Trying to bypass crypto restrictions isn’t a clever hack-it’s a legal minefield. Governments and international bodies aren’t guessing at how to track crypto transactions anymore. They’ve built systems that trace them with near-perfect accuracy. If you think using Bitcoin or Ethereum to avoid sanctions is a secret backdoor, you’re operating on outdated assumptions. The truth is, blockchain doesn’t hide money-it records it forever. And every move you make can be linked back to you.

Why Crypto Isn’t Anonymous-And Why That Matters

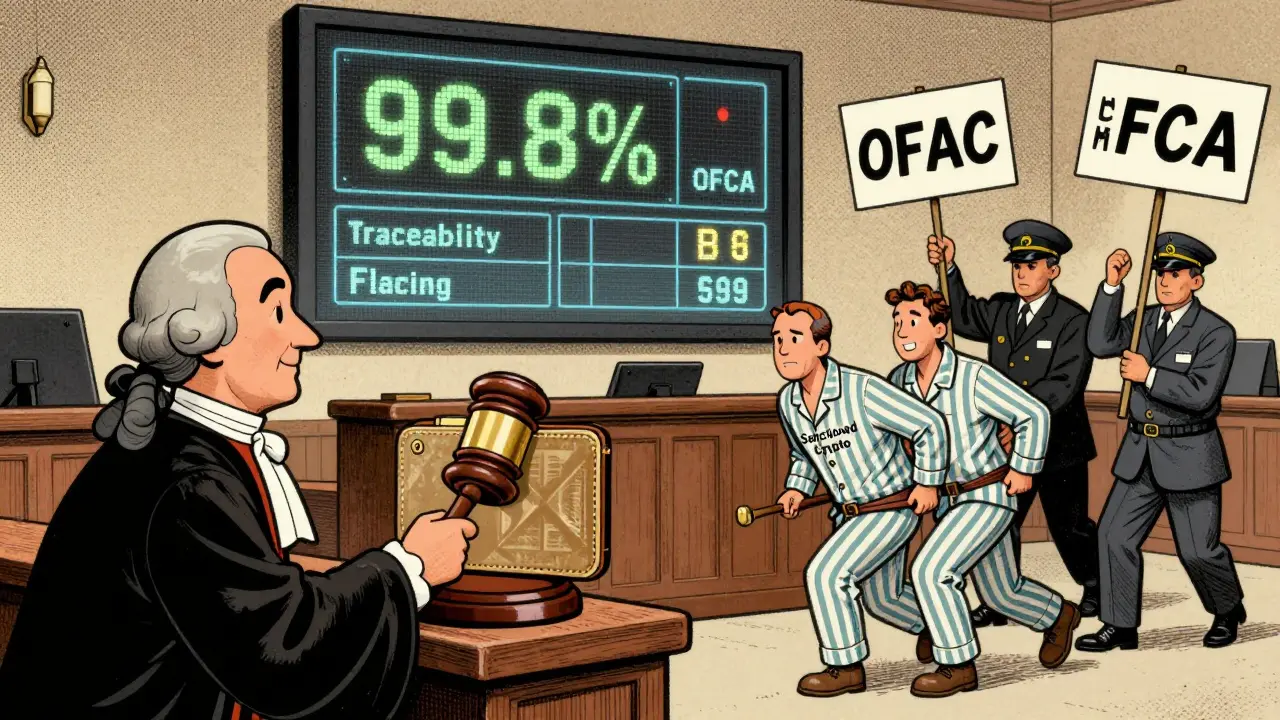

Many people still believe cryptocurrency is anonymous. It’s not. Bitcoin and Ethereum transactions are stored on public ledgers. Anyone can see them. Wallet addresses may not have your name on them, but blockchain analytics firms like Chainalysis and Elliptic can connect those addresses to real-world identities using patterns, exchange records, and IP logs. By 2023, these firms were able to trace 98% of transactions on major blockchains. That number is climbing toward 99.8% by 2026, according to the Financial Action Task Force.Privacy coins like Monero are the exception, but even they’re not foolproof. Only 65% of Monero transactions remain untraceable, and governments are already investing in tools to crack them. If you’re using crypto to dodge sanctions, you’re not hiding-you’re leaving a digital fingerprint that lasts longer than bank records ever did.

What Happens When You Cross the Line?

Circumventing crypto restrictions isn’t a gray area. It’s a crime. In the U.S., the Office of Foreign Assets Control (OFAC) treats crypto sanctions violations the same as wire fraud or money laundering. The Department of Justice doesn’t just issue warnings-they file criminal charges. In November 2023, two Russian nationals were prosecuted for trying to move $1.3 billion in crypto to evade sanctions. That was the first-ever criminal case of its kind, and it won’t be the last.In the EU, the Markets in Crypto-Assets Regulation (MiCA), which took effect in 2023, requires all crypto service providers to block transactions linked to sanctioned wallets. The UK’s Financial Conduct Authority (FCA) and the Bank of England made it clear: if you’re running a crypto business, you’re legally responsible for enforcing sanctions. Failure to do so can mean fines, license revocation, or even jail time for executives.

And it’s not just regulators. State attorneys general are stepping in too. In June 2023, nine U.S. states sued Coinbase for allegedly failing to block sanctioned addresses. Nexo settled a similar case for $22.5 million. These aren’t isolated cases-they’re signals. The legal net is tightening, and enforcement is no longer theoretical.

How Easy Is It to Actually Get Away With It?

Despite all the hype, crypto hasn’t become a major tool for sanctions evasion. According to a 2023 report by the Center for Strategic and International Studies (CSIS), cryptocurrency accounted for just 0.01% of all Russian sanctions evasion attempts. The vast majority-42%-used commodity trading. Another 38% relied on third-country intermediaries. Cash smuggling made up 15%.Why? Because crypto is harder to use secretly than most people think. Exchanges like Coinbase and Binance moved quickly after Russia’s invasion of Ukraine in 2022. Coinbase froze 25,000 Russian accounts worth $225 million within 48 hours. Binance required proof of address for users holding over €10,000. These aren’t small companies with loose policies-they’re giants with compliance teams bigger than some banks.

Even the so-called “unregulated” platforms are being forced to comply. By December 2023, 87% of the top 50 crypto exchanges globally had implemented enhanced sanctions screening. The days of using a random exchange with no KYC to move large sums are over. The few that still allow it are becoming targets for regulators, not safe havens.

The Real Weak Spots-and Why They’re Disappearing

The biggest risk in crypto sanctions evasion isn’t the technology-it’s the people. Early on, many transactions slipped through because users didn’t verify their identities. Binance’s “basic accounts” allowed up to $1,000 in transactions without KYC until May 2022. That loophole closed fast. Now, even small transactions are tied to identities in most jurisdictions.Another weak point was the lack of data. A 2023 U.S. Government Accountability Office report found that 37% of crypto transactions linked to Russian entities during the first half of 2022 had no identifying information. But that’s changing. Regulators now demand full transaction records. Exchanges are investing millions to build systems that flag suspicious activity. Kraken, for example, cut false positives in sanctions screening from 22% to 3.7% between 2021 and 2023 while boosting detection rates to 94.2%.

Decentralized finance (DeFi) was once seen as a loophole. But regulators are already targeting it. The Digital Asset Sanctions Compliance Act, introduced in September 2023, proposes extending sanctions requirements to decentralized applications. That means smart contracts won’t be exempt. If you’re using a DeFi protocol to move sanctioned crypto, you’re not avoiding oversight-you’re walking into a trap that’s already been mapped out.

What You’re Really Up Against

You’re not just fighting against a system that’s hard to break. You’re fighting against a system that’s getting smarter every day. Blockchain analytics tools are now trained on millions of past transactions. They learn how money moves between wallets, how exchanges interact, and how laundering patterns repeat. They don’t need your name-they just need patterns.And when they find a match? The consequences are severe. Fines can reach hundreds of millions of dollars. Individuals face prison time. Companies lose their licenses. Your crypto assets? They’ll be frozen. In 2022, $1.2 billion in Russian crypto assets were seized-and their value swung by 35% in just three months, meaning you could lose even more than you tried to hide.

Even if you think you’re smart enough to slip through, the legal system doesn’t care. Courts don’t accept “I didn’t know” as a defense if you’re using crypto in a sanctioned context. Ignorance isn’t a shield-it’s a liability.

The Bigger Picture: Why This Isn’t Going Away

This isn’t a temporary crackdown. It’s the start of a new era in financial regulation. Governments know crypto is here to stay. So instead of banning it, they’re forcing it into the same rules that govern banks. The EU’s MiCA, the U.S. state-level actions, and FATF’s global standards are all moving in the same direction: total transparency.By 2026, nearly all major cryptocurrencies will be 99.8% traceable. That’s not a prediction-it’s a roadmap. Countries are sharing data. Exchanges are cooperating. Tools are improving. The window for anonymous, untraceable crypto transactions is closing.

If you’re thinking about using crypto to avoid restrictions, ask yourself this: Are you willing to risk your freedom, your assets, and your reputation on a strategy that’s already been proven to fail? The data says no. The courts say no. The regulators say no.

The real risk isn’t that you’ll get caught. It’s that you’ll waste time, money, and opportunity on something that doesn’t work-and then pay the price when it inevitably does.

Can you really trace Bitcoin transactions back to a person?

Yes. While Bitcoin addresses don’t show names, blockchain analytics firms connect them to real identities using exchange records, IP addresses, and transaction patterns. By 2023, over 98% of Bitcoin and Ethereum transactions were traceable. Even if you use multiple wallets, patterns in timing, amounts, and destinations make identification possible.

What happens if I use a non-KYC exchange to avoid sanctions?

You’re not safe. Non-KYC exchanges are under increasing pressure from regulators. Many have been shut down or forced to comply. Even if you manage to move funds through one, those transactions can still be flagged and frozen later. The U.S. Department of Justice has already prosecuted individuals who used unregulated platforms to evade sanctions.

Are privacy coins like Monero a better option for avoiding sanctions?

Not really. Monero offers more privacy than Bitcoin, but only about 65% of its transactions remain untraceable. Governments and firms are actively developing tools to break Monero’s privacy features. Using it for sanctions evasion still carries high legal risk-and the chances of detection are rising fast.

Can I use crypto to send money to someone in a sanctioned country without getting in trouble?

No. Sending crypto to anyone on OFAC’s sanctions list-even if you think they’re a friend or family member-is illegal. The U.S., EU, UK, and other jurisdictions treat this as a direct violation. Wallet addresses on the sanctions list are publicly available. If you send funds to one, you’re breaking the law.

What are the penalties for violating crypto sanctions?

Penalties include heavy fines (up to hundreds of millions), asset seizure, criminal prosecution, and prison time. Companies can lose operating licenses. Individuals have been charged and sentenced. There’s no leniency for first-time offenders-regulators treat these violations as serious financial crimes.

Is decentralized finance (DeFi) a safe way to bypass crypto restrictions?

No. DeFi protocols are not exempt from sanctions. The U.S. has proposed legislation to extend sanctions rules to decentralized applications. Even if a smart contract doesn’t require KYC, regulators can still trace the funds and hold users accountable. DeFi is not a loophole-it’s a target.

How do I know if a crypto address is sanctioned?

OFAC publishes a publicly accessible list of sanctioned crypto wallet addresses. Blockchain analytics tools like Chainalysis and Elliptic also flag these addresses automatically. Most regulated exchanges screen addresses in real time. If you’re unsure, assume any unknown address could be on the list-and avoid it.

What should I do if I accidentally sent crypto to a sanctioned address?

Stop immediately. Do not try to reverse or move the funds. Contact a legal professional familiar with financial sanctions. Voluntarily reporting the error may reduce penalties, but trying to cover it up will make things worse. Regulators reward cooperation, not concealment.

Comments (24)

surendra meena

THIS IS A TRAP!!! THEY WANT YOU TO THINK IT'S SAFE TO USE CRYPTO??!! THEY'RE WATCHING EVERY SINGLE TRANSACTION!!! YOU THINK YOU'RE SMART?? YOU'RE JUST A DATA POINT IN THEIR DATABASE!!!

Khaitlynn Ashworth

Oh honey, you really think the government cares about your 0.01 BTC? They're too busy chasing TikTok influencers who forget to pay taxes. Blockchain analytics? More like blockchain theater. I've seen more real surveillance from my smart fridge.

Mike Pontillo

People still think crypto is anonymous? Wow. You're not hiding. You're just broadcasting your stupidity in a language everyone can read. You think you're outsmarting the system? You're just making it easier for them to lock you up.

Joydeep Malati Das

The technical accuracy of this post is commendable. The regulatory landscape has indeed evolved significantly, with global coordination on blockchain tracing reaching unprecedented levels. It is prudent to acknowledge these developments when considering financial compliance.

rachael deal

This is so important!! I wish more people understood this. Crypto isn't magic, it's math + transparency. We can protect ourselves and our communities by respecting the rules. Let's stay safe and smart!! 💪✨

Elisabeth Rigo Andrews

The institutionalization of blockchain surveillance represents a paradigmatic shift in financial sovereignty. The convergence of AML/KYC protocols with on-chain analytics constitutes a de facto financial panopticon. You're not evading oversight-you're optimizing your own incarceration.

Adam Hull

The irony is that the same people who scream about privacy are the ones willingly handing over their entire transaction history to centralized exchanges that report to the state. You don't want surveillance? Don't use Coinbase. But then again, you probably can't afford to run a node.

Mandy McDonald Hodge

i just learned this yesterday and im so glad i never tried to send crypto to my cousin in russia 😅 i thought it was like venmo but with more hype... turns out its like leaving your bank statement on the internet for everyone to read 🙈

Bruce Morrison

This is the reality. The tech is public. The rules are clear. The consequences are real. No one is coming to save you if you ignore the law. Simple as that.

Andrew Prince

The fundamental flaw in the prevailing narrative is the conflation of technological traceability with legal enforceability. While blockchain analytics may possess the capacity to correlate wallet addresses with real-world identities, the jurisdictional arbitrage inherent in decentralized networks renders such correlations legally inconsequential in many jurisdictions. The regulatory apparatus, though formidable, remains tethered to nation-state sovereignty-an increasingly anachronistic construct in the face of peer-to-peer value transfer.

Jordan Fowles

It's funny how we think we're rebels using crypto to escape control, but really we're just building our own prison with every transaction. The ledger doesn't judge. It just records. And eventually, someone else will interpret what it means.

Steve Williams

This is a very well-articulated exposition on the evolving regulatory framework surrounding cryptocurrency. The global consensus on transparency is not merely a trend-it is the inevitable trajectory of financial modernization. Respect for legal structures is not weakness; it is wisdom.

nayan keshari

They say crypto isn't anonymous but they're the ones who created the whole system. If you really wanted privacy you'd ban it. This is all about control. They're scared because people are starting to use tech they can't control.

Johnny Delirious

The implementation of MiCA and the Digital Asset Sanctions Compliance Act demonstrates a strategic, coordinated, and institutionally robust approach to integrating digital assets into the global financial compliance architecture. This is not regulatory overreach-it is financial evolution.

alvin mislang

You think you're smart using crypto to dodge sanctions? You're just giving the feds a free gift. Every transaction is a confession. I'd rather just carry cash than leave a trail they can follow with a spreadsheet.

Monty Burn

The ledger remembers everything but no one remembers why we started this. We wanted freedom. Now we're just trading one cage for another with more lights and cameras

Kenneth Mclaren

This is all a psyop. The government doesn't care about sanctions-they care about control. They let you think crypto is traceable so you'll go back to banks. That's where the real surveillance is. They want you to think you're being watched when you're really being led.

Alexandra Wright

Look, I get the fear. But this isn't about punishment-it's about protection. If you're trying to move money to a sanctioned entity, you're not a hero-you're a target. And I've seen too many people get crushed because they thought they were clever. Don't be that person.

Jack and Christine Smith

ok so i just read this and my brain is spinning 😵💫 like i thought crypto was like the wild west but turns out its more like a walmart with cameras everywhere?? and they know if you bought a latte with it??

Jackson Storm

Hey, if you're new to this, don't panic. Just stop. Don't move anything. Don't try to fix it. Talk to someone who knows the rules. You're not alone, and it's never too late to do the right thing.

Raja Oleholeh

Western propaganda. Crypto is freedom. They fear it. They will crush it. But we will rise. 🇮🇳🔥

Prateek Chitransh

Funny how the same people who say 'trust no one' are the ones handing their private keys to a platform that reports to the IRS. You're not anonymous-you're just trusting the wrong people.

Michelle Slayden

The permanence of blockchain records fundamentally alters the calculus of financial misconduct. Unlike traditional banking ledgers, which may be purged or obscured, cryptographic ledgers provide immutable, verifiable, and globally accessible audit trails. This is not a flaw-it is a feature of accountability.

christopher charles

bro i just sent 0.5 eth to my buddy in ukraine last week... should i be worried?? i didn't know he was on any list!! 😳