KNG Staking: How It Works, Risks, and Real Projects to Watch

When you stake KNG, a crypto token often tied to gaming or DeFi platforms that rewards holders for locking up their supply. Also known as King Token, it enables users to earn passive income by supporting network security or liquidity pools. But here’s the catch—KNG isn’t one single token. There are multiple tokens with similar names across different blockchains, and most have zero trading volume, no team, or are outright scams. Real KNG staking only exists on a few verified platforms, and if you’re not careful, you’ll lose your crypto to fake staking sites.

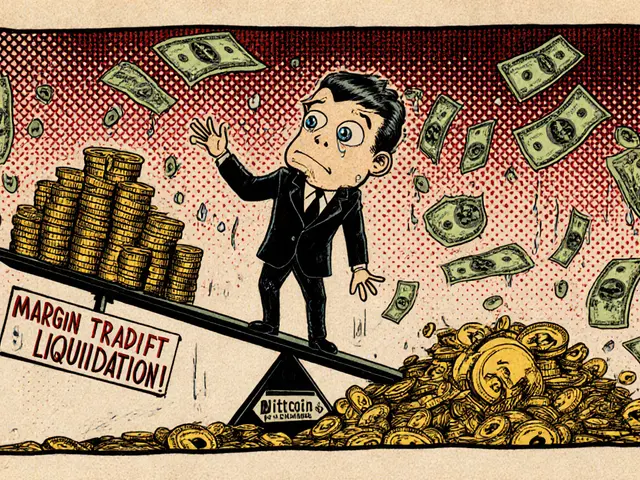

Staking itself is simple: you lock your tokens in a wallet or smart contract, and in return, you get more tokens over time. It’s like earning interest, but without a bank. Projects that actually do this—like some gaming or DeFi platforms—use staking to keep users locked in and help secure their networks. But if a project promises 50% APY on KNG with no whitepaper, no audit, and no live app, it’s a red flag. Most of the KNG staking claims you see online are fake. The real ones? They’re rare. You’ll find them in active communities with transparent code, real trading on DEXs like Uniswap or PancakeSwap, and verifiable team members. Always check the contract address. Never stake through a link sent in Discord or Telegram.

Related concepts like decentralized finance, a system that replaces banks with smart contracts for lending, trading, and earning interest and staking rewards, the tokens you earn just for holding and locking up crypto are what make KNG staking even worth considering. But these only matter if the underlying project is real. Look at the trading history. If the token hasn’t moved in six months, it’s dead. If the website looks like it was made in 2017, walk away. Real DeFi projects update their sites, publish audits, and respond to users. Fake ones vanish after the airdrop.

You’ll find plenty of posts below that expose fake staking schemes, dead tokens, and misleading claims—like the Galaxy Adventure Chest NFT scam, the E2P Token airdrop hoax, or the BSC AMP rumor that never happened. These aren’t just warnings—they’re lessons. The same patterns show up in KNG staking scams: fake websites, pressure to act fast, and promises that sound too good to be true. The good news? You don’t need to guess. The posts here give you the exact signs to look for, the real platforms to check, and how to protect your wallet before you click anything. This isn’t theory. It’s what’s happening right now in crypto—and how to stay safe while you earn.

KNG is the utility token powering Kanga Exchange, offering fee discounts, staking rewards, and loan collateral. Learn how it works, where to buy it, and whether it's worth holding in 2025.

Continue reading