When you're looking for a crypto exchange that doesn't hold your keys but still lets you trade with leverage, Swych PDEX stands out - but not because it's the biggest. It's one of the few decentralized exchanges that actually lets you practice trading before risking real money. If you've ever been burned by slippage on Uniswap or confused by dYdX's interface, Swych might feel like a breath of fresh air. But here's the real question: is it just a flashy toy, or does it have staying power?

What Is Swych PDEX?

Swych PDEX is not a traditional exchange. It’s a decentralized perpetual trading platform built on the Binance Smart Chain (BSC), launched in December 2023. Unlike spot-only DEXs like PancakeSwap, Swych focuses on perpetual contracts - meaning you can go long or short on BTC, ETH, and BNB without owning the actual asset. You're betting on price movement, not buying the coin.

It’s part of a larger ecosystem called Swych Finance, which also includes staking, yield farming, a lottery feature called SuperLotto, and a launchpad for new tokens. The whole thing runs on the SWYCH token, which powers fees, rewards, and governance. You don’t need to sign up or verify your identity. Just connect your MetaMask or TrustWallet, and you’re in.

How Trading Works on Swych

Trading on Swych feels familiar if you’ve used centralized platforms like Bybit or Binance Futures. You get:

- Market and limit orders

- Take profit and stop loss triggers

- Real-time charts powered by TradingView

- Position history and collateral tracking

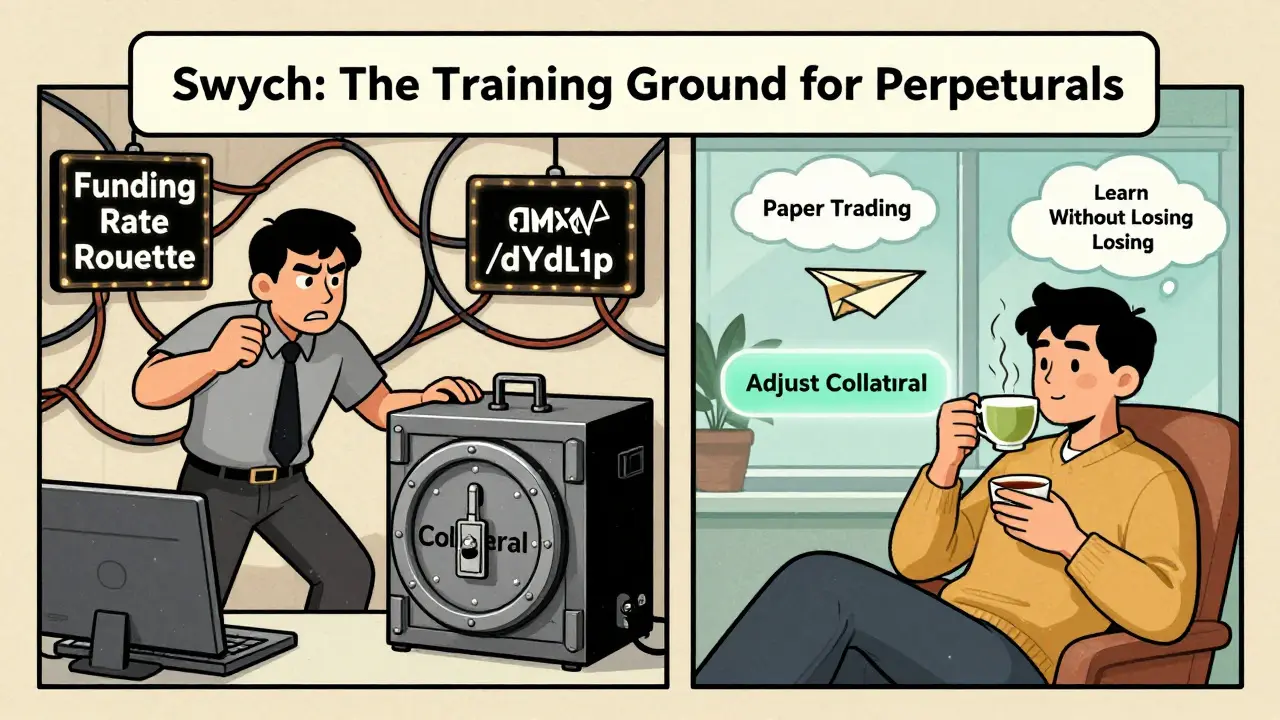

What sets it apart? Two things. First, you can add or remove collateral while a trade is active. Most platforms lock your margin until you close the position. Swych lets you adjust it on the fly - useful if the market moves fast and you need to avoid liquidation.

Second, there’s a paper trading mode with live pricing data. This isn’t a demo account with fake money. It’s a real-time simulation that mirrors actual market conditions. You can test strategies for weeks without spending a cent. No other DEX offers this - not even GMX or dYdX.

Fees and Costs

Swych charges a flat 0.3% trading fee. That’s slightly higher than PancakeSwap’s 0.25% for spot trades, but you’re not trading spot here. You’re trading leveraged perpetuals. For comparison, GMX charges 0.1% plus variable funding rates that can spike during volatility. Swych’s fee is simpler: you pay once, and that’s it.

Gas fees are another story. Since Swych runs on BSC, transaction costs are usually low - around $0.10 to $0.50 per trade. But during network congestion, things can spike. Some users report 8% slippage on $5,000 trades, especially with low liquidity. The fix? Increase your slippage tolerance from the default 0.5% to 5-8% in settings. It’s not ideal, but it works.

SWYCH Token: Utility and Value

The SWYCH token is the heartbeat of the ecosystem. You need it to:

- Pay trading fees (you get a 10% discount)

- Stake for rewards (APYs have hovered between 150% and 250%)

- Participate in SuperLotto (a token-based lottery)

- Access the launchpad for new projects

It’s deflationary - 2% of every trade fee is burned. But here’s the catch: those high staking yields rely on new token issuance. Analysts on Reddit and DeFi Discord servers have questioned whether this model is sustainable. One user, CryptoSkeptic87, put it bluntly: “APYs above 200% are usually unsustainable without massive inflation.”

As of October 2023, SWYCH had a market cap of around $18 million and was listed on KuCoin with a 3.8/5 rating from 427 users. Positive reviews praised the paper trading feature; negative ones called out low liquidity and high gas fees during peak times.

How Swych Compares to the Competition

Here’s how Swych stacks up against the big names:

| Feature | Swych PDEX | PancakeSwap | GMX | dYdX |

|---|---|---|---|---|

| Trading Type | Perpetuals only | Spot only | Perpetuals | Perpetuals |

| Trading Fee | 0.3% | 0.25% (spot) | 0.1% + funding rate | 0.05% + funding rate |

| Paper Trading | Yes | No | No | No |

| Collateral Adjustment | Yes | No | No | No |

| Liquidity (Daily Volume) | $1.2M | $450M | $1.1B | $980M |

| Third-Party Audit | Not public | Yes | Yes (CertiK) | Yes (CertiK) |

| Mobile App | Responsive web | Yes | Yes | Yes |

Swych doesn’t beat GMX on volume or audits. But it beats them on usability for beginners. If you’ve never traded perpetuals before, Swych’s paper trading mode is like a driving simulator for crypto. You can learn the mechanics, test leverage levels, and understand liquidation triggers - all without risking your capital.

Security and Risks

Swych claims to have an emergency fund that covers 5% of protocol revenue, meant to reimburse users if a smart contract bug causes losses. That’s a smart move. But there’s no public audit report from firms like CertiK or SlowMist. That’s a red flag for serious traders. GMX and dYdX have been audited multiple times. Swych hasn’t.

Also, since it’s non-custodial, you’re fully responsible for your keys. Lose your seed phrase? Your funds are gone. No customer support can help you. And because it’s built on BSC, you’re exposed to network congestion - which can delay trades or increase gas costs.

User Experience and Support

Getting started takes less than two minutes. Connect your wallet, pick a trading pair, and you’re in. The interface is clean, modern, and intuitive. Even users with no DeFi experience report they felt comfortable after 10 minutes.

But support is weak. Discord responses take an average of 14 hours. Documentation is “comprehensive but outdated,” according to a Twitter poll of 213 users. If you run into a problem, you’re mostly on your own. That’s fine for experienced traders, but risky for newcomers.

Who Is Swych For?

Swych PDEX isn’t for everyone. Here’s who it works best for:

- Beginners to perpetual trading - The paper trading mode is unmatched.

- DeFi enthusiasts who want flexibility - Adjusting collateral mid-trade is rare and useful.

- Users tired of complex fee structures - One flat fee beats GMX’s funding rate roulette.

It’s not for:

- High-volume traders - $1.2M daily volume means slippage and poor fills on large orders.

- Security-first users - No public audit means higher risk.

- Those seeking stable yields - High APYs may not last.

The Road Ahead

Swych has a roadmap. Phase one is about attracting users with high-yield staking and the SuperLotto lottery. Phase two - planned for 2024 - aims to make SWYCH a “protocol-owned asset” that generates real yield from trading fees, not just new token issuance.

Upcoming features include:

- NFT integration (Q1 2024)

- Cross-chain expansion to Ethereum and Arbitrum (Q2 2024)

- Mobile app development

If they pull this off, Swych could become a serious player. But right now, it’s a niche tool - not a replacement for GMX or dYdX. Think of it as a training ground. Use it to learn. Use it to test. But don’t put your life savings into it.

Final Verdict

Swych PDEX is not the biggest, fastest, or most secure perpetual DEX. But it’s the most beginner-friendly. If you’ve ever been intimidated by leverage trading, this is your doorway in. The paper trading feature alone is worth exploring. It’s like having a crypto trading coach that doesn’t charge you a cent.

For experienced traders, the low liquidity and lack of audits make it risky. Stick with GMX or dYdX if you’re trading large amounts.

Swych doesn’t promise to make you rich. But it might just teach you how to trade smartly - and that’s worth more than any APY.

Is Swych a centralized exchange?

No, Swych is a decentralized exchange (DEX). You trade directly from your wallet - no KYC, no account creation, and no custodial control. Your keys, your coins. Swych doesn’t hold your funds at any point.

Can I trade Bitcoin perpetuals on Swych?

Yes. Swych PDEX supports perpetual contracts for BTC, ETH, and BNB. You can go long or short with up to 10x leverage. All trades are settled in USDT or BUSD.

What wallets work with Swych?

Swych supports any BSC-compatible wallet. This includes MetaMask, TrustWallet, Coinbase Wallet, and MathWallet. You need to have BNB in your wallet to pay for gas fees.

Are there withdrawal limits on Swych?

No, Swych has no withdrawal limits. Since it’s non-custodial, you can withdraw your funds at any time. However, large withdrawals during network congestion may incur higher gas fees.

Is Swych safe to use?

Swych has an emergency fund to cover losses from smart contract issues, but it hasn’t been publicly audited by a third-party firm like CertiK. This is a significant risk. Use only what you can afford to lose. The platform is not insured, and there’s no recourse if funds are lost due to bugs or user error.

How does Swych’s paper trading work?

Swych’s paper trading mode simulates real perpetual trading using live market data from major exchanges. You get a virtual $10,000 balance, real-time price feeds, and full access to leverage, stop-loss, and take-profit tools. No real funds are used, and no trades are executed on-chain. It’s a risk-free way to learn.

What’s the future of the SWYCH token?

Swych plans to transition SWYCH into a protocol-owned asset that earns real yield from trading fees, not just inflationary rewards. This shift is scheduled for 2024. If successful, it could stabilize the token’s value. But until then, high staking yields are fueled by new token issuance - a model that’s hard to sustain long-term.