DeFi Project Safety Checker

Is This DeFi Project Safe?

Evaluate the project based on critical security and transparency criteria. Avoid projects like LeetSwap that fail these tests.

Project Safety Verdict

LeetSwap (Base) was never a working exchange. It was a promise that vanished. If you're reading this because you're wondering whether to use it, or if you lost money there, here’s the truth: LeetSwap (Base) is dead. Not inactive. Not under maintenance. Dead. No trades. No liquidity. No team. No recovery. Just a ghost in the blockchain.

What LeetSwap (Base) Was Supposed to Be

LeetSwap (Base) launched in 2022 as a decentralized exchange built on Base, Coinbase’s Ethereum Layer 2 network. It wasn’t trying to be Uniswap or PancakeSwap. It wanted to be the go-to swap platform for Base’s early meme coins and experimental tokens. Its native token, LEET, was meant to reward users and give them a say in the platform’s future. The idea wasn’t bad. Base was gaining traction. New tokens were popping up daily. There was space for a new DEX. But the execution was rushed. No serious audit. No clear roadmap beyond “swap tokens.” No backup plan for when things went wrong. That’s what made it dangerous.The Exploit That Killed It

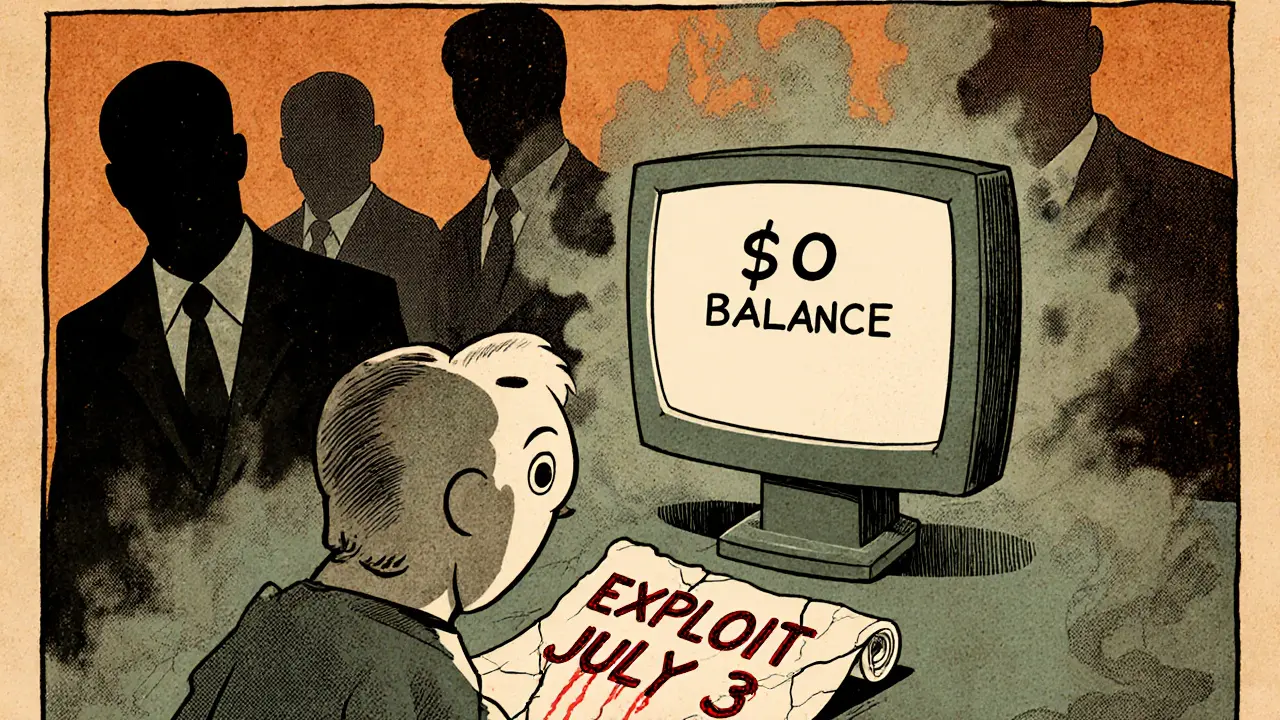

On July 3, 2023, LeetSwap’s Twitter account posted a single warning: “Some LPs on LeetSwap on Base was being exploited.” That’s it. No details. No explanation. No steps for users to protect themselves. Just a cryptic tweet and silence after. Within hours, the LEET token crashed 40%. Users who had staked their liquidity in the platform lost everything. One Reddit user, u/DeFiWatcher, reported losing 0.5 ETH-roughly $800 at the time-and said the team vanished after the exploit. Others posted screenshots of their wallets showing $0 balances after interacting with LeetSwap’s interface. The exploit targeted liquidity pools. That means the money users deposited to help others trade tokens was stolen. Not hacked from a wallet. Not lost to market swings. Stolen directly from the protocol’s smart contracts. And the team didn’t fix it. They didn’t even try.Zero Volume. Zero Activity. Zero Trust

By November 9, 2023, CoinGecko and CoinMarketCap both showed LeetSwap with 0 trading pairs and $0 in 24-hour volume. That’s not a glitch. That’s a tombstone. Every token pair listed-BPEPE/WETH, DOGE/WETH, LadyCat/WETH-had exactly $0 in trades. No one was using it. No one could use it. Compare that to Aerodrome Finance, the leading DEX on Base. At the same time, Aerodrome had over $1.2 billion locked in liquidity and $1.8 billion in daily volume. LeetSwap had nothing. Not even a fraction of a percent. The website, leetswap.xyz, stopped loading. The Twitter account, with 9,359 followers, posted nothing after July 3, 2023. GitHub showed no code updates since June 2023. No bug fixes. No new features. No response to issues. The project was abandoned.

Why It Failed When Others Succeeded

LeetSwap didn’t fail because Base was a bad network. It failed because the team didn’t care enough to do things right. Uniswap and Aerodrome had audits. They had community governance. They had transparency. LeetSwap had a Twitter account and a token contract. Experts at Messari and Galaxy Digital called it a textbook example of a failed DeFi launch on a new chain. “Rushed deployments without security protocols,” as Messari put it. That’s what LeetSwap was. A gamble with other people’s money. And unlike legitimate projects that recover from setbacks, LeetSwap didn’t even pretend to try. No post-mortem. No refund plan. No apology. Just silence.What Happened to the LEET Token?

The LEET token is worthless. Not “low price.” Not “illiquid.” Worthless. You can’t trade it. You can’t stake it. You can’t even find it on any major wallet anymore. It’s a dead asset. Some users still hold it in their wallets, hoping for a miracle. There won’t be one. The token’s smart contract still exists on the blockchain, but it’s empty. No liquidity. No buyers. No purpose. The same fate befell LeetSwap’s sister project, LeetSwap (Linea), launched later in 2023. Identical metrics: 0 coins, 0 pairs, $0 volume. This wasn’t a one-off mistake. It was a pattern.Is LeetSwap Still Active? Can You Get Your Money Back?

No. It is not active. And no, you cannot get your money back. There are no recovery tools. No legal avenues. No team to contact. The exploit was a smart contract vulnerability, not a centralized hack. That means the funds were lost to code, not a thief with a key. Even if the team wanted to fix it, they couldn’t. The money is gone. Some scammers have since created fake LeetSwap websites and Telegram groups, pretending to offer “refund services.” Don’t fall for it. They’re just stealing more money from people who already lost everything.

What You Should Learn From This

LeetSwap (Base) isn’t just a failed exchange. It’s a warning. If you’re considering using a new DEX, especially one on a newer blockchain like Base, Linea, or Scroll, ask yourself:- Has the project been audited by a reputable firm like CertiK or PeckShield?

- Is there active development on GitHub?

- Are the founders publicly known and accountable?

- Is there real trading volume, or just fake numbers?

- Have they responded to past issues, or disappeared after a problem?

Alternatives to LeetSwap on Base

If you want to trade on Base, use platforms that are alive and thriving:- Aerodrome Finance - The largest DEX on Base, with $1.2B+ TVL and active governance.

- Uniswap v3 on Base - Trusted, audited, and supports 287 trading pairs with $287M daily volume.

- BaseSwap - Simple, reliable, and backed by Coinbase’s ecosystem.

Final Verdict

LeetSwap (Base) is not a crypto exchange. It’s a cautionary tale. A reminder that not every project with a Twitter account and a token is worth your money. Not every “new DeFi platform” is innovation. Sometimes, it’s just a trap. If you’re still thinking about using LeetSwap, don’t. If you already lost money there, there’s no recovery. But you can learn. And that’s the only thing left to do.Is LeetSwap (Base) still operational?

No, LeetSwap (Base) is completely inactive. As of November 2023, it has zero trading pairs, zero volume, and no updates from its team since a security exploit in July 2023. The website is down, the Twitter account is silent, and no trading is possible.

Can I recover my funds from LeetSwap (Base)?

No, there is no way to recover funds lost in the July 2023 exploit. The hack targeted liquidity pools directly through a smart contract vulnerability, and the development team never responded with a fix, refund, or even an explanation. The funds are permanently lost.

Was LeetSwap (Base) a scam?

While not proven as a deliberate scam, the project’s behavior after the exploit strongly suggests a rug pull. The team disappeared without warning, left users with zero recourse, and showed no effort to fix the issue or communicate. Industry analysts labeled it an “alleged bald rug pull,” and the complete abandonment confirms it was not a legitimate project.

Why did LeetSwap (Base) fail when other Base DEXs succeeded?

LeetSwap failed because it skipped critical steps: no security audits, no transparent team, no community engagement, and no long-term planning. In contrast, DEXs like Aerodrome Finance and Uniswap v3 on Base had audits, active development, and real user volume. LeetSwap was built for quick profit, not lasting service.

Are there fake LeetSwap websites or scams now?

Yes. Since LeetSwap’s collapse, scammers have created fake websites and Telegram groups claiming to offer “fund recovery” or “token airdrops.” These are phishing scams designed to steal more crypto from people who already lost money. Never interact with any site claiming to be LeetSwap today.

What should I use instead of LeetSwap on Base?

Use Aerodrome Finance, Uniswap v3 on Base, or BaseSwap. All three are audited, have active development teams, real trading volume, and strong community support. They are the only reliable options on the Base network as of 2023.

Comments (21)

Angie McRoberts

Wow. Just... wow. I remember when people were hyping this thing like it was the next big thing. I didn’t invest, but I watched. And honestly? The silence after the exploit was louder than any announcement ever was.

It’s like watching a car crash in slow motion and everyone just walks away.

Somehow, the real tragedy isn’t the lost funds-it’s how quickly people forget.

Next time someone says ‘it’s decentralized so it’s safe,’ just laugh in their face.

And then block them.

Because this isn’t a lesson-it’s a funeral.

And we’re all just standing around with flowers we didn’t bring.

Rest in peace, LeetSwap. You were never meant to live.

But at least you taught us something.

And that’s more than most crypto projects do.

Still... I miss the memes.

Those were the good times.

Before the rug pulled.

Before the silence.

Before we all learned to check the audits.

And maybe that’s the only silver lining.

Still hurts though.

Chris Hollis

Zero volume zero team zero braincells

classic

Diana Smarandache

The complete absence of accountability in this case is not merely negligent-it is an affront to the principles of transparency and responsibility that underpin any legitimate financial infrastructure, decentralized or otherwise.

The abandonment of users following a critical exploit constitutes a moral failure, not merely a technical one.

This is not a market correction.

This is a breach of fiduciary trust.

And yet, the crypto space continues to normalize such behavior.

It is not innovation.

It is anarchy dressed in blockchain.

And we are all paying the price.

There is no excuse.

None.

Allison Doumith

LeetSwap didn’t die because of a hack

it died because someone thought a Twitter account and a token contract were a business plan

and people kept giving them money

not because they believed

but because they hoped

and hope is the most dangerous currency in crypto

you can’t trade it

you can’t stake it

you can’t even burn it properly

it just sits there

waiting for the next sucker

and the next one

and the next one

until the whole system turns into a ghost town

with neon signs that say ‘invest here’

but no one’s home

and the lights are off

and the door is locked

from the inside

by the people who left

and never looked back

and honestly

that’s the most terrifying part

not the money

but the silence

after the lie

is over

Scot Henry

Man I saw this coming when they launched without an audit. I told my buddy not to put anything in, he said ‘it’s just a little’

now he’s got 0.8 ETH in a wallet that won’t even load the site

and I just nod and say ‘I told you so’

but I don’t feel good about it

he’s a good guy

and now he’s scared to touch crypto again

and that’s the real loss

not the money

but the trust

that’s what they stole

and no audit could’ve fixed that

Vivian Efthimiopoulou

The collapse of LeetSwap (Base) represents a profound failure of governance, due diligence, and ethical stewardship within the decentralized finance ecosystem.

It is not merely a case of technical vulnerability; it is the consequence of a cultural rot wherein speed, hype, and speculative momentum are prioritized over security, transparency, and user welfare.

The absence of a post-mortem, refund mechanism, or even acknowledgment is not negligence-it is a declaration of contempt for the community.

Projects that operate under the guise of decentralization yet exhibit centralized arrogance deserve no place in our ecosystem.

We must demand accountability-not through regulation, but through collective rejection.

Do not fund the silent.

Do not interact with the abandoned.

And above all-do not confuse novelty with legitimacy.

There are no shortcuts to trust.

Only diligence.

And vigilance.

And the courage to walk away.

Fred Kärblane

LeetSwap was a classic case of a team chasing TVL instead of trust.

Zero audits? Check.

No roadmap? Check.

Team anonymous? Check.

Twitter hype? Double check.

And then-BAM-exploit hits, and they ghost like it’s a beta test.

Meanwhile, Aerodrome’s team is out here fixing bugs, engaging on Discord, and even doing AMAs.

That’s the difference between a project and a pump.

One builds.

The other burns.

And the community remembers.

So next time you see a new DEX with 10k followers and zero commits on GitHub?

Don’t invest.

Just mute.

And maybe send a meme to your friend who’s about to rug themselves.

It’s the only defense we’ve got.

Alexa Huffman

I’m from Canada but I’ve been watching Base projects for a while.

LeetSwap was such a shame because Base had so much potential.

It’s like someone took a beautiful new car and drove it into a wall just to see if the airbag would pop.

And now everyone’s scared to even touch the keys.

I really hope this doesn’t hurt the whole Base ecosystem.

There are so many good teams working hard there.

Let’s not let one bad apple ruin the whole basket.

Keep supporting the ones who show up.

They’re the real heroes.

gerald buddiman

Okay so I lost $1,200 on LeetSwap…

and I still think about it every time I open my wallet.

I didn’t even know what a liquidity pool was when I staked it.

I just saw ‘earn 45% APY’ and clicked ‘approve’.

Now I know.

And I’m so mad at myself.

But also… I’m mad at the people who made it.

They didn’t just take my money.

They took my confidence.

And now I second-guess every new project.

Even the good ones.

Is that fair?

Probably not.

But I don’t care.

They broke something in me.

And I’m not sure I’ll ever fully trust again.

Thanks, LeetSwap.

Real classy.

Arjun Ullas

LeetSwap is a textbook example of how not to build a DeFi protocol.

India has seen similar collapses-many with even less transparency.

The global crypto community must adopt mandatory audits, public team disclosures, and lock-up periods for team tokens.

Without structural safeguards, such failures will continue.

Regulation is not the enemy-complacency is.

Investors must be educated, not exploited.

And developers must be held accountable.

There is no excuse for silence after a exploit.

Only cowardice.

And cowardice has no place in blockchain.

Steven Lam

you people are so weak

if you lost money on a coin you didn’t research then you deserve it

crypto is wild west

no one owes you anything

stop crying

get better

or get out

Noah Roelofsn

LeetSwap was a glitter bomb wrapped in a whitepaper.

It didn’t just fail-it exploded in the face of everyone who trusted it.

And now? The ashes are still floating.

Some people are still picking through them, hoping for a spark.

There won’t be one.

But here’s the twist: the real lesson isn’t about LeetSwap.

It’s about how fast we forget.

How quickly we move on to the next ‘revolutionary’ token with a Discord channel and a meme.

We’re not victims.

We’re accomplices.

Every time we click ‘stake’ without reading the audit.

Every time we ignore the silence.

Every time we say ‘it’s different this time’-

we’re lighting the fuse.

So maybe the real question isn’t ‘what happened to LeetSwap?’

It’s ‘what are we still doing here?’

Sierra Rustami

US projects always think they’re special

turns out they’re just reckless

and now the whole crypto world has to clean up their mess

again

why do we keep letting this happen?

Glen Meyer

LeetSwap? Bro that was a joke.

They didn’t even have a Discord server with more than 50 people.

And you still put money in?

What were you thinking?

It’s not that they stole your money.

It’s that you gave it to a ghost.

And now you’re mad because the ghost didn’t answer?

Get real.

There’s no justice in crypto.

Only consequences.

And yours came early.

Good.

Maybe now you’ll learn.

Christopher Evans

The ethical implications of abandoning users after a critical exploit are deeply troubling.

While blockchain technology enables decentralization, it does not absolve developers of moral responsibility.

Users entrusted their assets under the implicit assumption of operational integrity.

When that assumption is violated without recourse, the legitimacy of the entire ecosystem is undermined.

Transparency, responsiveness, and accountability are not optional features.

They are foundational.

Projects that neglect them should be ostracized-not celebrated.

Let this be a lesson to all future builders: integrity precedes innovation.

Ryan McCarthy

I’ve been in crypto since 2017.

I’ve seen a lot of projects die.

But LeetSwap… it just felt different.

It wasn’t just a failure.

It was a quiet death.

No drama.

No final tweet.

No ‘we’re pivoting.’

Just… gone.

And I think that’s what makes it so haunting.

It didn’t fight.

It didn’t try.

It just… faded.

And I wonder how many other projects are like that right now.

Just… waiting to disappear.

Maybe the real danger isn’t the scams.

It’s the ones who never say goodbye.

Abelard Rocker

Let me tell you something about LeetSwap.

It wasn’t just a failed project.

It was a mirror.

And it reflected every single one of us.

Every person who clicked ‘stake’ because the APY was too good to ignore.

Every person who ignored the red flags because they wanted to believe.

Every person who thought ‘maybe this time it’s different’

while the team was already packing their bags.

LeetSwap didn’t die because of a hack.

It died because we were all too eager to be fooled.

We wanted a fairy tale.

So they gave us a fairy tale.

And then they vanished.

And now we’re left with the glitter.

And the silence.

And the haunting question-

who were we really trying to fool?

Them?

Or ourselves?

Because here’s the truth:

we didn’t lose money.

We lost our innocence.

And that’s the one thing no audit can fix.

Missy Simpson

so i didn't invest but i followed leetswap on twitter and i was so sad when they went quiet

like... i just wanted them to say something

anything

even ‘we’re sorry’

but they didn't

and now i’m scared to even look at new projects

it’s like losing a friend who just disappeared

and you don’t even know why

it hurts more than the money

thank you for writing this

it made me feel less alone

❤️

Tara R

Anyone who lost money on LeetSwap was complicit in their own downfall

There is no excuse for investing in a project without verifying its audit status, team credentials, or development activity

These are not advanced concepts

They are baseline requirements

For those who failed to meet them-

do not seek sympathy

Seek education

And then do better

Otherwise you are not a victim

You are a liability to the ecosystem

Matthew Gonzalez

LeetSwap’s silence is the most telling thing about it.

It didn’t just vanish.

It became a question mark.

And now every time I see a new project with no team, no audits, no updates-I ask myself:

‘Is this the next LeetSwap?’

And then I walk away.

Because sometimes the bravest thing you can do in crypto

is not invest.

Just… pause.

And listen.

For the silence.

Because that’s where the truth lives now.

Angie McRoberts

Missy Simpson said it best. I felt that too.

It’s weird how much you attach to a project just because you followed it.

Like it was going to be your little crypto baby.

And then it just… didn’t wake up.

And now I don’t even check my wallet anymore.

It’s like I’m afraid to see it.

But I’m glad someone wrote this.

It’s the only tribute LeetSwap deserves.

Not a refund.

Not a comeback.

Just… a memory.

And a warning.

Thank you.