DeFi Rewards: How to Earn Yield, Staking, and Incentives in Decentralized Finance

When you hear DeFi rewards, earnings you get for using decentralized finance platforms instead of traditional banks. Also known as crypto yield, it’s how users get paid just for locking up their crypto in apps like Uniswap or DeFi Kingdoms. No middleman. No bank fees. Just code that pays you in tokens for helping the network run.

Yield farming, the practice of moving crypto between protocols to chase the highest returns. Also known as liquidity mining, it’s what made people rich in 2020—and what left others with worthless tokens after the hype died. It’s not magic. You put your ETH or USDC into a pool, the platform uses it to let others trade or borrow, and you get a cut in the form of tokens like JEWEL or SDL. But not all rewards last. Some tokens crash fast. Others vanish. That’s why knowing the difference between real yield and fake incentives matters.

Staking crypto, locking your coins to help secure a blockchain and earn rewards in return. Also known as proof-of-stake income, it’s how you earn on networks like Ethereum, Chainlink, or Aptos without mining hardware. You don’t need to be a tech expert. Just hold, click ‘stake,’ and wait. But watch out: some platforms lock your funds for weeks. Others charge fees. And if the project fails, your rewards disappear with it. That’s why you’ll see posts here about Stake.link’s SDL token and Cellana’s ve(3,3) model—both are real examples of how staking works today, not just theory.

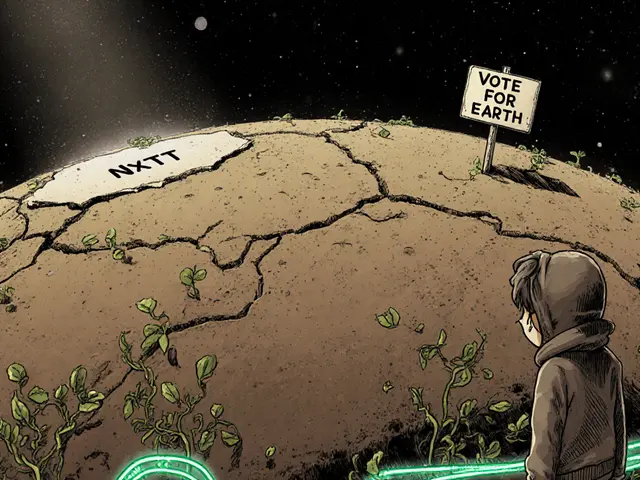

DeFi rewards aren’t just about earning. They’re about understanding what’s real. The best ones come from platforms with real users, real volume, and real incentives—not just a marketing campaign. You’ll find guides here on how Uniswap v3 on Blast gives you native yield, why DeFi Kingdoms mixes gaming with staking, and how Legion’s LGX airdrop tried to lure users with referral bonuses. You’ll also see warnings about tokens that looked promising but collapsed, like NextEarth or Baby Solana. Those aren’t just stories. They’re lessons.

Some people think DeFi rewards are free money. They’re not. They’re trade-offs: your liquidity for income, your time for risk, your trust for returns. The smartest earners don’t chase the highest APY. They look at who built it, how long it’s been running, and whether the token has any actual use. That’s what this collection is for. Not to tell you what to stake—but to help you ask the right questions before you click ‘confirm.’

Learn how to earn SAKE tokens through the SakePerp and Sake Finance airdrop by trading, lending, and completing simple tasks. No purchase needed - just active participation.

Continue reading