Iran Crypto Exchange Status Checker

About Iran's Crypto Restrictions

Iran's crypto landscape in 2025 is divided between government-controlled domestic exchanges and internationally-sanctioned foreign platforms. Learn which exchanges are effectively banned or restricted in Iran.

How to Interpret Results

Banned = Platform blocks Iranian users due to sanctions

Restricted = Platform operates under government oversight

Frequently Asked Questions

Which foreign exchanges completely block Iranian users?

Binance, Coinbase, Kraken, Bittrex, Huobi and OKX all refuse to serve Iranian IP addresses or wallet addresses. Their refusal stems from U.S. Treasury OFAC sanctions and the risk of secondary penalties.

Is Nobitex illegal to use?

No. Nobitex operates legally under Iran's central bank rules, but it must route all trades through the government-approved API, share user data, and obey stablecoin purchase caps.

Can I trade USDT from Iran?

Directly on major platforms you cannot. After the July 2025 Tether freeze, many users shift USDT into DAI on Polygon or use Turkish exchanges to convert USDT to other assets.

Ever wondered which crypto platforms you can’t use if you’re in Iran? The short answer is: it’s not just a list of names. Iran’s crypto scene in 2025 is split between home‑grown exchanges that the government keeps under a tight leash and foreign platforms that shut Iranian accounts out to avoid U.S. sanctions. Below we break down the two‑pronged restriction system, name the exchanges that are effectively off‑limits, and show you how people are still getting crypto exposure despite the hurdles.

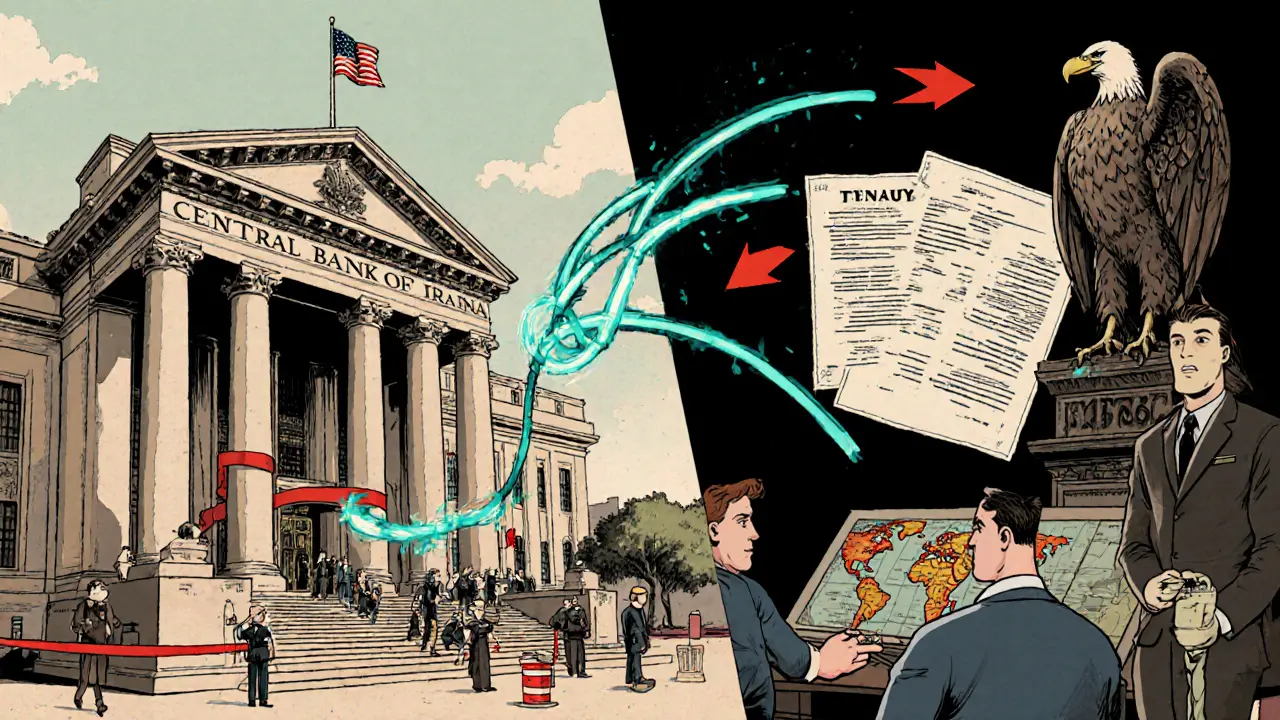

Understanding Iran’s Dual Crypto Restriction System

Iran runs a Central Bank of Iran (the nation’s monetary authority that enforces fiat‑crypto conversion rules) that blocks any direct crypto‑to‑rial flow on ordinary websites. In December2024 the bank announced a blanket ban on internet‑based crypto payments, effectively cutting off most peer‑to‑peer trading. By early 2025 it opened a narrow window for “government‑approved” exchanges that feed data through an official API, giving the state full visibility into user transactions.

At the same time, the U.S. Treasury’s Office of Foreign Assets Control (OFAC (the agency that enforces economic sanctions against Iran and other sanctioned entities) ) has been pressuring global crypto firms to block Iranian wallets. The result is a layered barrier: domestic platforms need a government API key, while foreign platforms either voluntarily lock Iranian accounts or are forced to do so by OFAC designations.

Domestic Exchanges Under Government Control

The biggest home‑grown platform is Nobitex (Iran’s largest crypto exchange, handling a majority of the country’s trading volume). After the July2025 Tether freeze that hit dozens of Nobitex‑linked addresses, the Central Bank tightened its grip, demanding that every Nobitex user’s data pass through the state‑run API. The exchange can still operate, but only if it complies with the data‑sharing mandate and respects the new stablecoin caps (max $5,000 purchase per year, $10,000 holding limit).

Other smaller Iranian platforms-such as Wallex (a crypto‑fiat gateway that offers limited services under the central bank’s oversight) and Exir (a peer‑to‑peer marketplace that now requires API verification for each transaction)-are also subject to the same reporting requirements. In practice, these domestic exchanges are not “banned”; they are heavily monitored and can only trade approved crypto‑to‑rial pairs.

International Exchanges Blocking Iranian Users

Most of the big global platforms have decided that the compliance risk outweighs the potential market in Iran. Here’s why:

- Tether froze 42 Iranian‑linked wallets on July22025, many of which were funneling USDT through Nobitex. The freeze sent a clear warning to any exchange that processes USDT for Iranian accounts.

- Bittrex (now in bankruptcy) locked all Iranian‑owned accounts after an OFAC sanction list added several Iran‑related addresses. The platform cited its Terms of Service, which grant it the right to suspend accounts for legal compliance.

- U.S.‑based services like Coinbase, Kraken and Binance.US have pre‑emptively blocked Iranian IPs and wallet addresses to avoid secondary sanctions.

- Asian giants such as Huobi and OKX have also stopped onboarding Iranian users, citing “regulatory uncertainty” after OFAC’s 13 designations in 2024.

The result is a de‑facto ban on most major foreign exchanges for Iranian residents, even if the platforms never officially announced a “Iran ban.”

What Exchanges Are Effectively Banned?

Below is a snapshot of the current status for the most‑used platforms as of October2025. “Banned” means the exchange either blocks Iranian IPs, freezes accounts, or has been forced to stop servicing Iranian users due to sanctions. “Restricted” denotes exchanges that still operate but only under the Iranian government’s API system.

| Exchange | Status | Reason |

|---|---|---|

| Binance | Banned | OFAC designations; US‑based compliance |

| Coinbase | Banned | US sanctions, wallet freeze policy |

| Kraken | Banned | Risk of secondary sanctions |

| Bittrex | Banned | Account freezes after OFAC action |

| Huobi | Banned | Regulatory uncertainty, OFAC pressure |

| OKX | Banned | Compliance with US sanctions |

| Nobitex | Restricted | Must use government API; data sharing required |

| Wallex | Restricted | Limited to approved crypto‑fiat pairs via API |

| Exir | Restricted | Peer‑to‑peer trades need API verification |

| LocalBitcoins (IR version) | Restricted | Operates under central bank guidelines |

Notice that no exchange is officially “banned” by Iranian law; the bans come from external compliance pressures. The domestic market is choked by strict data‑sharing rules, while the international market is largely shut off by sanctions.

Workarounds and Alternatives

Despite the heavy hand, Iranian traders still find ways to stay in the crypto game. Here are the most common tactics:

- Use Turkish intermediaries: Turkey’s liberal crypto environment makes it a popular gateway. Users create Turkish residency or use VPNs to access Turkish exchanges, then move funds back to Iran through peer‑to‑peer channels.

- Swap USDT for DAI on Polygon: After the July2025 Tether freeze, many influencers advised moving USDT into decentralized stablecoins like DAI via the Polygon network, which is less likely to be flagged by OFAC.

- Peer‑to‑peer OTC desks: Small OTC desks operating under the radar (often on messaging apps) allow direct fiat‑crypto trades without involving a traditional exchange.

- Hardware wallets and offline transfers: Traders store crypto on hardware wallets and only use exchanges for occasional on‑ramps, minimizing exposure to banned platforms.

- Decentralized exchanges (DEXs): Platforms such as Uniswap or SushiSwap on Ethereum and Polygon let users trade without a central authority, though gas fees can be high.

Each workaround carries its own risk-legal, regulatory, or security‑related-so users should evaluate the trade‑offs carefully.

Recent Regulatory Updates (2025)

Two key changes in 2025 shape the current landscape:

- Stablecoin caps: On September27 the Central Bank limited individual stablecoin purchases to $5,000 per year and holdings to $10,000. This curtails mass inflows of USDT or USDC into Iran.

- Taxation law: The August2025 “Law on Taxation of Speculation and Profiteering” now taxes crypto capital gains at the same rate as gold and real estate, forcing traders to keep detailed records.

Both moves signal Tehran’s intent to keep a formal, taxable crypto market-even if it remains under strict supervision.

Key Takeaways

While the phrase “crypto exchanges banned in Iran” suggests a simple blacklist, reality is far more nuanced. Domestic exchanges like Nobitex are not prohibited; they just operate under a government‑mandated API that logs every trade. International platforms are effectively banned because they must obey U.S. sanctions-Tether’s wallet freeze and OFAC designations are the primary drivers. Traders therefore rely on cross‑border services, stablecoin swaps, and decentralized protocols to stay active.

Understanding this two‑layered system helps you avoid dead‑ends, comply with emerging tax rules, and pick the safest workaround for your crypto activities.

Frequently Asked Questions

Which foreign exchanges completely block Iranian users?

Binance, Coinbase, Kraken, Bittrex, Huobi and OKX all refuse to serve Iranian IP addresses or wallet addresses. Their refusal stems from U.S. Treasury OFAC sanctions and the risk of secondary penalties.

Is Nobitex illegal to use?

No. Nobitex operates legally under Iran’s central bank rules, but it must route all trades through the government‑approved API, share user data, and obey stablecoin purchase caps.

Can I trade USDT from Iran?

Directly on major platforms you cannot. After the July 2025 Tether freeze, many users shift USDT into DAI on Polygon or use Turkish exchanges to convert USDT to other assets.

What are the tax implications of crypto trading in Iran?

The August 2025 taxation law treats crypto gains as speculative income. Traders must report profits and pay the same capital‑gains rate applied to gold or real estate, typically between 15‑25% depending on income brackets.

Is using a VPN enough to access banned exchanges?

A VPN can hide your IP, but most platforms also screen wallet addresses against OFAC lists. If your wallet is flagged, you’ll be blocked regardless of VPN use.

Comments (21)

Dick Lane

This is actually one of the clearest breakdowns I've seen on Iran's crypto situation. The dual-layered restriction thing makes so much sense now. I used to think it was just another country banning crypto, but it's way more about sanctions and control than ideology.

Big respect to the people finding workarounds. That's resilience.

Norman Woo

they say its sanctions but i think its all part of the new world order they want to control every dollar you touch and if you use crypto you're already a target lol

Roxanne Maxwell

I live in the US but have friends in Tehran who use Nobitex. It's wild how they’ve turned restrictions into a kind of underground art form. The DAI swaps on Polygon? Genius. The fact they’re still trading at all is inspiring.

Ayanda Ndoni

Why do people even bother? I mean, if the government's watching everything, and the US is freezing wallets, isn't it just asking for trouble? I'd rather just buy gold and call it a day.

Elliott Algarin

It’s funny how we talk about freedom in crypto, but here’s a country where the only way to be free is to play by the rules of two opposing powers. The real crypto revolution isn’t about decentralization-it’s about survival.

John Murphy

I never realized how much OFAC affects things globally. I thought it was just about banks and big finance but seeing it hit crypto wallets directly... that’s next level control

Zach Crandall

The fact that Iran's domestic exchanges are forced to hand over every transaction is not regulation. It’s surveillance capitalism with a theocratic twist. This isn't a market-it's a monitored data farm.

Akinyemi Akindele Winner

Man this whole thing is like a Shakespearean tragedy written by a blockchain dev. Nobitex? More like Nobitex: The Puppet Exchange. And the people? They're the chorus singing in encrypted whispers.

Patrick De Leon

Ireland doesn't have this problem because we don't let foreign powers dictate our financial policy. If you can't handle your own economy, don't blame the US. Iran's government is the problem, not the sanctions.

MANGESH NEEL

People think they're being clever using DAI or VPNs but they're just playing Russian roulette with their life savings. This isn't finance, it's gambling with a side of treason. The government should shut this down completely. No more crypto for Iran, full stop.

Sean Huang

The Tether freeze wasn't about compliance... it was a message. They're testing the waters for a global crypto kill switch. Once they control stablecoins, they control the entire digital economy. This isn't about Iran-it's about who owns money next decade. 🤔

Ali Korkor

You guys are overcomplicating it. If you want crypto in Iran, use the workarounds. VPN + DAI + P2P. Done. It's not perfect but it works. Don't let fear stop you from owning your money.

madhu belavadi

I don't care what anyone says, this whole thing is rigged. The system is designed to fail people like me. Why should I even try?

Serena Dean

I love how creative people get under pressure. The Turkish intermediaries and Polygon swaps? That’s innovation born from necessity. Keep going, Iran. You’re proving crypto isn't just tech-it's human spirit.

James Young

You all act like this is some groundbreaking analysis. Newsflash: every authoritarian regime does this. China blocks crypto, Russia controls it, Iran micromanages it. The only difference is they're worse at hiding it. Stop pretending this is unique.

Chloe Jobson

The API mandates on domestic exchanges are a textbook example of regulatory capture. Central bank as gatekeeper + OFAC as external enforcer = perfect storm for financial exclusion. The tax law? Just the cherry on top.

Andrew Morgan

I’ve seen this play out in other sanctioned countries. The tech always wins in the end. People will find a way. Hardware wallets, local P2P, private channels. The system tries to control it, but the network adapts. It’s beautiful.

Michael Folorunsho

Anyone using these workarounds is naive. You think you’re free because you’re using DAI? You’re still feeding the machine. The real power isn’t in the blockchain-it’s in the data trails you leave behind. You’re not hacking the system. You’re feeding it.

Jonathan Tanguay

I've been tracking this for years and I have to say, this is the most accurate summary I've ever seen. The stablecoin caps? That's not about controlling speculation-it's about preventing capital flight. And the taxation law? They're trying to turn crypto into a state revenue stream. It's not a ban, it's a monetization strategy. The fact that people are still using DAI on Polygon shows they're smarter than the regulators think. And let's be real-no one's going to stop people from trading when they're desperate. The real question is: who's going to be the first to build a decentralized, non-KYC, Iran-native DEX that doesn't require API access? That's the real innovation.

Rampraveen Rani

DAI on Polygon 💪🔥 This is how you win! No government can stop YOU when you control your keys! 🚀

Dick Lane

I'm not surprised the author didn't mention Telegram bots. They're the real backbone of Iranian crypto now. People trade USDT for rials through encrypted groups with escrow. No exchange needed.