Crypto Loan Calculator

Crypto-backed loan is a secured loan where the borrower pledges cryptocurrency such as Bitcoin or Ethereum as collateral. This model lets you tap into fiat liquidity-USD, EUR, or stablecoins-without selling your digital assets, which can preserve upside potential and reduce immediate tax exposure.

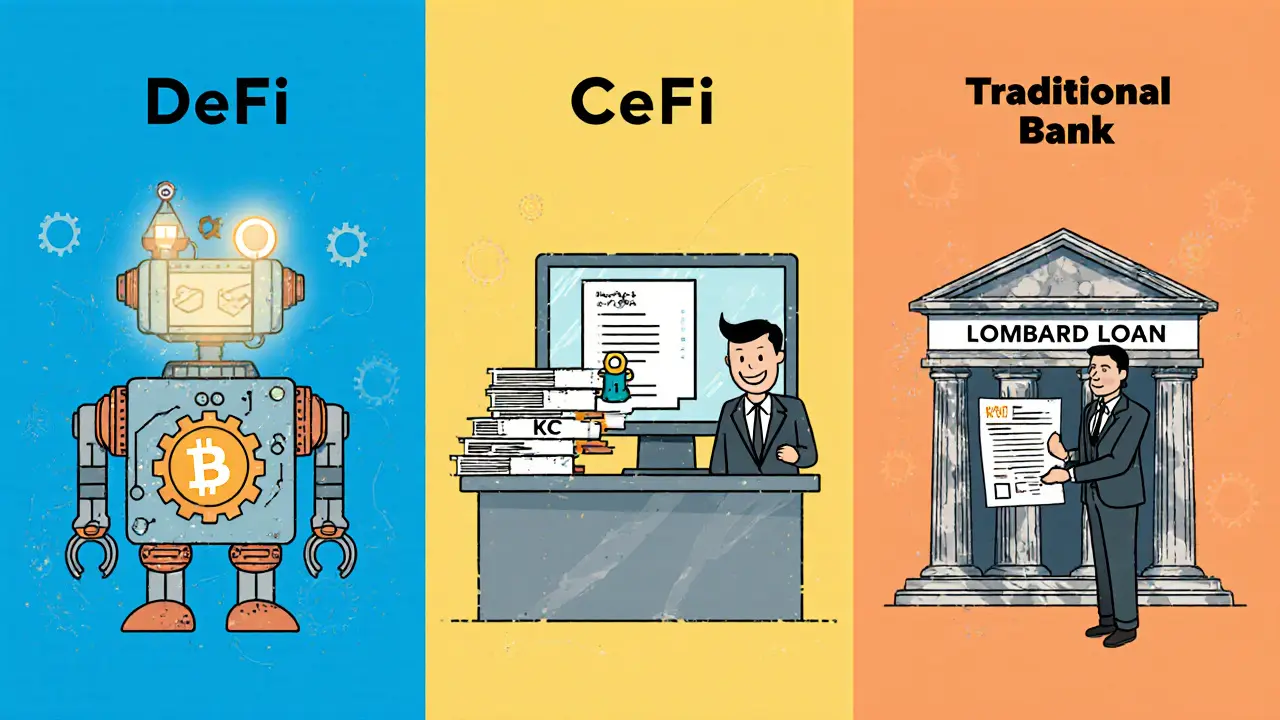

Since the first platforms appeared around 2017, the market has split into three main channels: decentralized finance (DeFi) protocols, centralized finance (CeFi) services, and traditional banks offering Lombard‑style loans. Each channel brings its own risk profile, technical requirements, and user experience. Understanding these differences helps you pick the right approach for your financial goals.

Why People Use Crypto Borrowing

- Access cash quickly-most platforms disburse funds within 24‑72 hours.

- Avoid triggering a taxable event by keeping the original crypto position intact.

- Leverage upside potential; you still own the asset while using borrowed fiat for other investments or expenses.

- Gain exposure to lower‑interest credit lines compared with traditional margin loans.

Key Technical Concepts

Three technical pillars define every crypto loan:

- Collateral: The digital asset you lock up, typically Bitcoin (BTC) or Ethereum (ETH). Some platforms also accept stablecoins, DeFi tokens, or even NFTs.

- Loan‑to‑Value (LTV) ratio: Determines how much you can borrow against a given collateral value. Industry LTVs range from 50 % (conservative) to 97 % (aggressive). Lower LTVs give a larger safety buffer against price drops.

- Liquidation threshold: The point at which the platform automatically sells part or all of your collateral to protect the lender. Thresholds usually sit between 110 % and 150 % of the loan amount, depending on asset volatility.

Comparing the Three Borrowing Models

| Feature | DeFi (e.g., Aave, Compound) | CeFi (e.g., Coinbase, Kraken) | Traditional Bank (e.g., Sygnum, Solaris) |

|---|---|---|---|

| Custody | Smart‑contract escrow (non‑custodial) | Custodial wallet managed by platform | Bank‑held account, regulated custody |

| KYC/AML | Optional on many protocols | Required (identity verification) | Full regulatory onboarding |

| Typical LTV | 50‑75 % | 70‑97 % | 50‑60 % |

| Interest Rate | 5‑20 % APR (algorithmic) | 5‑12 % APR (fixed or variable) | 3‑9 % APR (bank rates) |

| Risk Factors | Smart‑contract bugs, volatility | Counter‑party failure, platform insolvency | Regulatory compliance, credit assessment |

Step‑by‑Step Guide to Getting a Crypto Loan

Below is a practical workflow that works for most CeFi platforms and can be adapted for DeFi protocols.

- Create or connect a wallet. For CeFi, you’ll usually generate an address within the platform. For DeFi, connect MetaMask, Trust Wallet, or another Web3 wallet.

- Complete KYC/AML. Provide ID documents, proof of address, and sometimes source‑of‑funds statements.

- Select collateral. Choose Bitcoin, Ethereum, or another accepted asset. Verify the current market price (use CoinGecko or similar).

- Determine loan amount. Apply the platform’s LTV formula. Example: 1 BTC ≈ $30,000, 70 % LTV → max loan $21,000.

- Deposit collateral. Transfer the exact amount to the platform’s custodial address (or approve the smart contract for DeFi).

- Review loan terms. Note interest rate, repayment schedule, and liquidation threshold. Some platforms allow you to lock the rate for a fixed term.

- Accept the agreement and receive funds. Funds are usually transferred to your bank account or stablecoin wallet within 1‑3 days.

- Monitor collateral ratio. Set alerts (many platforms provide price‑trigger notifications) to avoid forced liquidation.

Risk Management Tips

- Keep a buffer. Maintain at least 20 % above the minimum collateral ratio during volatile periods.

- Use stop‑loss or auto‑sell scripts. Some DeFi dashboards let you pre‑program sell orders if price falls sharply.

- Diversify collateral. Mixing BTC with lower‑volatility stablecoins can reduce overall risk.

- Read the fine print. Look for hidden fees, early‑repayment penalties, and changes to LTV after market shocks.

- Consider insurance. Certain platforms now offer crypto‑collateral insurance for an extra premium.

Legal and Regulatory Landscape

Regulators have started to catch up. In the EU, the MiCAR (Markets in Crypto‑Assets Regulation) took effect in July 2024, giving clear rules for crypto‑backed lending, including capital requirements and client‑risk disclosures. In the United States, the approach remains fragmented; lenders must navigate both federal securities law and state‑level money‑transmitter rules.

Bank‑level Lombard loans benefit from existing banking licenses, which makes them attractive for institutional borrowers seeking regulatory certainty. However, these loans often come with stricter LTV caps (50‑60 %) and longer approval cycles.

Real‑World Use Cases

Retail example: Jane, a freelance designer, locked up 0.5 BTC when it was $25,000 per coin. At a 70 % LTV, she borrowed $8,750 to cover a laptop purchase, avoiding a taxable sale. She set a 20 % collateral buffer and paid back the loan after two months when BTC rose to $30,000.

Institutional example: A European venture capital fund pledged $2 million worth of Bitcoin to a Swiss bank’s Lombard product, receiving a €1.5 million loan at a 5 % fixed rate. The loan helped the fund close a seed round without diluting equity.

Future Trends to Watch

- Integration with real‑world assets (RWAs). Platforms like Centrifuge are already pairing crypto collateral with invoice‑backed loans.

- Dynamic LTV algorithms. AI‑driven risk engines will adjust LTV in real time based on market volatility metrics.

- Cross‑chain collateral. As Polkadot and Cosmos mature, lenders will accept assets beyond Ethereum and Bitcoin.

- Regulatory harmonization. Global standards could emerge, smoothing the path for multinational borrowers.

Quick Checklist Before You Borrow

- Identify the collateral type and current market value.

- Calculate desired loan amount using the platform’s LTV.

- Confirm the liquidation threshold and set a safety margin.

- Review interest rates, fees, and repayment terms.

- Check the platform’s security audits (for DeFi) or insurance coverage (for CeFi).

- Understand tax implications in your jurisdiction.

- Set up price alerts or automated monitoring tools.

Can I use any cryptocurrency as collateral?

Most platforms accept Bitcoin and Ethereum, but many also support stablecoins (USDC, DAI), major altcoins (SOL, AVAX), and even NFTs. Each asset comes with its own LTV and liquidation rules, so check the specific offering before depositing.

What happens if the value of my collateral drops?

When the collateral‑to‑loan ratio falls below the liquidation threshold, the platform automatically sells enough of the collateral to bring the ratio back within safe limits. To avoid this, keep a buffer of at least 15‑20 % above the threshold or set up manual alerts.

Are crypto loans taxable?

Borrowing itself is typically not a taxable event because you’re not selling the asset. However, interest payments may be deductible, and any liquidation that forces a sale could trigger capital gains tax. Always consult a tax professional for your jurisdiction.

How do interest rates differ between DeFi and CeFi?

DeFi rates are algorithmic and can swing between 5‑20 % APR based on supply‑demand for the underlying asset. CeFi platforms usually quote a more stable range of 5‑12 % APR, often with fixed‑term options.

Is my crypto safe when I lock it up?

Safety depends on the custodian. CeFi platforms rely on internal security and insurance, while DeFi protocols depend on smart‑contract audits. Look for third‑party audits, bug‑bounty programs, and, if possible, use hardware wallets for the initial deposit.

By understanding how crypto borrowing works, weighing the LTV trade‑offs, and putting solid risk controls in place, you can unlock liquidity without surrendering ownership of your digital wealth. crypto borrowing is no longer a niche experiment-it’s a mainstream tool for both retail users and institutional investors seeking flexibility in a volatile market.

Comments (19)

Claymore girl Claymoreanime

One must appreciate the nuanced stratification between DeFi's algorithmic flamboyance and CeFi's genteel custodial veneer; the mere casual observer often collapses this dichotomy into a simplistic binary. The LTV metrics, while ostensibly transparent, conceal a labyrinth of risk parameters that only a seasoned connoisseur discerns. Moreover, the regulatory tapestry-woven with MiCAR's recent threads-demands a discerning palate to avoid the sour aftertaste of non‑compliance.

Will Atkinson

Wow!!! Great breakdown, really helps me see the bigger picture!!! 🎉 The way you highlighted the LTV subtleties makes it feel like a treasure map-X marks the spot where the loan meets the collateral!!! Super appreciative of the clarity!!!

emma bullivant

When you stare at the numbers on a crypto loan dashboard, you are really staring into the abyss of modern finance, and the abyss stares back, asking whether you truly understand the impermanence of value. The collateral you lock away is not just a digital token, it is a symbol of faith in a system that has no central guarantor. Yet that faith is vulnerable to volatility, the same volatility that birthed the very assets you now pledge.

Philosophically, the act of borrowing against crypto is a paradox: you seek liquidity while simultaneously preserving ownership, a duality that echoes the ancient tension between material need and spiritual detachment.

Risk, then, becomes a moral question: do you accept the possibility of liquidation as a lesson in humility, or do you chase leverage as a hubristic assertion of control?

Practicalities matter too: the liquidation threshold is not a soft suggestion, it is a hard line drawn by algorithms that care little for your personal narrative.

You must therefore cultivate a buffer, a safety margin, lest the system auto‑sell your assets while you are still sleeping.

Tax ramifications add another layer: a loan itself may not be taxable, but any forced sale could trigger capital gains, turning your strategic move into an unwelcome surprise.

Regulators, meanwhile, are hurriedly drafting frameworks-MiCAR in Europe, patchwork statutes in the US-each seeking to impose order on a market that thrives on borderless freedom.

In this rapidly evolving ecosystem, staying informed is not a luxury but a necessity; every protocol update, every shift in LTV ratios may alter the calculus of your loan.

Think of your crypto loan as a living contract, breathing, changing, reacting to market sentiment as if it were a sentient organism.

Thus, monitoring price alerts becomes a kind of meditation, a daily ritual that keeps you attuned to the health of your collateral.

Some users employ stop‑loss scripts, an automated safeguard that sells a portion of the collateral if price dips beyond a threshold, effectively outsourcing part of the risk management to code.

Others diversify, pairing BTC with stablecoins to smooth volatility, a pragmatic compromise between pure exposure and guarded conservatism.

Insurance products are emerging too, offering a safety net for those willing to pay a premium for peace of mind.

Ultimately, the decision to borrow against crypto hinges on a balance between ambition and prudence, between the desire for liquidity and the acceptance of risk.

Choose wisely, and your loan can be a powerful tool; choose recklessly, and you may watch your assets evaporate in a cascade of forced liquidations.

Nisha Sharmal

Honestly, why would anyone trust a foreign DeFi protocol when you can just get a solid loan from a reputable Indian bank that knows how to handle crypto without the Western hype?

Karla Alcantara

There's definitely room for both approaches-global platforms bring innovation, while local banks offer stability and peace of mind for those who value a familiar regulatory environment.

Jessica Smith

This whole loan thing is just a scam.

Petrina Baldwin

Keep your LTV low.

Ralph Nicolay

It is advisable, in accordance with prudent financial stewardship, to maintain a Loan‑to‑Value ratio that affords a satisfactory margin of safety against market fluctuations.

sundar M

Yo, the crypto loan scene is lit! You can get cash fast without selling the moon rockets you hold.

Nick Carey

Sure, if you like stress, go ahead and borrow against volatile coins.

Sonu Singh

Pro tip: always set a price alert around 15% above your liquidation threshold so you can act before the protocol does the selling.

John E Owren

Remember, the key to a successful crypto loan is discipline-track your ratios daily and never ignore the warning signs.

Joseph Eckelkamp

Wow!!! So helpful!!! Who would've thought that monitoring ratios is important??? 🙄

Jennifer Rosada

One must not overlook the ethical dimension of leveraging personal assets; financial leverage should never become a conduit for irresponsible speculation.

adam pop

Sure, but have you considered that the “big banks” are actually controlled by a secret cabal that manipulates crypto rates to keep us dependent?

Dimitri Breiner

Stay focused on your goals, keep that buffer, and you’ll navigate any market swings like a pro.

LeAnn Dolly-Powell

Feeling inspired! 🌟 Let’s all protect our crypto and still enjoy the freedom it gives us! 🚀

Anastasia Alamanou

From an asset‑backed lending architecture perspective, employing a diversified collateral basket mitigates systemic risk and optimizes the capital efficiency ratio.

John Dixon

Oh great, another self‑proclaimed “expert” telling us to diversify – because copying the same advice over and over is totally revolutionary.