SecretSky.finance Airdrop: What It Is, Why It’s Unverified, and How to Avoid Fake Drops

When you hear about a SecretSky.finance airdrop, a rumored token distribution tied to a decentralized finance platform claiming to offer yield and privacy. Also known as SecretSky token drop, it’s one of many crypto projects stirring buzz without official proof. Right now, there’s no verified airdrop from SecretSky.finance. No website update, no Twitter announcement from a confirmed team account, no smart contract deployed for claiming. Yet, people are sharing links, asking for wallet addresses, and pushing fake claim pages. This isn’t unusual—it’s the norm in today’s crypto airdrop jungle.

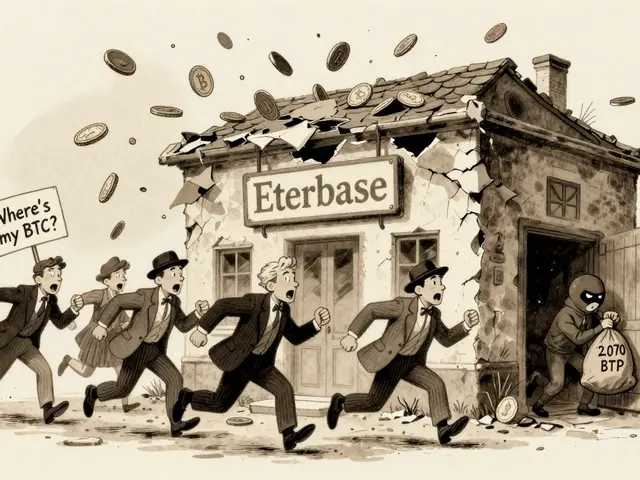

Scammers love targeting projects like SecretSky because they sound plausible. They mix real-sounding DeFi terms—like private staking, encrypted rewards, or Layer 2 yield—with zero substance. You’ll find fake Telegram groups, YouTube videos with stock footage of blockchain graphics, and even fake CoinGecko listings. These aren’t just annoying—they’re dangerous. One click on a phishing site can drain your wallet. The same pattern shows up in other unverified drops like xSuter airdrop, a token tied to a defunct DeFi protocol with no active development, or SCIX airdrop, a project that vanished after initial hype. If a project has no team, no code, and no history of transparency, treat any airdrop claim as a red flag.

Real airdrops don’t ask for your private key. They don’t require you to send crypto to "unlock" tokens. They don’t rush you with fake countdowns. They’re announced on official channels, backed by public smart contracts, and often tied to actual on-chain activity—like using a DEX or holding a specific NFT. Look at how the SAKE airdrop, a legitimate DeFi reward from SakePerp and Sake Finance worked: users earned tokens by trading, lending, and completing simple tasks—no deposits needed. That’s how real rewards operate.

So what should you do if you see a SecretSky.finance airdrop pop up? First, check the official website. Does it have a .io or .finance domain that matches exactly? Is there a GitHub repo with recent commits? Is the team anonymous or do they have verified social profiles? If the answer is no to any of those, walk away. Second, search for audits. No reputable project launches without a security review from firms like CertiK or Hacken. Third, check CoinMarketCap or CoinGecko—real tokens show trading volume, liquidity, and a clear token contract address. If it’s not there, it’s not real.

Below, you’ll find real breakdowns of other crypto airdrops—some that worked, most that didn’t. You’ll see how OpenDAO’s SOS token faded into obscurity, how SPIN from Spintop Network gave out 500 tokens to early users, and why GEO from GeoDB is now worth pennies. These aren’t just stories—they’re lessons. The next time you hear about a "free" token drop, you’ll know exactly what to look for—and what to avoid.

SecretSky.finance claims to offer an SSF token airdrop, but there's no official campaign, no trading volume, and no working app. Learn why this is a scam and how to avoid losing your crypto to fake airdrops.

Continue reading