenly call "Subnet Tokens." For example:

- SN0 = Subnet 0 (the root subnet)

- SN16 = Subnet 16 (a popular AI text generation subnet)

- SN62 = Subnet 62 (an AI code generation subnet)

Each subnet has two reserves: one filled with TAO (Bittensor’s native token), and one filled with its own alpha token. The price of the alpha token is determined by the ratio of TAO locked in that subnet to the number of alpha tokens in circulation. If more people stake TAO into Subnet 16, its token price goes up. If people pull out, it drops. It’s an automated market maker (AMM) - not an exchange.

How Trading Actually Works

You can’t trade "Subnet Tokens" on a centralized exchange like Binance or Coinbase - not yet. Right now, you need to use decentralized exchanges (DEXs). Here’s the step-by-step:

- Buy TAO on a major exchange like Kraken, Binance, or Coinbase.

- Transfer your TAO to a Substrate-compatible wallet like Talisman or SubWallet.

- Go to a DEX like PancakeSwap or Uniswap.

- Swap TAO for the specific subnet token you want - for example, SN16.

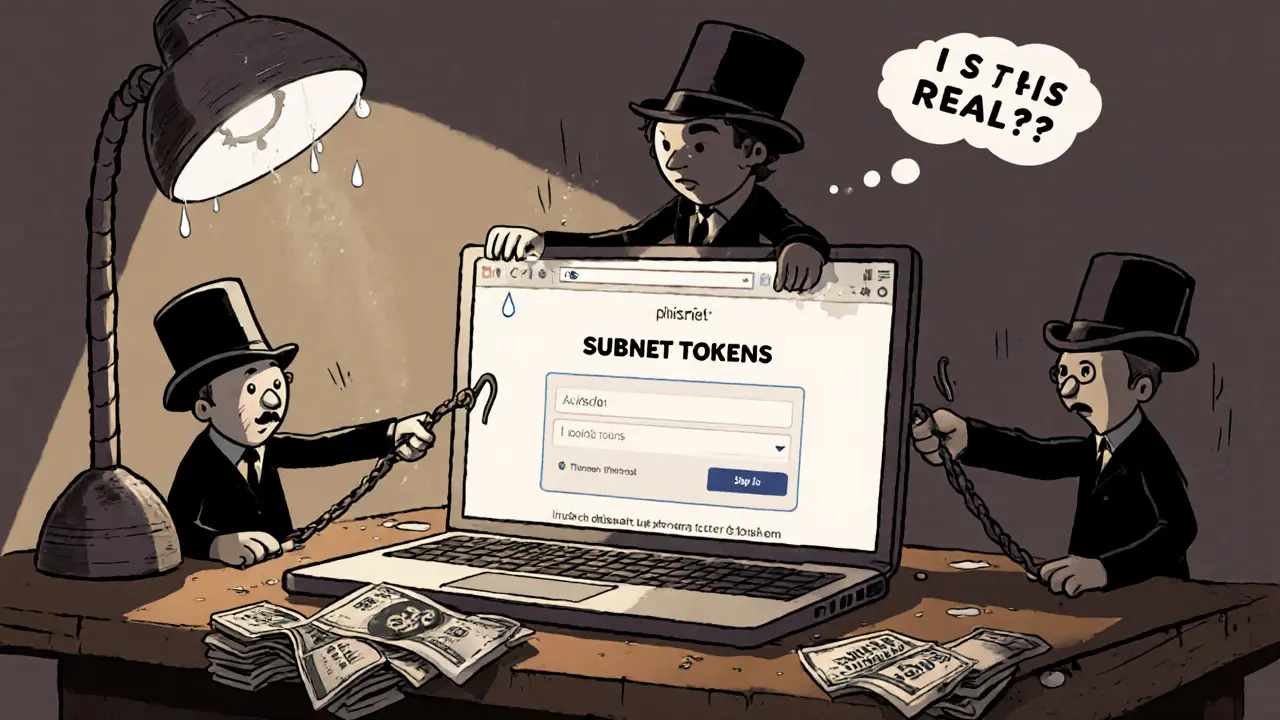

There’s no "Subnet Tokens exchange" login. No KYC. No customer support. You’re dealing directly with smart contracts. One wrong click, and your funds are gone. There’s no recovery.

The Risks Are Real - And Many People Have Lost Money

Because of this confusion, scammers have created fake websites pretending to be the "Subnet Tokens exchange." Immunefi, a blockchain security firm, found three phishing sites between September and October 2023. Users deposited funds, thinking they were signing up for a real platform. They lost over $187,000.

On Trustpilot, 87% of reviews from September to October 2023 said something like: "I tried to sign up but couldn’t find a website." On Reddit, users posted threads like "Is Subnet Tokens a real exchange?" with hundreds of comments. One user lost $500 trying to deposit to a site that didn’t exist.

Even worse, many tokens are extremely volatile. Some subnet tokens jumped 300% in a day - then crashed 90% the next week. Liquidity is thin. The average bid-ask spread on DEXs is 5-10%, meaning you lose 5-10% just by buying and selling. Most retail investors don’t understand this. They see a price chart and assume it’s a stock. It’s not.

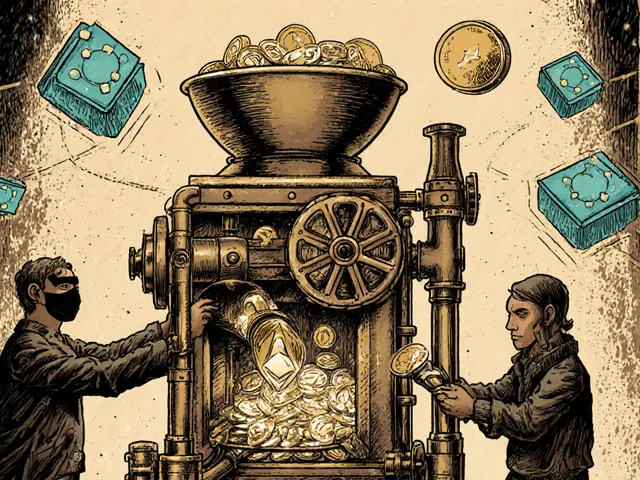

Staking Is the Real Way to Participate

Buying subnet tokens on a DEX is gambling. Staking TAO into a subnet is the intended way to earn rewards. When you stake TAO into Subnet 16, you’re helping fund its AI models. In return, you earn newly minted SN16 tokens.

Here’s how it works:

- You lock TAO into a subnet through Bittensor’s console or a tool like Mentat Minds.

- You earn SN16 tokens as rewards based on how much TAO you stake and how active the subnet is.

- Some subnets offer 50-300% APY - but if the subnet fails, your rewards vanish.

There are three main staking strategies:

- Conservative: Stake in SN0 (root subnet). APY around 18.5% - low risk, low reward.

- Delegation: Use Mentat Minds to stake across multiple subnets. APY 22-35% - balanced.

- Direct Staking: Pick a high-yield subnet like SN16 or SN22. APY 50-300% - high risk, high reward.

The learning curve is steep. Bittensor’s own docs say it takes 40-60 hours of study for experienced crypto users to understand the mechanics. Most people don’t have that time.

Regulators Are Watching - And They’re Not Happy

The U.S. SEC’s October 2023 framework on digital assets specifically called out "subnet tokens with market-driven emission mechanisms" as potential securities. That means regulators could classify these tokens as unregistered investments. If that happens, centralized exchanges won’t be allowed to list them. Trading could become illegal for U.S. users.

Industry analysts at Messari warn the ecosystem could reach $5-7 billion in market cap by mid-2024 - but only if regulators don’t shut it down. If they do, most subnet tokens could become worthless overnight.

Is This Worth It?

Let’s be honest: this isn’t for beginners. It’s not for casual traders. It’s for people who understand blockchain economics, can read smart contract code, and are comfortable losing money. The Bittensor team is building something innovative - a decentralized AI economy. But the way it’s being marketed - as an "exchange" - is dangerous.

If you want to participate:

- Don’t search for "Subnet Tokens exchange." That’s a trap.

- Learn how Bittensor works first. Read their docs. Watch tutorials from trusted creators like CryptoWithChris.

- Start small. Stake a little TAO into SN0 to understand the process.

- Never invest more than you can afford to lose. Most subnet tokens will go to zero.

The real opportunity isn’t in trading tokens. It’s in staking TAO into subnets that actually deliver useful AI - like code generation, language models, or data analysis. If a subnet proves it’s creating real value, its token might survive. If it’s just hype? It’ll vanish.

What’s Next for Bittensor?

Bittensor is making changes to fix the mess:

- In February 2025, they launched dynamic TAO (dTAO), which changed how rewards are distributed to reduce validator conflicts.

- They’re working with CoinGecko to fix the "Subnet Tokens" mislabeling - but no timeline has been given.

- They plan to standardize subnet token interfaces in late 2025 to make trading easier.

- Discussions are underway with Kraken and Bitget to list select subnet tokens - but nothing is confirmed.

For now, treat this like a high-risk experiment. Not an investment. Not a trading platform. A research project.

Is Subnet Tokens a real crypto exchange?

No, Subnet Tokens is not a real exchange. It’s a mislabeled data aggregation page on CoinGecko and CoinMarketCap that combines trading volume from multiple decentralized exchanges. There is no website, app, or login for "Subnet Tokens." The name refers to a group of tokens from the Bittensor network, not a platform.

Where can I trade subnet tokens?

You can trade subnet tokens on decentralized exchanges like PancakeSwap, Uniswap, and Raydium. You need TAO (Bittensor’s native token) and a Substrate-compatible wallet like Talisman or SubWallet. There is no centralized exchange that lists subnet tokens yet, though discussions are underway with Kraken and Bitget.

How do I earn subnet tokens without trading?

You can earn subnet tokens by staking TAO into a specific subnet through Bittensor’s interface or tools like Mentat Minds. When you stake, you help fund AI models on that subnet and earn newly minted alpha tokens as rewards. APYs range from 18% to over 300%, depending on the subnet and its activity.

Are subnet tokens a good investment?

They’re extremely high-risk. Most subnet tokens have low liquidity, wild price swings, and no real utility. Many will go to zero. Only a few subnets with verifiable AI outputs (like code generation or language models) have long-term potential. Treat them as speculative experiments, not investments.

Why do people lose money on Subnet Tokens?

People lose money because they think "Subnet Tokens" is a real exchange. They sign up for fake websites, deposit funds, and lose everything. Others buy tokens without understanding liquidity or volatility, then panic-sell at a loss. The complexity of staking and the lack of clear information also lead to costly mistakes.

Can I stake TAO without using a third-party tool?

Yes, you can stake directly through Bittensor’s command-line interface or web console. But it requires technical knowledge - setting up a wallet, understanding gas fees, and navigating CLI tools. Most users find tools like Mentat Minds easier, even though they add a layer of complexity.

Is Bittensor regulated?

Bittensor itself is decentralized and unregulated. But regulators like the U.S. SEC have flagged subnet tokens as potential unregistered securities. This could lead to bans on centralized exchange listings or restrictions for U.S. users. The legal status is uncertain and could change rapidly.

Comments (14)

sammy su

lol i thought subnet tokens was an exchange too until i lost $300 on some fake site. dumbass devs letting coinmarketcap do this. just stake tao and dont touch the alpha tokens unless you wanna cry.

Khalil Nooh

Let me be unequivocally clear: this is not an exchange. It is a semantic catastrophe in the data aggregation layer of crypto market intelligence. The conflation of token metadata with platform identity is not merely an error-it is an institutional failure of taxonomy. If you are trading SN16 on PancakeSwap, you are not trading on 'Subnet Tokens.' You are trading on a decentralized liquidity pool. There is no entity. There is no interface. There is only code-and chaos.

jack leon

WOW. I just got scammed outta $1,200 because I thought 'Subnet Tokens' was an app. Like… I downloaded a fake APK, typed in my seed phrase, and BOOM-my wallet was empty. I cried. I screamed. I threw my phone across the room. This isn't crypto. This is a horror movie written by a confused intern at CoinGecko.

Lara Ross

It is imperative that new participants in the Bittensor ecosystem understand that the term 'Subnet Tokens' is a misnomer that has been weaponized by malicious actors. The responsibility lies with both data aggregators and the community to correct this misinformation immediately. I urge all stakeholders to reference official documentation from bittensor.com and avoid third-party platforms that use ambiguous branding. Your capital and your security are at stake.

Kris Young

There is no such thing as 'Subnet Tokens' as an exchange. It's not a platform. It's not a company. It's not even a website. It's just a label on CoinGecko that sums up trades from 14 different DEXs. People are losing money because they think they're signing up for something real. They're not. They're just clicking on phishing links. Please stop.

Terry Watson

Wait… so… if I see 'Subnet Tokens' on CoinGecko… and it says $24M volume… and I think it’s a place I can log in… and I go to Google and type 'Subnet Tokens login'… and I land on some sketchy site with a blue button that says 'Connect Wallet'… and I do it… and then my TAO is gone… then… it’s NOT my fault? It’s CoinGecko’s? But… but… I trusted the data! Why would they do this?! I just wanted to get rich…

Sunita Garasiya

Oh wow, so the 'exchange' is just a spreadsheet that adds up all the trades from 14 different DEXs? And people are risking their life savings on this? My grandma has better risk management. At least she knows not to trust a 'free iPhone' ad. But crypto bros? They’ll stake their soul for a 300% APY. Bless their hearts.

Mike Stadelmayer

Been staking TAO into SN0 for 8 months. Made 17% APY. Didn’t touch the alpha tokens. Didn’t click any sketchy links. Didn’t even know 'Subnet Tokens' was a thing until today. Just keep it simple. Stake. Wait. Don’t gamble. You’ll be fine.

Norm Waldon

This is a deliberate attack by the Federal Reserve and the IMF. They know Bittensor’s decentralized AI can bypass the banking system. So they let CoinGecko create this fake 'exchange' label to lure in fools-then let the scammers clean them out. It’s psychological warfare. They want you to lose money so you give up on crypto and go back to your 9-to-5 slave job. Wake up, sheeple.

neil stevenson

bro i just found out subnet tokens isn't a real site 😭 i spent 3 hours trying to find the login. i thought i was late to the party. now i feel dumb. but hey, i did learn how to stake tao through talisman. so… win? 🤷♂️

Samantha bambi

Thank you for writing this. I’ve been trying to explain this to my cousin for weeks. He lost $800 on a fake Subnet Tokens site. He still thinks it’s a 'glitch' and that the money will come back. I’m so glad someone finally put this in plain language. Maybe now he’ll listen.

Anthony Demarco

why do people keep falling for this its not hard to google subnet tokens and see its not a website the fact that you think you can just click a link and get rich is why crypto is a joke you should be ashamed

Lynn S

Let me be unequivocal: the Bittensor ecosystem is a regulatory time bomb. The fact that CoinGecko continues to mislabel this aggregation as an 'exchange' constitutes gross negligence. Furthermore, individuals who trade subnet tokens without understanding AMM mechanics, liquidity pools, or tokenomics are not investors-they are speculators in a Ponzi-like structure disguised as innovation. This is not Web3. This is Web3.0.0.1-half-baked, poorly documented, and dangerously misleading.

Jack Richter

cool. so what do i do now? just ignore it?