When a blockchain changes its rules, it doesn’t just update like a phone app. It splits. And how that split happens - whether it’s smooth and planned or messy and fought over - determines the future of the whole network. You’ve probably heard of Bitcoin Cash or Ethereum Classic. Those are contentious forks. But you’ve also heard of Ethereum’s Shanghai upgrade or the Merge. Those are planned forks. The difference isn’t just technical. It’s about trust, community, and survival.

What a Fork Actually Means

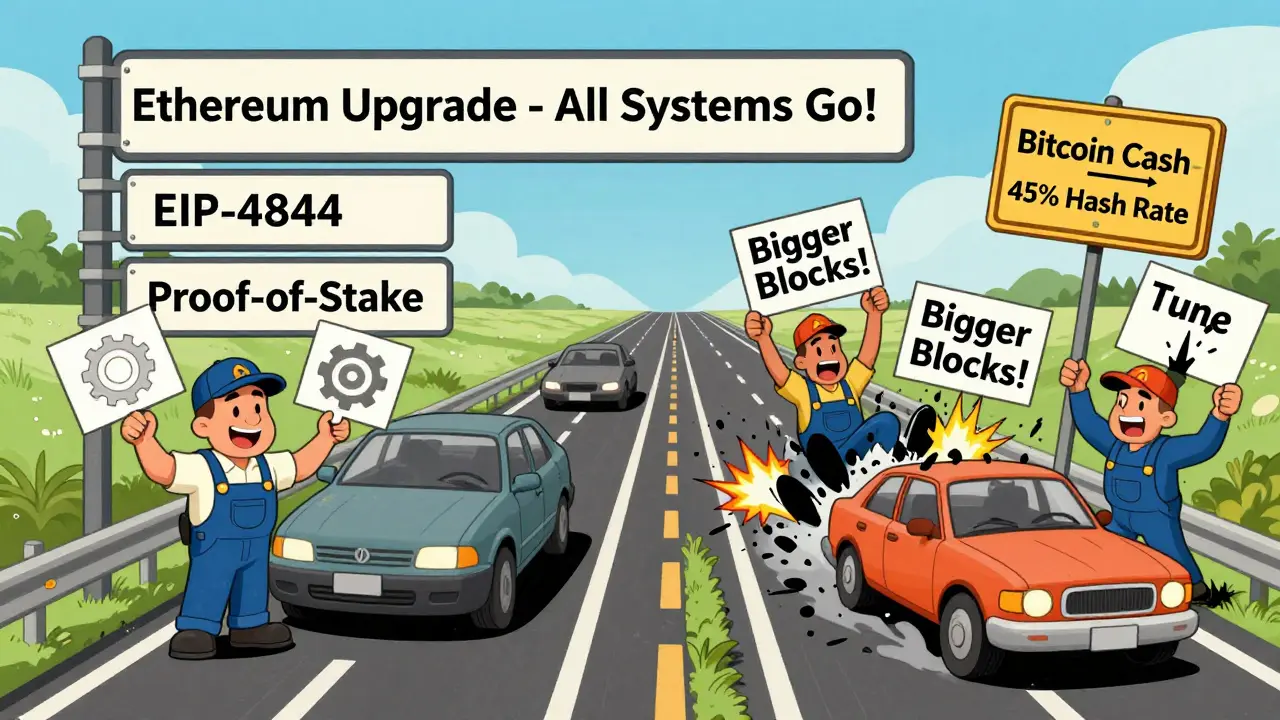

A blockchain fork happens when the network’s rules change. Think of it like a road splitting into two paths. Before the fork, everyone follows the same rules: how transactions are verified, how blocks are added, how much data can fit in each block. After the fork, there are two versions of the blockchain - each with its own history and set of rules. One path might allow bigger blocks. The other might change how smart contracts work. The key is: once the fork happens, the two chains can’t talk to each other anymore. Transactions on one won’t work on the other.Planned Forks: Upgrades, Not Wars

Planned forks are like scheduled maintenance for a highway. Everyone knows when it’s coming. Work crews are ready. Signs are posted. Traffic is rerouted. In blockchain terms, this means the community agrees months in advance on what change to make, how to test it, and when to activate it. Ethereum is the best example. Since 2015, it’s done 12 planned hard forks. Each one was announced publicly, tested on a separate network first, and then activated at a specific block number. The Shanghai upgrade in April 2023 let users withdraw staked ETH. The Merge in September 2022 switched Ethereum from energy-heavy mining to a greener proof-of-stake system. Both went off without a hitch. Over 99% of nodes upgraded. Exchanges like Binance and Coinbase didn’t even ask users to do anything. The network kept running. These upgrades follow a clear process. First, someone writes an Ethereum Improvement Proposal (EIP). Then it gets reviewed by developers, tested on testnets, debated in public forums, and voted on by core contributors. It can take 12 to 18 months from idea to activation. But because everyone’s on the same page, there’s no chaos. The chain stays one chain.Contentious Forks: When the Community Breaks

Contentious forks happen when people can’t agree. No one planned it. No one agreed on the timing. It’s not an upgrade - it’s a rebellion. The most famous example is Bitcoin Cash. In 2017, a group of Bitcoin miners and developers wanted to increase the block size from 1MB to 8MB to handle more transactions. Others said that would centralize power in the hands of big mining companies. The debate got ugly. Emails turned into flame wars. Forums exploded. Then, on August 1, 2017, the chain split. Half the network kept running Bitcoin (BTC). The other half started Bitcoin Cash (BCH). The numbers tell the story. Bitcoin kept 55% of the hash rate. Bitcoin Cash got 45%. But here’s the catch: hash rate isn’t just about computing power. It’s about trust. The original Bitcoin chain kept its name, its brand, its market value. Bitcoin Cash? It started with $1.2 billion in value. Today, it’s worth less than 0.15% of Bitcoin’s $800 billion. The fork didn’t fix Bitcoin - it split it. Another example is Bitcoin SV, which split from Bitcoin Cash in 2018. Now both chains barely process 1,200 transactions a day. Bitcoin, by comparison, handles over 300,000. The energy, the code, the attention - all wasted.

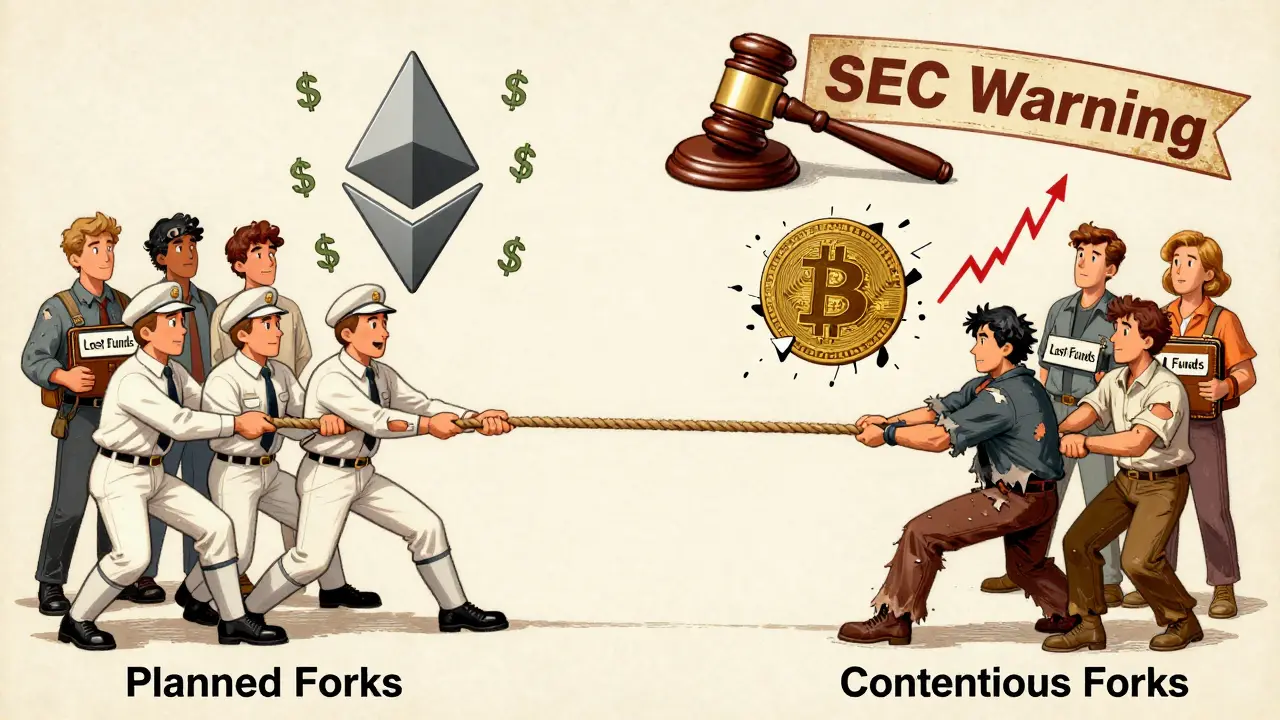

Why It Matters: Stability, Value, and Survival

The difference between these two types of forks isn’t academic. It’s economic. Projects that use planned forks grow. Ethereum’s market cap went from $18 billion before its Byzantium fork in 2017 to over $550 billion before the Merge. Developers keep building on it. Exchanges keep listing it. Users trust it. Contentious forks? They drain value. The Cambridge Centre for Alternative Finance found that 78% of all blockchain forks since 2009 were planned. Only 22% were contentious. But those 22% created nearly all the drama. They caused confusion for users. They led to lost funds. They scared away enterprise adoption. A 2023 Gartner survey showed that 92% of Fortune 500 companies using blockchain stick to networks with planned upgrades - like Ethereum Enterprise or Hyperledger. None use Bitcoin Cash or Bitcoin SV. Even regulators notice. The SEC warned in 2022 that tokens created by contentious forks might be considered new securities. That means legal risk. That means fines. That means uncertainty.What Happens Behind the Scenes

Planned forks have structure. Ethereum’s AllCoreDevs meetings include 25-30 core developers from ConsenSys, ChainSafe, and other trusted teams. They meet weekly. They test. They document. Their fork documentation gets a 4.7/5 rating from developers. Contentious forks? Chaos. Bitcoin Cash’s codebase required 1,247 lines of changes to Bitcoin Core - and that was just the start. Post-fork, 43% of issues stayed unresolved for over six months. Developers weren’t working together. They were working against each other. Exchanges noticed. Before Ethereum’s upgrades, 95% of major exchanges announced support 30 days in advance. For Bitcoin Cash, only 65% listed the new coin right away. Many users got confused. They deposited BTC and got BCH instead. Some lost money. Coinbase got a 3.2/5 rating on Trustpilot from users complaining about “duplicate assets.” Binance? 4.6/5 for seamless Ethereum upgrades.

What’s Next?

The trend is clear: planned forks are winning. Ethereum has three more scheduled upgrades by 2024. Polkadot has done 12 consecutive upgrades without a single fork - all done on-chain, with no split. Even Bitcoin, once the poster child for hard forks, has gone years without one. Why? Because decentralized doesn’t mean chaotic. It means organized. The best blockchains aren’t the ones that never change. They’re the ones that change together. Contentious forks aren’t dead. But they’re becoming relics. They’re what happens when a community lacks trust, structure, or leadership. Planned forks are the future. They’re how blockchains evolve without breaking.Key Takeaways

- Planned forks are upgrades - coordinated, tested, and agreed on by the community.

- Contentious forks are splits - caused by disagreement, often leading to wasted resources and lost value.

- Ethereum’s success is built on planned forks. Bitcoin Cash’s decline came from a contentious one.

- 92% of enterprise blockchain users avoid contentious forks entirely.

- The future belongs to networks that upgrade smoothly - not those that split apart.

What’s the difference between a soft fork and a hard fork?

A soft fork is a backward-compatible upgrade. Old nodes can still validate new blocks - they just can’t create them. Bitcoin’s SegWit upgrade in 2017 was a soft fork. A hard fork changes rules in a way that old nodes can’t accept new blocks. That creates a split. Both planned and contentious forks are hard forks. The difference is whether the split was intended or not.

Can a planned fork become contentious?

Yes - if too many users refuse to upgrade. But it’s rare. Planned forks rely on community coordination. If 95% of nodes upgrade and 5% don’t, the chain still works. But if 40% refuse, it can trigger a split. That’s what almost happened with Ethereum’s DAO fork in 2016. The majority chose to reverse the hack. The minority stayed on the original chain - creating Ethereum Classic. Even though it was planned, it became contentious because of the moral disagreement.

Why do some people still support contentious forks?

Some believe in absolute immutability - that no transaction should ever be reversed, even if hacked. Others think bigger blocks mean faster transactions. These are philosophical differences. But while they feel strong, they rarely translate into long-term value. Bitcoin Cash supporters still believe they’re saving Bitcoin. But Bitcoin itself grew 100x while BCH shrank. Philosophy doesn’t pay bills - network effects do.

Do I need to do anything during a planned fork?

Usually, no. If you hold crypto on a major exchange like Coinbase or Binance, they handle the upgrade for you. Your balance stays the same. No action needed. If you run your own node or wallet, you’ll need to update your software. But most users don’t - and they don’t need to.

Are contentious forks ever useful?

Only in rare cases - like preserving a principle. Ethereum Classic emerged to keep the blockchain immutable after the DAO hack. But even then, it came at a huge cost. The network lost 95% of its value and developer attention. Most contentious forks don’t create value - they destroy it. They’re a last resort, not a strategy.

Comments (15)

Angela Henderson

So basically, planned forks are like when your group chat decides on pizza for Friday and everyone shows up on time. Contentious forks? That’s the guy who shows up with tacos, screams ‘this is better,’ and then leaves with half the cheese. No one’s mad at him… just confused why he’s still mad we didn’t order tacos in the first place.

george chehwane

Let’s not romanticize ‘planned’ forks as some kind of techno-democratic utopia. The AllCoreDevs meetings? More like a cabal of MIT bros with GitHub access and a god complex. They don’t ‘agree’-they enforce. The market capitulates because liquidity is centralized, not because consensus was reached. This isn’t governance. It’s corporate capture wrapped in open-source pajamas.

And don’t get me started on ‘Ethereum Enterprise.’ That’s not blockchain. That’s a permissioned SQL database with a fancy smart contract veneer and a PR team that reads too much TechCrunch.

Real decentralization doesn’t need a roadmap. It needs resistance. The fact that 92% of Fortune 500 avoid contentious forks? That’s not a win. That’s a confession: they never wanted decentralization in the first place.

They wanted predictability. They wanted liability shields. They wanted to pretend crypto was a tool, not a revolution. And now they’re the ones writing the history books.

History will remember Ethereum not as the chain that evolved-but as the chain that sold out.

Paul David Rillorta

ok but what if the merge was just a distraction? what if the whole proof-of-stake thing was a honeypot set by the fed to track wallet addresses? i mean, why else would they shut down mining so fast? miners are the real nodes. miners are the people. they got replaced by stakers who just hold coins and cry when the price drops. also, who paid for all those testnets? someone’s gotta fund that. and why do all the devs work for consensys? coincidence? i think not.

also, bitcoin cash was right. 1mb was never enough. the real bitcoin died in 2017. we’re living in a simulation now. the real chain is still running on some server in switzerland with a guy in a tinfoil hat.

ps. if you think shanghai upgrade was smooth, you haven’t seen the backend logs. i know. i work at coinbase. they had to do a rollback on day 2. they just hid it.

Chris Thomas

Let’s be clear: planned forks aren’t ‘democratic’-they’re orchestrated. The EIP process? A theater of inclusion designed to pacify the masses while the core team quietly deploys the upgrade. You think developers debated? No. They voted with their code. The rest of us were spectators. The ‘community’ was never consulted. It was curated.

And the 99% node adoption? That’s not consensus. That’s coercion. Exchanges don’t give a damn about decentralization-they care about liquidity. If Binance lists it, you upgrade. If they don’t, you’re stuck on a dead chain. So ‘agreement’ is just market pressure with a whitepaper.

Ethereum didn’t evolve. It centralized. The Merge didn’t reduce energy use-it moved the energy burden to validators who now need institutional backing to stake. The ‘green’ narrative? Marketing. The reality? A new class of financialized node operators emerged, replacing miners with hedge funds.

And let’s not pretend Bitcoin Cash was a failure. It was a warning. The fact that it’s worth 0.15% of BTC isn’t proof it failed-it’s proof the system is rigged. The market doesn’t reward innovation. It rewards branding. And ETH has the best brand.

Don’t confuse stability with control. The future isn’t ‘planned forks.’ It’s the collapse of centralized narrative control.

Alex Williams

Look, if you're holding crypto on an exchange, you're not part of the network-you're a customer. And customers don't care about forks. They care about their balance showing up. So yeah, Binance handled the Merge smoothly. That's because they didn't let you see the gears turning.

But if you're running your own node? You know the pain. You know what it means to update software before a deadline. You know what it means to lose a day of sleep because a dev pushed a patch at 3 AM.

Planned forks aren't better. They're just more polished. The real win is that Ethereum didn't split. But that's because the community was managed, not empowered.

And honestly? The fact that 92% of enterprises avoid contentious forks? That's not because they're smart. It's because they're scared. They don't trust decentralized systems. They want a vendor. And Ethereum gave them one.

So yeah, it's working. But at what cost? You traded sovereignty for simplicity. And that's not progress. That's surrender.

Sarah Shergold

So Ethereum is the new Apple. Planned upgrades. Controlled ecosystem. No weird forks. No chaos. Just… sleek. Boring. Perfect. 🤮

yogesh negi

Hey everyone, I just want to say thank you for this thoughtful breakdown-it really helped me understand the difference between planned and contentious forks. I’ve been learning about blockchain for a few months now, and this is the clearest explanation I’ve come across. I especially appreciated how you tied in the real-world impact on exchanges and enterprise adoption. It made me realize that blockchain isn’t just about code-it’s about people, trust, and cooperation. I’m excited to see how Polkadot’s on-chain upgrades evolve next! Let’s keep building together 💪🌍

Nikki Howard

92% of Fortune 500 avoid contentious forks? That’s not a feature-it’s a red flag. It means these networks are not decentralized. It means they are compliant. It means they are regulated. It means they are not blockchain. It means they are fintech with a blockchain-shaped veneer. You’re not upgrading-you’re conforming. And conformity is the death of innovation.

Also, the fact that you mention ‘SEC warning’ as if it’s a badge of honor? That’s not stability. That’s surveillance.

Don’t mistake compliance for credibility.

jennifer jean

Love this breakdown!! 🙌 I’ve been on both sides-used to be a Bitcoin Cash supporter back in ‘17, then realized how messy it all got. Seeing Ethereum upgrade so smoothly made me rethink what ‘decentralized’ really means. It’s not about never changing-it’s about changing together. 🌱✨

Sasha Wynnters

Planned forks are the opium of the blockchain masses. You think you’re evolving? No. You’re being pacified. The ‘roadmap’ is a leash. The ‘EIPs’ are petitions signed by people who don’t own the chain. The ‘consensus’? Manufactured by developers who got paid to write it.

Bitcoin Cash wasn’t a failure-it was a scream. A primal cry against the slow, bureaucratic death of a movement turned into a corporate product.

They didn’t split the chain-they split the lie.

And now we live in a world where ‘stable’ means ‘controlled.’ Where ‘secure’ means ‘monitored.’ Where ‘innovation’ means ‘rebranding.’

They didn’t upgrade the blockchain.

They buried it.

Scott McCrossan

Planned forks are just soft authoritarianism with a GitHub profile. You call it ‘coordination.’ I call it a cult of efficiency. The fact that you’re proud of 99% adoption means you’re terrified of dissent. Real networks don’t need 99%-they need 1% that refuses to obey.

Ethereum didn’t become a better blockchain.

It became a better PR campaign.

Rajib Hossaim

Thank you for the comprehensive analysis. The distinction between planned and contentious forks is indeed critical for understanding blockchain governance. The economic implications are profound, and the data on enterprise adoption reinforces the importance of stability. I believe that future blockchain ecosystems must balance innovation with predictability to sustain long-term trust.

Beth Erickson

USA built the internet. China’s building the next one. Ethereum? Just another EU-funded tech project pretending to be revolutionary. Bitcoin Cash had guts. You call it a failure? I call it the last honest chain.

Tarun Krishnakumar

you ever wonder why all the ‘planned’ forks happen right before big price pumps? like, the merge? right before the bull run? shanghai? right after the ETF news? coincidence? i think not. the core devs have access to insider info. they time the upgrades to make the price go up. then they sell. then they tell you it’s ‘community-driven.’

and the testnets? oh yeah, they’re ‘public.’ but who runs them? consensys. chainsafe. all the same companies. same wallets. same wallets that get funded by venture capital. same wallets that get listed first on binance.

the fork isn’t planned.

it’s scheduled.

and the ‘community’? just the audience.

Ruby Ababio-Fernandez

So basically Ethereum’s just a corporate blockchain now. Cool. I’m out.