Imagine buying a house and finding out the title was forged - not by some shady lawyer, but by someone who hacked the county’s outdated database. Or receiving a luxury watch that costs $5,000, only to learn it’s a counterfeit made in a garage. These aren’t rare cases. They happen every day. And the systems meant to stop them? They’re broken. That’s where blockchain transparency changes everything.

Why Fraud Thrives in Hidden Systems

Fraud doesn’t survive in the open. It thrives in silence - in paper files locked in filing cabinets, in databases controlled by one company, in spreadsheets no one audits. Traditional systems rely on trust: trust that the bank recorded the right amount, trust that the warehouse shipped what was ordered, trust that the title office didn’t lose the deed. But trust is fragile. One corrupt employee, one hacked server, and the whole system collapses. Blockchain fixes this by removing the middleman and replacing trust with proof. Every transaction is recorded on a public, shared ledger. Not stored in one place. Not controlled by one entity. Spread across thousands of computers worldwide. And once it’s written? It’s permanent.How Blockchain’s Transparency Works

Think of blockchain like a digital notebook that everyone can see but no one can erase. Every time someone makes a transaction - say, transfers ownership of a piece of land or ships a box of medicine - it’s added as a new page. That page is linked to the one before it using cryptography. Change even one letter on page 50? You’d have to rewrite every page after it, and get 51% of the network to agree. That’s impossible without controlling the majority of the network. This is called immutability. It’s not magic. It’s math. Each block has a unique fingerprint - a hash - that depends on everything before it. Alter anything, and the hash changes. The network notices. The transaction gets rejected. Add to that: every participant in the network can verify the transaction themselves. No need to call a third party. No waiting days for confirmation. You see it. You check it. You know it’s real.Real Estate: Ending Title Fraud

In the U.S. alone, title fraud costs homeowners over $1 billion annually. Scammers forge signatures, steal identities, and file fake deeds. Traditional land registries are messy. Records are scattered across counties. Some are still on microfiche. It’s easy to slip through the cracks. Blockchain changes that. Companies like Propy and TitleChain now use blockchain to record property titles. When a house is sold, the transfer is logged on the chain. The buyer’s identity is verified with digital signatures. The deed can’t be altered. Previous owners, liens, and mortgages are all visible. No more hidden mortgages. No more fake deeds. If someone tries to sell a house they don’t own, the blockchain shows the real owner - instantly. Cities like Georgia and Illinois have tested blockchain-based land registries. Results? Fraud dropped by 90%. Processing time went from weeks to minutes.Supply Chains: Stopping Counterfeit Goods

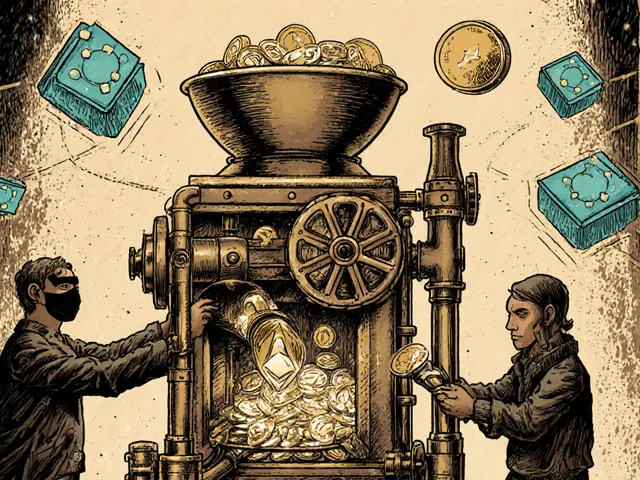

You think your $300 sneakers are real? They might not be. The global counterfeit market is worth over $500 billion a year. Fake pharmaceuticals, electronics, even baby formula - all flood the market because supply chains are opaque. Blockchain fixes that by tracking every step. A bottle of insulin leaves the factory. That’s recorded. It moves to the distributor. Recorded. Then the pharmacy. Recorded. Each step includes a timestamp, location, and digital ID of the handler. If a fake bottle appears, the blockchain shows where it entered the chain - and who was responsible. Walmart uses blockchain to track food from farm to shelf. In 2022, they traced the origin of mangoes in 2.2 seconds. Before? It took seven days. And when a supplier tried to slip in substandard produce, the system flagged it immediately.

Finance: Catching Insider Fraud

Banks lose billions to internal fraud - employees manipulating transactions, falsifying invoices, laundering money. Traditional audits are slow and reactive. By the time they catch it, the damage is done. Blockchain makes fraud visible in real time. Every payment, every transfer, every adjustment is recorded permanently. Smart contracts can be set up to auto-flag anything unusual - say, a payment over $10,000 going to a new vendor with no history. No human needs to review it. The system does it automatically. HSBC and JPMorgan have piloted blockchain-based ledgers for trade finance. In one case, they reduced fraudulent invoice claims by 80%. Why? Because every document was hashed and stored on-chain. No one could swap out a fake invoice for a real one.Anti-Corruption: Public Money, Public Ledger

Corruption thrives in secrecy. When government contracts are awarded behind closed doors, kickbacks happen. When aid money disappears, no one knows where it went. Estonia uses blockchain to track public spending. Every euro spent by a ministry is recorded on a public ledger. Citizens can see exactly who got paid, for what, and when. In 2023, a whistleblower flagged a suspicious contract. The blockchain showed the vendor had been paid twice - and both times to the same bank account. The case was closed in 11 days. The World Bank now recommends blockchain for aid distribution in fragile states. In Kenya, blockchain was used to send cash to refugees. No middlemen. No theft. Every transfer was traceable.What Blockchain Can’t Fix

But here’s the catch: blockchain doesn’t fix bad data. If you record a fake transaction, the blockchain will still record it - perfectly. It doesn’t know if the person claiming to own the house is lying. It doesn’t know if the drug shipment was actually inspected. Blockchain is like a security camera. It doesn’t prevent a robbery. It just records it. If the thief walks in with a fake ID, the camera still films him - but the ID is still fake. That’s why trusted data entry matters. Blockchain needs identity verification, digital signatures, and human checks at the point of input. The tech is solid. The humans at the front end? That’s the weak link.

Comments (13)

Anselmo Buffet

Blockchain doesn’t fix bad data but it sure makes it harder to hide.

Kathryn Flanagan

Let me tell you something important. When I first heard about blockchain, I thought it was just another tech buzzword, you know? Like NFTs or metaverse. But then I saw how my cousin in Georgia used it to sell her house-no more waiting weeks for title checks, no more shady lawyers hiding documents. It was just… clear. Everyone could see who owned what, when, and why. And honestly? That’s peace of mind. No more nightmares about someone stealing your home with a fake signature. It’s not magic, but it’s close. And the best part? It’s not just for big companies. A local bakery in my town started using it to prove their flour is organic. Imagine that. A little shop, doing big things with simple tech. It’s not about being fancy. It’s about being honest. And if we can make honesty easy, why wouldn’t we?

JoAnne Geigner

I love how you framed this-not as a tech revolution, but as a shift in how we relate to truth. It’s not about replacing people, it’s about giving them the tools to be trustworthy. I’ve seen too many systems where one person’s mistake or malice collapses everything. Blockchain doesn’t make people perfect, but it makes lying… inconvenient. And sometimes, that’s all we need.

Rakesh Bhamu

From India, I’ve seen how corruption drains public trust. In rural areas, farmers still get shortchanged because payments get lost in paper trails. When I heard about Kenya’s blockchain aid system, I cried. Not because it’s perfect-but because it’s possible. No middlemen. No bribes. Just a digital trail that even a grandmother with a basic phone can verify. This isn’t just for rich countries. It’s for the forgotten. The tech is simple. The impact? Life-changing.

Ian Norton

Let’s be real. You think blockchain stops fraud? Or does it just move it to the front end? Someone still has to input the data. If a corrupt official says a fake shipment is real, the blockchain records it faithfully. That’s not transparency-that’s automation of lies. And don’t get me started on how many ‘blockchain’ systems are just centralized databases with a fancy name. You’re not solving the problem. You’re just making it look digital.

Andy Walton

broooooo… blockchain is the new religion 😭✨ everyone’s worshiping the immutable ledger like it’s gonna save us from capitalism… but what if the person scanning the QR code on the milk carton is just lying?? 😭 the camera doesn’t care if you’re a thief… it just films you being a thief… and then you get a tax write-off?? 🤡

Claire Zapanta

Let me tell you something the Silicon Valley elites won’t admit: blockchain is a Trojan horse for global surveillance. The EU’s 5AMLD? That’s not regulation-it’s digital control. Every transaction tracked. Every citizen monitored under the guise of ‘fraud prevention.’ And who controls the nodes? Big banks. Big tech. The same entities that caused the crisis in the first place. This isn’t transparency. It’s centralized control with a decentralized label. And don’t even get me started on Estonia-your government already knows everything you’ve ever bought. You think this is freedom? It’s just a prettier cage.

Kathy Wood

And yet, people still trust banks. Still trust lawyers. Still trust paper. Why? Because they’re scared of change. This isn’t about tech-it’s about fear. People would rather be lied to by a person they know than told the truth by a machine. Pathetic. Just pathetic.

Alex Warren

Blockchain’s strength isn’t in preventing fraud-it’s in enabling accountability. The system doesn’t assume honesty. It enforces verifiability. That’s a fundamental shift from trust-based to evidence-based systems. And yes, garbage in, garbage out. But now, at least, the garbage is visible. And visibility is the first step toward correction.

Steven Ellis

There’s a quiet beauty in this: blockchain doesn’t shout. It doesn’t need applause. It just… records. Like a river that never forgets where each drop came from. We’ve spent centuries building systems based on reputation, influence, and privilege. Now we have something that says: ‘Show me the proof.’ Not because I trust you-but because I trust the chain. That’s not cold. It’s compassionate. It gives power back to the ones who’ve always been left out of the room.

amar zeid

I’ve worked with supply chains in India-poor infrastructure, lots of fraud. We tried blockchain for spice exports. Took three months to onboard farmers. They didn’t understand QR codes. But after training, one woman said, ‘Now I know if someone stole my cardamom before it reached the port.’ That’s not tech. That’s dignity. Blockchain isn’t about algorithms. It’s about giving people back their truth.

PRECIOUS EGWABOR

Let’s be honest-this is just a fancy way for venture capitalists to rebrand their exit strategies. Real estate on blockchain? Please. The only thing being ‘transparent’ is how much money they’re making off the hype. Meanwhile, actual homeowners are still drowning in paperwork and fees. This isn’t revolution. It’s rebranding.

Patricia Whitaker

Wow. Just wow. You really believe this? You really think a digital ledger is going to stop a guy with a printer and a forged signature? Newsflash: the system was broken before blockchain. Now it’s broken and digital. Congrats. You’ve upgraded from a leaky bucket to a leaky bucket with Wi-Fi.