If you're looking for a decentralized crypto exchange that actually rewards you just for holding its token, Ballswap might have caught your eye. But here’s the truth: it’s not another Uniswap. It’s not even close. Ballswap is a tiny, niche player in a market dominated by giants, and whether it’s worth your time depends entirely on what you’re looking for. If you want fast trades, low fees, or deep liquidity - walk away. But if you’re okay with slow swaps, high slippage, and betting on a community reward system that’s still unproven? Then maybe, just maybe, it’s worth a small test.

What Exactly Is Ballswap?

Ballswap is a decentralized exchange (DEX) built on Ethereum. That means no central company controls it, no KYC, and no middleman. You trade directly from your wallet using smart contracts. Its native token, BSP, runs on the Ethereum blockchain as an ERC-20 token. The platform launched its mainnet in August 2022 and is currently on version 1.2. It doesn’t have a mobile app. You access it through your browser using wallets like MetaMask or Trust Wallet.

What sets Ballswap apart? It’s not the interface. It’s not the speed. It’s the rewards. While most DEXs like Uniswap take transaction fees and keep them, Ballswap gives back 45% of every swap fee to BSP token holders. That’s not a gimmick - it’s baked into the tokenomics. Every time someone trades on the platform, a slice of the fee gets distributed automatically to everyone holding BSP. No staking required. Just hold.

How Does Trading Work on Ballswap?

Using Ballswap is straightforward if you’ve used other DEXs before. Here’s the exact process:

- Create a swap request - pick the token you want to trade and the one you want to receive.

- Confirm the details - rate, slippage tolerance, and estimated gas fee.

- Approve the token transfer - this is a separate transaction on Ethereum that lets Ballswap move your tokens.

- Send the tokens - once approved, the swap executes and you get your new tokens.

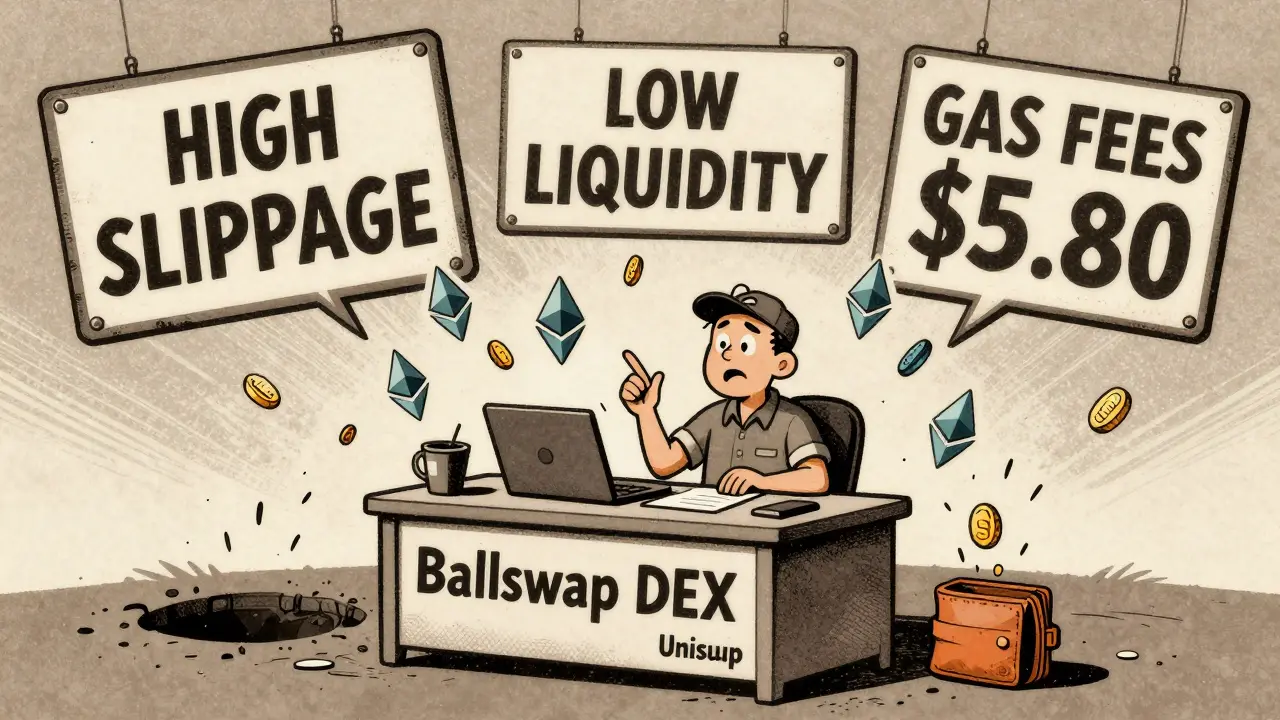

Each swap takes 15 to 30 seconds, depending on how busy the Ethereum network is. Gas fees? They range from $1.20 to $5.80. That’s typical for Ethereum right now. But here’s the catch: because Ballswap has so little liquidity, slippage is brutal. On trades over $100, slippage averages 2.8%. Compare that to Uniswap’s 0.35%. That means if you try to swap $500 of ETH for BSP, you might end up with $15 to $20 less than you expected. That’s not a bug - it’s the default behavior.

Liquidity and Trading Pairs - The Big Problem

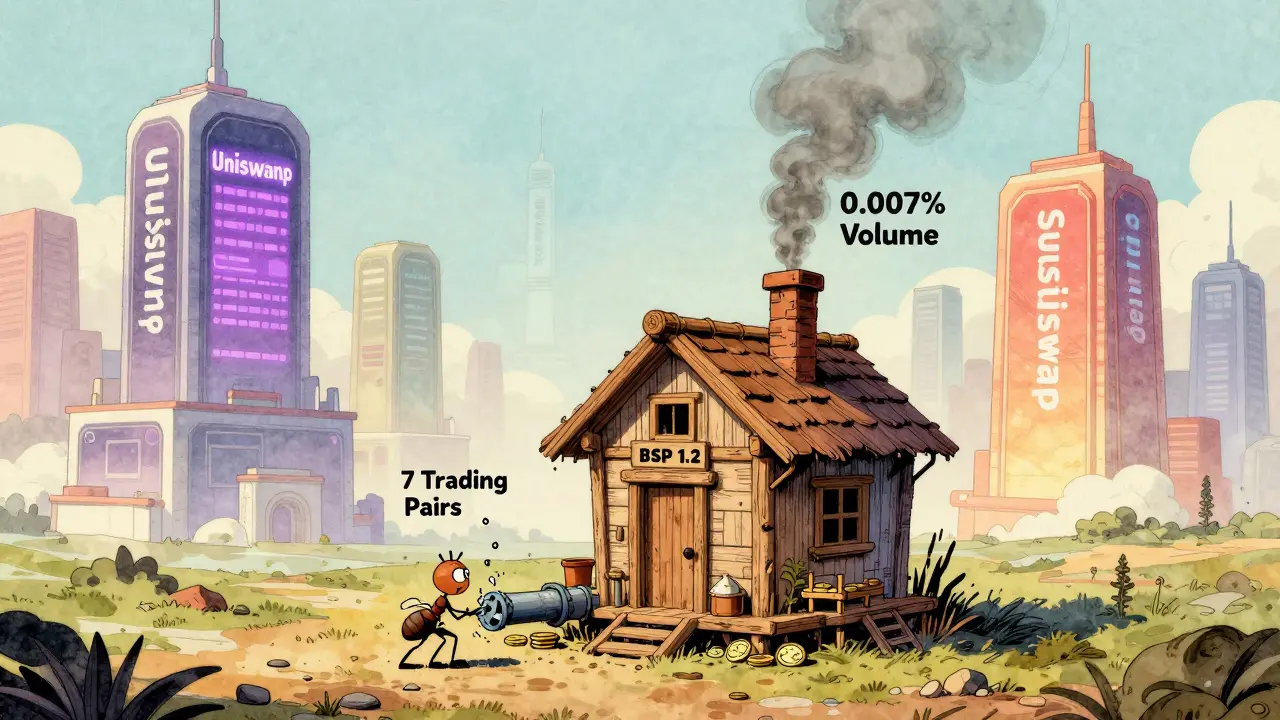

Ballswap supports only 7 trading pairs. That’s it. You can swap BSP for ETH, USDT, WBTC, and a few others - but that’s all. No SOL, no AVAX, no new memecoins. If you’re looking to trade anything outside the top 5 Ethereum-based assets, you won’t find it here.

Total Value Locked (TVL) on Ballswap is around $8.7 million. That sounds like a lot until you realize Uniswap has over $5 billion. PancakeSwap? Over $1 billion. Ballswap’s TVL is less than 0.2% of Uniswap’s. That’s not just small - it’s statistically irrelevant. Low liquidity means wider spreads, higher slippage, and fewer traders. It’s a vicious cycle: low volume scares away traders, which keeps volume low.

And the daily trading volume? Around $142,000. Uniswap does over $1.8 billion daily. Ballswap handles 0.007% of that. In a market that processed $1.27 trillion in Q1 2024, Ballswap’s share is 0.00011%. You’re not trading on a platform - you’re trading on a testnet with a real token.

Who Is Ballswap For?

Ballswap isn’t for traders. It’s not for investors looking for growth. It’s not even for DeFi beginners. It’s for one very specific group: people who want passive income from holding a token with no other utility.

If you bought BSP early and still hold it, you’re getting a small daily payout from swap fees. One Reddit user reported receiving 12.7 BSP tokens just for holding - worth maybe $0.50 at current prices. Not life-changing. But better than nothing. That’s the entire value proposition.

For everyone else? It’s a trap. High gas fees. High slippage. No advanced tools. No limit orders. No stop-loss. No mobile app. No customer support worth mentioning. Support emails take 38 hours to get answered. Uniswap’s is under 5 hours. Ballswap’s Telegram has 2,800 members. Uniswap’s has over 200,000.

Security and Risk - What No One Talks About

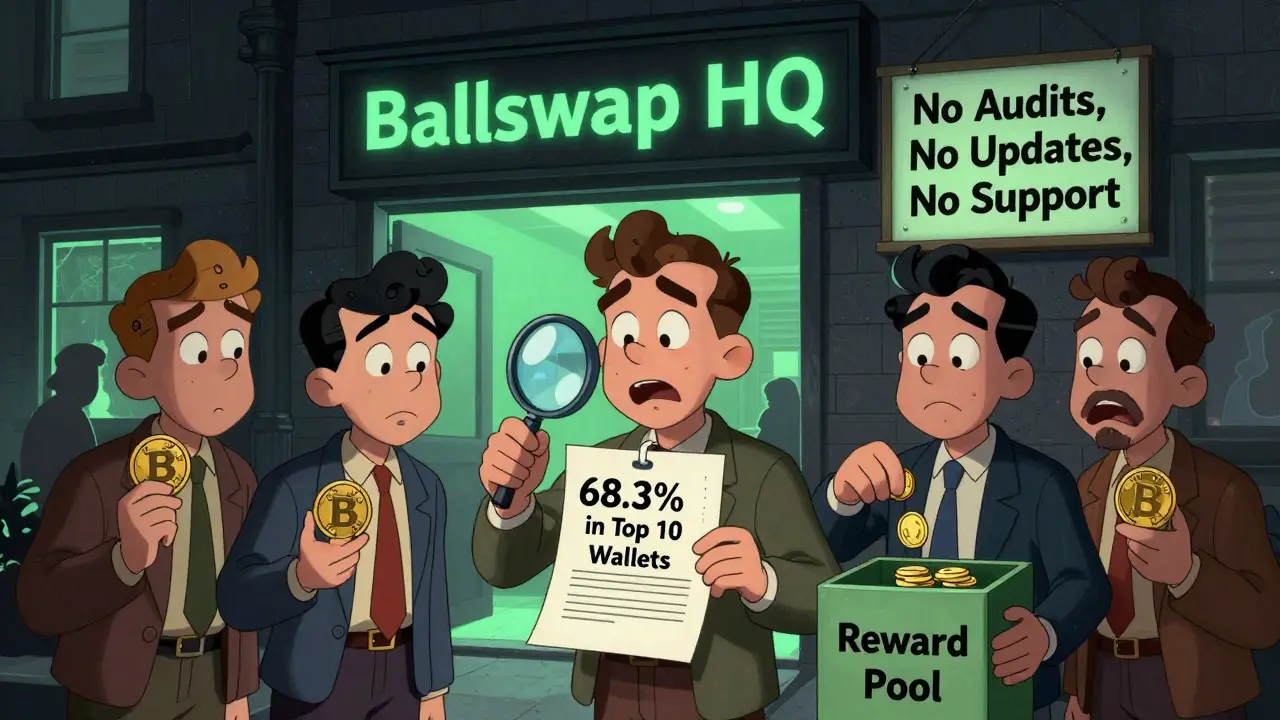

Ballswap hasn’t published any public smart contract audits. Not from CertiK. Not from PeckShield. Not from anyone. That’s a red flag. You’re trusting code that hasn’t been independently reviewed. That’s risky.

And then there’s token concentration. The top 10 wallets hold 68.3% of all BSP tokens. That means a handful of people control the majority of rewards. If they sell, the price could crash. If they move their tokens, the reward pool could dry up overnight. There’s no governance. No voting. No transparency.

DeFi safety expert Sarah Kim rated Ballswap’s security as “medium risk” - and that’s being generous. Most platforms with this level of opacity get rated “high risk.”

Future Plans - Promises Without Proof

Ballswap’s roadmap says they’ll launch “BSP 2.0” by Q4 2024 and add cross-chain support by Q2 2025. Sounds great. Except there are zero technical details. No whitepaper updates. No GitHub commits showing progress. No developer updates. Just a Medium post with vague promises.

Meanwhile, the platform hasn’t added a single new feature since early 2024. The UI got a minor cosmetic update. That’s it. In a market where competitors are adding layer-2 scaling, AI-driven order routing, and institutional-grade tools - Ballswap is standing still.

User Feedback - The Real Story

On Trustpilot, only 12% of users would recommend Ballswap. The industry average for DEXs? 63%. On Reddit, the complaints are consistent: “Lost $28 on a $500 swap.” “Slippage killed my trade.” “Wasted gas for nothing.”

Only 2% of users mention the rewards as a reason to stay. The rest? They’re gone. Bitget’s analysis of 147 verified reviews shows an average rating of 2.3 out of 5. That’s worse than a failing grade.

Final Verdict: Should You Use Ballswap?

Here’s the honest answer:

- Don’t use Ballswap if you want to trade crypto efficiently.

- Don’t use Ballswap if you care about security or transparency.

- Don’t use Ballswap if you’re looking for growth or liquidity.

Only consider Ballswap if:

- You already hold BSP and want to earn small daily rewards.

- You’re willing to lose money on slippage and gas fees for the sake of participation.

- You’re treating it like a lottery ticket - not an investment.

There’s no shame in experimenting with small amounts. But if you’re thinking of putting in more than $100 - don’t. You’ll lose more to fees and slippage than you’ll earn in rewards. Ballswap isn’t a failed project. It’s a side experiment. A quiet echo in a loud room.

For now, it survives because a few people still believe in the idea. But if nothing changes by late 2026, it’ll vanish quietly - like so many others before it.

Is Ballswap a scam?

No, Ballswap isn’t a scam. The platform operates as advertised - it’s a real decentralized exchange with live smart contracts. The rewards are distributed. Transactions go through. But that doesn’t mean it’s safe or smart. It’s a high-risk, low-reward platform with weak liquidity, no audits, and poor user experience. It’s not fraudulent - it’s just not worth your time unless you’re already invested.

Can I earn real money with Ballswap?

You can earn tiny amounts of BSP tokens from swap fee rewards, but the value is negligible. Most users report earning less than $1 per week just for holding. After accounting for gas fees to claim rewards or trade, you’re often breaking even or losing money. It’s not a reliable income source - it’s a side perk for early adopters.

Is Ballswap compatible with MetaMask?

Yes, Ballswap works with MetaMask, Trust Wallet, Coinbase Wallet, and any other standard Ethereum wallet. You just connect your wallet to the Ballswap website and start trading. There’s no separate app or login - it’s all done through your wallet.

Why is slippage so high on Ballswap?

Slippage is high because Ballswap has extremely low liquidity. With only $8.7 million locked and 7 trading pairs, even small trades move the price significantly. When you swap $500, the system has to pull from shallow pools, causing your final amount to be much lower than expected. This is normal on tiny DEXs - but dangerous if you’re not expecting it.

Will Ballswap survive past 2026?

Most analysts say no. With 83% of experts skeptical about its future, and no real development progress since 2023, Ballswap lacks the traction, liquidity, or innovation to compete. Without a major funding injection or a strategic partnership, it’s likely to fade into obscurity by late 2026. It’s not dead yet - but it’s on life support.