Kambria (KAT) Tokenomics Calculator

How Supply Figures Affect KAT Value

Kambria's tokenomics have conflicting supply data. Enter your own values to see how different supply scenarios impact market cap and price.

Note: Current KAT price is approximately $0.00006226 (as of October 2023)

Results

Ever stumbled on a crypto project that promises to let anyone co‑own breakthrough tech? That’s the pitch behind Kambria and its KAT token. If you’re wondering what the coin actually does, whether it’s worth a glance, and how you could even get involved, this guide breaks it all down in plain English.

Key Takeaways

- Kambria (KAT) is an ERC‑20 token that powers a DAO‑based platform for deep‑tech innovation.

- It launched in 2018, backed by institutions like Stanford University and Nanyang Technological University.

- Token supply figures differ: many sources list a max of 5 billion KAT, while others show 2.71 billion.

- Liquidity is extremely low - 24‑hour volume was about $10.80 in Oct 2023.

- Future success hinges on growing its micro‑DAOs and attracting real‑world developers.

What Is Kambria?

Kambria (KAT) is a decentralized innovation platform built on the Ethereum blockchain. The project’s core idea is simple: let a community of engineers, researchers, and investors pool resources into “micro‑DAOs” that develop deep‑tech solutions, then share any commercial revenue.

The token itself, KAT, acts as the utility currency inside the ecosystem. Innovators use KAT to fund proposals, manufacturers pay for access to finished tech, and community members earn a slice of profits when a product hits market.

How the DAO Model Works

Kambria’s DAO isn’t just a voting contract; it’s a full‑stack framework for project life‑cycles. Here’s the typical flow:

- Proposal Submission: A team drafts a tech solution - think AI‑powered robotics or quantum‑ready software - and posts it on Kambria.io.

- Community Funding: Anyone holding KAT can allocate tokens to the proposal. The minimum threshold is set by the project lead.

- Micro‑DAO Formation: Once funded, a dedicated micro‑DAO is created. Governance rules, revenue split, and milestones are codified in smart contracts.

- Development & Review: The team works on the product while the DAO monitors progress. Monthly updates are required; failing to meet them can trigger a vote to reallocate funds.

- Commercialization: When the product is ready, the DAO negotiates licensing or sales deals. Revenue streams flow back to KAT holders according to the pre‑agreed split.

This structure aims to democratize ownership of high‑tech IP, something you rarely see outside of traditional corporate labs.

Tokenomics - Supply, Distribution, and Price History

Understanding the numbers helps you gauge risk. Below is a snapshot of the most commonly cited figures (as of Oct 2023):

| Metric | Value |

|---|---|

| Total Supply (reported) | 5 billion KAT (IQ.wiki, CryptoPotato) / 2.71 billion KAT (CoinMarketCap) |

| Circulating Supply | ≈1.2 billion KAT (IQ.wiki) / 1.77 billion KAT (CoinMarketCap) |

| Market Cap | ≈$120,660 |

| 24‑h Volume | $10.80 (very low liquidity) |

| All‑Time High Price | $0.0326 (2021) |

| Current Price | ≈$0.00006226 |

The huge gap between total and circulating supply shows many tokens are still locked or reserved for the DAO program. Low daily volume means any sizable trade will swing the price dramatically - a key risk for newcomers.

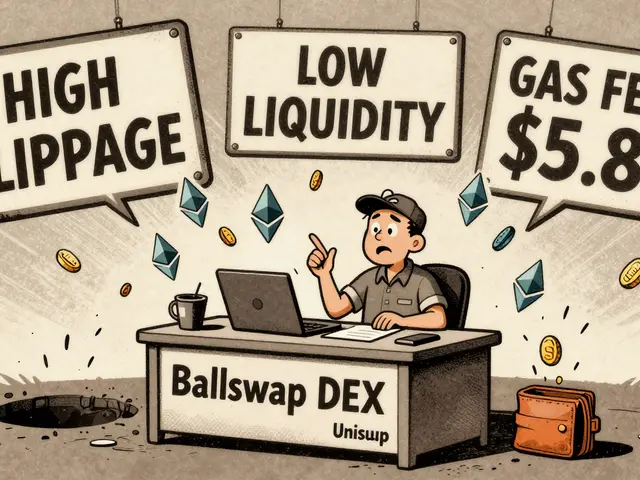

Where You Can Trade KAT

Kambria’s listing footprint is tiny. KuCoin is the only exchange with an active KAT pair. Because order books are shallow, you’ll often need to place limit orders and be prepared for partial fills.

If you already have an Ethereum‑compatible wallet (MetaMask, Trust Wallet, etc.), you can also receive KAT via its contract address and hold it off‑exchange. Just remember to add the token manually - most wallets won’t list KAT by default.

How to Acquire & Use KAT

- Set Up a Wallet: Install MetaMask, fund it with ETH for gas, and add the KAT contract address.

- Buy on KuCoin: Register, complete KYC if required, deposit USDT or BTC, and place a market or limit order for KAT.

- Transfer to Your Wallet: Withdraw the purchased KAT to your MetaMask address to interact with the DAO platform.

- Participate in a Micro‑DAO: Browse proposals on Kambria.io, stake the amount you want, and track progress in the dashboard.

Even if you’re just holding KAT for speculation, the same steps apply - just skip the staking part.

Risks, Criticisms, and Common Pitfalls

Every crypto has a risk profile, and Kambria’s is on the higher side for several reasons:

- Liquidity crunch: With a $10 daily volume, buying or selling any meaningful amount will move the price.

- Small community: Only about 4,200 token holders are recorded, which means limited peer support and fewer eyes on the project.

- Unclear token supply: Conflicting reports on max supply make market‑cap calculations shaky.

- Technical barrier: Joining a micro‑DAO requires solid knowledge of Ethereum transactions, smart‑contract governance, and the specific deep‑tech domain.

Many analysts label KAT as a high‑volatility asset. If you decide to invest, treat it like a speculative blot rather than a long‑term store of value.

Future Outlook - Will Kambria Gain Traction?

Predictions diverge wildly. Some models (SwapSpace) project a price of $0.0015 by 2025 if liquidity improves, while others (CoinLore) point to a 96 % drop over five years as a warning sign. The decisive factor is whether Kambria can scale its micro‑DAO experiment beyond the current four global groups.

Institutional backing from Stanford University and Nanyang Technological University lends credibility, but credibility alone won’t pump the token. Real‑world product launches, broader exchange listings, and a surge in active developers would be the signals to watch.

Quick FAQ

What does KAT stand for?

KAT is the ticker symbol for the Kambria token. It doesn’t stand for a longer phrase; the project simply uses the three‑letter code for trading.

Is Kambria a blockchain itself?

No. Kambria runs on the Ethereum network using ERC‑20 smart contracts. It leverages Ethereum’s security and does not maintain a separate chain.

How can I join a Kambria micro‑DAO?

First, acquire KAT in a wallet. Then, visit Kambria.io, browse the list of active proposals, and click “Stake” on the one you like. You’ll need to approve a transaction in your wallet and lock the tokens for the duration of the project.

What are the main risks of holding KAT?

Liquidity is the biggest risk - you may not be able to sell without slippage. Additionally, the community is small, the token supply data is inconsistent, and meaningful participation requires technical expertise.

Where is KAT listed?

Currently the only active exchange listing is on KuCoin. Off‑exchange, you can hold KAT in any ERC‑20 compatible wallet.

Bottom Line

Kambria tries to turn crypto into a tool for collective tech creation. The vision is compelling, and the academic partners add a layer of legitimacy. But the market numbers paint a stark picture: low liquidity, tiny holder base, and a token price deep in the weeds. If you’re intrigued by DAO‑driven R&D and are comfortable with high risk, a modest KAT allocation could be a way to watch the experiment unfold. If you need stability or quick exits, you’ll probably look elsewhere.

Comments (22)

Ryan Comers

Kambria? More like a crypto soap opera-just another over‑hyped fad! 😂

Prerna Sahrawat

One must first acknowledge that the very notion of a "decentralized innovation platform" smacks of utopian hubris, a term I have witnessed countless times in whitepapers that never materialize. The authors of the Kambria dossier appear to have conflated academic partnership with actual productization, a classic case of name‑dropping Stanford to mask a lack of tangible deliverables. Their tokenomics section reads like a fever dream, oscillating between a 5‑billion supply and a 2.71‑billion figure, thereby confusing any rational investor. Moreover, the liquidity statistics-$10.80 in 24‑hour volume-signify not merely illiquidity but a market that is effectively dead. The micro‑DAO structure is presented as revolutionary, yet the governance mechanisms are so opaque that even seasoned DAO participants would balk at committing capital. In practice, the threshold for proposal funding is undeclared, silently setting a barrier that filters out anyone but the project's inner circle. The purported revenue‑sharing model is untested, lacking any precedent beyond speculative token economics. While the partnership with Nanyang Technological University may lend a veneer of legitimacy, it does not guarantee any pipeline of breakthrough hardware or software. The article neglects to discuss the regulatory landscape, which for a token of this nature could entail securities law complications. The token’s price history peaked at $0.0326 in 2021, a spike likely driven by speculative hype rather than fundamental value. The reliance on KuCoin as the sole exchange listing further underscores the project's marginalization from mainstream liquidity venues. One must also consider the broader macro‑economic context: with global crypto markets in a prolonged bearish phase, projects like Kambria face an uphill battle for relevance. The community size, reported at roughly 4,200 holders, suggests a meager base insufficient for robust network effects. In short, the project is a textbook example of a technically ambitious but financially under‑funded venture that trades on academic prestige rather than on proven market demand. I advise potential participants to treat KAT with the same caution one would apply to a speculative biotech startup without FDA approval. Finally, the notion that anyone can "co‑own" breakthrough technology is, frankly, a romantic delusion without a clear pathway to enforceable IP rights. Proceed with the vigilant skepticism that only seasoned cryptonauts possess.

Anna Kammerer

Look, if you actually want to get KAT into your wallet, the first step is to fund a MetaMask with a tiny amount of ETH for gas-don’t try to spend all your ETH at once, that’ll just burn you. Then you copy the contract address from the official site (double‑check it) and add it manually; wallets won’t auto‑detect KAT. The only exchange that lists it right now is KuCoin, so you’ll have to register there, pass KYC, and hope the order book isn’t empty-yeah, it often is. Once you have KAT, you can stake it on Kambria.io, but remember you’re locking up tokens in a smart contract that will only return them after a milestone is met, so treat it like a lock‑in rather than a free‑float. Also, be aware that the token’s price is so low that any sizable buy will cause slippage, so use limit orders if you can. And if you’re just holding for speculation, skip the staking and keep it in your personal wallet-just don’t expect massive gains without a real product launch. Lastly, the community forums are small; you’ll probably be answering your own questions. Good luck, and may your gas fees be low!

Mike GLENN

Honestly, I feel a bit sorry for anyone who thinks Kambria is a magic bullet for crypto profits. The platform’s concept of micro‑DAOs is intriguing, but the execution feels half‑baked. You need a decent grasp of smart‑contract interactions just to participate, which is beyond most retail investors. The token’s liquidity is practically nonexistent; you’ll spend half your time waiting for a match on KuCoin. On the bright side, the academic backing could eventually produce something worthwhile, but that’s a long‑term gamble. If you’re looking to dip your toe in, start with a tiny amount of KAT, just to understand the mechanics. Watching how proposals get funded (or die) can be an educational experience, albeit a pricey one. Remember, every time the price spikes, it’s probably due to a single whale moving the market, not organic demand. So, keep expectations low and treat it as an experimental hobby rather than a serious investment vehicle. If you have the technical chops, you might enjoy the governance side, but for most, the friction outweighs the fun.

BRIAN NDUNG'U

Dear prospective participants, it is with great enthusiasm that I invite you to consider the strategic merits of engaging with the Kambria ecosystem. While the token’s market performance may appear modest, the underlying framework presents a unique opportunity for collaborative innovation. By allocating a modest portion of your portfolio to KAT, you position yourself at the forefront of a potential paradigm shift in decentralized R&D. I encourage a disciplined approach: commence with a small acquisition, observe the governance processes, and incrementally increase exposure should the platform demonstrate measurable progress. Let us champion the spirit of collective advancement together, guided by prudence and optimism.

Nikhil Chakravarthi Darapu

From a strictly American perspective, the notion of outsourcing cutting‑edge research to a token‑driven DAO raises serious concerns about national technological sovereignty. While Kambria touts its academic affiliations, one must question whether critical intellectual property is being relinquished to a jurisdictionless entity. The token’s minuscule liquidity further undermines confidence in its capacity to fund sizable American‑led projects. Precision in contract language is essential; any ambiguity could expose domestic innovators to undue risk. Therefore, I advise a cautious, measured approach, ensuring that any participation aligns with U.S. regulatory frameworks and safeguards national interests.

Ryan Steck

Yo, everybody thinks this KAT thing is just another crypto scam, but they dont tell ya how the whole thing is probably a front for a big corp, like deep state tech labs pulling strings. The low volume? That's just them sucking all the liquidity to keep the price low and dump on us later. Plus, those univeristy partnerships are just a PR cover‑up. Stay woke, dont put your money where the hidden agenda feeds.

James Williams, III

From a technical standpoint, Kambria's architecture leverages ERC‑20 standards which simplifies integration with existing DeFi tooling. However, the platform's low on‑chain activity suggests a paucity of real‑world usage metrics. The micro‑DAO model, while theoretically scalable, suffers from high gas costs on Ethereum-potentially deterring smaller contributors. Interoperability with layer‑2 solutions could mitigate this, but the roadmap remains vague. In short, the tech stack is sound, yet the economic incentives need stronger alignment to drive sustainable participation.

Patrick Day

Honestly, I think there's a hidden group pulling the strings on Kambria-everything's too quiet, like they're waiting for a trigger.

Scott McCalman

Okay, here’s the deal: if you want to understand KAT, think of it as a tiny piece of an enormous puzzle where most pieces are missing. 🤔 The only exchange listing on KuCoin is like trying to sell a car on a one‑person Craigslist thread. 🏎️ And the supply numbers? They’re as confusing as a math test without a calculator. Bottom line: treat it as a speculative experiment, not a stable asset.

PRIYA KUMARI

Let’s cut through the hype: Kambria’s tokenomics are a mess, the liquidity is abysmal, and the community is practically non‑existent. The project bleats about “deep‑tech innovation” while offering nothing more than a vague DAO framework and a token that’s barely tradable. If you’re looking for real returns, look elsewhere; this is a textbook case of a over‑promised venture with zero execution.

johnny garcia

In contemplating the ontological implications of a token‑driven micro‑DAO, one must recognize the dialectic between decentralization and the inevitability of hierarchical emergence. 🤔 While Kambria aspires to a democratized R&D ecosystem, the scarcity of liquidity and the concentration of token holdings suggest a de facto centralization. Yet, from a phenomenological perspective, the act of staking KAT may embody a collective intentionality that transcends mere financial speculation. Thus, the project operates at the intersection of epistemic aspiration and pragmatic limitation.

del allen

Hey, just wanted to say I get why people are curious about KAT-it's kinda cool that you can actually fund a project with a token. I tried setting up my wallet and it was a bit of a pain, but once it's done, you can actually see the proposals live. Hope more folks jump in so the community grows! :)

Donnie Bolena

What an exciting opportunity!!; The platform might be small now, but imagine the breakthroughs we could see if more innovators join!!; Even with the low volume, every token staked is a vote for progress!!!

Elizabeth Chatwood

keep it real we cant expect big gains from a token thats barely moving keep your expectations low and dont lose sleep over it

John Lee

Look, I see both the promise and the pitfalls here. If the community can rally around a few solid proposals, the DAO could grow organically. But without a clear roadmap and more exchange listings, it’ll stay a niche experiment. Let’s stay hopeful but keep our feet on the ground.

Jon Miller

Drama aside, Kambria is just another crypto project trying to ride the DAO wave. If you’re into that, go for it; otherwise, there are better places to park your money.

Rebecca Kurz

Honestly, i think the whole thing is a set‑up, the low volume is a sign that they dont want anyone to actually trade it, its a trap!

Tiffany Amspacher

One could argue that the very act of staking KAT is a metaphor for humanity's quest to co‑author its own technological destiny-an audacious yet profoundly poetic endeavor.

Lindsey Bird

Ugh, another crypto hype train. I barely have the energy to read the whitepaper, let alone stake tokens. Save your breath.

john price

Look, if you think Kambria is some grand experiment, you’re missing the point that it's a risky speculative play. The token's price is effectively negligible, and the liquidity is practically non‑existent. Unless you enjoy watching your money evaporate, steer clear.

Jessica Pence

For anyone considering diving into KAT, start by securing a reputable ERC‑20 wallet and ensure you have a small amount of ETH for gas. Use the official contract address to add the token manually, then monitor the KuCoin order book for any viable liquidity. If you’re looking to participate in micro‑DAOs, browse proposals on Kambria.io, but keep your stake modest until the platform proves its stability. Good luck, and stay vigilant.