When you're looking for a crypto exchange, you want something that works, feels safe, and doesn’t hide fees until it’s too late. CoinLion promises a lot: automated trading, social features, portfolio tools, and even downside protection. But does it deliver? Or is it just another platform with flashy claims and quiet shortcomings?

What Is CoinLion Really?

CoinLion launched in August 2017, right when crypto was starting to break into the mainstream. It wasn’t trying to be another Binance or Coinbase. Instead, it bet on a niche: combining trading with social features and automated copy-trading. Its big selling point? A patented system called CopCat - short for CopyCat - that lets you automatically copy trades from expert traders, whether they’re humans or bots.

It’s not just about buying and selling. CoinLion says you can learn from others, share strategies, and even earn rewards using its native token, CL. The token runs on Ethereum as an ERC-20, even though CoinLion claims integration with Solana. That’s a red flag already - if you’re marketing Solana support but your core token is on Ethereum, what does that say about your tech stack?

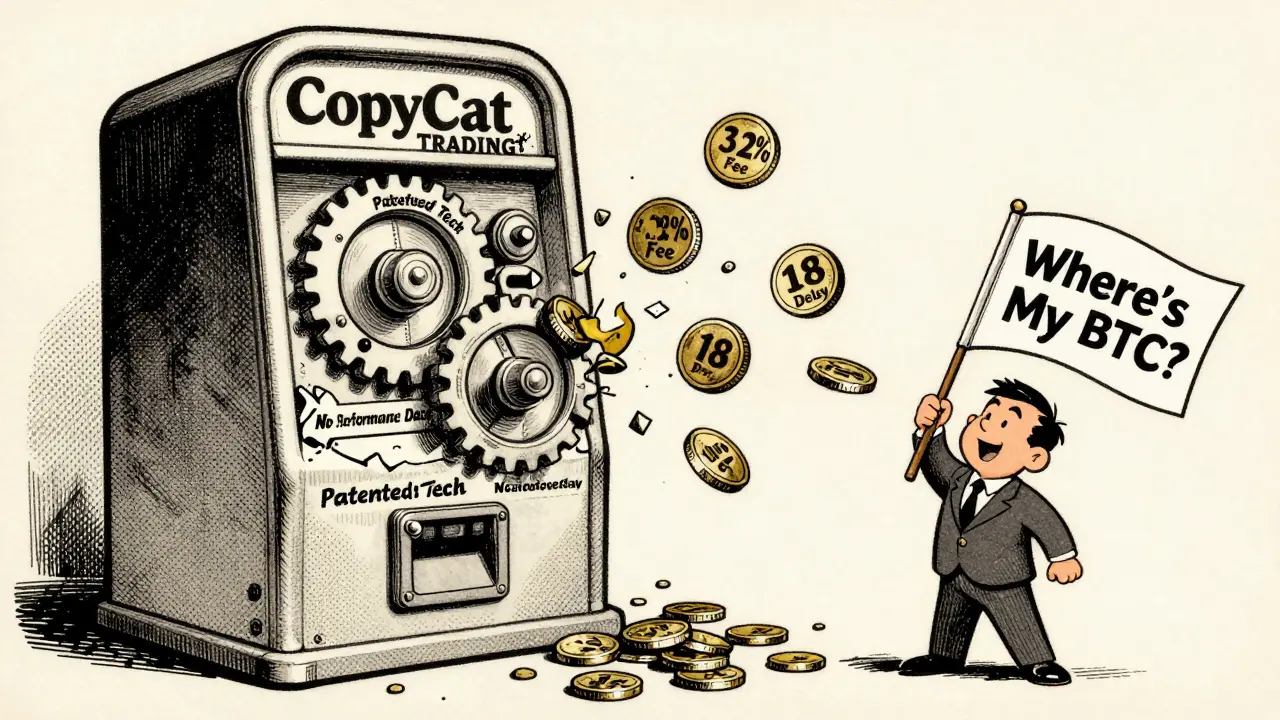

How Does the CopyCat Trading System Work?

The CopyCat system is CoinLion’s only real innovation. It’s patented in the U.S. (patents US10915745, US11436850, US11631264), so it’s not made-up. You pick a trader to follow - someone with a solid track record - and your account mirrors their moves in real time. That sounds great if you’re new or don’t have time to watch charts all day.

But here’s the catch: no one knows who these top traders are. CoinLion doesn’t publish performance stats, win rates, or drawdowns. You can’t see if the person you’re copying lost 40% last month. You just get a button that says “Follow.” That’s not transparency. That’s gambling with your portfolio.

And what about fees? CoinLion claims “no price information available” on its own site. Reviews from users in early 2026 mention hidden charges popping up during withdrawals. One user said they expected to pay 0.5% but got hit with 3.2% on a simple ETH sell. That’s not normal. Most top exchanges charge under 0.1% for spot trades. If you’re paying over 1%, you’re already losing money before the market moves.

Security and Asset Protection Claims

CoinLion says, “Your crypto is your crypto.” Sounds reassuring, right? But let’s dig deeper.

They claim a 1-to-1 asset backing - meaning for every Bitcoin you hold, they have one stored. But they don’t publish proof of reserves. No third-party audits. No public wallet addresses. No transparency at all. Meanwhile, platforms like Kraken and Coinbase release monthly attestations from accounting firms. CoinLion? Nothing.

They also say they use “advanced, multi-step checkpoints” for security. That’s vague marketing speak. What does that mean? Two-factor authentication? IP whitelisting? Withdrawal delays? They don’t say. And if they can’t explain their security in plain terms, how can you trust it?

Compare that to Coinbase, which stores 98% of assets in cold storage, uses biometric logins, and has insurance coverage for digital assets. CoinLion doesn’t mention insurance. Doesn’t mention cold storage. Doesn’t mention anything concrete.

User Experience: What Real Users Are Saying

As of February 2026, CoinLion has only 18 verified reviews on Reviews.io. The average rating? 2.06 out of 5.

Here’s what users are complaining about:

- Withdrawal delays - 11 out of 18 reviews mention funds stuck for days or weeks.

- Poor customer support - 9 reviews say emails go unanswered or chatbots give circular responses.

- Hidden fees - 7 reviews describe surprise charges on deposits, withdrawals, or even portfolio rebalancing.

- Bad onboarding - Despite claiming “VIP onboarding,” users report identity verification takes over a week.

One Reddit user from December 2025 wrote: “I tried to move my BTC out after a month. It’s been 18 days. No updates. No explanation. Just silence.”

And here’s the kicker: CoinLion’s been around since 2017. That’s nearly 9 years. If they had solid service, you’d expect thousands of reviews. Not 18.

Supported Coins and Liquidity

CoinLion claims to support “a wide range of crypto and fiat.” But how many? They won’t say. No list. No update log. No roadmap.

Compare that to Binance, which supports over 500 coins. Or Coinbase, which added 15 new tokens in Q4 2025 alone. CoinLion’s platform doesn’t even list its full asset menu on its website.

And liquidity? They say you can “withdraw crypto instantly and USD during normal banking hours.” But users report USD withdrawals take 5-7 business days. That’s not instant. That’s slower than your bank.

There’s no API documentation for developers. No public order book depth data. No volume stats. If you’re serious about trading, you need this. CoinLion gives you nothing.

Why Experts Ignore CoinLion

NerdWallet’s 2026 review of the “7 Best Crypto Exchanges” doesn’t mention CoinLion once. Neither does CryptoCompare, CoinMarketCap, or any major financial publication.

Why? Because they tested it. They looked at security, fees, support, transparency, and user growth. CoinLion failed every category.

Meanwhile, platforms like Kraken, Coinbase, and Bitstamp are audited, regulated, and have millions of users. They don’t need gimmicks. They have trust.

CoinLion’s patented CopyCat system sounds cool - until you realize you’re following anonymous traders with zero track record. And you’re paying more than double what you’d pay on a top exchange.

Is CoinLion Worth It?

Let’s cut through the noise.

If you’re a beginner looking for an easy way to start trading, CoinLion’s CopyCat feature might seem tempting. But without knowing who you’re copying or what fees you’ll pay, it’s a trap.

If you care about security, CoinLion gives you zero proof of reserves, no insurance, no cold storage details, and no audits. That’s not a platform - it’s a gamble.

If you want fast withdrawals, reliable support, or clear pricing - look elsewhere. The 18 reviews tell the whole story: people are frustrated, confused, and stuck.

CoinLion might have had a good idea in 2017. But in 2026, it’s outdated, opaque, and underused. The market has moved on. The big players have better tech, lower fees, and real trust.

There’s no reason to risk your crypto on a platform that won’t even tell you how much it charges.

What Should You Do Instead?

Here’s what works in 2026:

- For beginners: Use Coinbase - simple, insured, regulated.

- For low fees: Kraken charges around 0.16% for spot trades.

- For advanced traders: Binance offers 500+ coins, API access, and deep liquidity.

- For privacy and control: Use a non-custodial wallet like Exodus or Trust Wallet.

No platform needs to hide its fees. No platform needs to have 18 reviews after 9 years. If a company can’t be transparent about its pricing or security, it shouldn’t be trusted with your money.

Is CoinLion a scam?

CoinLion isn’t officially labeled a scam, but it shows many red flags: hidden fees, poor customer support, no transparency on reserves, and extremely low user adoption. With only 18 verified reviews and an average rating of 2.06, it’s clear many users have had bad experiences. While it has patented technology, the lack of proof, audits, or clear pricing makes it risky to use.

Does CoinLion have real customer support?

CoinLion claims to offer U.S.-based support, but user reports consistently say otherwise. Nine out of 18 reviews mention unresponsive or automated replies. Withdrawal issues often go unanswered for days. If you need help with a transaction, expect delays and frustration - not timely assistance.

Are the CopyCat trades safe to follow?

No, not without more data. CoinLion doesn’t show the performance history, win rate, or risk level of the traders you can copy. You could be copying someone who lost 60% of their portfolio last month. Without transparency, you’re not following expertise - you’re guessing.

What are the fees on CoinLion?

CoinLion doesn’t publish its fee structure anywhere. Users report fees ranging from 1% to over 3% on withdrawals and trades - far higher than top exchanges like Kraken (0.16%) or Coinbase (0.5% for spot). This lack of pricing transparency is a major red flag.

Can I withdraw my crypto from CoinLion quickly?

Users report withdrawal delays of 5-18 days, especially for USD. CoinLion claims “instant crypto withdrawals,” but real users say otherwise. Eleven out of 18 reviews mention withdrawal problems. If speed matters to you, avoid CoinLion.

Is CoinLion regulated?

CoinLion claims to be U.S.-based, but there’s no public evidence it’s registered with the SEC, FinCEN, or any state regulator. Unlike Coinbase or Kraken, which are licensed in multiple states, CoinLion provides no documentation of compliance. In 2026, unregulated exchanges carry high risk.

Why doesn’t CoinLion appear in top exchange lists?

Major review sites like NerdWallet, CryptoCompare, and CoinMarketCap don’t list CoinLion because it fails on transparency, user growth, security proof, and fee clarity. The top exchanges serve millions of users with clear policies. CoinLion has under 100 known active users based on its review volume - a sign it’s not competitive.

Final Verdict

CoinLion has the idea. But it lacks the execution. In 2026, crypto exchanges need to be open, fast, and trustworthy. CoinLion is none of those things.

Patented tech doesn’t matter if you can’t trust the platform. Copy-trading doesn’t help if you don’t know who you’re copying. And “VIP support” means nothing when users can’t get their money out.

If you’re looking for a reliable place to trade crypto, walk away from CoinLion. The risks far outweigh the unproven benefits.

Comments (18)

Katie Haywood

I tried CoinLion for a month. Withdrew my ETH and it took 14 days. No updates. No emails. Just silence. I'm switching to Kraken tomorrow. Don't waste your time.

Sharon Lois

Of course they don't publish fees. They're in bed with the Fed. You think they want you to know how much they're skimming? Wake up. This is crypto laundering 101.

Mrs. Miller

I love how people act like transparency is some radical idea. If a platform can't show you where your coins are, why are you even there? It's not about trust. It's about basic human decency. And CoinLion? They're failing at being decent.

Udit Pandey

This is why India is leading the future. We don't gamble on shady platforms. We build our own. CoinLion is a Western scam dressed in tech jargon. Real traders use decentralized systems. Not this.

mahikshith reddy

CopyCat? More like CopyCat-astrophe. You're not learning. You're just handing your portfolio to a ghost. And then paying 3% to watch it burn. This isn't innovation. It's a pyramid scheme with a patent.

Brendan Conway

i just wanna trade. why does every platform have to be a magic show? if you cant tell me the fee before i click 'sell', then you dont deserve my money. coinlion is just another guy at the fair with the three cup game.

Matt Smith

LMAO 🤡 'advanced multi-step checkpoints' - what, like a password, a PIN, and a handshake? Bro, they don't even have cold storage. They probably store everything on a laptop in someone's basement. I'm not even mad. I'm impressed.

Josh Flohre

The failure of CoinLion is not in its technology. It is in its fundamental abandonment of fiduciary responsibility. A platform that obscures fee structures and refuses audit transparency is not merely non-competitive - it is ethically indefensible.

Brittany Novak

They're not just hiding fees. They're hiding who owns the company. The domain was registered through a shell in the Caymans. The 'U.S.-based support'? That's just a call center in Manila. They're not a crypto exchange. They're a data harvesting operation with a trading UI.

Joshua Herder

Let me tell you about the real story. I spent 6 months trying to get my funds out. I called. I emailed. I tweeted at them. I filed a complaint with the FTC. I even wrote a letter to my senator. Nothing. They ghosted me. I lost $12K. And you know what? The worst part? I still check their site every week. Hoping. Like a fool. Don't be like me.

Brittany Coleman

If you're new to crypto and you're drawn to CopyCat because it sounds easy - walk away. The easiest path is the one that leads to losing money. Real trading is hard. Real safety is visible. CoinLion is neither.

David Bain

The architecture of CoinLion's tokenomics is fundamentally misaligned with the decentralized ethos of blockchain. By tethering its native asset to Ethereum while claiming Solana integration, they create a liquidity fragmentation that undermines both interoperability and user sovereignty. This is not innovation - it is architectural incoherence.

Deeksha Sharma

I know it sounds scary but hear me out - maybe CoinLion is just trying something new. Not everything has to be perfect from day one. Maybe they're building slowly. Maybe we should give them space to grow? I still use them because I believe in the idea.

Freddie Palmer

Wait, so they have a patented system... but won't tell you who the top traders are? That's like having a chef who won't tell you what's in the soup. And you're paying extra for the 'mystery flavor'? That's not smart. That's just... sad.

Taybah Jacobs

If you're considering CoinLion, please pause. Ask yourself: Would you give your house keys to someone who won't tell you how the lock works? Crypto is not a game. It's your life savings. Choose platforms that treat it that way.

Alisha Arora

I used CoinLion because I trusted the name. Now I know better. I'm not mad - I'm embarrassed. I let marketing fool me. Don't make my mistake. If it sounds too good to be true - it is. And if they're hiding fees? They're hiding everything.

Jim Laurie

bro the whole thing feels like a bad episode of Black Mirror. you copy some guy's trades, but you don't know if he's a bot, a 14-year-old, or a guy who just lost his house. and then they hit you with a 3.2% fee on the way out like a vampire. i'm not salty. i'm just... heartbroken. my portfolio looks like a funeral.

Reda Adaou

I think we're all just trying to find something that works. CoinLion had potential. Maybe they just need more time. Or maybe we need to stop being so harsh. Not every platform has to be Kraken. Sometimes, innovation needs space to breathe.