Crypto Exchange 2025: What’s Real, What’s Scam, and Where to Trade Safely

When you search for a crypto exchange 2025, a platform where you buy, sell, or trade digital assets like Bitcoin, Ethereum, or new tokens. Also known as crypto trading platform, it’s the gateway to your portfolio—but not all gateways are safe. In 2025, the number of exchanges has exploded, but so have the fake ones. You’ll see ads for exchanges promising 10x returns, zero fees, or free airdrops. Most are just traps. The real ones? They’re transparent about security, regulation, and who runs them.

Many of the exchanges you’ll find in 2025 are built on new blockchains like Blast or Base, offering lower fees and faster trades. But here’s the catch: if the exchange doesn’t publish its audit reports, doesn’t name its team, or hides where it’s legally registered, it’s not trustworthy. Look at BitUBU or LeetSwap—they had flashy websites, but no real security or user support. Both collapsed after exploits. On the other hand, exchanges in the UAE or Singapore follow clear rules from bodies like VARA or MAS. That’s not marketing—it’s legal accountability. A decentralized exchange, a peer-to-peer trading platform that doesn’t hold your crypto. Also known as DEX, it gives you control, but you’re still responsible for every trade. Uniswap v3 on Blast is a real DEX with actual volume and clear code. LeetSwap was called a DEX too—but it vanished after a hack.

And then there are the airdrop scams. You’ll see pop-ups claiming Coinstore, Greenex, or BSC AMP are giving away free tokens. But if you check the posts below, you’ll find none of those are real. The only safe airdrops come from projects with history, public teams, and active communities. If a token has zero trading volume and a website that looks like it was made in 2017, walk away. The same goes for exchanges that don’t list their security practices. In 2025, your seed phrase is your only backup. No exchange can recover your funds if you lose it. That’s not a flaw—it’s how crypto works.

So what’s left? A few solid choices. Exchanges that are regulated, have public audits, and don’t promise magic returns. Platforms that let you trade real assets like Bittensor subnet tokens or stablecoins used in Venezuela to survive hyperinflation. Tools that actually work, not hype. Below, you’ll find honest reviews of exchanges that made the cut—and the ones that didn’t. No fluff. No fake promises. Just what’s happening in 2025, and who you can actually trust with your money.

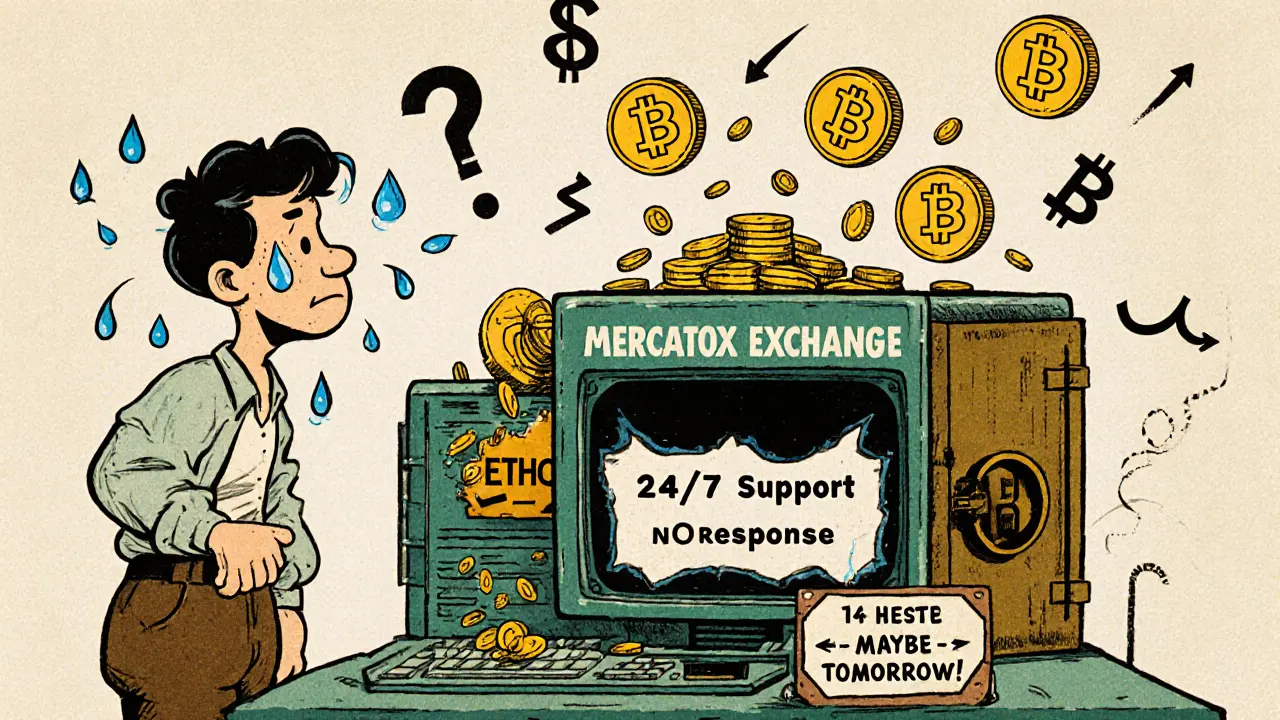

Mercatox is a decade-old crypto exchange with low fees and decent features, but serious withdrawal delays and poor customer support make it risky. Here's what real users are saying in 2025.

Continue reading