Cosmos (ATOM) Staking Calculator

Estimated Annual Staking Rewards

Gross Reward: $0.00

Commission Fee: $0.00

Net Reward: $0.00

APR: 0.00%

Daily Reward: $0.00

Monthly Reward: $0.00

Note: These calculations are estimates based on current data. Actual rewards may vary due to network conditions, validator performance, and changes in inflation rates.

About ATOM Staking

In the Cosmos network, ATOM tokens can be staked to secure the network and earn rewards. Validators validate transactions and create new blocks, while delegators contribute to network security by staking their tokens.

As of July 2025, ATOM has an inflation rate of approximately 12%, with an average validator commission of 5%. The network rewards active participants through staking rewards.

Key Takeaways

- Cosmos creates an "Internet of Blockchains" using the IBC protocol to link independent chains.

- ATOM is the native token that pays fees, secures the network through staking, and powers governance.

- The network runs on Tendermint BFT consensus, offering sub‑second block times after the July2025 upgrade.

- Cosmos SDK and CosmWasm let developers build custom zones in weeks, not months.

- Compared to Polkadot and Avalanche, Cosmos trades faster but has higher inflation and validator centralization concerns.

When people ask, "What is Cosmos (ATOM) crypto coin?", they’re really looking for a quick snapshot of a blockchain that promises to connect many other blockchains together. In plain terms, Cosmos is a modular ecosystem where each independent chain - called a "zone" - can talk to each other through a shared protocol. The whole system is anchored by the Cosmos Hub, and the native token ATOM does the heavy lifting: paying transaction fees, securing the network via staking, and giving holders a say in protocol upgrades.

Cosmos a blockchain ecosystem designed for interoperability among independent blockchains was co‑founded by Jae Kwon and Ethan Buchman in 2014, stemming from their earlier work on the Tendermint consensus engine. The project's white paper dropped in 2016, followed by a 2017 token sale that funded the first wave of development.

How Cosmos Is Structured

The architecture splits into three layers:

- Application layer - where smart contracts and custom logic live.

- Networking layer - powered by the Inter‑Blockchain Communication (IBC) protocol.

- Consensus layer - driven by Tendermint a Byzantine Fault Tolerant Proof‑of‑Stake engine.

At the heart sits the Cosmos Hub the central blockchain that connects all zones via IBC. Each zone can set its own rules, tokenomics, and governance while still leveraging the Hub for cross‑chain value transfers.

What ATOM Does

ATOM the native cryptocurrency of the Cosmos network isn’t just a speculative asset. It has three core functions:

- Transaction fees: Users pay roughly $0.01 per transaction, keeping the network cheap for high‑frequency use.

- Staking: Validators lock up ATOM to earn block rewards and secure the chain. Current annual inflation ranges from 7% to 20% depending on the proportion of tokens staked.

- Governance: Holders vote on upgrades, fee parameters, and ecosystem grants.

As of July112025, ATOM trades around $4.66, with a circulating supply of about 286million and a market cap near $1.82billion. The token’s all‑time high was $44.70 in September2021, while its low hit $1.13 during the March2020 crash.

Staking, Validators, and Security

Validators are the network’s gatekeepers. To run a validator node you need at least a 4‑core CPU, 8GB RAM, and a 500GB SSD. The node software is written in Go and talks to the Tendermint engine for block production. When a validator behaves badly - double‑signing or downtime - the protocol automatically slashes a portion of its staked ATOM, acting as a financial deterrent.

Because of the inflationary token model, the network rewards active participants. According to a 2025 user survey, 68% of ATOM holders stake their tokens, earning an average net return of 12.7% after accounting for inflation. However, the top 100 validators control most governance decisions, a point raised by critics who fear centralization.

Developer Toolkit: Cosmos SDK and CosmWasm

For developers, the Cosmos SDK an open‑source framework for building custom blockchains is the go‑to resource. It abstracts away the low‑level consensus code, letting teams focus on application logic. The SDK ships with modules for staking, governance, and IBC out of the box.

In July2025, Cosmos added CosmWasm a WebAssembly smart‑contract platform for Cosmos zones. This means developers can write smart contracts in Rust, AssemblyScript, or Go, then compile to WASM and deploy across any zone. Early adopters report a 40% reduction in development time for DeFi products.

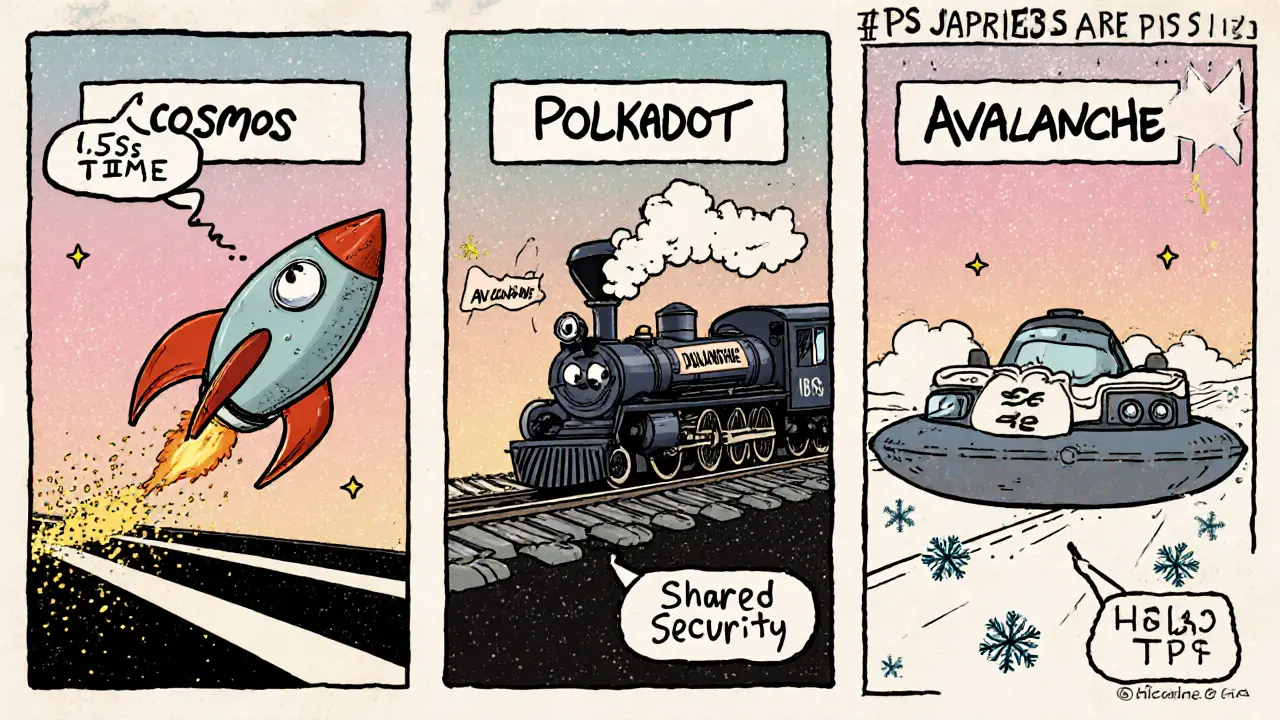

Cosmos vs. Other Interoperability Platforms

| Feature | Cosmos | Polkadot | Avalanche |

|---|---|---|---|

| Consensus | Tendermint BFT PoS | Nominated Proof‑of‑Stake | Snowman (PoS) |

| Block time (post‑upgrade) | 1.5seconds | 6seconds | 2seconds |

| Inter‑chain protocol | IBC | XCMP | Subnet bridges |

| Max TPS (theoretical) | ~10,000 | ~1,000 | 4,500 |

| Supply model | Inflationary, no cap | Finite (1billion DOT) | Fixed (720M AVAX) |

Cosmos wins on block speed and developer flexibility, while Polkadot offers shared security and Avalanche shines on raw throughput. Your choice depends on whether you value sovereign zones (Cosmos), pooled security (Polkadot), or blazing‑fast DeFi pipelines (Avalanche).

Market Position and Outlook

In Q22025 the blockchain‑interoperability market was valued at $3.2billion, growing at a 42.7% CAGR through 2030. Cosmos captures roughly 18.3% of that slice, placing it behind Polkadot (22.1%) but ahead of Avalanche (15.6%). Daily transaction volume sits at about 2.3million, with $15.2billion in cross‑chain value moved in 2025 alone.

Price forecasts vary widely. WalletInvestor’s algorithm sees ATOM between $5.45 and $10.77 by year‑end 2025; Cryptopolitan expects a max of $5.38; while more bullish analysts like Nugget’s News project $34.40 by 2030. The main risks cited are inflationary tokenomics, validator centralization, and regulatory scrutiny of utility tokens.

Pros and Cons

- Pros: Fast finality, low fees, modular SDK, strong IBC ecosystem, growing enterprise adoption (IBM Food Trust, Mastercard pilots).

- Cons: No hard cap on ATOM supply, validator concentration, steeper learning curve for new developers, occasional slashing during upgrades.

Getting Started with Cosmos

If you’re new to the ecosystem, here’s a quick cheat‑sheet:

- Set up a wallet (e.g., Keplr) and fund it with ATOM.

- Visit the official Cosmos site to read the latest validator requirements.

- Stake ATOM via the wallet’s delegation interface - most delegators see ~12% annual yield.

- Explore the Cosmos SDK tutorials to spin up a test zone on your local machine.

- Try a CosmWasm contract on the Juno testnet to see smart‑contract interaction across zones.

Remember, the first time you interact with a validator you’ll need to lock up at least 1ATOM, but you can withdraw after a 21‑day unbonding period.

Frequently Asked Questions

What is the main purpose of Cosmos?

Cosmos aims to create an "Internet of Blockchains" where each independent chain can transfer data and assets securely via the IBC protocol, solving the isolation problem of early blockchains.

How does ATOM differ from Bitcoin?

Unlike Bitcoin’s fixed 21million supply and proof‑of‑work mining, ATOM is inflationary, uses proof‑of‑stake, and serves multiple roles: fee payment, staking, and governance.

Can I earn passive income by staking ATOM?

Yes. Delegating ATOM to a reputable validator typically yields 8‑15% annual returns after accounting for inflation and network fees.

What are the hardware requirements for running a validator node?

A minimum of a 4‑core CPU, 8GB RAM, and a 500GB SSD is recommended. Stable broadband (≥10Mbps) and a public IP are also needed.

How does Cosmos compare to Polkadot?

Both target interoperability, but Cosmos gives each zone full sovereignty and uses IBC, while Polkadot pools security in a single relay chain and relies on XCMP for cross‑chain messages. Cosmos generally offers faster block times, whereas Polkadot’s shared security can lower entry barriers for new chains.

Comments (12)

Andrew Morgan

so cosmos is basically like the internet but for blockchains and honestly that’s wild

you got chains talking to each other like old friends at a bar

no more walled gardens

just pure chaos and connection

madhu belavadi

i dont get why anyone would stake atom when inflation is so high

Dick Lane

the thing people forget is that inflation isnt always bad

if its going to validators who keep the network safe and you’re earning 12%

thats basically free money with skin in the game

plus the fees are dirt cheap

you can send 100 txns for less than a coffee

Norman Woo

they say ibc is secure but what if the hub gets hacked

what if the gov is already controlling the top 100 validators

i mean look at the fed and the cia

they control everything

cosmos is just the next phase of the matrix

Serena Dean

if you're new to cosmos start with keplr and just stake 1 atom

you'll see how easy it is

and then try a cosmwasm contract on juno

it's like building legos but for blockchains

so satisfying

and yes you can earn 12%+

it's real passive income

James Young

polkadot is for people who can't handle responsibility

shared security? please

you're giving up your sovereignty to a central relay chain

cosmos is the only real solution

if you're not building on cosmos you're building on sand

and your code is gonna break when the next bull run hits

Chloe Jobson

IBC is the real MVP

no cross-chain bridges with 3rd party oracles

just direct p2p message passing

and cosmwasm + sdk means you can deploy a dapp in 2 weeks

not 6 months

enterprise adoption is accelerating fast

Michael Folorunsho

the us is the only country with the tech stack to run this properly

india? africa? they're just trying to ride the wave

cosmos was built by americans for americans

if you're not on the hub you're just a tourist

and your chain will get ignored

Roxanne Maxwell

i staked my first 5 atom last month and got my first reward yesterday

it felt like magic

like i was part of something bigger

thank you to the devs who made this so accessible

you're changing the game

Jonathan Tanguay

you guys are all missing the point

the real risk isnt inflation or centralization

its the fact that most devs still dont understand tendermint bft

they think its just another poS

but its not

tendermint has finality in 1.5 seconds

ethereum cant even do that after 10 years

and cosmwasm is the only wasm implementation that actually works with ibc

everyone else is just copy pasting

if you dont know the difference between ibc and xcmp you shouldnt even be here

Ayanda Ndoni

why bother with all this when you can just buy btc and chill

Elliott Algarin

there's something poetic about building an internet of blockchains

like we're finally creating a digital civilization

not just tools

but communities

with their own rules

their own economies

their own identities

and atom is the glue

not because it's valuable

but because it's necessary