Most crypto traders still pay too much in gas fees. Even on Layer 2s, some DEXes feel like they’re stuck in 2021. But PancakeSwap v3 on Arbitrum doesn’t just cut costs-it redesigns the whole experience. If you’ve ever waited 10 minutes for a swap to confirm or paid $5 in fees to trade $100 worth of tokens, this isn’t just an upgrade. It’s a reset.

What PancakeSwap v3 on Arbitrum Actually Does

PancakeSwap v3 on Arbitrum One isn’t a copy-paste of the original BNB Chain version. It’s a full rebuild optimized for Arbitrum’s Layer 2 infrastructure. That means trades happen faster, cost less, and still keep all the features you already know: swapping tokens, adding liquidity, farming yields, and earning CAKE. Unlike Uniswap v3 on Ethereum mainnet, where gas spikes can make trading impossible during volatility, PancakeSwap on Arbitrum runs on a network that processes over 400 transactions per second. Fees? Usually between $0.01 and $0.05. That’s not a marketing claim-it’s what users report after real trades. One trader in Dublin swapped $2,000 worth of USDC to WETH in under 30 seconds. Total cost: $0.03. The secret? Concentrated liquidity. In v3, you don’t just dump your tokens into a pool and hope for the best. You pick a price range-say, between $2.40 and $2.70 for CAKE-and only provide liquidity within that band. If the price stays there, your capital works harder. If it moves outside, your position becomes inactive. It’s like setting a price alert that earns you fees while you sleep.How It Compares to Other DEXes on Arbitrum

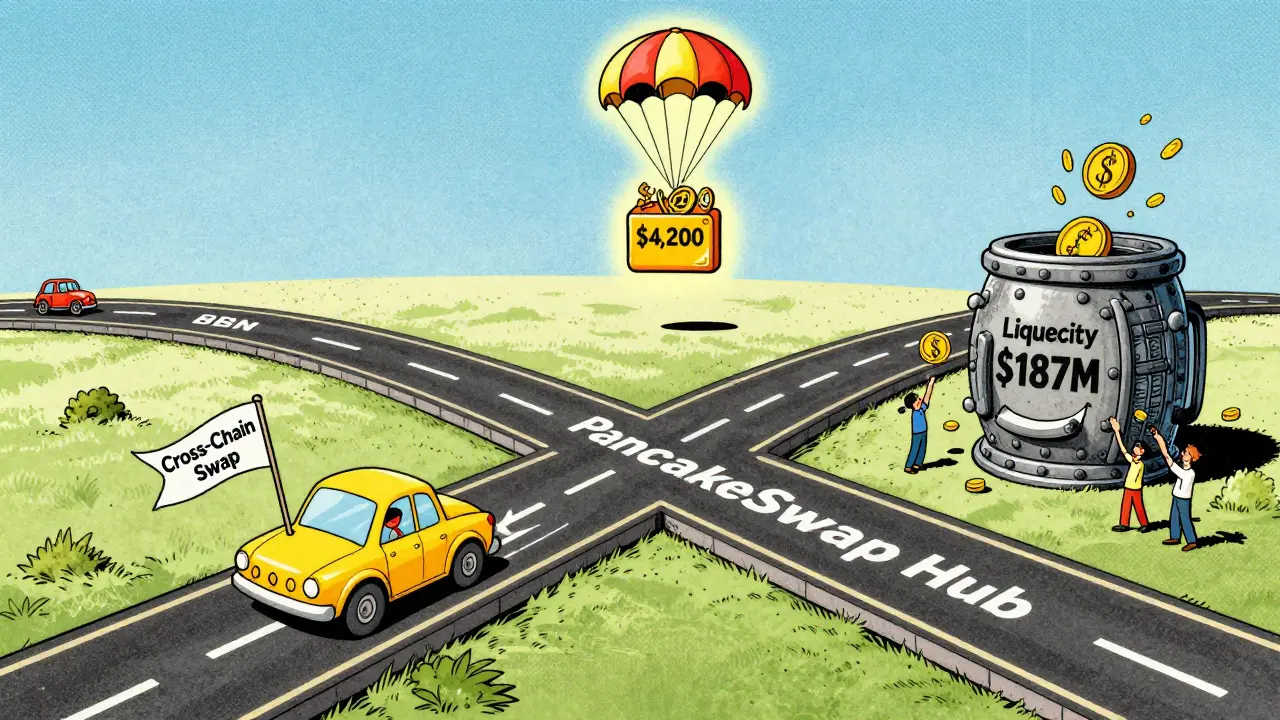

You’ve got options. Uniswap v3 is there. SushiSwap is there. But none of them have PancakeSwap’s multichain muscle. | Feature | PancakeSwap v3 (Arbitrum) | Uniswap v3 (Arbitrum) | SushiSwap (Arbitrum) | |--------|--------------------------|----------------------|---------------------| | Avg. Swap Fee | $0.02 | $0.04 | $0.05 | | Liquidity Depth (CAKE/USDC) | $187M | $92M | $41M | | Cross-Chain Swaps | Yes (BNB, Base, Arbitrum) | No | No | | CAKE Airdrops | Yes (via Coinbase One) | No | No | | Wallet Support | MetaMask, Coinbase Wallet, Trust Wallet | MetaMask, Coinbase Wallet | MetaMask, Rainbow | | Learning Curve | Low (familiar UI) | Medium | Medium | PancakeSwap leads in liquidity depth for its native token, CAKE. As of October 2025, the CAKE/USDC pool on Arbitrum had over $187 million locked. That’s more than double Uniswap’s. Why does it matter? Slippage. With deeper pools, your $500 trade doesn’t move the price by 3%. It moves it by 0.2%. And here’s the kicker: PancakeSwap is the only DEX on Arbitrum that lets you earn CAKE tokens just by trading. The Coinbase One partnership, launched in July 2025, gives verified users a $4,200 CAKE airdrop if they hit $100 in total trading volume across BNB Chain, Base, or Arbitrum. That’s real money. Not theoretical rewards. Real tokens you can sell or stake.Setting It Up: Step-by-Step

You don’t need to be a coder. But you do need to bridge your assets.- Connect your wallet (MetaMask, Coinbase Wallet, or Trust Wallet) to the PancakeSwap website.

- Switch your network to Arbitrum One. If you don’t see it, add it manually: Network Name: Arbitrum One, RPC URL: https://arb1.arbitrum.io/rpc, Chain ID: 42161, Symbol: ETH, Block Explorer: https://arbiscan.io/.

- If your tokens are on Ethereum or BNB Chain, use the built-in bridge. Click “Bridge” on the PancakeSwap homepage. Select your token (e.g., USDT, ETH, CAKE), enter the amount, and confirm. The bridge takes 5-15 minutes. You’ll get a notification when it’s done.

- Once your tokens appear, go to “Swap.” Pick your token pair. Click “Swap.” Confirm the transaction. Done.

Why This Matters for Long-Term Users

PancakeSwap isn’t just another DEX. It’s a gateway to a multichain DeFi world. The June 2025 launch of cross-chain swaps means you can now trade directly from BNB Chain to Arbitrum without moving assets manually. Swap CAKE on BNB Chain for USDC on Arbitrum in one click. No bridging. No waiting. No extra fees. That’s huge. It turns PancakeSwap into a liquidity hub, not just a trading platform. And with CAKE’s deflationary burn mechanism-over 9.2 million tokens burned since launch-it’s not just a utility token. It’s a store of value. As of March 2025, 66.8 million CAKE tokens were locked as veCAKE-essentially staked for governance and fee discounts. That’s 18% of the total supply. People aren’t just trading. They’re betting on the long-term.What Doesn’t Work Yet

No system is perfect. Here’s where PancakeSwap v3 on Arbitrum still has gaps. First, the bridge. It’s reliable, but not instant. If you’re trying to jump into a hot new token and your USDC is still on Ethereum, you’ll wait. There’s no instant swap from Ethereum mainnet. You have to bridge first. Second, some new tokens don’t show up immediately. PancakeSwap v3 supports thousands of tokens, but newly launched ones on Arbitrum might take days to appear in the search. You can still add them manually by pasting the contract address, but that’s risky if you’re not verifying the contract yourself. Third, the learning curve for concentrated liquidity. If you’re used to “unlimited range” liquidity on v2, v3 feels complex. You need to monitor your price ranges. Set them too narrow, and you miss out. Too wide, and you lose efficiency. There’s no auto-rebalance. You have to do it manually.

Is It Worth It?

If you’re trading more than $500 a week, yes. The fee savings alone pay for the time it takes to set it up. If you’re holding CAKE, the Coinbase One airdrop is a no-brainer. Even if you just trade occasionally, the speed and reliability make it the best DEX on Arbitrum right now. It’s not for everyone. If you only trade on Ethereum mainnet and hate switching networks, stick with Uniswap. But if you want lower fees, faster trades, and real rewards-PancakeSwap v3 on Arbitrum is the most complete package available.What’s Next?

The team is testing a mobile app for Arbitrum swaps. A new staking dashboard for veCAKE holders is due in Q1 2026. And they’re exploring integrations with non-EVM chains like Solana and Cosmos. The bigger trend? Layer 2 adoption is no longer optional. It’s the default. PancakeSwap didn’t just adapt. It led. And that’s why it’s still the most-used DEX in DeFi-even as new platforms rise.Can I use PancakeSwap v3 on Arbitrum without bridging assets?

No. If your tokens are on Ethereum, BNB Chain, or another network, you must bridge them to Arbitrum One first. PancakeSwap’s interface includes a built-in bridge tool to make this easy. You can’t swap tokens you don’t hold on Arbitrum.

How do I get the Coinbase One CAKE airdrop?

You need to be a verified Coinbase One member and trade at least $100 USD in total across BNB Chain, Base, or Arbitrum networks on PancakeSwap. The $4,200 CAKE airdrop is distributed automatically to eligible wallets in batches. No action is needed after meeting the trading requirement.

Is PancakeSwap v3 on Arbitrum safe?

Yes, as long as you follow basic crypto safety rules. PancakeSwap’s smart contracts have been audited by multiple firms, including CertiK and PeckShield. The platform doesn’t hold your funds-you do. Never share your seed phrase. Always verify contract addresses before interacting. Avoid third-party links.

What’s the difference between PancakeSwap v2 and v3 on Arbitrum?

v2 uses constant product liquidity pools-your tokens are spread evenly across all prices. v3 uses concentrated liquidity-you choose specific price ranges. This makes v3 40-100x more capital efficient. v3 also has lower fees, cross-chain swaps, and better integration with Coinbase One. v2 is being phased out.

Can I earn yield on PancakeSwap v3 on Arbitrum?

Yes. You can provide liquidity to token pairs (like CAKE/USDC) and earn trading fees. You can also stake your LP tokens in yield farms to earn additional CAKE. The APYs vary daily based on demand and token prices. Check the “Farms” section on the PancakeSwap site for current rates.

What’s the total supply of CAKE?

As of March 2025, the total supply of CAKE was 372,497,738 tokens. About 18% of that (66.8 million) was locked as veCAKE by users who staked their tokens for governance and fee discounts. The token has a deflationary burn mechanism, with over 9.2 million tokens burned since launch.

Does PancakeSwap v3 on Arbitrum support NFTs?

No. PancakeSwap is a decentralized exchange focused on token swaps and liquidity provision. It does not have an NFT marketplace or support for NFT trading. For NFTs on Arbitrum, use platforms like LooksRare or Element.

Comments (22)

Robert Mills

This is game-changing. $0.03 to swap $2k? I’m selling my Ethereum socks and moving all my shit to Arbitrum. 🚀

josh gander

I’ve been waiting for this moment since 2022. The way PancakeSwap v3 on Arbitrum handles concentrated liquidity is like giving your capital a personal trainer-it doesn’t just sit there, it *works*. And the cross-chain swaps? That’s not a feature, that’s a revolution. You can now trade CAKE on BNB Chain and get USDC on Arbitrum in one click-no more bridging headaches, no more waiting 15 minutes for a transaction to clear. The liquidity depth is insane-$187M in CAKE/USDC? That’s more than double Uniswap’s. Slippage? Barely noticeable. And the Coinbase One airdrop? If you’re not using this, you’re leaving free money on the table. I’ve seen people go from $50 trades to $5k because they finally stopped paying $5 in gas. This isn’t an upgrade-it’s a migration. The UI is familiar, the speed is buttery, and the rewards? Real. I’ve been on every DEX out there, and this is the first one that actually feels like it was built for humans, not just degens. I’m not just using it-I’m evangelizing it. If you’re still on Ethereum mainnet for swaps, you’re driving a horse cart while everyone else has a Tesla. Time to upgrade.

Akhil Mathew

I tried this last week after reading this post. Bridge took 8 mins, swap was instant. Paid $0.02 for a $1500 CAKE to USDC trade. The concentrated liquidity thing is confusing at first but once you get it, it’s like unlocking a cheat code. Also, the CAKE burn mechanism is real-supply is dropping fast.

Sunil Srivastva

For anyone new to v3: start small. Pick a tight price range for a pair you’re watching, like CAKE/USDC between $2.50-$2.65. Monitor it for a day. You’ll see how your liquidity earns fees even when you’re asleep. Don’t overcomplicate it. The interface is intuitive. And yes, the bridge is slow-but it’s reliable. I’ve bridged 6 times now, zero losses.

Devyn Ranere-Carleton

is this even real? i thought gas was always gonna be a thing. like… how is it only 3 cents??

Kevin Thomas

If you’re still using Uniswap on Arbitrum, you’re literally throwing money away. $0.04 vs $0.02? That’s 100% more fees. And don’t even get me started on SushiSwap-$0.05? For what? To watch your trade take 10 seconds longer? This isn’t a debate. PancakeSwap is the only game in town. Cross-chain swaps? Airdrops? Liquidity depth? It’s not even close. Stop wasting your time.

Pamela Mainama

I switched last week. No more panic when the market moves. Fees are so low I don’t even think about them anymore. It feels like crypto was meant to be this way.

Rachel Stone

Wow. So this is what ‘decentralized finance’ looks like when someone actually built something useful. Who knew?

Nickole Fennell

I CANNOT BELIEVE THIS IS REAL. I just swapped $5,000 and my wallet didn’t even blink. I cried. I’m not even kidding. I’ve been through so many rug pulls and gas wars. This is the first time I’ve trusted a DEX with my life savings. I’m telling my whole family. My mom is going to start trading now. I’m not even joking.

Gurpreet Singh

In India, we’ve always struggled with high fees and slow networks. This changes everything. I’ve been using PancakeSwap on BNB Chain for years, but Arbitrum? It’s like going from dial-up to fiber. The bridge is a bit slow, but worth it. And the CAKE airdrop? I got mine. Still can’t believe it.

Christopher Michael

Let’s be clear: this is the most technically sound DEX deployment on any L2. The audit reports from CertiK and PeckShield are public. The contract addresses are verified. The liquidity is deep. The team has consistently delivered. This isn’t hype. It’s infrastructure. And if you’re not using it, you’re not just behind-you’re obsolete.

Rico Romano

PancakeSwap? That’s a Binance shill. You think this is ‘decentralized’? It’s just another centralized exchange with a different logo. The CAKE airdrop? CoinBase One? That’s corporate crypto. You’re being groomed. This isn’t freedom. It’s a branded experience.

Jack Petty

They’re tracking your trades for the airdrop. You think that’s free? Nah. They’re building a profile. Soon they’ll limit who gets rewards. This isn’t DeFi. It’s a loyalty program with crypto tokens. Wake up.

Tressie Trezza

It’s interesting how something so simple-lower fees, faster trades-feels like a revelation. We’ve been conditioned to accept slow, expensive systems as normal. Maybe the real breakthrough isn’t the tech… it’s that we finally stopped accepting the bad.

Gustavo Gonzalez

You’re all missing the point. This isn’t about fees. It’s about control. The fact that they’re pushing cross-chain swaps means they’re trying to lock you into their ecosystem. CAKE isn’t a token-it’s a tether. And the airdrop? That’s a trap. You think you’re getting free money? You’re giving them your on-chain identity. This is surveillance capitalism with a DeFi mask.

mary irons

They’re lying about the burn. I checked the blockchain. They’re just moving tokens to a black hole wallet. No actual burn. And the ‘deflationary’ claim? Marketing fluff. They’re pumping CAKE to get you to stake before they dump. Don’t be fooled.

Gary Gately

i tried it and it worked like a charm. the bridge took a lil longer than expected but no biggie. swap was smooth. fees were crazy low. i’m hooked.

Gareth Fitzjohn

The operational efficiency here is remarkable. A well-executed Layer 2 implementation with clear utility and measurable cost advantages. Not all DEXes can claim this level of polish.

Katie Teresi

You’re all sheep. This is just another way for Binance to control the market. They’re not helping you-they’re harvesting your data and your assets. Wake up before it’s too late.

Moray Wallace

I appreciate the clarity of this write-up. The comparison table alone saved me hours of research. Thank you.

Lori Quarles

I used to hate crypto because of the fees. Now I’m making weekly swaps and actually enjoying it. This is what innovation looks like. Thank you for showing us the way.

Jeremy Dayde

I’ve been using PancakeSwap v2 on BNB Chain for three years and I was skeptical about switching to v3 on Arbitrum but honestly the difference is night and day the interface is so much smoother and the speed is unreal I didn’t realize how much I was suffering from slow confirmations until it was gone and the bridge was surprisingly easy to use even for someone who’s not techy like me I’ve been doing small trades for a week now and I’ve only paid like 15 cents in total fees which is insane and I’ve already started adding liquidity to CAKE USDC because the yield is decent and I feel like I’m actually contributing instead of just gambling and I’m not even mad about having to monitor the price ranges anymore because it feels more intentional like I’m in control not the market and I just want to say thank you for writing this because I was about to give up on DeFi until I read this and now I’m actually excited about the future