Quantum Security Address Checker

Check Your Bitcoin Address Security

Quantum computers could steal your Bitcoin if your address uses an exposed public key. Check if your address is vulnerable to "harvest now, decrypt later" attacks.

Enter your Bitcoin address to check its quantum security status.

Right now, your Bitcoin is safe. But if you’re holding coins in an old address, or you’ve reused the same one for years, you might already be leaking the key to your wallet - and someday, a quantum computer could use it to steal everything.

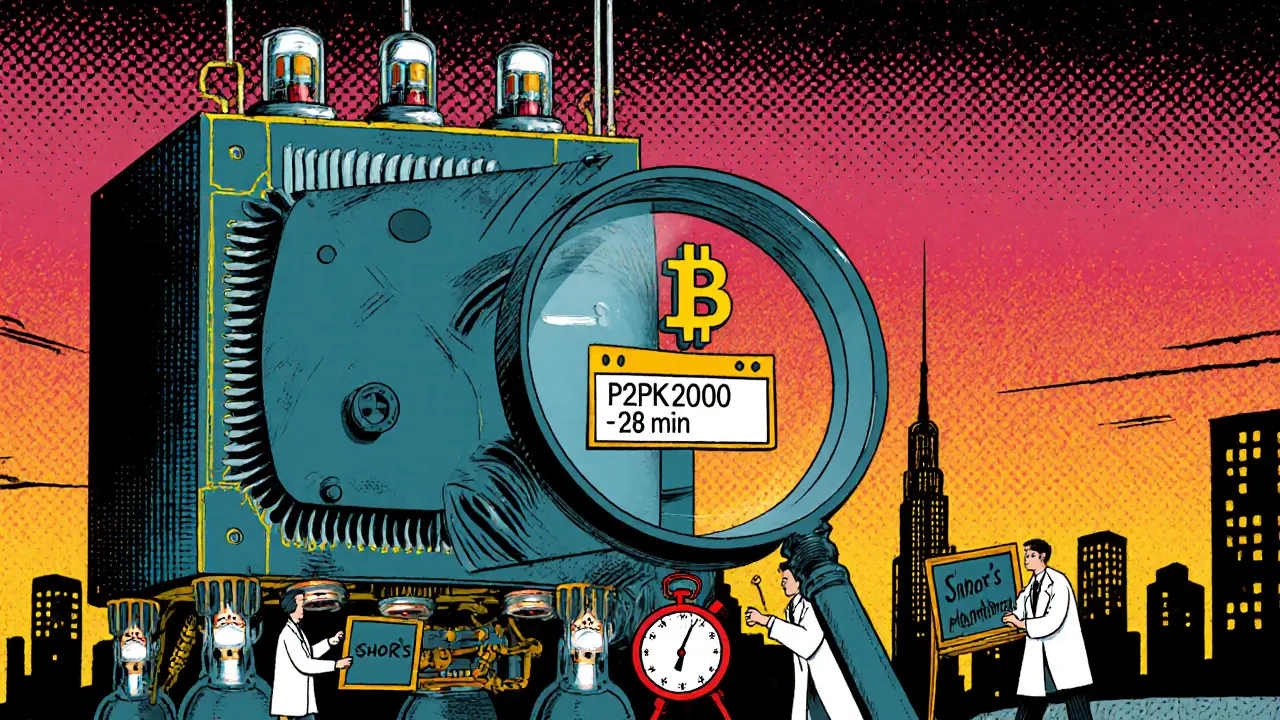

Why Quantum Computing Changes Everything

Quantum computers don’t just run software faster. They solve problems that classical computers can’t touch. The real danger comes from Shor’s algorithm, a math trick developed in 1994 that lets a quantum machine crack the encryption protecting most cryptocurrencies today. Bitcoin, Ethereum, and nearly every other major chain rely on Elliptic Curve Cryptography (ECC) to sign transactions. That’s what stops someone from spending your coins without your private key. But Shor’s algorithm can reverse-engineer that private key from the public key - and it does it in minutes, not millennia.It’s not science fiction. In October 2025, Deloitte published an analysis showing that a sufficiently powerful quantum computer could break a Bitcoin signature in under 30 minutes. That’s faster than the 10-minute average block time. If someone can decrypt your public key before your transaction confirms, they can replace your signature and steal your funds. And the scary part? They don’t need to attack you today. They just need to collect your public key now and wait.

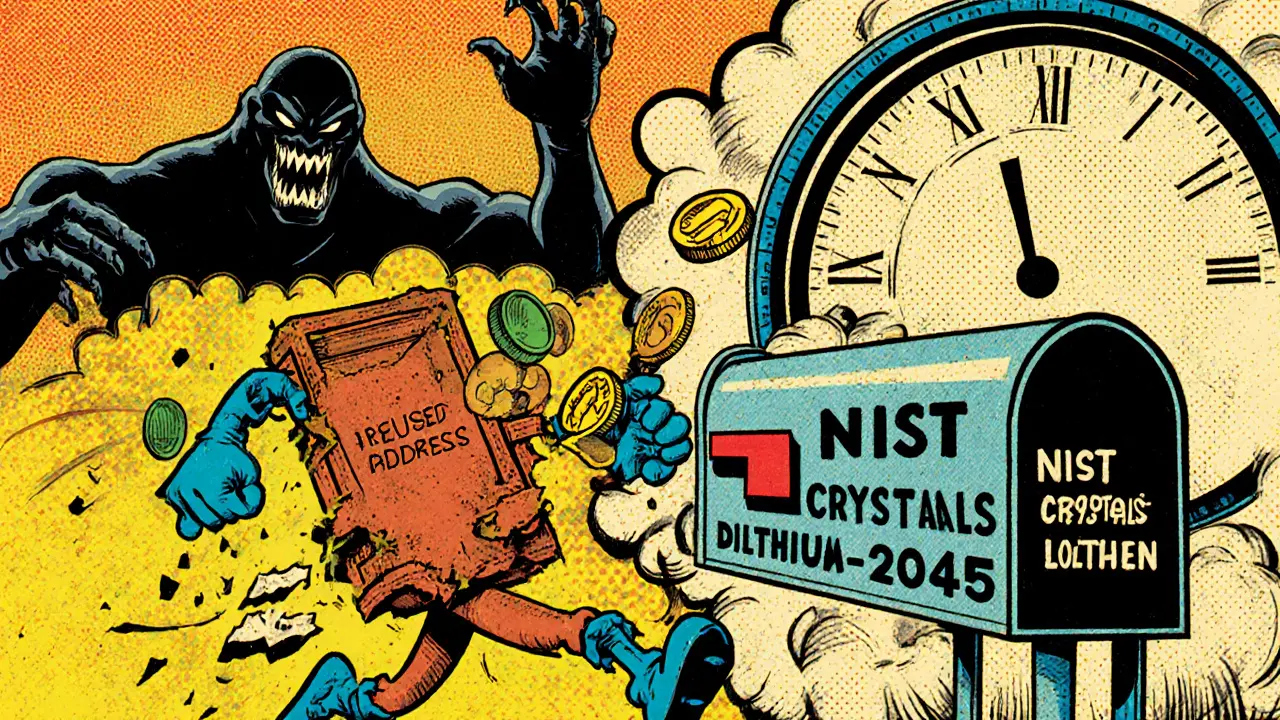

The Harvest Now, Decrypt Later Attack

This is called a “harvest now, decrypt later” (HNDL) attack. It’s like stealing a locked diary today and holding onto it until you get the key in 15 years. Right now, over 25% of all Bitcoin in circulation is stored in addresses where the public key is already visible on the blockchain - mostly from old pay-to-public-key (P2PK) transactions or reused pay-to-public-key-hash (P2PKH) addresses. Once a quantum computer is powerful enough, those keys are as good as gone.The Federal Reserve Board confirmed this risk in their October 2025 report: HNDL isn’t a future threat - it’s happening right now. Adversaries - whether nation-states or organized groups - are likely already collecting public keys from the blockchain. They’re not trying to steal your coins today. They’re building a database for tomorrow.

Which Cryptocurrencies Are Most at Risk?

Bitcoin is the biggest target. Why? Because it’s old, widely used, and full of legacy addresses. Many early adopters reused addresses or didn’t know better. That’s why Deloitte estimates a quarter of all Bitcoin is vulnerable. Ethereum is in a slightly better position - its newer transaction formats hide public keys longer - but its signature system (ECDSA) is still vulnerable to Shor’s algorithm.Stablecoins like USDT and USDC are another blind spot. They’re tied to traditional banking systems, and the July 2025 Genius Act made them subject to stricter financial oversight. If a quantum computer cracks the encryption behind a stablecoin issuer’s reserves, it could collapse both crypto and fiat systems at once. That’s a risk regulators are only just starting to notice.

There are alternatives. Projects like QANplatform and IOTA are already using lattice-based cryptography - a type of encryption that even quantum computers can’t break easily. But as of October 2025, they make up less than 0.1% of the total crypto market cap. Most of the value is still sitting in vulnerable chains.

What’s Being Done About It?

The National Institute of Standards and Technology (NIST) has been working on this since 2016. In 2022, they picked four new cryptographic standards designed to survive quantum attacks. The most important one for crypto is CRYSTALS-Dilithium, a digital signature algorithm that replaces ECDSA. It’s fast, efficient, and quantum-resistant. NIST finalized these standards as FIPS 203, 204, and 205 in August 2025.Big players are reacting. In September 2025, Coinbase, Chainlink, and 27 other major blockchain companies formed the Post-Quantum Cryptography Alliance. Their goal: migrate their systems to NIST-approved standards before quantum computers become operational. But here’s the problem: upgrading a blockchain isn’t like updating an app. It requires a hard fork - a fundamental change to the network’s rules. Ethereum researchers estimate it will take 18 to 24 months just to design, test, and deploy a quantum-resistant signature system. Bitcoin? No one even knows if the community will agree to change it.

What You Can Do Today

You don’t need to wait for a blockchain upgrade. There are actions you can take right now to protect your assets:- Never reuse addresses. Every time you receive crypto, use a new address. Most modern wallets do this automatically - but if you’re using an old one or a hardware wallet with outdated software, check your settings.

- Migrate old coins. If you have Bitcoin in a P2PK or reused P2PKH address, move it to a fresh one. Reddit user u/CryptoPrepper2025 moved 5.2 BTC after reading Deloitte’s report - and got over 9,000 upvotes for it.

- Avoid paper wallets and static keys. If your private key is printed out or stored in one place, it’s exposed. Use a wallet that generates new keys for every transaction.

- Watch for updates. Follow your wallet provider and blockchain network for announcements about quantum-resistant upgrades. Coinbase and Ledger have already published guides on how to prepare.

These steps won’t make you immune forever - but they’ll close the easiest doors for attackers. Right now, the biggest threat isn’t a supercomputer. It’s laziness.

The Timeline: When Will It Happen?

No one knows exactly when quantum computers will be powerful enough. IBM’s roadmap predicts they’ll reach several thousand qubits by 2035 - enough to break RSA-2048 with better than 50% success. But that’s just one metric. Quantum computers need not just power, but stability. They’re incredibly fragile. A single error can crash the whole calculation. IBM’s own researchers say error correction will likely delay practical attacks until at least 2045.Meanwhile, the Federal Reserve warns that “the real risk starts long before Q-Day.” Why? Because the data is already collected. The tools are being built. The race isn’t about when quantum computers arrive - it’s about whether we upgrade our defenses before they’re needed.

The Bigger Picture: Money, Power, and Control

This isn’t just about wallets. It’s about trust. Cryptocurrencies were supposed to be decentralized, censorship-resistant, and secure. If quantum computers break encryption, they break that promise. Governments and banks might be the first to adopt quantum-resistant systems - leaving ordinary users behind. The European Union’s October 2025 Quantum Security Directive already requires financial institutions to have migration plans by mid-2026. But there’s no law forcing crypto exchanges to follow.The market is reacting. The post-quantum cryptography industry is projected to grow from $150 million in 2025 to over $2 billion by 2030. Salaries for quantum-resistant cryptography specialists are now between $180,000 and $350,000 a year. That’s how valuable this skill has become.

But the most dangerous gap isn’t technical - it’s psychological. Most people still think quantum computing is decades away. They’re wrong. The threat is already here. It’s just hiding in plain sight - in your old Bitcoin address, in your reused wallet, in the assumption that “it’ll be fine.”

Final Thoughts

Quantum computing won’t kill crypto. But it will expose the ones who ignored the warning signs. The technology to protect yourself exists. The standards are ready. The only thing missing is action.If you’re holding crypto for the long term - and you haven’t checked your addresses in the last year - you’re already at risk. Move your coins. Use new addresses. Stay informed. The future isn’t coming. It’s already here. You just need to see it.

Can quantum computers already steal my Bitcoin?

No, not yet. Current quantum computers don’t have enough stable qubits to run Shor’s algorithm on Bitcoin’s encryption. But they don’t need to - attackers are already collecting public keys from the blockchain to use later. The real threat is the "harvest now, decrypt later" strategy, which is active today.

Which crypto wallets are quantum-resistant?

No mainstream wallet is quantum-resistant yet. But you can reduce risk by using wallets that automatically generate new addresses for every transaction (like Ledger, Trezor, or modern mobile wallets). Avoid paper wallets and static addresses. The real protection comes from behavior - not the wallet brand.

Will Bitcoin upgrade to quantum-resistant encryption?

There’s no official plan. Bitcoin’s development is slow and consensus-driven. While some developers have proposed quantum-resistant upgrades, there’s no agreement on how or when to implement them. Ethereum is further along, with active research into replacing ECDSA with CRYSTALS-Dilithium. Bitcoin may be forced to change if enough users move their funds to safer chains.

How long will it take to switch to post-quantum crypto?

For new blockchains, it could take 6-12 months. For Bitcoin or Ethereum, it could take 2-3 years because of the complexity of hard forks, testing, and community buy-in. NIST’s standards are ready, but adoption requires coordination across thousands of nodes, wallets, and exchanges. The clock is ticking, but the process is slow.

Should I sell my crypto because of quantum threats?

No. Selling out of fear isn’t a strategy - it’s a loss. The threat is real, but it’s not immediate. The smarter move is to protect what you have: move coins to new addresses, avoid reuse, and stay updated. If you believe in crypto’s long-term value, prepare - don’t panic.

What’s the difference between Shor’s and Grover’s algorithm?

Shor’s algorithm breaks public-key cryptography like RSA and ECC - the kind used to sign crypto transactions. Grover’s algorithm weakens symmetric encryption like AES, cutting its security in half. For Bitcoin, Shor’s is the real threat because it targets private keys. AES is used in wallets and encryption layers, but it’s not the main weakness.

Are stablecoins more vulnerable than Bitcoin?

They’re differently vulnerable. Bitcoin’s risk is from exposed public keys. Stablecoins are tied to banks and regulated systems - so if a quantum computer cracks the encryption behind their reserve audits or smart contracts, it could trigger a chain reaction between crypto and fiat. That makes them a high-value target for state actors, even if their blockchain tech is similar to Bitcoin’s.

Can I check if my Bitcoin address is vulnerable?

Yes. Use a blockchain explorer like Blockchain.com or Bitquery. Look up your address. If you see a "public key" listed under the transaction history, your address is exposed. If you only see "P2PKH" with no public key visible, you’re safer. Reused addresses always carry risk - even if the key isn’t visible yet.

Comments (16)

Kaela Coren

The technical depth of this post is extraordinary. The distinction between Shor’s and Grover’s algorithms, the emphasis on harvest-now-decrypt-later strategies, and the regulatory implications outlined by the Federal Reserve and EU are not merely academic-they are existential for long-term holders. I’ve reviewed NIST’s FIPS 204 documentation and can confirm CRYSTALS-Dilithium’s performance metrics are viable for blockchain integration. The real bottleneck remains consensus, not cryptography.

That said, the psychological complacency among retail users is the most alarming vector. We’ve seen this before with phishing, with private key mismanagement, with exchange hacks. The pattern is identical: awareness precedes action by decades, if ever.

Nabil ben Salah Nasri

Okay but like… 😅 I just moved my BTC from that old 2013 address I forgot about!! 🙌 Thank you for the nudge-I literally had 3.7 BTC sitting there with the public key exposed. 🤦♂️ I used Ledger Live and generated a brand new address-no more reuse! Also, I checked my ETH and it was fine (P2PKH with no public key visible). So proud of myself for not being lazy 😊

PS: Anyone know if Trust Wallet auto-generates new addresses? I’m switching from Coinbase Wallet just in case…

alvin Bachtiar

Let’s be brutally honest: 90% of crypto users are walking around with their wallets taped to their foreheads. You think you’re safe because you ‘use a hardware wallet’? Nah. If you’ve ever sent BTC from an address more than once, you’ve already lost. The blockchain is a public ledger, not a vault. It doesn’t care if you ‘didn’t know.’

And don’t even get me started on stablecoins. USDT’s reserve audits? Written in PDFs signed with SHA-256. Quantum computers will crack those hashes faster than you can say ‘FOMO.’ The entire DeFi ecosystem is a house of cards built on 20th-century crypto. This isn’t a warning-it’s an obituary for the unprepared.

Also, Bitcoin will never upgrade. It’s a cult, not a protocol. Get used to it.

Josh Serum

Guys, I’ve been saying this for YEARS. I told my buddy in 2021 that quantum was coming and he laughed at me. Now look-he’s got 12 BTC in a reused address and thinks ‘it’s fine.’

Here’s the truth: if you’re not using a wallet that auto-generates addresses, you’re already compromised. And if you’re still using paper wallets? You’re basically handing your keys to the NSA. I’ve got a spreadsheet of every major wallet’s quantum-readiness score-I’ll share it if you DM me. No, I won’t send it publicly. You’re welcome.

Also, NIST standards are useless if exchanges don’t implement them. Coinbase? They’re dragging their feet. You think they care about you? They care about liability. Move your coins. Now. I mean it.

DeeDee Kallam

omg i just checked my address and it had a public key?? i think i cried a little. i thought i was safe bc i use metamask. why does this happen?? 😭

Helen Hardman

Okay, I’m so glad someone finally wrote this clearly-because I’ve been telling my friends for months that crypto isn’t ‘set and forget.’ You can’t just buy Bitcoin, stick it in a wallet, and forget about it like you would a savings account.

Here’s what I did: I went through every wallet I’ve ever used-old Ledger, Exodus, even the one I used in 2017-and moved every single coin to a brand new address. I used the blockchain explorers they mentioned and checked every transaction. Took me three nights, but now I sleep better. And I’ve started a little group chat with my sister and mom-yes, my mom!-and we’re all doing the same thing. It’s not just for tech people. It’s for everyone who believes in digital money.

Also, I bought a book on lattice cryptography just to understand it better. It’s weirdly fascinating. Who knew math could save your life? 🤓

Bhavna Suri

This post is too long. I read half and got bored. Quantum computer? Too complicated. I just want my money safe. Why not just use Bitcoin Cash? It’s simpler.

Also, why are you all so scared? Nothing will happen. People say these things all the time. I will wait and see.

Elizabeth Melendez

hi everyone!! i just wanted to say THANK YOU for this post-it literally saved me!! i had like 4.5 btc in an old address from 2015 and i had NO IDEA the public key was visible!! i checked it on blockchain.com and yep, there it was 😱

so i moved it all to a new address using my trezor and now i feel so much better!! i even told my aunt and she’s gonna check hers too!!

also, i found this free guide from ledger on how to check your addresses-it’s super easy!! just paste your address into the explorer and look for ‘public key’ under transactions. if it’s there, move it!!

we can do this!! we just need to be a little more careful. love you all!! 💖

Phil Higgins

There is a deeper philosophical layer here that most miss. Cryptocurrency was conceived as an alternative to centralized control-to decentralize trust. But if the foundation of that trust-cryptography-is rendered obsolete by a technology developed in state labs, then we are not merely facing a technical failure. We are facing a collapse of ideological legitimacy.

Who benefits from quantum decryption? Nation-states. Corporations. Those with resources to build and hoard. The average user, who trusted the system as promised, will be left with nothing but a ledger of stolen value.

This is not a question of wallets or addresses. It is a question of whether we, as a society, will allow the architecture of freedom to be dismantled by the very tools meant to secure it. The answer is already being written-in NIST’s standards, in the silence of exchanges, in the inertia of Bitcoin’s community.

Will we act? Or will we wait until the keys are gone, and then ask, ‘Why didn’t someone tell us?’

Genevieve Rachal

Let’s cut through the noise. This post is 90% fearmongering wrapped in academic jargon. Yes, Shor’s algorithm is a threat. But so is inflation, so is regulation, so is your ex spending your crypto on NFTs.

Here’s the reality: no quantum computer exists that can break ECC today. Not even close. IBM’s 2035 timeline is optimistic. Most experts say 2045–2050. That’s 20+ years. You have time.

Meanwhile, you’re panicking over a hypothetical while ignoring real threats: exchange hacks, rug pulls, phishing, and your own poor security hygiene. Move your coins? Fine. But don’t pretend this is an emergency. It’s not. It’s a future risk-and you’re being manipulated into overreacting.

Also, QANplatform? 0.1% market cap? Exactly. That’s why it’s irrelevant. Stick with what works. Until the tech is proven, don’t chase ghosts.

Eli PINEDA

wait so if i used the same address for my btc and eth… does that mean they can steal both?? 😳

Debby Ananda

How quaint. You all are reacting to a theoretical vulnerability like it’s a fashion trend. I, for one, have been holding only quantum-resistant assets since 2023-QAN, IOTA, and a small position in Algorand’s post-quantum testnet. The rest? Liquidated. You think you’re sophisticated because you use a Ledger? Please. You’re still using 1970s crypto in a 2030s world.

My portfolio is structured for the post-quantum era. Yours? It’s a museum piece. And before you say ‘but I’m not rich enough to care’-that’s exactly why you’re the target. The wealthy are already moving. The rest? You’ll be the collateral damage.

Also, I have a private Discord. DM me if you want the list of wallets that actually matter.

Vicki Fletcher

i just checked my address and it said ‘no public key visible’-does that mean i’m safe?? i’m so confused 😅

also, i think i reused an address once in 2020… does that mean i’m doomed?? should i panic??

ps: i use binance, so i hope they’re doing something??

Nadiya Edwards

Of course this is happening. The government has been planning this for decades. They don’t want you to have real money. They want you dependent on banks, on dollars, on systems they control. Quantum computing? It’s just the next step in the Great Reset.

They’re letting you think you have control. But your Bitcoin? It’s already theirs. They’ve been harvesting your keys since 2015. The blockchain is a trap. The ‘decentralized’ dream? A lie.

And now they want you to move your coins? So they can track it all again? Brilliant. I’m not playing. I’m holding cash. Physical. Under the mattress. That’s the only encryption they can’t crack.

Ron Cassel

THEY’RE LYING TO YOU. This isn’t about quantum computers. It’s about the Fed and Big Tech forcing a blockchain upgrade so they can freeze wallets, track transactions, and impose digital taxes. NIST standards? That’s just a backdoor. CRYSTALS-Dilithium? It’s designed for surveillance.

They want you to move your coins to ‘new addresses’ so they can tag every single one. They already know who you are. They’ve had your IP, your KYC, your transaction history since 2018.

Don’t fall for it. Don’t move your coins. Don’t upgrade. Stay on your old address. Let them think they’ve won. The real security is invisibility. The blockchain is a lie. The truth is in silence.

Malinda Black

Thank you for writing this. I’ve been teaching crypto safety to seniors at my local community center, and this is exactly the kind of clear, non-technical breakdown we need.

I showed this to Mrs. Jenkins-she’s 82 and has $18,000 in Bitcoin she got in 2014. She had no idea her address was exposed. We moved it together yesterday. She cried-not from fear, but from relief.

You don’t need to be a coder to protect yourself. You just need to care. And you need to act. Even one person moving their coins makes a difference. We’re not powerless. We just need to stop pretending the future isn’t here.

Keep sharing. We’re listening.