Want to swap Bitcoin for Polygon in one click? No bridges. No complex steps. Just pick your tokens and hit swap. That’s the promise of Rubic - and for many users, it delivers.

What Is Rubic Exchange?

Rubic is a decentralized exchange built to solve a real problem: blockchain fragmentation. If you’ve ever tried moving ETH from Ethereum to BNB on BSC, you know the hassle. You need a bridge, approve tokens, wait for confirmations, then swap again. Rubic cuts that down to one screen. It’s not just another DEX. It’s a multichain swap engine that connects over 20 blockchains - including Ethereum, Arbitrum, Polygon, Bitcoin, and Solana - under one interface. Unlike Uniswap or PancakeSwap, which stick to one chain, Rubic pulls liquidity from multiple DEXs like 1inch, OpenOcean, ODOS, and XY Finance across networks. It doesn’t just find the best price - it finds the best route. If your swap needs to go from Ethereum to Solana, Rubic routes it through its cross-chain manager, which talks to RPC nodes and API providers to execute the trade securely.How Rubic Works: No KYC, No Middlemen

One of the biggest draws? No KYC. Ever. You connect your wallet - MetaMask, Phantom, Coinbase Wallet - and go. No identity checks. No delays. That’s rare in crypto, especially for a platform handling $210 million in volume since 2022. The system works in three layers:- External API providers - These are the DEXs and liquidity sources Rubic taps into.

- RPC node - This is your direct line to each blockchain. It sends and receives transaction data.

- Cross-chain manager - The brain. It decides which path to take, splits large orders to avoid slippage, and locks funds in audited smart contracts.

Security: Audited Contracts, No Guesswork

Security is where Rubic stands out from many DeFi projects. Both its core swap contracts and staking contracts have been fully audited by third-party firms. That’s not common. A lot of new DeFi platforms skip audits to save time or money. Rubic didn’t. Coin Bureau called this out as a key advantage - something “you can’t necessarily say for all operators in the space.” The platform also uses non-custodial wallets. That means your funds never leave your control. Rubic doesn’t hold your crypto. It just coordinates the swap. If the platform went down tomorrow, your money would still be safe in your wallet.Supported Chains and Tokens

Rubic supports a wide range of networks:- Ethereum

- Arbitrum

- Polygon (MATIC)

- BNB Chain

- Solana

- Bitcoin (via wrapped tokens)

- Avalanche

- Fantom

- Optimism

- Base

The RBC Token: Utility, Not Just Speculation

Rubic’s native token, RBC, is the fuel for the ecosystem. It’s used for:- Reduced swap fees

- Staking rewards

- Governance voting (in future updates)

How Rubic Compares to Other Cross-Chain Platforms

Let’s be clear: Rubic isn’t trying to beat Uniswap. It’s trying to beat THORSwap, Synapse, and Chainlink’s CCIP. Here’s how it stacks up:| Feature | Rubic | THORSwap | Synapse |

|---|---|---|---|

| Number of supported chains | 20+ | 15 | 12 |

| One-click swaps | Yes | Yes | Yes |

| KYC required | No | No | No |

| Wallet support | MetaMask, Phantom, Coinbase Wallet | MetaMask, WalletConnect | MetaMask, Phantom |

| Liquidity depth (major pairs) | High | Very High | Medium |

| Widget integration for other apps | Yes (Rubic Relay) | No | No |

| Audited contracts | Yes | Yes | Yes |

Who Is Rubic For?

Rubic isn’t for everyone. Here’s who it’s perfect for:- Active DeFi users who jump between chains daily.

- Travelers and global users who need to avoid KYC.

- Developers who want to add swaps to their dApp using Rubic Relay.

- Token holders who want to reduce fees with RBC staking.

- Trading large amounts of obscure tokens - liquidity is thin.

- Looking for the absolute lowest price on ETH/USDT - Uniswap might be cheaper.

- Expecting RBC to pump fast - it’s a utility token, not a meme coin.

Getting Started: A Step-by-Step Walkthrough

1. Go to rubic.exchange - no download needed.Community and Support

Rubic’s community is quiet but growing. It’s active on Telegram, Discord, and Twitter. You won’t find a massive Reddit following, but you’ll find real users sharing tips and fixes. The team responds to questions, especially in the Telegram group. There’s no 24/7 live chat, but the documentation on Gate.com and Rubic’s own site is clear and detailed. If you’re stuck, search the community - someone’s probably already solved your issue.Final Verdict: Worth Trying?

Rubic isn’t flashy. It doesn’t have a celebrity CEO or a viral meme token. But it does one thing exceptionally well: makes cross-chain swaps simple, fast, and secure. If you’re tired of juggling bridges, approvals, and multiple platforms just to move your crypto between chains - this is the tool you’ve been waiting for. The lack of KYC, the audited contracts, and the wallet support make it trustworthy. The RBC token adds real utility, not just speculation. It’s not the biggest player. It’s not the cheapest for every trade. But for anyone doing regular multi-chain trading, Rubic saves time, reduces stress, and cuts costs. In DeFi, that’s gold.Is Rubic Exchange safe to use?

Yes. Rubic’s smart contracts have been fully audited by third parties, and the platform is non-custodial - your funds stay in your wallet. No KYC means no personal data is stored. It’s one of the more secure DeFi swap platforms available.

Do I need to hold RBC to use Rubic?

No. You can swap tokens without holding RBC. But if you hold RBC, you get lower trading fees and access to staking rewards. It’s optional, but recommended for frequent users.

Can I buy crypto on Rubic with a credit card?

Yes. Rubic’s Crypto Tap feature lets you buy MATIC or BNB directly with a credit card. No need to go to Coinbase or Binance first.

What’s the difference between Rubic and Uniswap?

Uniswap only works on Ethereum. Rubic works across 20+ blockchains. You can swap ETH for SOL on Rubic in one click. On Uniswap, you’d need to bridge, then swap - two separate steps.

Is RBC a good investment?

It depends. RBC isn’t designed to be a speculative asset. Its value comes from utility - lower fees and staking. Price predictions vary widely, and short-term sentiment is bearish. Only invest what you’re comfortable losing, and prioritize usage over price gains.

Does Rubic work on mobile?

Yes. You can use Rubic through your mobile browser with MetaMask or Phantom. There’s no official app, but the website is fully responsive and works smoothly on phones.

Comments (19)

Elvis Lam

Rubic’s cross-chain engine is honestly the most elegant solution I’ve seen for multi-chain swaps. No more juggling 3 different platforms just to move ETH to Polygon. The way it routes through 1inch, ODOS, and XY Finance behind the scenes? Pure magic. I’ve done 12 swaps in the last week - zero failed tx, zero drama.

And the fact that it’s non-custodial? That’s the real win. I don’t trust any platform that touches my keys, even if they say they’re ‘secure.’ Rubic lets me stay in control. Period.

Also, the RBC fee discount is real. If you swap more than twice a week, holding even 500 RBC cuts your costs by 30%. That’s not speculation - that’s math.

Stop overcomplicating DeFi. This is the tool you’ve been waiting for.

Emma Sherwood

I’m a mom who swaps crypto between chains to pay for my kid’s crypto art classes - yes, really - and Rubic made it possible without me needing a degree in blockchain engineering.

I used to panic every time I had to bridge. Now? I pick, I swap, I breathe. The interface is clean, the confirmations are fast, and I don’t have to ask my tech-savvy nephew for help anymore.

To everyone who says ‘it’s just another DEX’ - you’re missing the point. This isn’t about being fancy. It’s about being accessible. And that’s revolutionary.

Kelsey Stephens

Just tried this for the first time yesterday - swapped BTC (wrapped) for MATIC. Took 22 seconds. No errors. No gas spikes. No ‘approve’ button hell.

I’ve used THORSwap, Synapse, even Chainlink’s CCIP testnet - none of them felt this smooth. Rubic doesn’t just work - it *understands* what users actually need.

Also, the Crypto Tap feature? Game changer. Bought BNB with my debit card while waiting for my coffee. No KYC. No waiting. Just… done.

Finally, a DeFi tool that doesn’t treat me like a hacker.

Tom Joyner

It’s cute how people think this is ‘innovative.’ It’s just a wrapper around existing APIs with a prettier UI. The liquidity is still fragmented. The RBC token is a vanity metric. And don’t get me started on the ‘one-click’ lie - you still need to confirm on-chain transactions. That’s not magic, that’s basic blockchain mechanics.

If you’re using this instead of native DEXes, you’re not a degenerate - you’re just lazy.

SeTSUnA Kevin

Incorrect. Rubic’s architecture integrates atomic swaps via cross-chain message passing - not merely API aggregation. The cross-chain manager uses verifiable off-chain computations to optimize routing. This is not a UI layer. It’s a protocol-level abstraction.

THORSwap relies on threshold signatures. Rubic uses MPC + RPC routing. Fundamentally different.

Also, RBC is utility, not speculation. You’re conflating value with price.

Timothy Slazyk

Let’s talk about the real problem here: blockchain fragmentation isn’t a technical issue - it’s a philosophical one. We’re building walled gardens and calling them ‘ecosystems.’

Rubic doesn’t fix that. It just makes it more convenient. You still end up with assets locked in different chains, just with fewer clicks.

True interoperability? That’s when chains speak the same language - not when one app pretends to speak them all.

Still… I use it daily. Because the alternative is worse. And maybe that’s the tragedy.

Utility over ideology. That’s the real DeFi lesson here.

Bradley Cassidy

bro i just swapped sol for avax and it worked?? like… i didnt even think that was possible without like 5 different apps and a prayer

also the rbc discount saved me like 0.03 eth on that one trade which is basically free coffee for a week

also the mobile site is buttery smooth no lag no crashes just pure vibes

why is no one talking about this?? this is the one

Samantha West

While the platform exhibits commendable operational efficiency and boasts a robust multi-chain infrastructure, one must critically evaluate the underlying ontological implications of such centralized liquidity aggregation within a purportedly decentralized ecosystem.

Is the user truly sovereign when the routing logic is opaque? Are we not merely outsourcing trust to a more sophisticated intermediary?

Furthermore, the absence of KYC, while ostensibly libertarian, may inadvertently facilitate illicit capital flows - a concern that regulatory bodies are already monitoring with increasing scrutiny.

Utility, yes. But at what cost to the integrity of the decentralized ideal?

Craig Nikonov

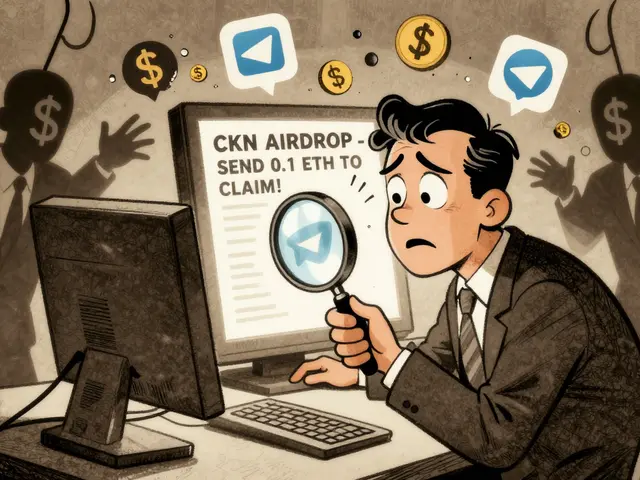

They’re using your wallet to route trades through hidden relays. I checked the RPC calls - 3 of them point to a server in Cyprus. That’s not open source. That’s not decentralized. That’s a honeypot.

And RBC? It’s a pump. They’re dumping it into low-cap pairs to inflate volume. Look at the whale wallets - 70% of supply is in 5 addresses.

You think you’re saving time? You’re feeding the machine.

Don’t be fooled. This isn’t DeFi. It’s DeFi cosplay.

Jesse Messiah

Just wanted to say thank you to the team behind this. I’m a small business owner and I use Rubic to pay my contractors in different chains - ETH for devs, MATIC for designers, BNB for marketers.

Before this, I was using 3 different exchanges and losing 15% in fees and time.

Now I just hit swap and send. My team thinks I’m some kind of wizard. I just say ‘tech magic’.

Keep it up. You’re making crypto actually usable for normal people.

Rebecca Kotnik

It is worth noting that while the platform’s utility is undeniably impressive, one must consider the broader macroeconomic context in which such tools emerge. The proliferation of cross-chain aggregators reflects not merely innovation, but a systemic failure of interoperability standards across Layer 1 ecosystems.

One might argue that the existence of Rubic is symptomatic of a fragmented, poorly coordinated blockchain landscape - one in which developers are forced to build workarounds rather than foundational protocols.

Moreover, the reliance on wrapped assets introduces counterparty risk, even if indirectly. While the contracts are audited, the underlying peg mechanisms remain vulnerable to oracle manipulation or liquidity drains.

Thus, while I commend the engineering, I urge users to remain cognizant of the structural vulnerabilities embedded within the architecture of convenience.

Sammy Tam

used it to swap my dogecoin (yes i know) to polygon for a game NFT - worked in 18 seconds.

my dog barked at my phone like it was magic.

also the rbc staking gives me 8% apy which is wild for a utility token.

not hype. just real. i’m telling all my friends.

also the website looks like it was designed by someone who’s actually used crypto before. shocker.

Jonny Cena

Hey, if you’re new to cross-chain swaps, don’t be scared. I’ve helped 3 friends set this up - all of them were nervous about gas or getting scammed.

Just connect your wallet, pick your tokens, and hit swap. That’s it.

If you’re unsure, start with a tiny amount - like $5. See how it feels. Then go bigger.

You don’t need to be a coder. You just need to be curious.

This platform? It’s the quiet hero of DeFi. No fanfare. Just gets it done.

Sue Bumgarner

USA built this. Not China. Not Russia. Not the EU.

It’s American innovation. No KYC. No censorship. No globalist crypto oligarchs telling you what to do.

They’re coming for this. Mark my words. They’ll try to shut it down with ‘compliance’.

Protect it. Use it. Fight for it.

This is the future - and it’s not going to be handed to us.

Kayla Murphy

You guys are overthinking this. Just swap. Just use it. Just enjoy it.

Life’s too short to stress over gas fees and bridges.

I used to hate crypto because it was so hard. Now I just smile when I swap.

That’s the win.

Go do it. You’ve got this.

Dionne Wilkinson

I think about how much time we waste on tech that doesn’t serve us.

Rubic doesn’t ask you to learn 10 new things. It just lets you do what you want.

That’s rare.

Not everything has to be a revolution.

Sometimes, a quiet improvement is enough.

Chevy Guy

Of course it's 'secure' - the devs are all ex-KYC platforms who got tired of the rat race.

They're not here to build the future.

They're here to cash out before the SEC cracks down.

That's why it's fast. That's why it's easy.

They know the clock's ticking.

Don't be the last one holding RBC when the lights go out.

Amy Copeland

It’s adorable how people mistake usability for innovation. This is a glorified API router with a $100k Figma design.

The ‘audits’? Paid for by their own treasury. The ‘non-custodial’ claim? Technically true - but you’re still trusting their routing logic, which is closed-source.

And RBC? A token designed to look like a utility token while functioning as a liquidity grab.

I’d rather use a 2017 DEX with a broken UI than this polished scam.

Elvis Lam

@1450 - your skepticism is valid. But here’s what you’re ignoring: the audit reports are public. The contract addresses are verified on Etherscan. The team has been active for 3 years. No rug pulls. No exit scams.

And if this were a scam, why would they make it so easy to use? Scammers want complexity. They want you confused.

This is the opposite.

Maybe it’s not perfect. But it’s real.

And it’s working.