Cellana Token Locking Calculator

Calculate Your Voting Power

The ve(3,3) model rewards longer lock periods with increased voting power. This calculator shows how much voting power you'll gain by locking your CELL tokens for different durations.

Your Voting Power Estimate

Voting power increases with longer lock periods and larger token amounts

What is voting power?

Your voting power determines how much influence you have over liquidity pool emissions. Longer lock periods give you more voting power.

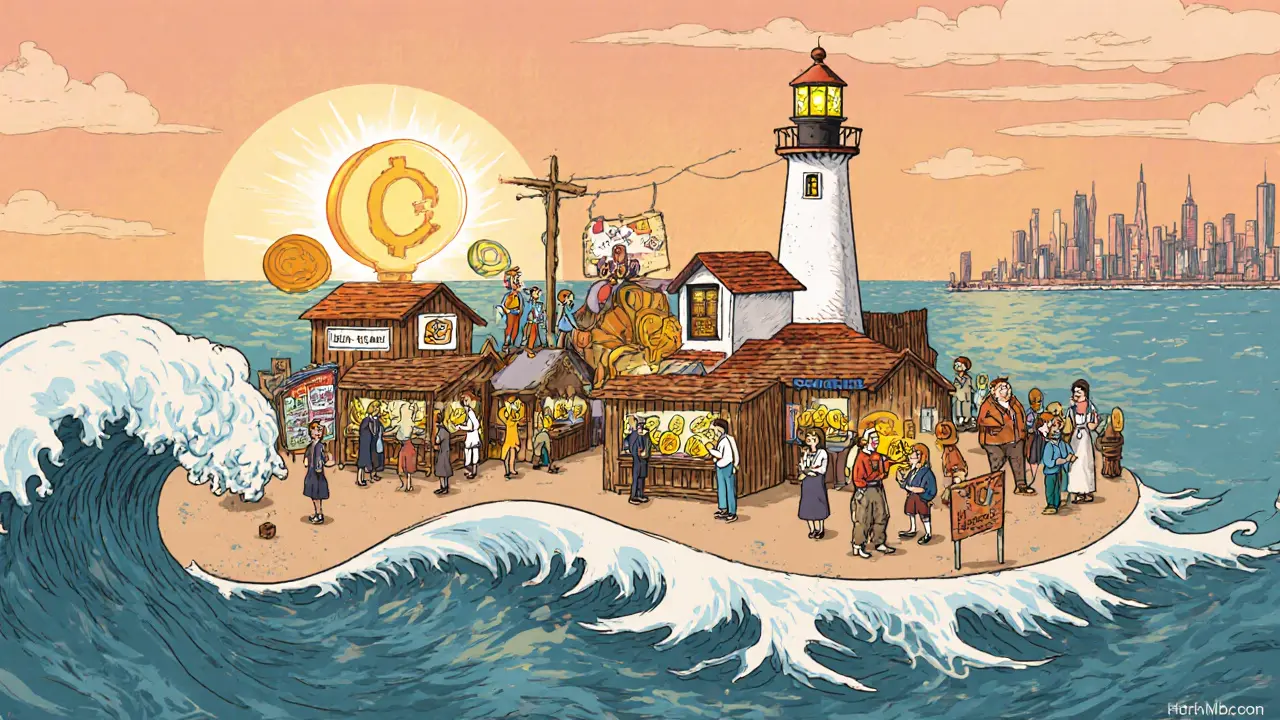

If you’ve been scouting new decentralized exchanges (DEXes) on the Aptos blockchain, you’ve probably heard the name Cellana crypto exchange review popping up in forums. Let’s cut through the hype and see whether Cellana Finance lives up to its sustainable‑liquidity promise or just another niche DEX with thin order books.

What is Cellana Finance?

Cellana Finance is a community‑owned DEX built on the Aptos network. Founded in 2023 as a division of Ocean Floors Technology Ltd., the platform aims to address the token‑inflation problems seen on older DEXs like PancakeSwap and Uniswap. Its native governance token, CELL, has a total supply of 1,083,370,166 tokens.

Core Features and Architecture

Cellana’s standout feature is the implementation of the ve(3,3) model on Aptos using the Move programming language. Users lock CELL tokens for periods ranging from two weeks to two years and receive veNFTs (vote‑escrowed CELL). The longer the lock, the more voting power you get over liquidity‑pool emissions, effectively letting the community decide where trading fees flow.

Beyond the voting mechanic, the platform runs a hybrid swap engine that tailors pricing formulas to the correlation of the assets being swapped. This is a technical differentiator from the constant‑product formula used by Uniswap.

Tokenomics at a Glance

- Current price (Oct 2024): $0.0061 per CELL

- Market cap: $1.95 M (fully diluted: $6.63 M)

- 24‑hour volume: $118,670; 7‑day volume: $796,910

- All‑time high: $0.0672 on 5 Oct 2024 (down 91%)

The token’s sharp decline reflects limited liquidity and modest trading activity-only seven pairs are listed on CoinGecko, putting Cellana’s daily volume at a fraction of 0.00092 % of total DEX volume.

Liquidity and Market Position

Cellana sits in a niche corner of the DEX landscape. While Ethereum‑based Uniswap commands over 60 % of DEX market share, Cellana’s share is effectively zero. Its limited pair count and shallow order books lead to high slippage, especially for trades above $500. On the plus side, the ve(3,3) incentive model avoids continuous token emissions, offering a more sustainable liquidity incentive compared with SushiSwap’s 10 % inflation.

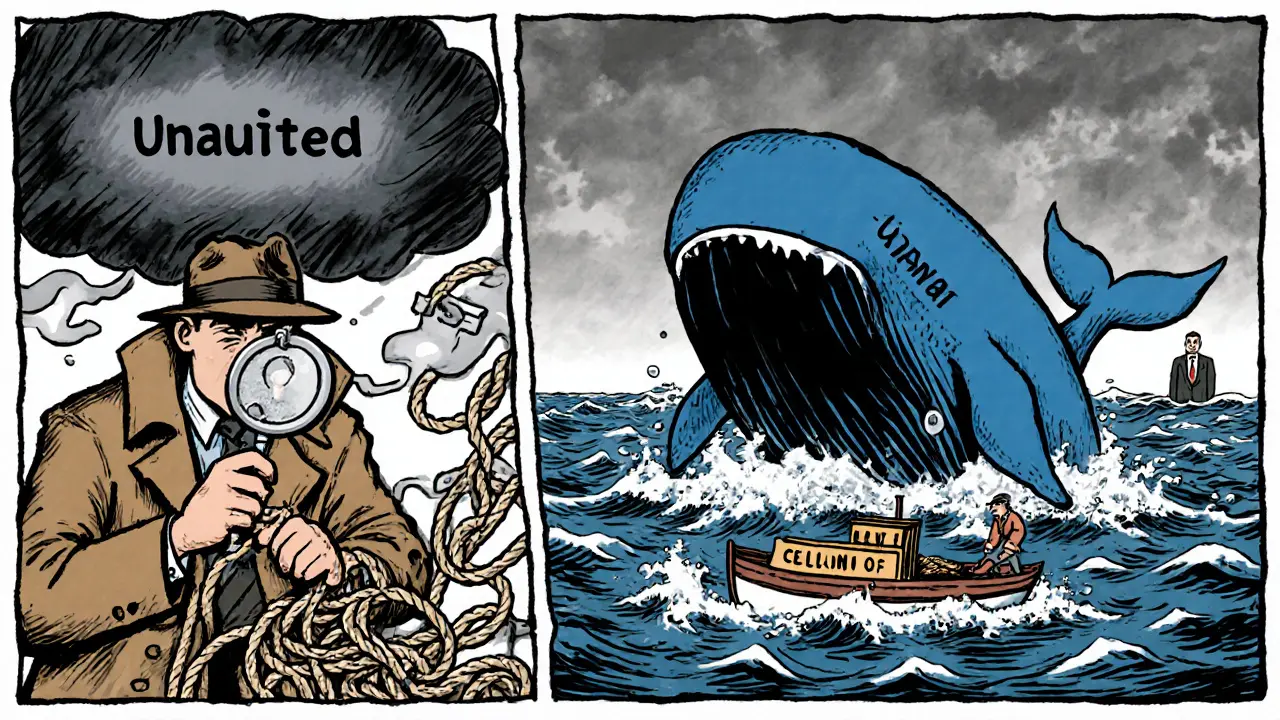

Security Landscape

Security is a gray area for Cellana. The Aptos network’s BFT consensus and Move’s resource‑oriented programming provide a solid base, but no third‑party audit reports have been published for the Cellana contracts. CryptoOpsec’s 2024 DeFi report warned that projects with market caps under $5 M often lack the resources for thorough audits, and 78 % of DeFi hacks that year involved unaudited code. Users should therefore employ hardware wallets and multi‑signature setups wherever possible.

User Experience and Onboarding

Getting started requires an Aptos‑compatible wallet such as Petra or Martian. Wallet setup typically takes 15 minutes, but newcomers stumble over gas‑fee estimation (≈0.0005 APT per tx) and slippage settings. The platform’s documentation scores just 2.8/5 on CoinGecko, lacking tutorials on advanced features and security best practices.

Customer support lives on Telegram, with response times reported between 12-24 hours. Community size is small but engaged: around 1,200 members on Telegram and 800 followers on Twitter, most discussions revolving around voting mechanics and liquidity concerns.

Pros and Cons Summary

| Aspect | Cellana Finance | Uniswap (Ethereum) | PancakeSwap (BNB Chain) |

|---|---|---|---|

| Blockchain | Aptos (Move) | Ethereum (EVM) | BNB Chain (EVM) |

| Liquidity Model | ve(3,3) community voting | Fee‑based, no token emissions | Token‑emission farms |

| Daily Volume (Oct 2024) | $118k | $12.8 B | $3.8 B |

| Trading Pairs | 7 | Over 4,000 | ~2,500 |

| Security Audits | None publicly disclosed | Multiple audits | Multiple audits |

| Fiat On‑ramps | None | Limited (via partners) | Available |

The table highlights where Cellana shines-sustainable tokenomics-and where it lags-liquidity depth and audit transparency.

Roadmap and Future Development

Cellana’s public roadmap (Sept 2024) promises cross‑chain bridges to Ethereum and Solana, limit‑order functionality, and a mobile app by Q4 2024. An October 2024 update added better gas‑fee estimation tools, but core features like stop‑loss orders remain missing. Without a substantial liquidity boost (targeting a 500 % increase), the platform’s long‑term viability remains questionable.

Regulatory Considerations

The SEC’s September 2024 guidance flagged ve‑token structures as potentially falling under securities regulations. Because CELL holders receive voting rights tied to future fee streams, regulators could view veCELL as a security, adding compliance risk for the project and its users.

Final Verdict: Is Cellana Worth Your Time?

For DeFi enthusiasts who love experimenting with novel governance models and are comfortable navigating low‑liquidity environments, Cellana offers a fresh take on sustainable incentives. However, traders seeking deep order books, robust audit trails, and fiat gateways will likely be better served by established DEXs. If you decide to try Cellana, start with a small amount, lock your tokens for a short period, and keep an eye on community votes to see where liquidity incentives are headed.

Quick Checklist for Prospective Users

- Use an Aptos‑compatible wallet (Petra or Martian).

- Lock CELL for at least two weeks to earn veCELL voting power.

- Set slippage tolerance low (0.5‑1 %) to avoid costly price impact.

- Monitor Telegram for real‑time updates on liquidity allocations.

- Consider the regulatory risk around ve‑token models.

What wallets can I use with Cellana Finance?

Cellana runs on the Aptos blockchain, so you need an Aptos‑compatible wallet. The most popular options are Petra and Martian, both offering browser extensions and mobile apps.

How does the ve(3,3) model work?

You lock CELL tokens for a chosen period (2 weeks to 2 years). In return you receive a veNFT that represents your voting power. The longer you lock, the higher your influence over which liquidity pools receive fee rewards.

Is Cellana Finance audited?

As of October 2025, no independent third‑party audit reports have been published for Cellana’s smart contracts. Users should treat the platform as unaudited and apply extra caution.

What are the main risks of using Cellana?

Key risks include high slippage due to shallow liquidity, potential regulatory scrutiny of veTOKEN models, and the lack of documented security audits. Additionally, the platform’s token price has fallen over 90 % from its all‑time high.

How does Cellana compare to Uniswap?

Uniswap runs on Ethereum, offers thousands of pairs, and has deep liquidity, but it does not use a ve(3,3) voting system. Cellana, on Aptos, provides a community‑governed fee allocation model but suffers from low volume and limited pairs.

Comments (15)

Jenna Em

Sometimes the blockchain feels like a mirror of our hidden fears, reflecting how power can slip through unseen cracks. The ve(3,3) model looks noble, but who really controls the voting power once tokens are locked away? A small group could steer liquidity incentives while the rest watch from the sidelines. In a world where data is collected silently, every lock could be a silent vote for someone else's agenda. Keep your eyes open.

Stephen Rees

One could wonder if the absence of a public audit is just an oversight, or perhaps a sign of deeper issues lurking beneath the code. The modest trading volume might simply be a market lull, not necessarily a flaw in design. Yet the possibility of hidden vulnerabilities should not be dismissed outright. It's worth observing the platform quietly before drawing firm conclusions.

Katheline Coleman

From an analytical perspective, Cellona Finance presents a unique amalgamation of governance mechanisms and liquidity incentives that merit thorough examination. The implementation of the ve(3,3) model on the Aptos blockchain introduces a novel approach to fee allocation, whereby token holders who commit their assets for extended periods obtain proportional voting authority. This design, in theory, aligns stakeholder interests with the long‑term health of the protocol, potentially mitigating the token‑inflation concerns observed on legacy platforms. Nevertheless, the empirical data reveals a modest market capitalization of approximately $1.95 million, indicative of limited adoption. The trading volume, hovering near $118 k daily, further underscores the platform’s nascent liquidity landscape. Moreover, the scarcity of listed pairs-merely seven according to CoinGecko-constricts the breadth of trading opportunities available to users. High slippage, particularly on transactions exceeding $500, may erode user confidence and deter substantial capital inflows. The absence of publicly disclosed third‑party audits raises legitimate security considerations, as evidenced by industry analyses linking unaudited contracts to elevated hack risk. While the Aptos network’s BFT consensus and Move language architecture provide a robust foundational layer, the on‑chain code itself remains an opaque variable. The platform’s roadmap, which envisages cross‑chain bridges and limit‑order functionality, is ambitious yet contingent upon a significant liquidity surge, estimated at a 500 % increase to achieve sustainable depth. Regulatory scrutiny, especially regarding the ve‑token structure’s potential classification as a security, adds an additional layer of compliance uncertainty. User onboarding experiences, although streamlined through wallets such as Petra and Martian, still encounter friction due to gas‑fee estimation and slippage settings. Community engagement appears active, with a modest Telegram presence, though the limited size may constrain collective governance efficacy. In conclusion, while Cellona Finance offers an intriguing experimental framework for decentralized governance, prospective participants should judiciously weigh its liquidity constraints, audit opacity, and regulatory exposure before allocating capital.

Amy Kember

It’s clear the roadmap sounds promising but without deeper liquidity the model can’t function effectively

Evan Holmes

Not impressed with the slippage.

Scott McCalman

Wow 😱 Cellona’s ve(3,3) is like the plot twist of a thriller – you think it’s safe, then BAM! 💥 The lack of audits feels like a ticking time bomb waiting to explode! 🚨

Andrew Smith

All right folks, don’t let the shallow order books scare you – this is a chance to get in early and shape the future, so grab some CELL and lock it up now!

mike ballard

From a DeFi primitives perspective, Cellona’s hybrid swap engine leverages adaptive pricing curves that deviate from the classic constant‑product invariant, offering a more efficient capital allocation model 🚀. However, the low TVL and limited pair diversity raise concerns about market‑making depth in a high‑frequency trading context.

Molly van der Schee

It’s understandable to feel uneasy about diving into a platform with limited audits, especially when your assets are at stake. Remember that every new protocol carries inherent risks, and staying informed can help you navigate those uncertainties with confidence.

Mike Cristobal

We must hold ourselves accountable for supporting projects that prioritize transparency. Investing in unaudited code is a moral compromise we should avoid 🙅♂️.

Erik Shear

Liquidity may be low but the community governance could evolve if more users participate

Donnie Bolena

Hey everyone!! 🎉 Let’s keep the conversation rolling!! The ve(3,3) model is fascinating!! If we all lock our tokens, we could see a surge in liquidity!! Imagine the possibilities!!

Elizabeth Chatwood

i think its def not the best for newbies but if u got some spare coin u can try it out lol

Lindsey Bird

Oh my gosh, the drama of watching CELL price tumble 90% is like watching a tragic opera! The suspense of waiting for a liquidity boost feels like the climax of a blockbuster movie! Will the heroes rise? Stay tuned!!!

john price

Listen, this whole ve(3,3) thing is overhyped and the lack of audit is a red flag. If you dont want to lose your coins, stay away now.