Anycoin Direct Fee Calculator

Trading Cost Breakdown

Base Trade Value: €0.00

Implicit Spread (Estimated): 0%

Estimated Additional Fee: €0.00

Total Estimated Cost: €0.00

Withdrawal Information

Withdrawal fees are equal to the blockchain network charges only. Anycoin Direct does not apply additional service fees.

About Anycoin Direct's Fee Structure

Anycoin Direct uses an implicit spread model instead of percentage-based fees:

- Buy Rate: Market rate + 1-2% markup

- Sell Rate: Market rate - 1-2% markdown

- Withdrawal Fee: Blockchain network charges only (no service fee)

Note: Exact spreads vary based on market conditions and payment method used.

Here’s the Anycoin Direct review you’ve been looking for. If you’re a European crypto newbie or a seasoned trader wondering whether this Dutch broker still makes sense in 2025, this article breaks down the platform’s purpose, cost structure, security model, and how it stacks up against the big‑name exchanges.

What is Anycoin Direct?

Anycoin Direct is a Dutch cryptocurrency brokerage that launched in 2013 and operates under the regulatory umbrella of the Netherlands. Backed by Phoenix Payments B.V., the service markets itself as a user‑friendly gateway for buying and selling crypto with euros (EUR) only.

The platform limits access to residents of the European Union and Switzerland, meaning anyone outside these regions will hit a “service not available” wall.

How the Brokerage Model Works

Unlike traditional exchanges that match you with other traders, Anycoin Direct acts like a broker: you place a buy or sell order and the company fulfills it using its internal liquidity pool. The user experience feels like a simple bank app - you pick a coin, enter an amount, and confirm. There’s no order book, no limit orders, and no need to understand market depth.

Supported coins include the major players - Bitcoin, Ethereum, and the stablecoin Tether - plus a handful of altcoins. All transactions are settled in EUR, and you must move the crypto to your own wallet after purchase; Anycoin Direct does not provide a built‑in wallet for long‑term storage.

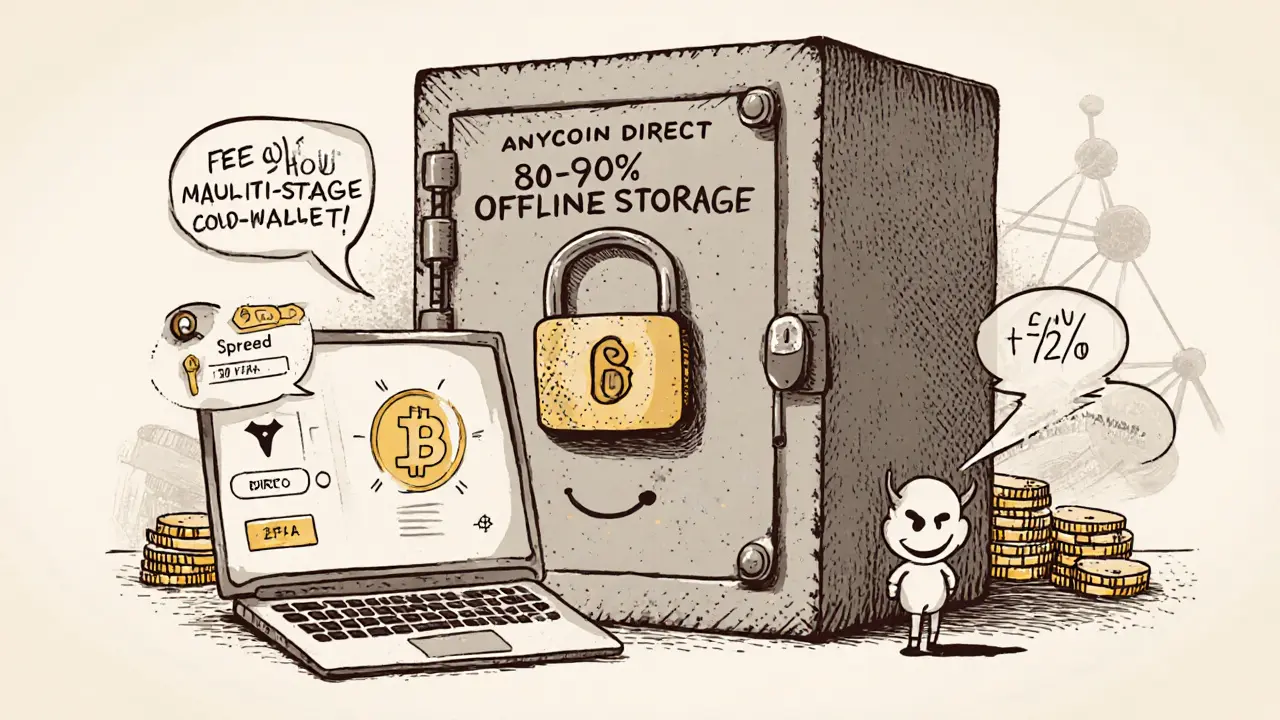

Security and Wallet Strategy

The platform stores 80‑90% of user funds offline, using an “elastic multi‑stage wallet” approach that mirrors cold‑storage best practices. For the remaining online portion, two‑factor authentication (2FA) is mandatory, and withdrawals can be locked to a whitelist of approved addresses.

Because the service never holds your crypto in a hot wallet, the risk of a large‑scale hack is reduced. However, you’re responsible for safeguarding your own private keys, whether you use a hardware wallet or a software wallet on your phone.

Fee Structure - The Good, The Bad, and The Hidden

Anycoin Direct skips the percentage‑based taker fees you see on most exchanges. Instead, it applies a markup when you buy and a markdown when you sell. These price adjustments are built into the quoted rate, so you never see an explicit “fee” line on the receipt.

Because the exact spread is not published, users often complain that the final price is “a bit higher” than the market rate. Independent reviews (e.g., Forex.wikibit.com) rate the trading cost at 3.0/5, citing opacity and higher effective fees compared to low‑cost competitors.

Withdrawal fees are limited to the blockchain network charge - there’s no added service fee. Payment methods include SEPA wire transfers, VISA/MasterCard credit cards (available since 2019), and PayPal for withdrawals. The inclusion of credit‑card purchases adds convenience but also pushes the buy‑side spread higher.

Verification Process - What to Expect

New accounts must pass a video‑call verification via Skype, where you show a government ID and a live selfie. Once the basic KYC is cleared, you can trade small amounts. To lift limits or enable withdrawals, you’ll need enhanced verification: a proof of address, a selfie with the ID, and sometimes a source‑of‑funds document.

This rigorous approach aligns with Dutch AML regulations, but it can slow down onboarding for users who prefer a quick sign‑up.

Pros and Cons - Quick Reference

- Pros

- Very easy UI - ideal for beginners.

- Multi‑language support (Dutch, English, French, German, Italian, Spanish).

- Responsive customer support - email, live chat, phone.

- Cold‑storage‑heavy security model.

- Cons

- Higher effective spreads; lack of transparent fee schedule.

- Restricted to EU and Switzerland.

- No built‑in wallet - you must manage your own storage.

- Stringent verification can delay larger withdrawals.

How It Compares to Popular Exchanges

| Feature | Anycoin Direct | Binance | Kraken |

|---|---|---|---|

| Geographic coverage | EU + Switzerland only | Global (except restricted countries) | Global (except restricted countries) |

| Supported fiat | EUR only | USD, EUR, GBP, etc. | USD, EUR, GBP, CAD, etc. |

| Fee model | Implicit spread (no % fee) | 0.1% taker / 0.0% maker (plus network fees) | 0.26% taker / 0.16% maker (plus network fees) |

| Verification speed | Video call + document review (hours‑to‑days) | Standard KYC (minutes‑to‑hours) | Standard KYC (minutes‑to‑hours) |

| Custodial wallet | No - user‑managed wallets only | Yes - Binance Wallet | Yes - Kraken Wallet |

| Customer support rating (out of 5) | 4.5 (highly praised) | 3.8 (mixed) | 4.0 (solid) |

In short, Anycoin Direct wins on simplicity and support, but it falls short on price transparency and global reach. If you trade small amounts, the higher spread may be acceptable; for high‑volume traders, an exchange like Binance or Kraken usually offers tighter pricing.

Is Anycoin Direct Right for You?

If you fit any of the following profiles, Anycoin Direct could be a good match:

- You are a EU resident who prefers to avoid complex order books.

- You value fast, friendly customer service over the lowest possible fees.

- You want a platform that stores most of its liquidity offline for added security.

Conversely, you might look elsewhere if:

- You need advanced trading tools (margin, futures, stop‑loss orders).

- You trade large volumes and need the tightest spreads.

- You live outside the EU/Switzerland.

- You want a built‑in wallet to keep crypto on the platform.

Bottom Line

Anycoin Direct remains a solid entry point for European users who want a hassle‑free way to buy Bitcoin, Ethereum, or Tether with euros. Its strength lies in a clean UI, multi‑language help desk, and a security model that keeps most funds offline. The biggest drawbacks are the opaque spread and the limited geographic scope.

Overall, treat it as a “bank‑style” crypto broker rather than a full‑featured exchange. If that matches your goals, the platform can get you into crypto quickly and safely.

Frequently Asked Questions

Can I use Anycoin Direct if I live in the United Kingdom?

Yes, the UK is part of the European market for Anycoin Direct, so you can sign up and trade using euros or convert pounds via a SEPA transfer.

What is the typical spread on a Bitcoin purchase?

The spread isn’t published, but user reports suggest a 1‑2% markup over the inter‑exchange rate. The exact number varies by market volatility.

Do I need to verify my identity to start buying?

Yes. A short video‑call KYC is required before any trade can be executed.

Are there any hidden fees when I withdraw crypto?

No. Withdrawals only incur the network fee charged by the blockchain. Anycoin Direct does not add a service surcharge.

Can I store my crypto on Anycoin Direct’s platform?

No. After purchase, you must transfer the coins to an external wallet you control. The platform does not offer a custodial wallet.

How does customer support compare to other brokers?

Support scores are high (4.5/5) - you can reach them via live chat, email, or phone, and response times are typically under an hour.

Comments (6)

Ali Korkor

Love this review. As a total newbie, I was scared to jump into crypto but Anycoin Direct made it feel like buying coffee. No chaos, no order books, just tap and go. Perfect for folks who just want Bitcoin without the drama.

Also huge props for the customer support - got my KYC done in under an hour. Most platforms take days.

madhu belavadi

Ugh I tried this thing last year and got stuck in verification hell for 3 days. They asked for a selfie holding my ID and a utility bill and then just ghosted me. I swear they have a team of 3 people handling 50k users. Don't waste your time unless you're desperate.

James Young

Anyone who thinks this is a good option is delusional. 2% spread on Bitcoin? That's robbery. You're literally paying $200 extra for every $10k you buy. Binance charges 0.1% - that's $10. The only reason this service exists is to prey on people too lazy to learn how to use real exchanges.

And don't get me started on the 'no wallet' thing - that's not a feature, it's a bug. If you can't store your own crypto on the platform, why even exist? Just become a payment processor.

Also, 'responsive support'? Yeah, until you ask for a refund or dispute a spread. Then you're in a black hole. This is a glorified money changer with a fancy UI.

Dick Lane

I used Anycoin Direct for my first BTC purchase and honestly it was the calmest crypto experience I've ever had. No confusing charts, no FOMO, no one yelling about mooning or dumping. Just me, my euro balance, and a simple button that said 'Buy Bitcoin'.

Yeah the spread is higher than Binance but I paid for peace of mind. I'm not trading, I'm saving. And if I need help, someone actually answers the phone. That's rare these days.

Also, the fact they don't hold your crypto? That's actually smart. I'd rather have it in my Trezor than some exchange's hot wallet. I've seen too many hacks.

Norman Woo

wait a minute... this company is based in the netherlands and they say they use cold storage but did you know that the dutch government has backdoor access to all financial platforms under the eu's new crypto regulations? they're literally feeding your data to the eu surveillance network

and the 'video call verification'? that's not for security that's for tracking. they're recording your face and your voice and selling it to data brokers

also why is paypal supported? paypal is owned by elon musk who works with the feds. you think they don't freeze accounts when you buy crypto?

just use cashapp and p2p. this place is a trap

MANGESH NEEL

Wow. Just wow. You people are hilarious. This review is objectively accurate and you're all acting like it's a scam because the fees aren't zero. Let me break it down for you: if you're too lazy to use a real exchange, you deserve to pay a premium for convenience. That's capitalism. That's life.

And Norman, your conspiracy nonsense about Dutch surveillance is the kind of nonsense that makes crypto look like a cult. The Netherlands has one of the most transparent financial systems in the world. They don't need backdoors - they have laws. And guess what? Those laws protect YOU from fraud.

James, you're right that Binance has lower fees - but you're also right that 90% of people who use Binance get hacked, scammed, or lose their keys because they don't understand self-custody. Anycoin Direct forces you to learn it. They don't hold your keys. That's not a flaw - it's a lesson.

Madhu, you had a bad experience? Cool. That's why we have reviews. One bad experience doesn't invalidate a service that works for millions. I've used this platform 8 times. Every time, my crypto arrived. Every time, support replied within 30 minutes. Every time, I got home safely.

And Ali? You're right. It's like buying coffee. Why does that need to be complicated? Not everyone wants to be a trader. Some of us just want to own Bitcoin without becoming a blockchain engineer.

Stop pretending your aggression is wisdom. This platform exists for a reason. And if you hate it so much, don't use it. But don't poison the well for people who actually benefit from it.