Digital Asset Security: Protect Your Crypto from Scams, Loss, and Hacks

When you hold crypto, you’re not just owning a number—you’re holding the keys to your money. digital asset security, the practice of protecting cryptocurrencies and blockchain-based assets from theft, loss, or unauthorized access. Also known as crypto security, it’s not optional—it’s the foundation of everything you do in web3. If you lose your seed phrase, no bank can reset it. If you click a fake airdrop link, no support team can undo it. This isn’t sci-fi—it’s daily reality for thousands.

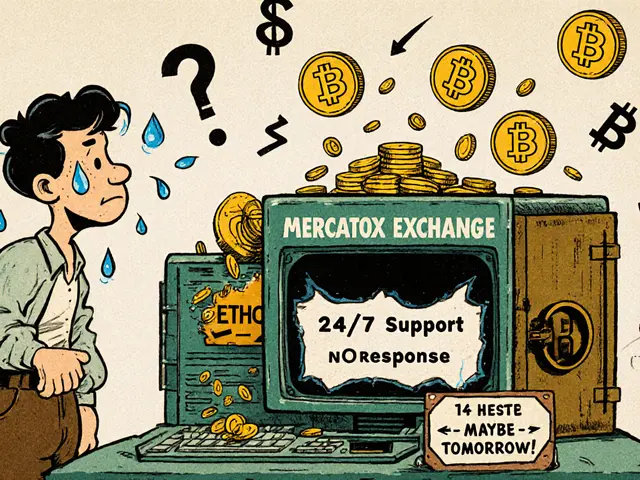

That’s why seed phrase, a unique set of words that acts as the master key to your crypto wallet. Also known as recovery phrase, it’s the one thing that can’t be recovered if lost matters more than your password. No app, no service, no hacker can bypass it. That’s by design. And yet, people still write it on sticky notes, screenshot it, or share it in Discord. Meanwhile, crypto scams, fraudulent schemes that trick users into giving up control of their funds through fake airdrops, phishing sites, or fake exchanges. Also known as crypto fraud, they’re growing smarter and more targeted are everywhere. You’ll see ads for "free Galaxy Adventure Chest NFTs," fake E2P airdrops on CoinMarketCap, or promises of 1000% returns on BAMP tokens. These aren’t mistakes—they’re traps built to look real. And they work because people don’t know how to spot them.

Real digital asset security isn’t about fancy tools or complex setups. It’s about habits. Never share your seed phrase. Double-check every URL before connecting your wallet. Assume every airdrop is fake until proven real. And if you don’t know what a token is, don’t touch it. The posts below show you exactly how this plays out in the wild—from the Venezuelan who uses USDT to buy groceries because the bolívar collapsed, to the trader who lost everything because they trusted a fake M2 exchange. You’ll see how Jordan’s new crypto law changed who’s responsible for security, how Bitnomial’s CFTC approval adds a layer of trust, and why projects like DOOMER or GSTS aren’t worth the risk. You’ll also learn why recovering crypto without your seed phrase is impossible—and why that’s actually a good thing. This isn’t theory. It’s what’s happening right now. And if you’re holding crypto, you need to know it.

Institutional crypto custody solutions secure digital assets for hedge funds, pension funds, and asset managers using multi-sig, MPC, and cold storage. Learn how they work, who the top providers are, and what to look for in 2025.

Continue reading