Physical Delivery Crypto Futures: How They Work and Why They Matter

When you trade physical delivery crypto futures, a type of derivative contract where the underlying cryptocurrency is actually transferred at expiration instead of being paid out in cash. Also known as deliverable crypto futures, they turn speculation into ownership—no more just betting on price moves, but actually getting the Bitcoin, Ethereum, or other coin you traded for. This isn’t just a technical detail. It’s a fundamental shift in how crypto markets operate.

Most crypto futures you hear about are cash-settled, contracts that pay out the profit or loss in USD or stablecoins, without any real coin changing hands. These are popular because they’re easier to manage and avoid wallet issues. But physical delivery crypto futures are growing fast, especially among institutions and long-term holders. Why? Because they let you hedge your actual crypto holdings without selling them. If you own Bitcoin and worry about a price drop, you can short a physical delivery future and get the real BTC back if you win—then use it, hold it, or sell it later. It’s not a bet. It’s a tool.

These contracts also reduce manipulation. With cash settlement, big players can move prices near expiry just to trigger stop-losses. With physical delivery, you need real coins to settle. That means more market depth, fewer fake spikes, and more trust. Exchanges like CME and OKX now offer them for Bitcoin and Ethereum, and more are following. This isn’t a niche feature—it’s becoming the standard for serious traders.

And it’s not just about trading. Physical delivery futures help stabilize crypto’s role as real money. When institutions can lock in delivery, they treat crypto less like a gamble and more like an asset class. That’s why you see banks, hedge funds, and even mining operations using these contracts to manage risk across their operations. If you’re holding crypto long-term, understanding how these futures work helps you see where the real value is being built—not just where the hype is.

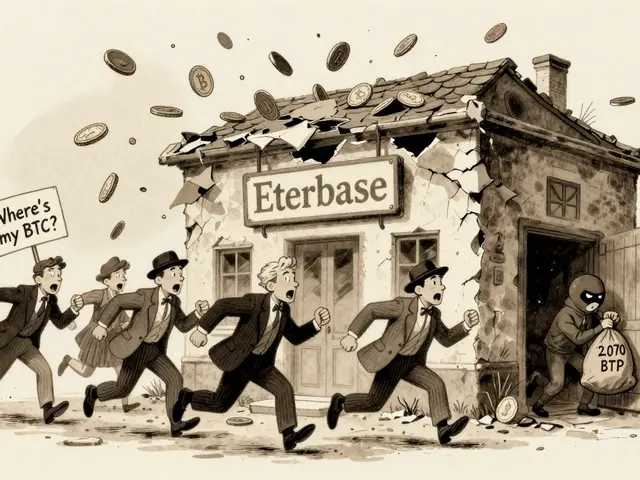

Below, you’ll find real reviews and breakdowns of exchanges that offer these contracts, what traders actually experience, and how to avoid scams disguised as delivery futures. No fluff. Just what works—and what doesn’t—in today’s market.

Bitnomial is the only U.S.-regulated crypto exchange offering physically delivered futures on Bitcoin, Ethereum, Solana, XRP, and USDC. With CFTC approval and crypto-as-margin, it’s built for serious traders.

Continue reading