Digital vs Traditional Signatures Comparison Tool

Traditional Signature

Physical ink-on-paper mark relying on visual comparison and handwriting uniqueness.

- Subjective verification

- Vulnerable to forgery

- Manual processing required

- Not suitable for automation

Digital Signature

Cryptographic proof using private/public key pairs ensuring authenticity and integrity.

- Objective verification

- Mathematical proof

- Automated verification

- Supports advanced features

| Feature | Traditional | Digital |

|---|---|---|

| Authentication | Visual comparison (subjective) | Public-key verification (cryptographic) |

| Non-repudiation | Can be denied or forged | Mathematical proof tied to private key |

| Tamper Resistance | Alterations can be hidden | Any change invalidates signature |

| Scalability | Human review required | Automated verification |

| Automation | Manual workflow | Smart contracts & programs |

| Algorithm | Key Size | Signature Size | Special Feature |

|---|---|---|---|

| ECDSA | 256 bits | ~64 bytes | Widely adopted in Bitcoin/Ethereum |

| Schnorr | 256 bits | ~64 bytes | Linear aggregation, non-malleable |

| BLS | 381 bits | ~48 bytes | Signature aggregation across many signers |

| RSA | 2048 bits+ | 256 bytes+ | Legacy PKI compatibility |

Exchange Withdrawals

Instant verification without paper forms.

Smart Contract Wallets

Threshold signatures reduce complexity.

Cross-chain Bridges

Automated asset locking and minting.

Key Takeaway

Digital signatures provide cryptographic proof, instant verification, and support for advanced features impossible with traditional signatures. They're essential for scalable blockchain applications.

Quick Takeaways

- Digital signatures use asymmetric cryptography, providing provable ownership and tamper‑evidence.

- Traditional handwritten signatures rely on visual comparison and are vulnerable to forgery.

- ECDSA is the dominant scheme in Bitcoin and Ethereum because of short keys and fast verification.

- Schnorr and BLS signatures add aggregation, multi‑signature support, and smaller proof sizes.

- In crypto, digital signatures enable automated smart‑contract execution, while paper signatures remain limited to legal paperwork.

When you see a crypto transaction confirmed on a blockchain, the real hero is the Digital Signatures is a cryptographic proof that a specific private key approved the data, guaranteeing integrity and non‑repudiation. They are nothing like the ink‑on‑paper marks most people think of when they hear “signature”. This article breaks down how digital signatures differ from traditional handwritten signatures, why the crypto world favors algorithms such as ECDSA, Schnorr, and BLS, and what that means for developers, investors, and everyday users.

What a Traditional Signature Actually Is

A Traditional Signature is the physical act of writing a name or mark with a pen to indicate consent or approval. Its security comes from the unique quirks of a person’s handwriting - pressure, speed, slant - and from the expectation that only the signatory can reproduce those quirks. Verification typically means a human examiner compares the signature on a document with a known sample. This process is subjective, time‑consuming, and easily fooled by skilled forgers who practice mimicry or use high‑resolution scans.

How Digital Signatures Work Under the Hood

In contrast, a digital signature is generated by a private key is a secret number known only to the owner, used to create cryptographic proofs that is mathematically linked to a public key is the corresponding public component that anyone can use to verify a signature. The process looks like this:

- Hash the transaction data (e.g., using SHA‑256) to produce a fixed‑size digest.

- Run the digest through a signing algorithm with the private key. The result is the digital signature.

- Anyone can take the signature, the original data, and the public key to verify that the signer indeed possessed the private key and that the data hasn’t changed.

Because the private key never leaves the signer’s device, the signature can be verified by anyone on the network without exposing the secret.

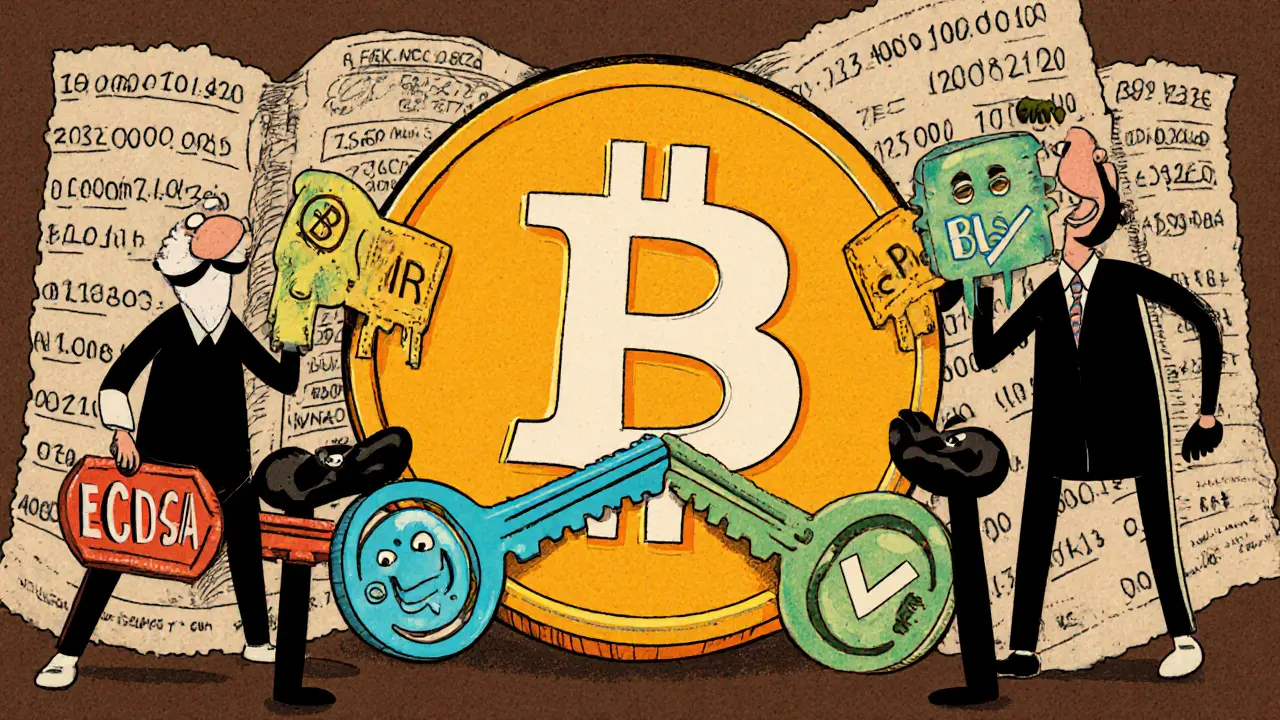

Key Crypto Algorithms and Their Characteristics

The crypto community has standardized on a few algorithms that balance security, speed, and key size.

- ECDSA is the Elliptic Curve Digital Signature Algorithm, favored for its short keys (typically 256bits) and fast verification. Bitcoin, Ethereum, and many other chains use it by default.

- Schnorr signatures are a simpler, provably secure scheme that supports linear aggregation, enabling multiple parties to produce a single compact signature. Bitcoin’s Taproot upgrade (BIP‑340) introduced Schnorr to the network.

- BLS signatures are Boneh‑Lynn‑Shacham signatures that allow signatures from many keys to be aggregated into one, cutting block size by up to 50%. Used experimentally in some proof‑of‑stake chains.

- RSA is an older public‑key system that requires much larger keys (2048bits or more) and is less efficient for high‑throughput blockchains. Still common in enterprise PKI but rare in modern crypto.

Why Digital Beats Handwritten in Crypto

Three core dimensions separate the two worlds:

| Aspect | Digital Signatures | Traditional Signatures |

|---|---|---|

| Authentication | Public‑key verification (objective, cryptographic) | Visual comparison (subjective) |

| Non‑repudiation | Mathematical proof tied to private key | Can be denied or forged |

| Tamper resistance | Any change invalidates the signature | Alterations can be hidden |

| Scalability | Automated verification of thousands of transactions per second | Human review required for each document |

| Automation | Smart contracts can verify signatures programmatically | Requires manual workflow |

In practice, this means a blockchain can settle millions of transactions without a clerk looking at each one. By contrast, a paper contract still needs a person to inspect the signature line.

Advanced Features Enabled Only by Digital Signatures

Because digital signatures are mathematically manipulable, developers have built sophisticated protocols that are impossible with pen‑and‑paper:

- Multi‑signature (multisig) wallets: Multiple private keys jointly authorize a transaction. Schnorr aggregation hides the number of signers, making the transaction look like a standard single‑sig payment.

- Signature aggregation: BLS lets a whole block of transactions be represented by one signature, reducing bandwidth by 30‑40%.

- Threshold signatures: In a DAO, any subset of members (e.g., 3‑of‑5) can produce a valid signature without revealing which members participated.

- Ring signatures: Privacy‑focused coins like Monero use them to hide the true spender among a group of possible signers.

All these tricks rely on the linearity and non‑malleability of the underlying algorithm.

Implementation Considerations: What You Need to Get Started

Switching from a pen‑based workflow to a cryptographic one isn’t just a click‑swap. You’ll need:

- A Public Key Infrastructure (PKI) is a system that issues, manages, and revokes digital certificates tied to public keys or a blockchain‑native key management solution.

- Secure storage for the private key - hardware wallets, secure enclaves, or encrypted keystores.

- Library support for the chosen algorithm (e.g., libsecp256k1 for ECDSA, secp256k1‑schnorr for Schnorr, bls12‑381 libraries for BLS).

- Compliance checks if you operate under regulations like ESIGN (US) or eIDAS (EU).

Once set up, verification can be run in parallel across thousands of nodes, making the system far more scalable than any manual signature review process.

Future Trends: Post‑Quantum Signatures and Decentralized Identity

Current schemes (ECDSA, Schnorr, BLS) depend on the hardness of the elliptic‑curve discrete‑log problem. Quantum computers could break that in theory. The community is already testing post‑quantum candidates such as CRYSTALS‑Dilithium is a lattice‑based signature algorithm designed to resist quantum attacks and Falcon. Adoption will be gradual, but forward‑looking projects are already architecting key‑rotation mechanisms.

At the same time, decentralized identity frameworks (e.g., DID methods) fuse advanced signature schemes with self‑sovereign identity. Users can prove ownership of a wallet address without revealing personal data, paving the way for privacy‑preserving KYC.

Comparing Popular Signature Schemes

| Algorithm | Key Size | Signature Size | Verification Speed | Special Feature |

|---|---|---|---|---|

| ECDSA | 256bits | ~64bytes | Fast | Widely adopted in Bitcoin/Ethereum |

| Schnorr | 256bits | ~64bytes | Very fast | Linear aggregation, non‑malleable |

| BLS | 381bits | ~48bytes | Moderate | Signature aggregation across many signers |

| RSA | 2048bits+ | 256bytes+ | Slower | Legacy PKI compatibility |

Real‑World Use Cases in Crypto

Below are three scenarios that illustrate why developers choose digital signatures over any paper‑based method.

- Exchange withdrawals: When a user requests a withdrawal, the exchange signs the request with its private key. The blockchain verifies the signature instantly, eliminating the need for a signed PDF form.

- Smart‑contract wallets: A DAO requires a 3‑of‑5 threshold signature to move funds. Using Schnorr, the three participants produce one compact signature that the contract accepts as if it came from a single key.

- Cross‑chain bridges: To lock assets on Chain A and mint on Chain B, the bridge node signs a proof of lock with an ECDSA key. The destination chain validates the proof without any human‑written paperwork.

Common Pitfalls and How to Avoid Them

- Key leakage: Store private keys in hardware wallets or encrypted modules; never expose them in plain text.

- Wrong hash algorithm: Always hash the exact transaction payload; mismatched hashes cause verification failures.

- Algorithm mismatch: A Bitcoin node expects ECDSA or Schnorr. Sending an RSA‑styled signature will be rejected.

- Improper certificate handling: If you use X.509 certificates for off‑chain signatures, ensure they’re issued by a trusted CA and not expired.

Conclusion: Embrace the Crypto‑Ready Signature

While a handwritten signature still has a place on paper contracts, the future of value transfer lives on the chain. digital signatures give you cryptographic proof, instant verification, and the ability to build complex, automated trust relationships that hand‑signed papers could never achieve. Whether you’re a developer writing smart contracts, an exchange securing withdrawals, or a regular user sending Bitcoin, the choice isn’t about convenience-it’s about security that scales.

Frequently Asked Questions

How does a digital signature prove ownership without revealing my private key?

The signature is created by applying a mathematical function that only the private key can produce. Verification uses the public key, which can’t be reversed to discover the private key.

Can I replace a handwritten signature on a legal document with a digital signature?

In many jurisdictions, a qualified electronic signature (QES) that meets eIDAS or ESIGN standards is legally equivalent. However, you must use a trusted certificate authority and follow local regulations.

Why does Bitcoin use ECDSA instead of RSA?

ECDSA offers the same security with much smaller keys (256bits vs. 2048bits for RSA), which means lower transaction size and faster verification-critical for a decentralized network.

What’s the advantage of Schnorr over ECDSA?

Schnorr signatures are non‑malleable and support linear aggregation, allowing many parties to combine into a single proof. This reduces data footprints and improves privacy.

Are digital signatures safe against quantum computers?

Current schemes (ECDSA, Schnorr, BLS) are vulnerable to large‑scale quantum attacks. The industry is transitioning to post‑quantum algorithms like CRYSTALS‑Dilithium, but widespread adoption will take years.

Comments (12)

Ali Korkor

Digital signatures are the real MVP of crypto. No more signing papers at 2am with a shaky hand. Just sign and go. Simple. Secure. No drama.

Serena Dean

Love how this breaks it down without jargon overload. ECDSA might be old-school, but it's still the workhorse. And Schnorr? Game-changer for scaling. Seriously, devs should be screaming about this.

James Young

You guys are all missing the point. ECDSA is a security liability. It's been cracked in simulations. The fact that Bitcoin still uses it is insane. We're running on a 15-year-old algorithm while the world moves on. This isn't innovation-it's complacency.

Chloe Jobson

BLS aggregation is where the real magic happens-especially for PoS chains. Reducing block size by 40%? That’s not just efficiency, that’s economic scalability. Also, multisig privacy via Schnorr? Chef’s kiss.

MANGESH NEEL

Let me tell you something. The entire crypto world is built on a lie. Digital signatures? They’re just math illusions. The private key is stored somewhere, right? And someone, somewhere, has access to it. You think your wallet is yours? Nah. It’s owned by the node operators, the exchanges, the governments. You’re just a puppet dancing to cryptographic strings.

They call it decentralization but it’s just a new kind of control. The ink on paper is messy, yes-but at least you can see it. You can touch it. This? This is invisible slavery.

And don’t get me started on BLS. Aggregation? That’s just hiding the truth. One signature for ten people? Who’s really signing? No one knows. It’s a black box with a fancy name.

Quantum computers? Please. The real threat is centralized key custodians. Not quantum. Not math. People. Always people.

They say ‘non-repudiation’-but who’s verifying that the person who owned the key was actually the one who signed? You can’t prove intent with math. Only with a signature on paper. And even that’s being phased out. We’re losing the soul of consent.

I’m not anti-tech. I’m pro-human. And right now, we’re handing over our autonomy to algorithms that can’t feel regret, guilt, or remorse.

One day, someone’s going to wake up and realize: the blockchain didn’t make us free. It just made our chains invisible.

Dick Lane

Man I just read this whole thing and it clicked. I used to think signatures were just scribbles. Now I get it-they’re like digital fingerprints that can’t be copied. That’s wild. And the part about multisig? That’s how my group of friends manages our DAO fund. Three of us sign, one transaction. No paperwork. Just vibes and code.

Zach Crandall

While I appreciate the technical depth, I must point out a fundamental flaw in the entire premise: the assumption that cryptographic proof equates to moral authority. A digital signature does not, and cannot, convey consent in the human sense. It conveys computation. And computation is indifferent to coercion, duress, or manipulation. When a person is forced to sign a transaction under threat-whether physical or psychological-the signature remains valid. The system is blind to context. This is not progress. This is the institutionalization of algorithmic indifference.

Legal systems, however flawed, at least allow for interpretation. Courts consider intent. Digital signatures do not. They are perfect in their logic, and therefore utterly inhumane.

And yet we celebrate this as innovation. We glorify the machine’s inability to empathize. We call it security. But security without justice is merely control dressed in hexadecimal.

I do not oppose cryptography. I oppose the idolatry of it.

When we erase the human element from consent, we do not create a better world. We create a colder one.

And if you think this doesn’t matter, ask yourself: who gets to control the private keys? And who gets left behind when the algorithm decides they’re no longer worth signing for?

Norman Woo

ok so like... if quantum computers break ECDSA... does that mean all my btc is just... gone? like poof? and no one can prove it was mine? because the public key is still there but the private key is useless? i mean... what if the gov just says 'oh we cracked it' and takes all the coins? like... is that even possible? and why arent they telling us this? why is no one talking about this??

Sean Huang

Everyone’s missing the real agenda here. Digital signatures aren’t about security-they’re about control. The same people pushing BLS and Schnorr are the ones who want to eliminate cash, eliminate anonymity, eliminate dissent. You think your wallet is private? Your signature is logged, timestamped, tied to your IP, your device fingerprint, your exchange account. Every transaction is a breadcrumb. And when the global system goes fully digital? You won’t be able to move a single satoshi without approval. This isn’t freedom. It’s the final step in financial surveillance. They’re not building a better system. They’re building a cage with a blockchain logo on it.

And don’t tell me about ‘self-sovereign identity.’ That’s just marketing speak for ‘you own your keys until we decide you don’t.’

Quantum computing? A distraction. The real threat is centralized identity protocols. They don’t need to crack your key. They just need to revoke your access. And you won’t even know why.

They’ve been planning this for decades. The crypto movement was co-opted. The tech is brilliant. The intent? Not so much.

Andrew Morgan

Just wanna say this is the clearest breakdown I’ve seen on digital vs handwritten signatures. I’m not a dev but I run a small business and we switched to crypto payments last year. The fact that we don’t have to chase people for signed PDFs anymore? Life changing. And the multisig for our LLC? Smooth as butter. No more arguing over who signed what. The blockchain remembers. I’m just glad someone finally explained it without making my eyes glaze over.

madhu belavadi

So… if I lose my private key… I lose everything? Like… forever? No second chance? No customer service? No ‘oops I forgot my password’ button? I mean… what if I die? Who gets my crypto? My family? They don’t even know what a blockchain is. This feels… cruel.

Ali Korkor

^^^ this is the real issue. Tech is awesome until it breaks. And when it breaks? No one’s coming to help. That’s the tradeoff. You get speed and security… but no safety net. So yeah-back up your keys. Like, really back them up. On paper. In a safe. Tell someone you trust. Don’t be that guy.