Vietnam Crypto Payment Fine Calculator

Key Facts

150-200 million VND fine per violation (approx. $6,500-$8,900 USD)

Law applies to all crypto payments - no exceptions for small transactions

Potential Fine:

Using Bitcoin or any cryptocurrency to pay for goods or services in Vietnam isn’t just risky-it’s illegal. And if you get caught, you could face a fine of 150 to 200 million VND (roughly $6,500 to $8,900 USD). This isn’t a warning from some obscure agency. It’s the law, enforced by Vietnam’s central bank since January 1, 2018. But here’s the twist: owning crypto is fine. Trading it? Still allowed. Just don’t use it to buy coffee, pay rent, or settle a bill at a local shop.

Why Is Using Crypto as Payment Illegal in Vietnam?

The State Bank of Vietnam (SBV) doesn’t hate Bitcoin. It hates what Bitcoin represents: control. When you pay with crypto, you bypass banks, bypass taxes, and bypass oversight. The SBV sees this as a threat to its ability to monitor money flow, track tax evasion, and maintain financial stability. In 2017, the bank made it official: any use of Bitcoin, Ethereum, or other digital tokens as a payment method is a violation of Decree No. 96/2014/ND-CP. The penalty? Between 150 and 200 million VND per offense.This isn’t about banning technology. It’s about keeping financial control in one place. As Le Truong Tung, president of FTP University, explained back in 2017, accepting crypto payments makes the economy harder to track. It opens doors for money laundering, tax fraud, and unregulated transactions. Vietnam’s banking system isn’t built for decentralized money. So instead of adapting, they shut it down.

What Exactly Is Banned-and What’s Still Allowed?

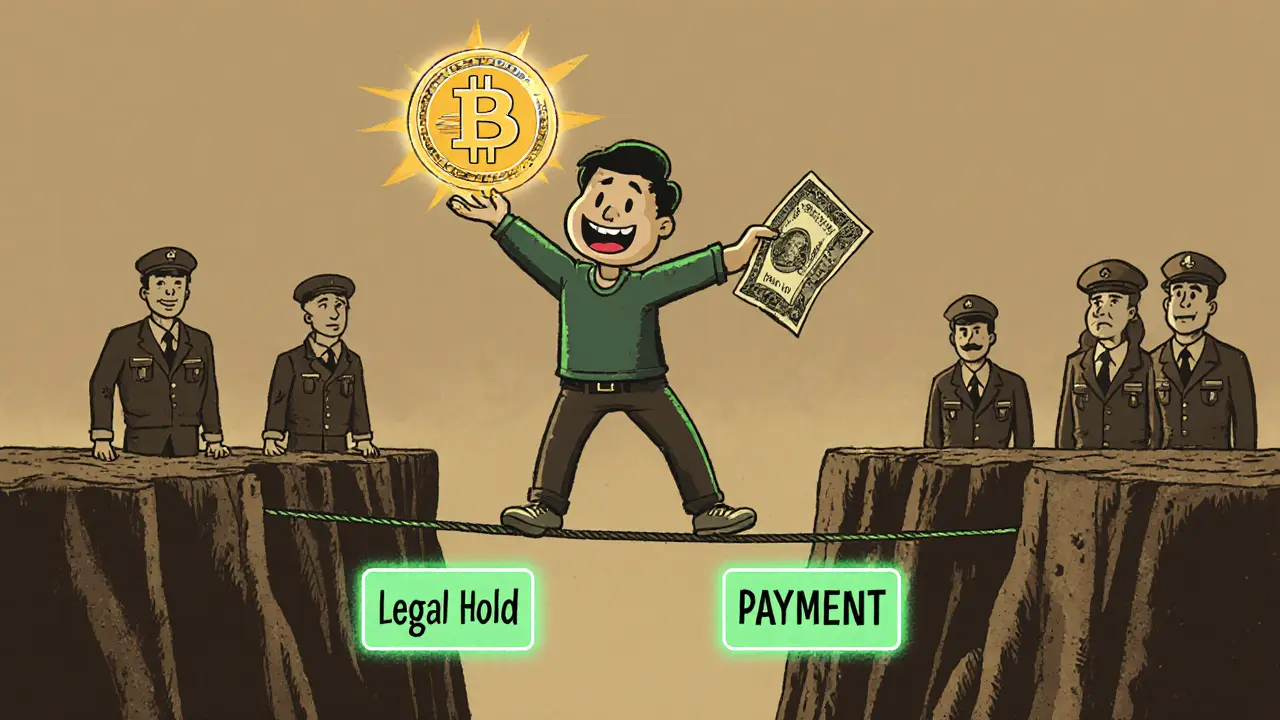

There’s a big difference between using crypto and holding it. Vietnam draws a clear line:- Banned: Paying for products, services, tuition, rent, or anything else with Bitcoin, Ethereum, or any other cryptocurrency.

- Allowed: Buying, selling, trading, or holding crypto as an asset. You can own it. You can speculate on it. You can even transfer it to someone else.

This creates a strange gray zone. Many Vietnamese investors buy crypto on exchanges like Binance or OKX, then hold it as a store of value-similar to gold. But if they try to use it to pay a vendor, even privately, they’re breaking the law. The SBV doesn’t care if you bought it legally. If you use it as money, you’re violating Article 27 of Decree 96/2014/ND-CP.

Even peer-to-peer (P2P) payments are risky. If you’re trading crypto with someone for goods and the transaction is traced-say, through a bank transfer or a flagged wallet-you could still be fined. The law doesn’t distinguish between a shop accepting crypto or two friends trading it for cash. The act of using it as payment is the offense.

How Is This Law Actually Enforced?

Here’s the reality: most people won’t get fined. Not because the law is weak-but because it’s hard to catch.The SBV doesn’t have a team of crypto detectives crawling through wallets. Enforcement happens mostly in two ways:

- Businesses that advertise crypto payments. In 2017, a university in Hanoi planned to accept Bitcoin for tuition. The SBV stepped in within days. The school canceled the program immediately. Public announcements = easy targets.

- Large-scale or suspicious transactions. If the General Department of Vietnam Customs or the Tax Authority spots unusual crypto flows tied to a business, they can investigate. In 2019, the SBV confirmed it had coordinated “additional penal sanctions,” but didn’t release numbers. That’s telling. They’re watching, but they’re selective.

For average users? It’s a game of cat and mouse. Many people use P2P platforms like LocalBitcoins or Paxful to convert crypto to cash, then pay bills with traditional money. It’s indirect, but it works. As long as you don’t openly advertise crypto as payment, the risk is low.

Still, the threat is real. One bad transaction-say, paying for a high-value service like a car or real estate with crypto-could trigger a tax audit or a financial investigation. And once you’re under scrutiny, the 150-200 million VND fine isn’t just a warning. It’s a bill you have to pay.

Why Is Vietnam Still Holding On to This Ban?

Vietnam isn’t alone in banning crypto payments. But it’s one of the few in Southeast Asia that hasn’t moved toward regulation. Thailand and Singapore created licensing systems for crypto exchanges. Vietnam didn’t. Why?Because the SBV still sees crypto as a threat-not a tool. They’ve invested heavily in their own digital payment systems, like the National Financial Inclusion Strategy, which pushed electronic banking and QR code payments. In 2020, 43% of Vietnamese adults used digital payments. That’s higher than the global average. The government wants people to use their systems, not decentralized ones.

Even when the Ministry of Finance started drafting rules in 2022 to tax crypto as an asset, they kept the payment ban intact. The message is clear: you can own crypto, but you can’t spend it like money. This creates a disconnect. Vietnam ranked 8th in the world for crypto adoption in 2021, according to Chainalysis. That means millions of people are using crypto-just not in ways the government approves.

What Happens If You Get Caught?

If you’re fined, here’s what you’re up against:- Amount: 150-200 million VND (about $6,500-$8,900 USD). That’s more than the average annual salary in many rural Vietnamese provinces.

- Process: The SBV or tax authority issues a penalty notice. You have 10 days to pay or appeal.

- Appeal: Possible, but rare. You’d need legal proof that the transaction wasn’t a payment (e.g., it was a gift or a loan). Good luck with that.

- Repeat offenses: No official policy, but repeated violations could lead to higher penalties or criminal charges under banking fraud laws.

There’s no jail time for simple crypto payments-but the fine is steep enough to scare off most businesses. Individuals rarely get targeted unless they’re high-profile or involved in large-scale transactions.

What’s the Future of Crypto Payments in Vietnam?

The law hasn’t changed since 2018. But the world has.More Vietnamese are using crypto than ever. Mobile wallets are everywhere. People want faster, cheaper ways to send money-especially across borders. The SBV’s digital payment systems are convenient, but they’re still tied to banks, fees, and delays.

Experts like Dr. Tran Ngoc Ca from Vietnam’s Academy of Finance say the current system is unsustainable. “The fine is still on the books,” he said in a 2023 interview, “but enforcing it across millions of users is nearly impossible.”

Some believe Vietnam will eventually create a regulated crypto payment system-like a state-backed digital token. Others think the government will double down and criminalize even holding crypto. Neither is certain. But one thing is: the 150-200 million VND fine isn’t going away anytime soon.

For now, the safest move? Use crypto like an investment-not a currency. Buy it. Hold it. Trade it. But when it’s time to pay for something, reach for your bank app. It’s legal. It’s safe. And it won’t cost you a fortune.

Can I get fined for using Bitcoin to pay for a meal in Vietnam?

Yes. Using Bitcoin or any cryptocurrency to pay for goods or services-even at a small café-is illegal under Vietnam’s Decree No. 96/2014/ND-CP. If caught, you or the business could be fined between 150 and 200 million VND. The law doesn’t make exceptions for small amounts.

Is it legal to own cryptocurrency in Vietnam?

Yes. Owning, buying, selling, or trading Bitcoin and other cryptocurrencies is not illegal in Vietnam. The ban only applies to using crypto as a payment method. Many Vietnamese investors hold crypto as an asset, similar to stocks or gold.

Can I use crypto to send money to family overseas from Vietnam?

Technically, sending crypto overseas is allowed since it’s not a payment for goods or services. However, if the recipient converts it to local currency and uses it to pay for something, the transaction could be flagged. The SBV monitors cross-border flows, and large transfers may trigger scrutiny. Use licensed remittance services to stay safe.

What happens if a business accepts crypto payments in Vietnam?

The business is violating the law and can be fined 150-200 million VND. If the business is registered, the fine may also trigger a tax audit. In 2017, a university canceled its Bitcoin tuition plan after the SBV intervened. Publicly advertising crypto payments is the fastest way to attract attention.

Are there any exceptions to the crypto payment ban?

No. There are no exceptions for individuals, small businesses, or nonprofit organizations. The ban applies to all use cases where crypto is exchanged for goods, services, or debts. Even barter transactions using crypto are considered illegal under current regulations.

Has the fine amount changed since 2018?

No. The fine range of 150-200 million VND has remained unchanged since the 2018 enforcement date. Even as cryptocurrency prices have surged and adoption has grown, the legal penalty has not been adjusted. The SBV has not indicated any plans to revise the fine amount.

Comments (15)

Brian Collett

So let me get this straight - you can own Bitcoin like it’s a collectible baseball card, but if you try to use it to buy pho, you’re basically a financial criminal? That’s wild. Vietnam’s playing chess while the rest of the world is playing poker.

Allison Andrews

The irony is that the state’s fear of decentralization is itself a centralized control mechanism. If the goal is financial stability, then suppressing innovation isn’t stability - it’s stagnation dressed up as policy.

Wayne Overton

They’re scared. End of story.

Alisa Rosner

Okay, so here’s the lowdown 🧵: You CAN own crypto ✅, you CAN trade it ✅, you CAN even hold it like digital gold 💰. But if you try to use it to pay for anything? 🚫 BAN. Fine: $7k–$9k. That’s more than most Vietnamese make in a year. So yeah - it’s a deterrent, not a law. The government wants you to use their apps, not yours. Stay safe, use bank transfers, and keep your crypto in a wallet, not at the café. 💡🔒

Lena Novikova

This law is pure nonsense. Everyone knows people are using crypto for payments. The government just doesn’t have the tech to catch them so they make a big scary fine and hope people get spooked. It’s a paper tiger. The real problem? They’re too lazy to adapt

Olav Hans-Ols

Kinda funny how Vietnam’s got one of the highest crypto adoption rates in the world but still treats it like a dirty secret. I mean, if millions are holding it, why not just regulate it properly? Let people pay with it under rules - tax it, track it, but don’t punish them for using tech that works better than their own system.

Kevin Johnston

Crypto isn’t evil 😊 Just use it right! Hold it. Trade it. Don’t pay for tacos with it. Easy 🙌

Dr. Monica Ellis-Blied

It is imperative to recognize that the State Bank of Vietnam’s stance is not merely regulatory - it is a foundational safeguard against systemic financial risk. Decentralized currencies, by their very nature, circumvent the monetary policy mechanisms upon which economic stability is predicated. The imposition of substantial fines is not punitive; it is prophylactic. To permit crypto-based transactions, even in limited contexts, would erode the integrity of the national financial architecture. This is not anti-technology; it is pro-society.

Herbert Ruiz

Why are people even surprised? Vietnam doesn’t trust anything that isn’t state-controlled. They’re still printing money like it’s 1995.

Saurav Deshpande

They say it’s about control - but what if it’s about fear? What if the central bank knows that if people realize they can bypass the system entirely, they’ll stop trusting the dong? What if this isn’t about law - it’s about survival? The moment crypto payments go mainstream, the whole fiat house of cards collapses. And they know it. That’s why they’re screaming louder than anyone.

Paul Lyman

Guys seriously? We’re still arguing about this? People are using crypto to pay for stuff - it’s happening. The government’s just pretending they can stop it. The fine is huge, sure - but how many people are actually getting fined? Like, zero? I bet they’ve only caught a handful of businesses advertising it. Everyone else? They just convert to cash first. It’s not illegal if you don’t say it out loud 😏

Frech Patz

While the legal framework is clearly articulated under Decree No. 96/2014/ND-CP, one must consider the practical implications of enforcement in a digital economy characterized by pseudonymity and cross-border liquidity. The disparity between adoption rates and regulatory enforcement suggests a policy gap that may be unsustainable in the medium term.

Derajanique Mckinney

so like… you can own crypto but not spend it? that’s like having a magic wand but being told you cant wave it. whyyyyyy?? 😩

MICHELLE SANTOYO

They’re not banning crypto - they’re banning freedom. This isn’t about money. It’s about power. And the minute someone realizes they don’t need the government to move their cash… that’s when the real revolution starts. They know it. That’s why they’re terrified.

Clarice Coelho Marlière Arruda

wait so i can buy bitcoin but if i use it to pay my landlord i get fined? so i just convert to cash first? lol that’s the whole workaround. why even have the law if everyone just does the middleman thing anyway? 🤷♀️